Ctc Rebate 2024 Under the provision the maximum refundable amount per child would rise to 1 800 in 2023 1 900 in 2024 and 2 000 in 2025 How many kids would benefit from the CTC changes

The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child For tax year 2021 the expanded child For the 2024 tax year returns you ll file in 2025 the refundable portion of the credit increases to 1 700 That means eligible taxpayers could receive an additional 100 per qualifying child

Ctc Rebate 2024

Ctc Rebate 2024

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

https://images.squarespace-cdn.com/content/v1/58c880d7893fc0f2350b0bbd/1671046938649-FD50N05XDSCYNJTD97B7/2023-01+to+2023-06-30+B%26L+Rebate+Form+Front.jpg

Buy Appointment Book 2023 2024 Weekly Appointment Book 2023 2024 8 X 10 Jul 2023 Jun

https://m.media-amazon.com/images/I/91JorPYWOEL.jpg

The framework suggests increasing the maximum refundable portion of the CTC from the current 1 600 per child to 1 800 in 2023 1 900 in 2024 and 2 000 in 2025 This provision modifies the calculation of the maximum refundable credit amount by providing that taxpayers first multiply their earned income in excess of 2 500 by 15 percent and then multiply that amount by the number of qualifying children This policy would be effective for tax years 2023 2024 and 2025

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax Jan 19 2024 12 31 PM PST By Sahil Kapur and Scott Wong WASHINGTON The House Ways and Means Committee voted 40 3 on Friday to approve a bipartisan tax package that includes an expansion of

Download Ctc Rebate 2024

More picture related to Ctc Rebate 2024

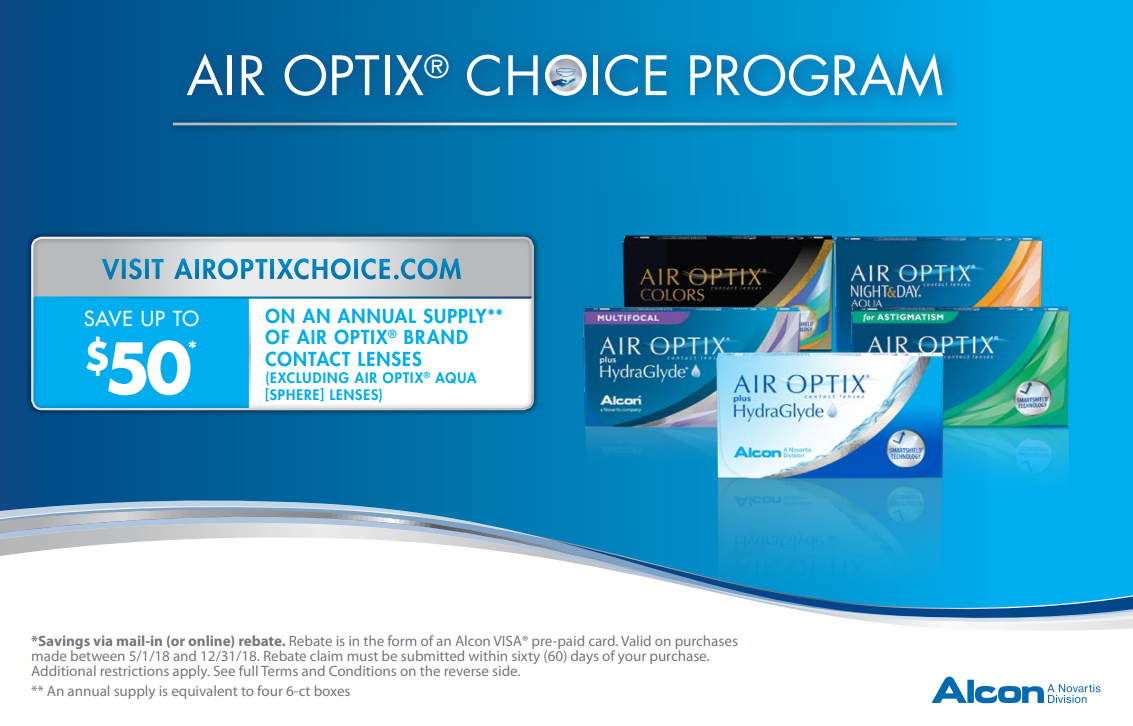

Alcon Rebate Form 2023 Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

GSTV U Save And S CC Rebates 950 000 Eligible Households To Receive Payouts Starting April

https://humanresourcesonline-assets.b-cdn.net/images/hr-sg/content-images/priya_apr_2023_mofsingapore_gstusave_gstscc_payouts_mofsingaporefb.jpg?auto_optimize=medium

Printable Alcon Rebate Form 2023 Printable Forms Free Online

https://s3.amazonaws.com/VisionSource/Promos/June2023-AlconUpgradeRebate-A.jpg

Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be refundable Legislation in the Jan 13 2024 1 00 a m PT 3 min read If you live in one of these states you could be eligible for more child tax credit money Sarah Tew CNET With the 2024 tax season right around the

However a recent change in legislation opened the doors for much needed relief Starting with the 2023 tax year filed in 2024 families with no income can also apply to the CTC and get a refund Key Takeaways The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax Credit ACTC ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024

Seresto Rebate Form PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/09/Seresto-Rebate-Form-768x563.png

Comprehensive Guide To Elanco Trifexis Rebate Form How To Claim Your Rebate Elanco Rebate

https://i0.wp.com/www.elancorebate.net/wp-content/uploads/2023/05/Elanco-Trifexis-Rebate-Form.png?fit=1174%2C813&ssl=1

https://www.cbsnews.com/news/child-tax-credit-increase-heres-who-would-benefit/

Under the provision the maximum refundable amount per child would rise to 1 800 in 2023 1 900 in 2024 and 2 000 in 2025 How many kids would benefit from the CTC changes

https://www.cnet.com/personal-finance/taxes/child-tax-credit-2024-how-much-is-it-and-who-qualifies/

The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child For tax year 2021 the expanded child

203 CTC

Seresto Rebate Form PrintableRebateForm

Cycle Tour 2024 CalTopo

New Wearer Rebate Alcon New Wearers Can Save Up To 225 On Your Contact Lens Purchase

Rebate Air Optix Printable Rebate Form

Tolminator 2024

Tolminator 2024

NWC Tryouts 2023 2024 NWC Alliance

Blockchaincon Latam 2024

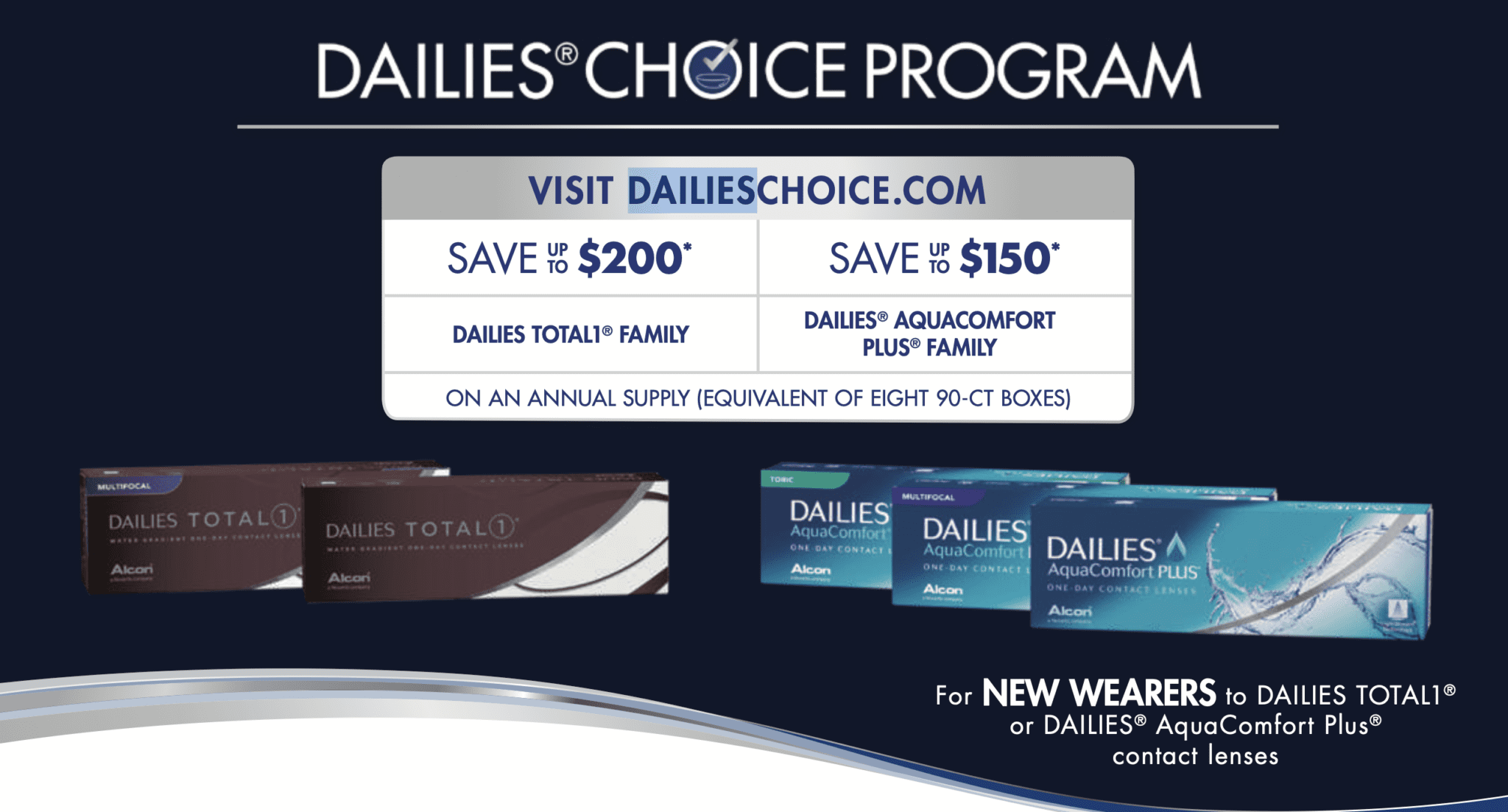

Dailies Total 1 Rebate Form Printable Rebate Form

Ctc Rebate 2024 - The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under the age of six and