Customs And Excise Tax Rebate Web 31 ao 251 t 2023 nbsp 0183 32 Full or unrebated rate of excise duty 163 per litre Rebate 163 per litre Type of tax code Effective rate of excise 163 per litre Biodiesel 0 5295 Nil 589 0 5295

Web 28 avr 2016 nbsp 0183 32 For each full import declaration your claim must be more than 10 euros 163 8 86 in value for goods imported on or before 31 December 2020 and more than 163 9 Web 12 sept 2023 nbsp 0183 32 The new simpler rules could reduce tax compliance costs for businesses operating in the EU by up to 65 Companies that are members of the same group will

Customs And Excise Tax Rebate

Customs And Excise Tax Rebate

https://cantruck.ca/wp-content/uploads/2016/12/TruckerTaxesGreen-593x1024.jpg

Fraudulent Availment Of Excise Rebate CESTAT Upholds Penalty

https://www.taxscan.in/wp-content/uploads/2023/01/Fraudulent-Availment-Excise-Rebate-CESTAT-Penalty-Excise-Service-Tax-Customs-Fraudulent-Availment-of-Excise-Rebate-Penalty-taxscan-.jpg

Central Excise Department Cannot Decide If Activities Amounted To

https://www.taxscan.in/wp-content/uploads/2023/02/Central-Excise-Department-Excise-Department-Manufacture-CESTAT-SCN-Customs-Excise-Service-Tax-Taxscan-.jpg

Web 31 ao 251 t 2023 nbsp 0183 32 Full or unrebated rate of excise duty 163 per litre Rebate 163 per litre Type of tax code Effective rate of excise 163 per litre Biodiesel 0 5295 Nil 589 0 5295 Web Customs and Excise Act No 91 of 1964 the Act to facilitate imports of raw materials and components at world market prices e g Rebate Item 470 03 00 00 01 00 Rebate of

Web Tax levied on goods coming into a country by Customs law with the purpose of protecting local industry and or generating state income In the Southern African Customs Union Web The DRI scheme allows registered persons and companies to import goods under full or partial rebate of import duties and taxes if the goods are intended for use in a specified

Download Customs And Excise Tax Rebate

More picture related to Customs And Excise Tax Rebate

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Service Tax On Overriding Commission Received As General Sales Agent

https://www.taxscan.in/wp-content/uploads/2023/02/Service-Tax-Commission-received-General-Sales-Agent-Sales-Agent-Foreign-Company-CESTAT-Customs-Excise-Taxscan.jpg

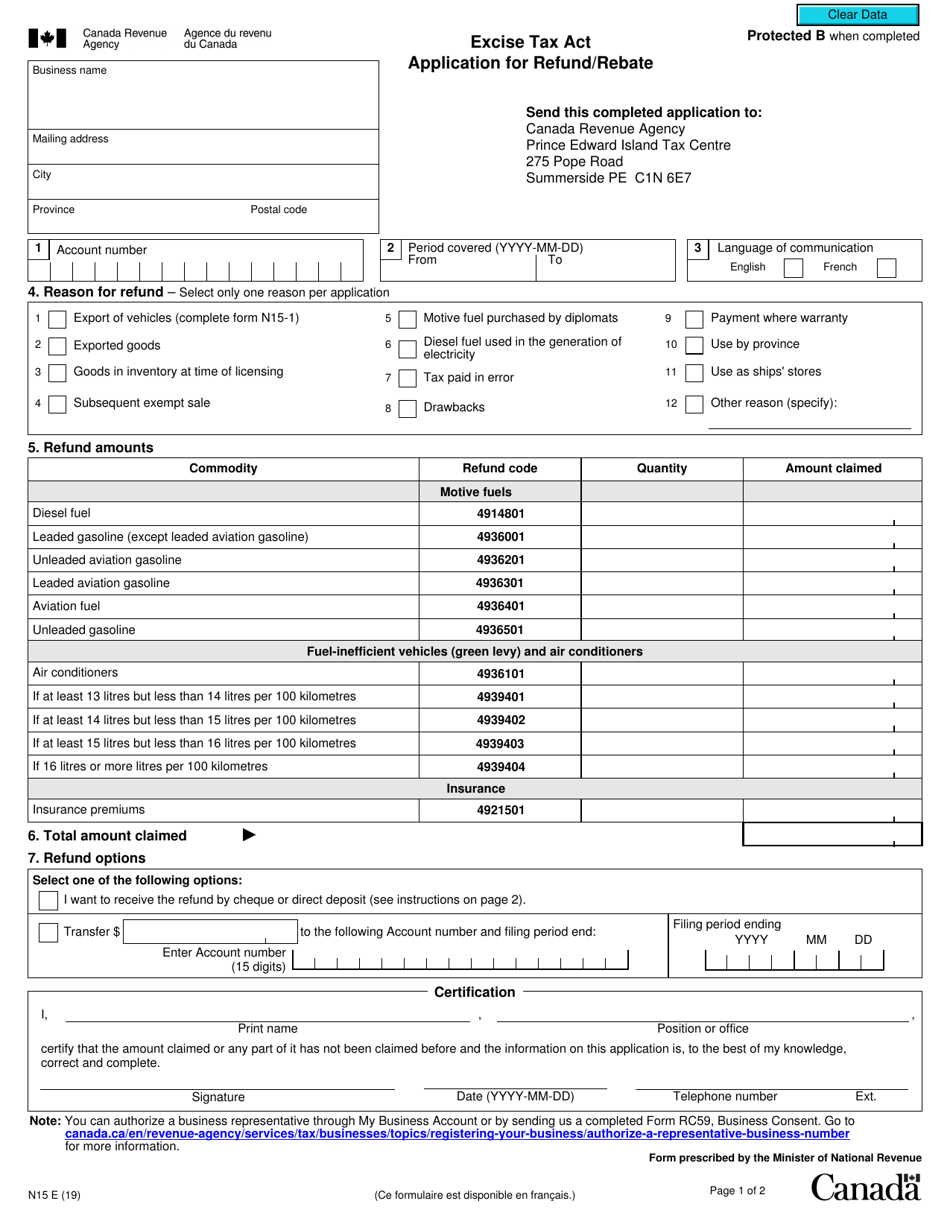

Form N15 Download Fillable PDF Or Fill Online Excise Tax Act

https://data.templateroller.com/pdf_docs_html/2030/20309/2030938/form-n15-excise-tax-act-application-for-refund-rebate-canada_print_big.png

Web Schedule 3 Industrial Rebates of Customs Duties Schedule 4 General Rebates of Customs Duties and Fuel Levy Schedule 5 Specific Drawbacks and Refunds of Web Rebates The circumstances in which rebates of duty may be made are also listed in Customs Regulation 126 Generally a rebate is a refund of part only of the customs

Web You are here Home 187 Documents 187 Notices Keyword Web 9 nov 2009 nbsp 0183 32 Overview You may be able to claim relief from or a repayment of Fuel Duty if you use certain fuels or oils for specific purposes export fuels and oils for use outside

No Service Tax On Reimbursable Expenses CESTAT

https://www.taxscan.in/wp-content/uploads/2023/03/Service-Tax-Reimbursable-Expenses-CESTAT-Customs-Excise-Taxscan.jpg

CESTAT WEEKLY ROUND UP

https://www.taxscan.in/wp-content/uploads/2023/02/CESTAT-WEEKLY-ROUND-UP-Excise-Customs-Service-Tax-taxscan.jpg

https://www.gov.uk/government/publications/uk-trade-tariff-excise...

Web 31 ao 251 t 2023 nbsp 0183 32 Full or unrebated rate of excise duty 163 per litre Rebate 163 per litre Type of tax code Effective rate of excise 163 per litre Biodiesel 0 5295 Nil 589 0 5295

https://www.gov.uk/guidance/refunds-and-waivers-on-customs-debt

Web 28 avr 2016 nbsp 0183 32 For each full import declaration your claim must be more than 10 euros 163 8 86 in value for goods imported on or before 31 December 2020 and more than 163 9

Cenvat Credit Available On Books Of Account Can Be Rejected Only With

No Service Tax On Reimbursable Expenses CESTAT

Common Effluent Treatment Plant Taxscan Simplifying Tax Laws

Section 66D Of The Finance Act 1994 Taxscan Simplifying Tax Laws

What Is Excise Definition And Examples Market Business News

CESTAT Weekly Round Up

CESTAT Weekly Round Up

No Recovery On Claim Of Erroneous Refund When Adjudication Has Taken

Excise Tax AwesomeFinTech Blog

Sales Tax And Service Tax Together Cannot Be Applied On Same

Customs And Excise Tax Rebate - Web Customs and Excise General Amendment Regulations 2022 No 107 f research and development initiatives carried out by the importer and g for importers that export their