Cvrp Rebate Income Tax Return Deduction Web Consumers are not eligible for CVRP rebates if their gross annual incomes are above the thresholds listed below The income cap applies to all eligible vehicle types except fuel

Web CVRP considers an applicant s most recent federal tax return to be the one most recently required to be filed by the IRS CVRP switches to requesting a new tax filing year for Web Effective August 15 2023 Increased Rebate recipients will receive an additional 2 000 EV Charging Card CVRP considers an applicant s most recent federal tax return to be the

Cvrp Rebate Income Tax Return Deduction

Cvrp Rebate Income Tax Return Deduction

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

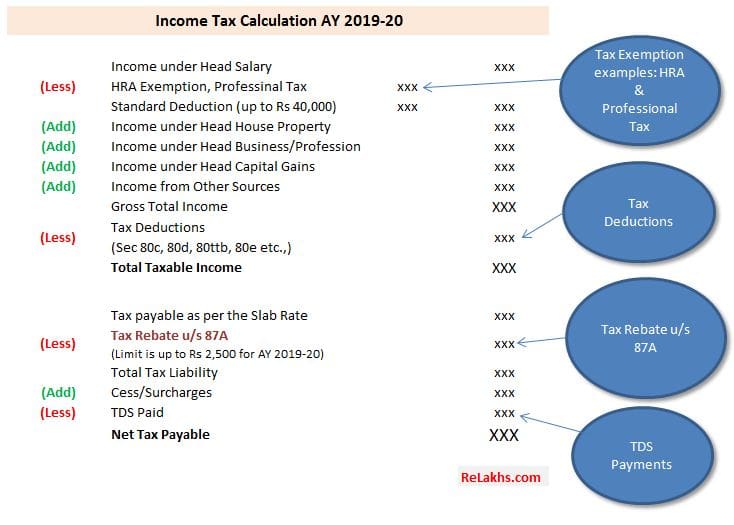

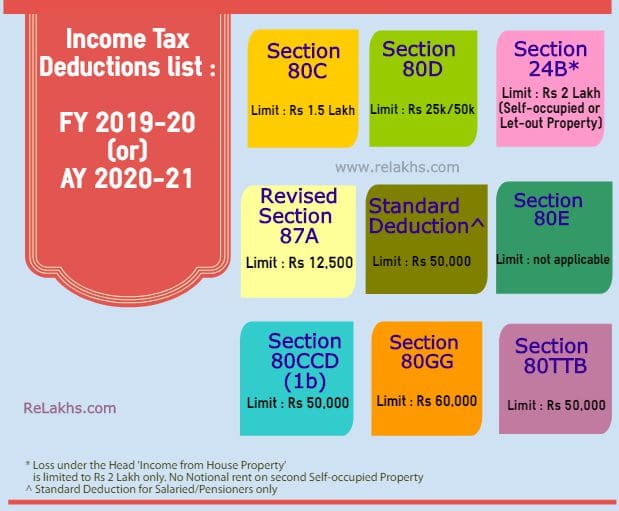

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

California s EV Rebate Changes A Good Model For The Federal EV Tax

https://cleantechnica.com/files/2019/11/CVRP-rebates-samples-768x374.png

Web CVRP considers an applicant s most recent federal tax return to be the one most recently required to be filed by the IRS CVRP switches to requesting a new tax filing year for Web 2 mars 2023 nbsp 0183 32 Just to double confirm The timeline application for rebates assuming you qualify if you buy a Tesla in 2023 before March 31 2023 Federal Rebate 7500 You

Web CVRP enables a purchaser or lessee of an eligible vehicle to apply for a CVRP rebate of up to 7 000 for fuel cell electric vehicles FCEVs up to 4 500 for all battery electric Web 8 juin 2023 nbsp 0183 32 10 des revenus professionnels de 2021 nets de cotisations sociales et de frais professionnels avec une d 233 duction maximale de 35 194 4 114 192 savoir

Download Cvrp Rebate Income Tax Return Deduction

More picture related to Cvrp Rebate Income Tax Return Deduction

Clean Vehicle Rebate Project CVRP California Income Question Tesla

https://teslamotorsclub.com/tmc/attachments/1670890966523-png.884230/?id=7255206

Does The Solo Electric Car Qualify For A Tax Credit OsVehicle

https://cdn.osvehicle.com/how_much_is_the_cvrp_rebate.png

Marginal Tax Rate Definition TaxEDU Tax Foundation

https://files.taxfoundation.org/20200714164745/Tax-Basics-How-Is-Tax-Liability-Calculated.png

Web 1 janv 2023 nbsp 0183 32 Selon votre situation vous pouvez b 233 n 233 ficier d une d 233 duction d une r 233 duction d imp 244 t ou d un cr 233 dit d imp 244 t sur les revenus 2022 Web The CVRP Increased Rebate makes it easier for more Californians to afford a new EV Browse Eligible Vehicles Do you qualify If your income and household size fall within

Web CVRP enables a purchaser or lessee of an eligible vehicle to apply for a CVRP rebate of up to 7 500 for fuel cell electric vehicles FCEVs up to 7 500 for all battery electric Web 22 avr 2005 nbsp 0183 32 CVRP offers vehicle rebates of up to 4 500 to eligible applicants on a first come first served basis to reduce the purchase price for light duty ZEVs plug in hybrid

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

What Is Income Tax Exemption Deduction And Rebate Inuranse

https://www.inuranse.com/wp-content/uploads/2023/05/Default_Income_Tax_ExemptionIncome_Tax_DeductionTax_RebatesTax_2.jpg

https://cleanvehiclerebate.org/en/faqs/what-are-income-requirements

Web Consumers are not eligible for CVRP rebates if their gross annual incomes are above the thresholds listed below The income cap applies to all eligible vehicle types except fuel

https://cleanvehiclerebate.org/en/eligibility-guidelines

Web CVRP considers an applicant s most recent federal tax return to be the one most recently required to be filed by the IRS CVRP switches to requesting a new tax filing year for

11 Section 80GGC SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Program Reports Clean Vehicle Rebate Project

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

9 Section 80E SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

9 Section 80E SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

What Is An Updated Income Tax Return TheBuyt

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Standard Deduction Tax Rebate EXPLAINED In New Tax Regime With

Cvrp Rebate Income Tax Return Deduction - Web Applicants are not eligible for CVRP rebates if their gross annual incomes are above the following thresholds 150 000 for single filers 204 000 for head of household filers or