Day Care Tax Deduction Verkko 1 jouluk 2023 nbsp 0183 32 If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 you can claim a tax credit of 50 of all qualifying expenses up to a

Verkko 1 jouluk 2023 nbsp 0183 32 In operating a daycare or childcare center certain business expenses are tax deductible that you can claim when filing your taxes Some Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit or CDCC is a tax credit for parents or caregivers to help cover the cost of qualified

Day Care Tax Deduction

Day Care Tax Deduction

https://www.pdffiller.com/preview/391/382/391382225/large.png

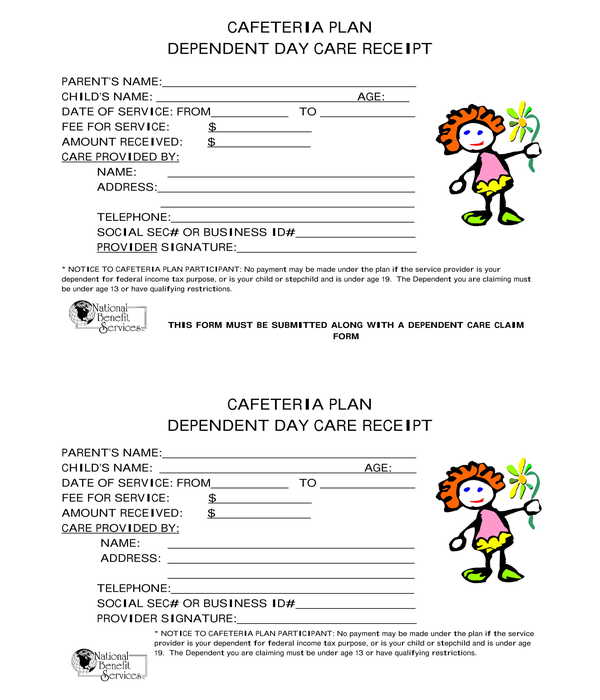

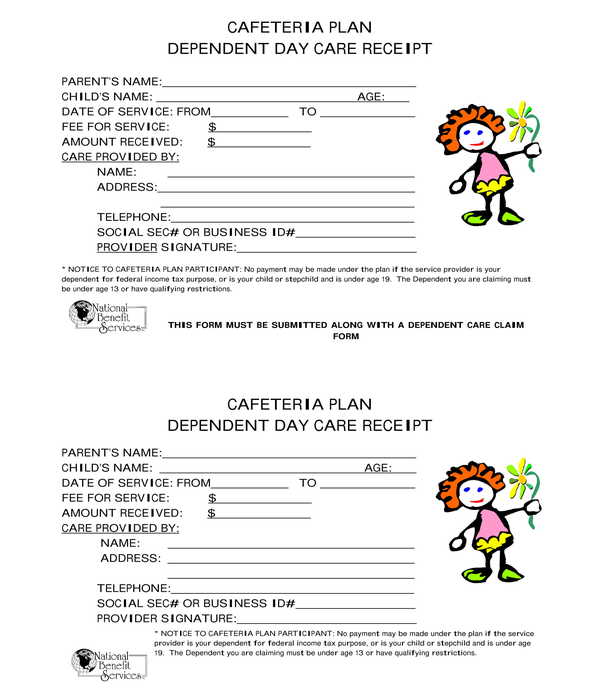

Daycare Tax Receipt Template Master Template

https://images.sampleforms.com/wp-content/uploads/2019/07/Cafeteria-Plan-Dependent-Daycare-Receipt-Form.jpg

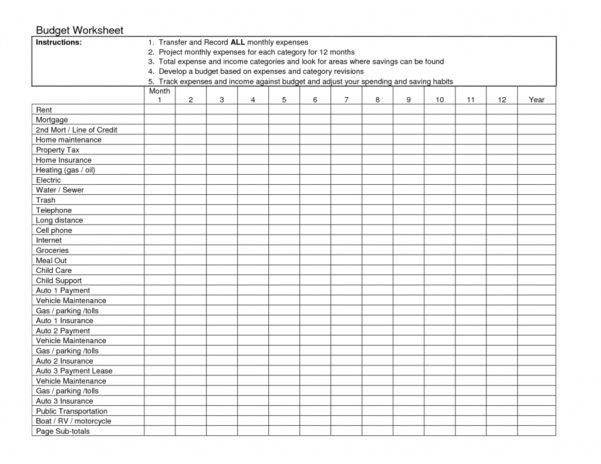

Home Daycare Tax Worksheet

http://db-excel.com/wp-content/uploads/2019/01/family-day-care-tax-spreadsheet-pertaining-to-child-care-receipt-template-excel-daycare-uis-payment-spreadsheet-601x464.jpg

Verkko 23 elok 2023 nbsp 0183 32 the Internal Revenue Service IRS has announced that daycare expenses will be tax deductible for the years 2023 and 2024 Verkko 11 kes 228 k 2021 nbsp 0183 32 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The

Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you had one qualifying person or Verkko 22 elok 2023 nbsp 0183 32 Here are the standout points of the daycare tax deduction rules for 2023 2024 Deduction Limits Depending on the taxpayer s income bracket there are

Download Day Care Tax Deduction

More picture related to Day Care Tax Deduction

Home Daycare Tax Deductions For Child Care Providers Where

https://whereimaginationgrows.com/wp-content/uploads/2017/02/Home-daycare-tax-deductions-write-offs-family-child-care-1.jpg

Tax Deduction Cheat Sheet For Real Estate Agents Independence Title

http://independencetitle.com/wp-content/uploads/RealtorTaxTips2016_Page_2.png

Tax Deduction Spreadsheet Within Truck Driver Tax Deductions Worksheet

https://db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-within-truck-driver-tax-deductions-worksheet-creation-of-tax-deduction-768x994.png

Verkko 16 jouluk 2023 nbsp 0183 32 If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any Verkko 2 helmik 2023 nbsp 0183 32 Child and Dependent Care Credit Information If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly

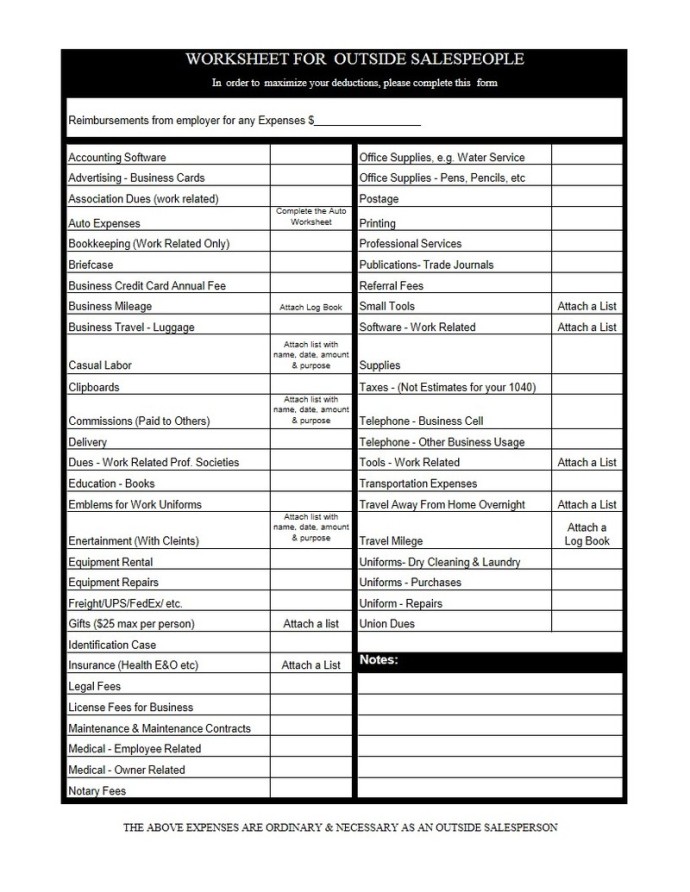

Verkko 24 kes 228 k 2022 nbsp 0183 32 Common Home Day Care Tax Deductions For Daycare Businesses 1 Expenses Of Employees and Contractors The first on our list of home daycare tax Verkko 7 huhtik 2023 nbsp 0183 32 Here are our top 10 deductions for a daycare business 1 Employee Wages 2 Bank Fees and Interest 3 Advertising Charges 4 Continuing Education

Pin By Wendy Howell On Business Tips Business Tax Deductions

https://i.pinimg.com/originals/5b/f1/1c/5bf11ce4adb7b2d7f007c6ab2ba2a967.png

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

https://nationaltaxreports.com/can-you-deduc…

Verkko 1 jouluk 2023 nbsp 0183 32 If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 you can claim a tax credit of 50 of all qualifying expenses up to a

https://mybrightwheel.com/blog/childcare-provider-taxes

Verkko 1 jouluk 2023 nbsp 0183 32 In operating a daycare or childcare center certain business expenses are tax deductible that you can claim when filing your taxes Some

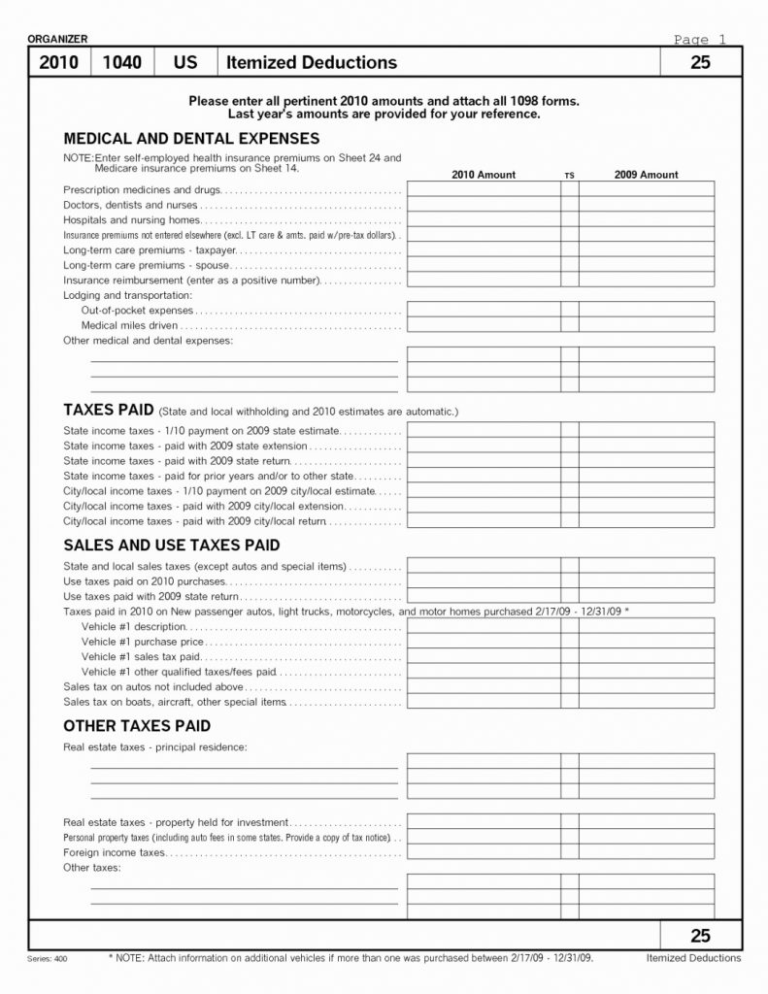

5 Best Images Of Itemized Tax Deduction Worksheet 1040 Forms Itemized

Pin By Wendy Howell On Business Tips Business Tax Deductions

Home Daycare Tax Worksheet Ivuyteq

10 Best Images Of Business Tax Deductions Worksheet Tax Itemized

Where Do I Enter Tax Deduction For Medicare Tax

Farm Cash Flow Spreadsheet Google Spreadshee Farm Cash Flow Projection

Farm Cash Flow Spreadsheet Google Spreadshee Farm Cash Flow Projection

Home Office Deduction Worksheet 2021

What Will My Tax Deduction Savings Look Like The Motley Fool

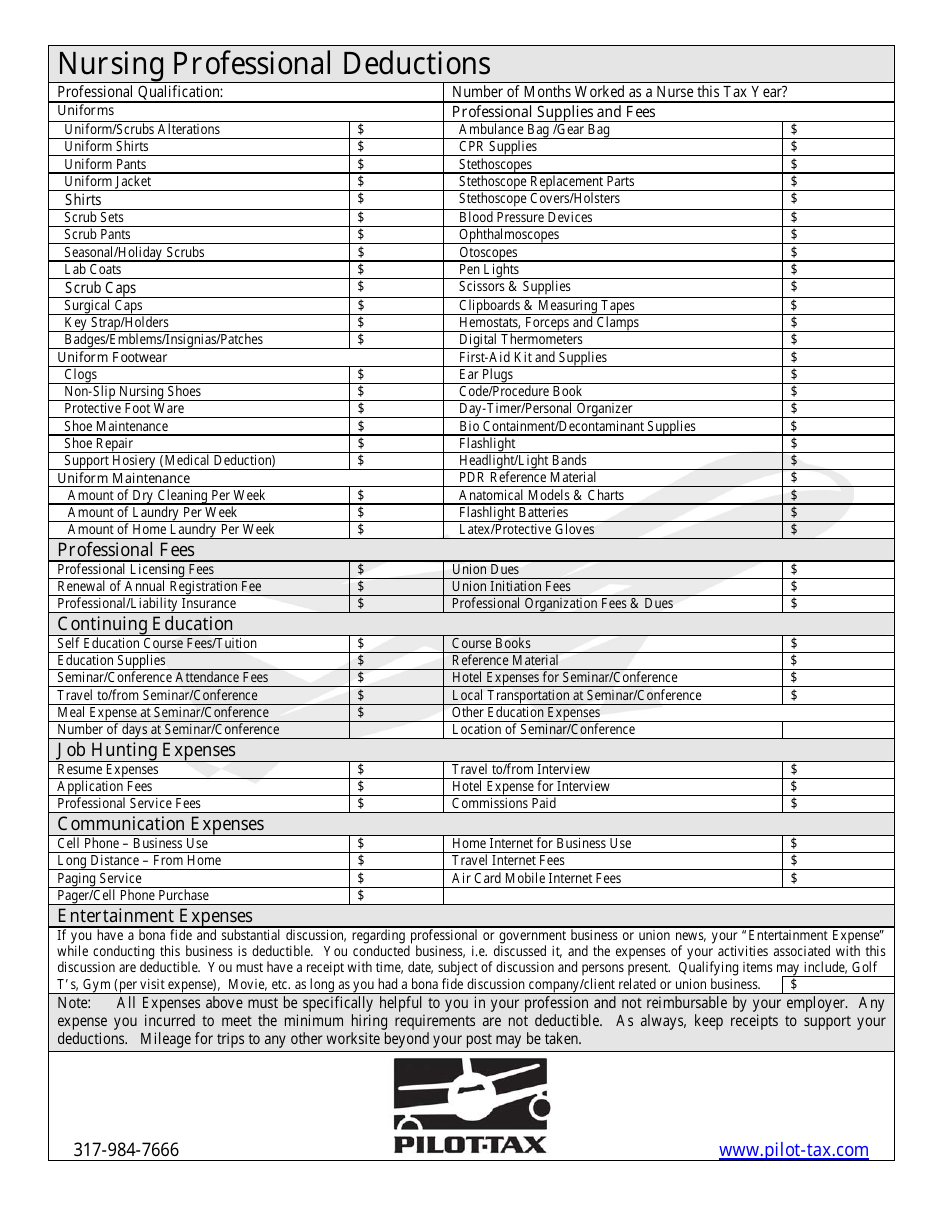

Nursing Professional Deductions Form Pilot Tax Fill Out Sign

Day Care Tax Deduction - Verkko 9 helmik 2017 nbsp 0183 32 Furniture and appliance purchases can be written off as home daycare tax deductions Some items you can write off the whole cost while others will need to