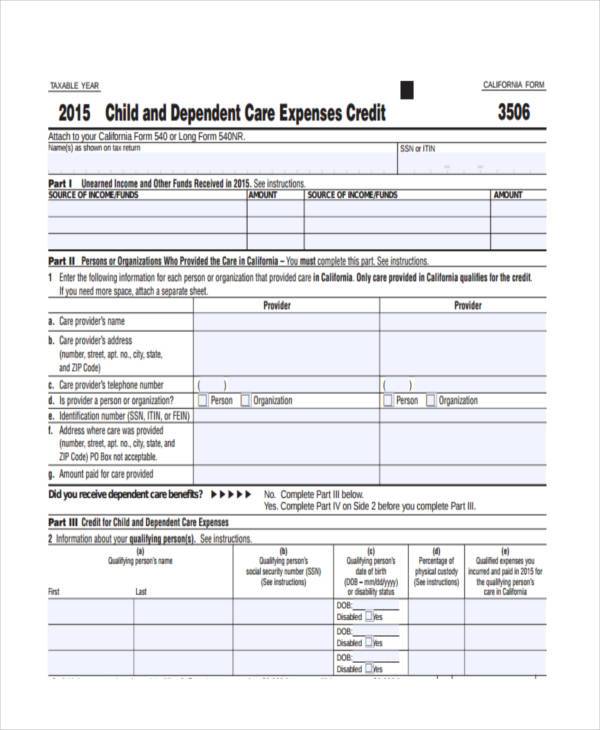

Day Care Tax Form Form 2441 Child and Dependent Care Expenses is an Internal Revenue Service IRS form used to report child and dependent care expenses on your tax return in order to

To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income tax return In To claim the credit taxpayers must complete Form 2441 a two page document that reports child and dependent care expenses as part of a federal income tax return and is used to determine the amount of child and

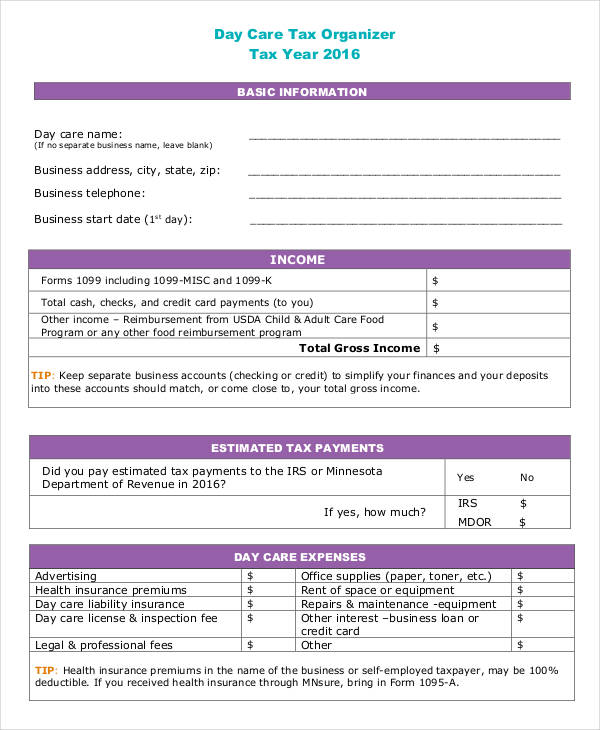

Day Care Tax Form

Day Care Tax Form

https://images.examples.com/wp-content/uploads/2017/04/Daycare-Tax.jpg

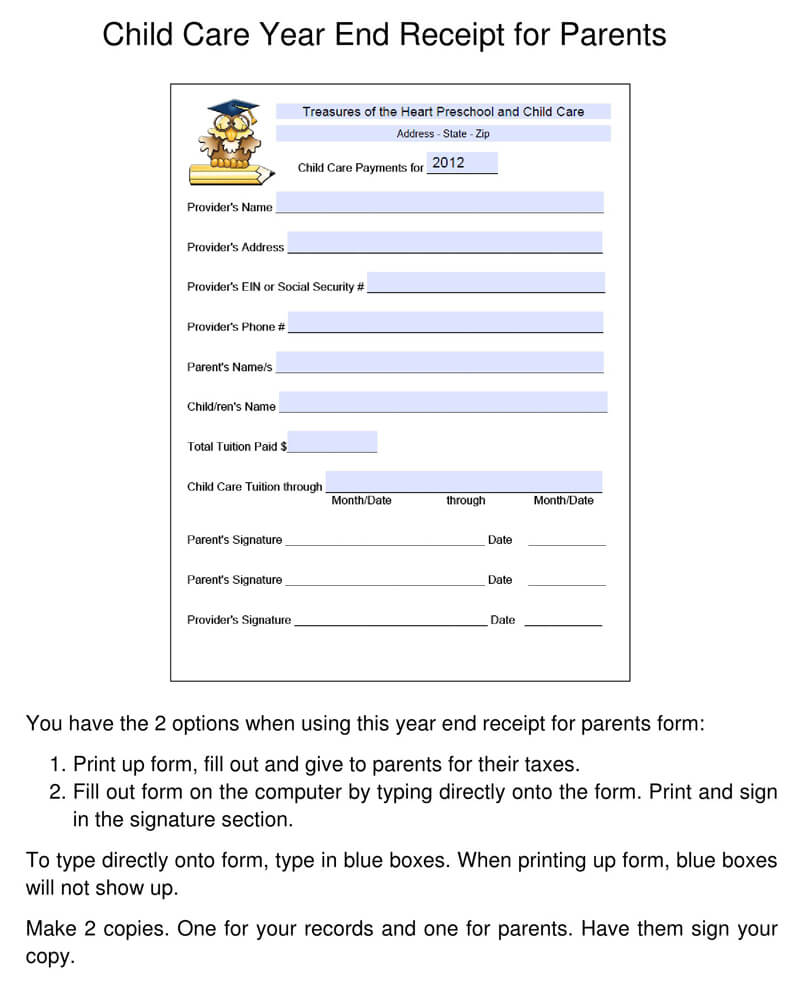

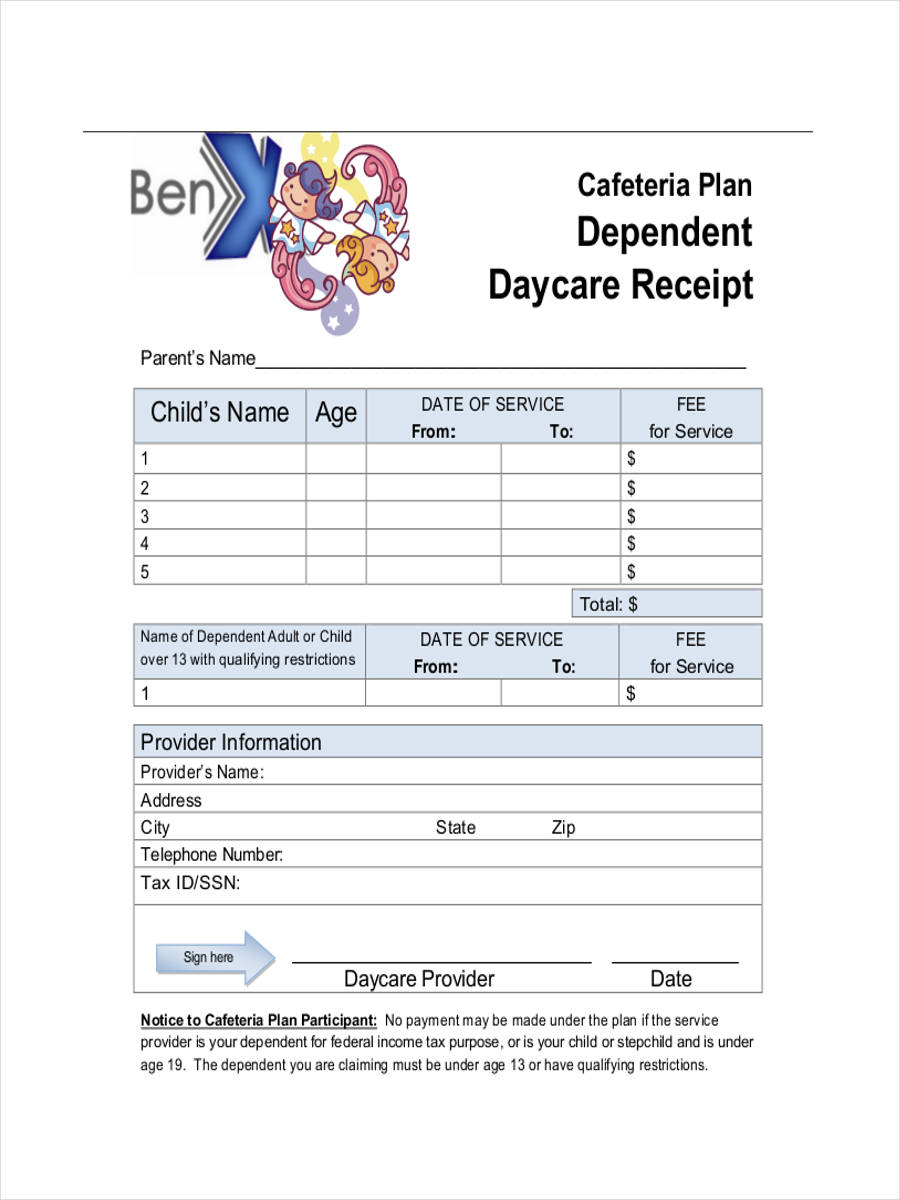

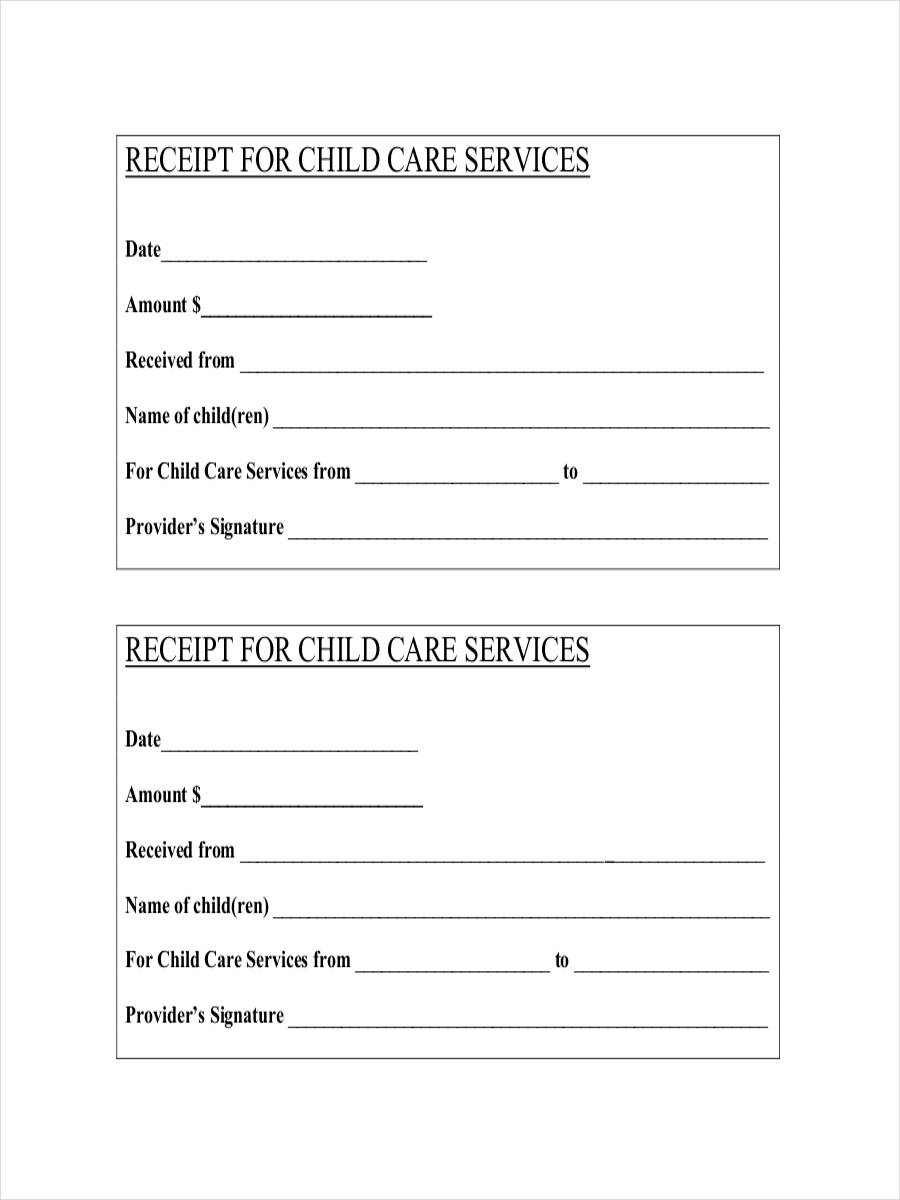

Free Printable Daycare Receipt Template

https://www.wordtemplatesonline.net/wp-content/uploads/Daycare-Year-End-Receipt.jpg

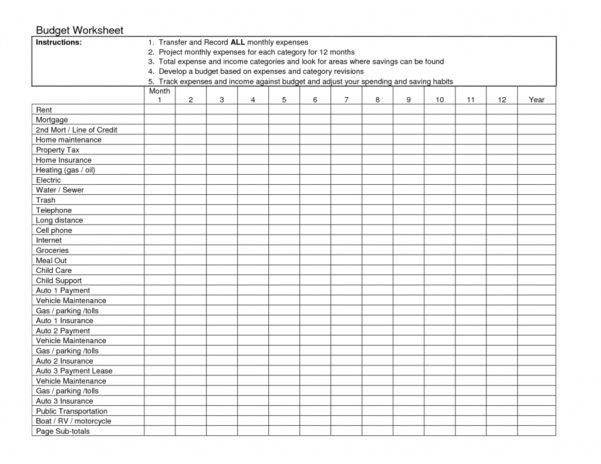

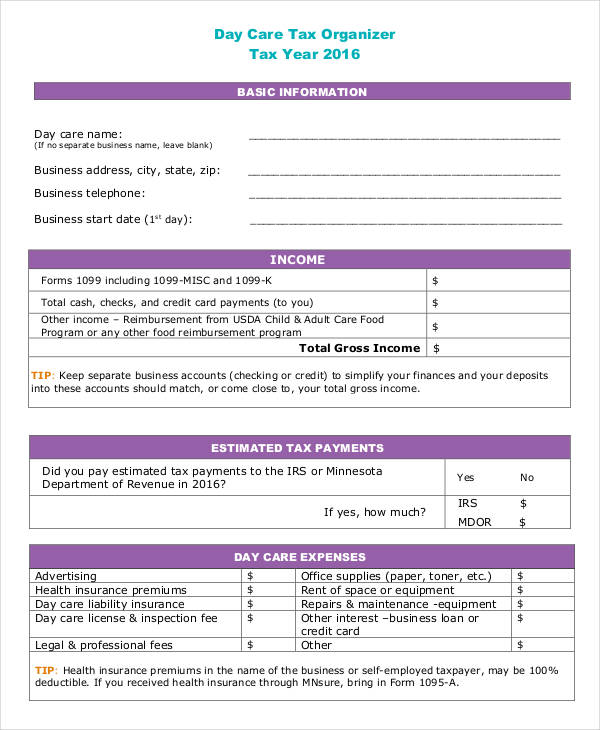

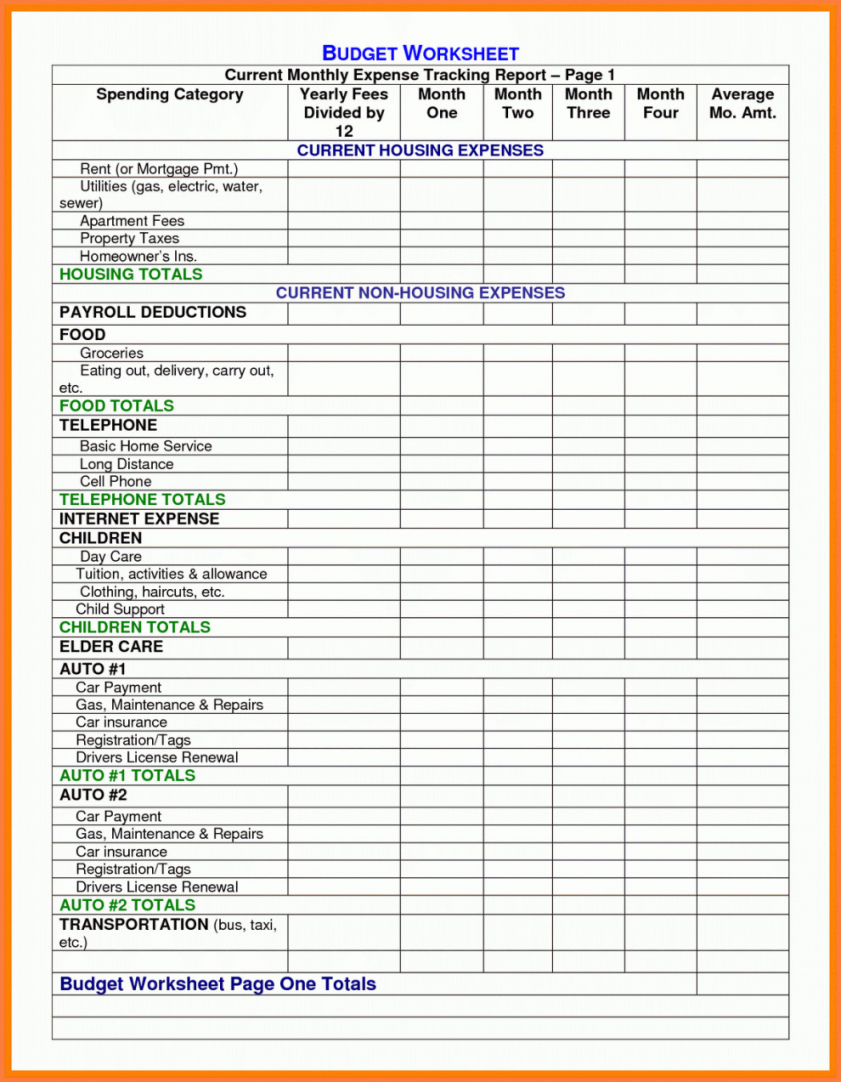

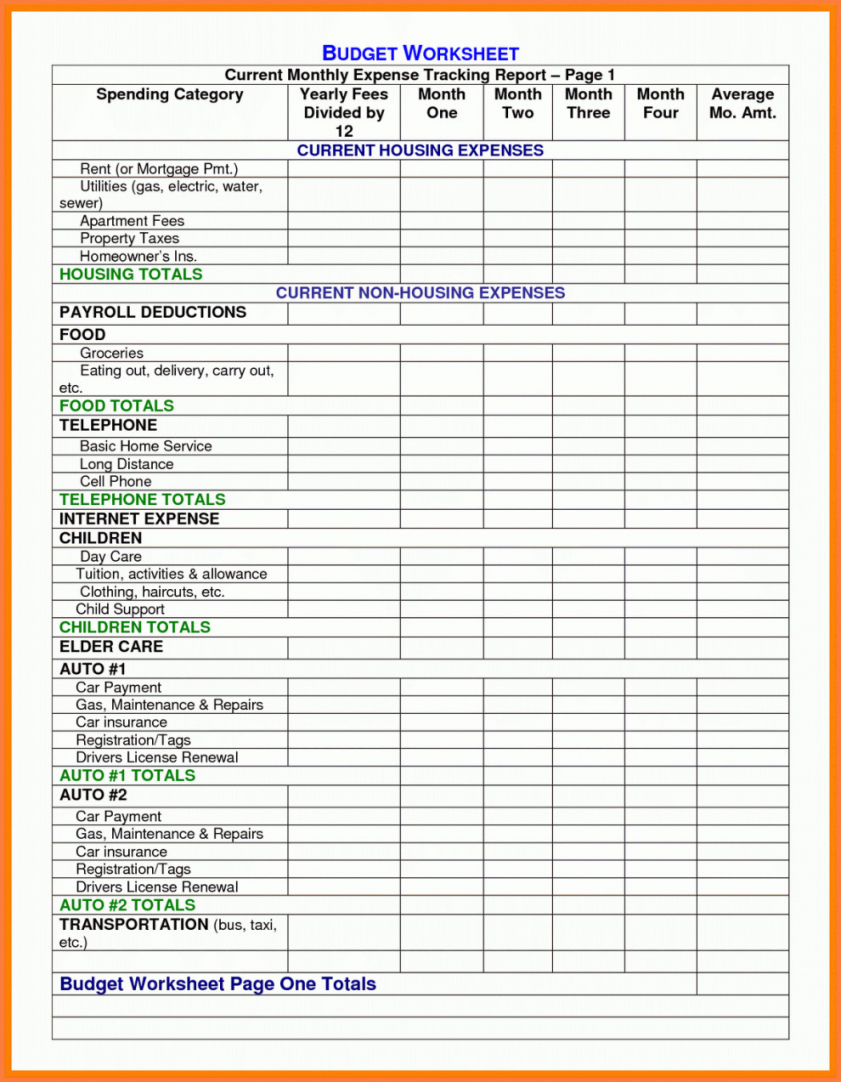

Family Day Care Tax Spreadsheet Printable Spreadshee Family Day Care

https://db-excel.com/wp-content/uploads/2019/01/family-day-care-tax-spreadsheet-pertaining-to-child-care-receipt-template-excel-daycare-uis-payment-spreadsheet-601x464.jpg

Most day care providers will use Schedule C as their child care tax form This is the form for reporting self employment income and expenses You may also need Form SE to report your If Dependent Care Benefits are listed in Box 10 of a Form W 2 Wage and Tax Statement then the taxpayer MUST complete Form 2441 Child and Dependent Care Expenses If Form 2441

If the care provider is your household employee you may owe employment taxes For details see the Instructions for Schedule H Form 1040 If you incurred care expenses in 2024 but didn t Provide details of the income of the children for whom you claim child home care allowance or private day care allowance Income that a child may have includes for instance child support

Download Day Care Tax Form

More picture related to Day Care Tax Form

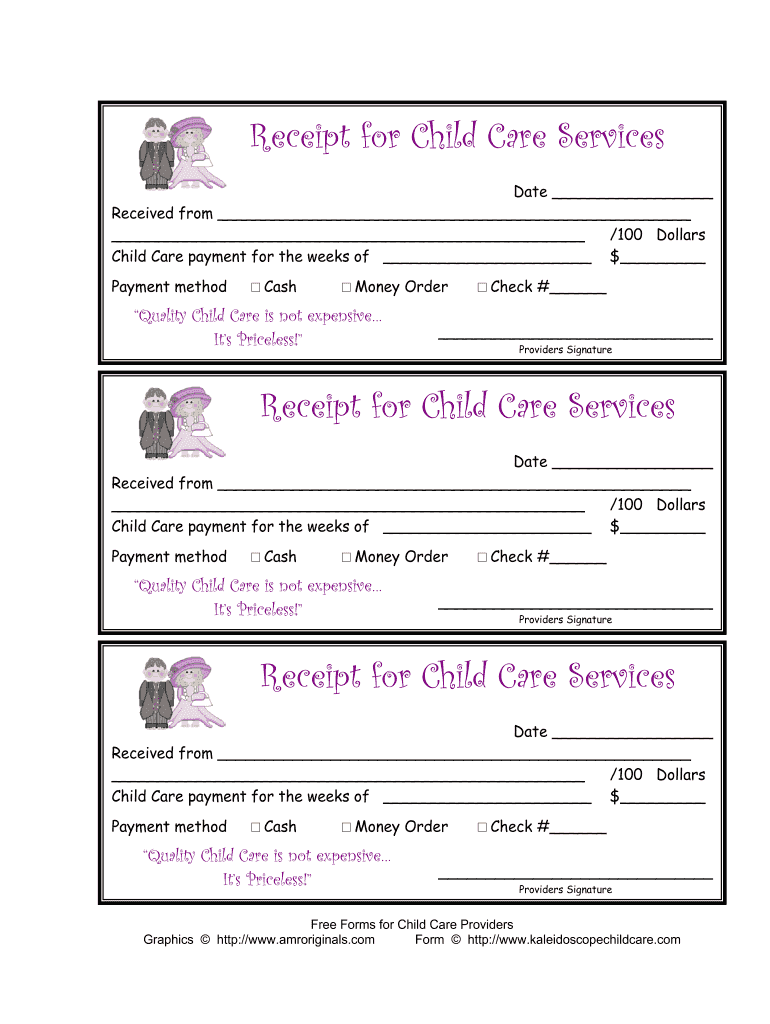

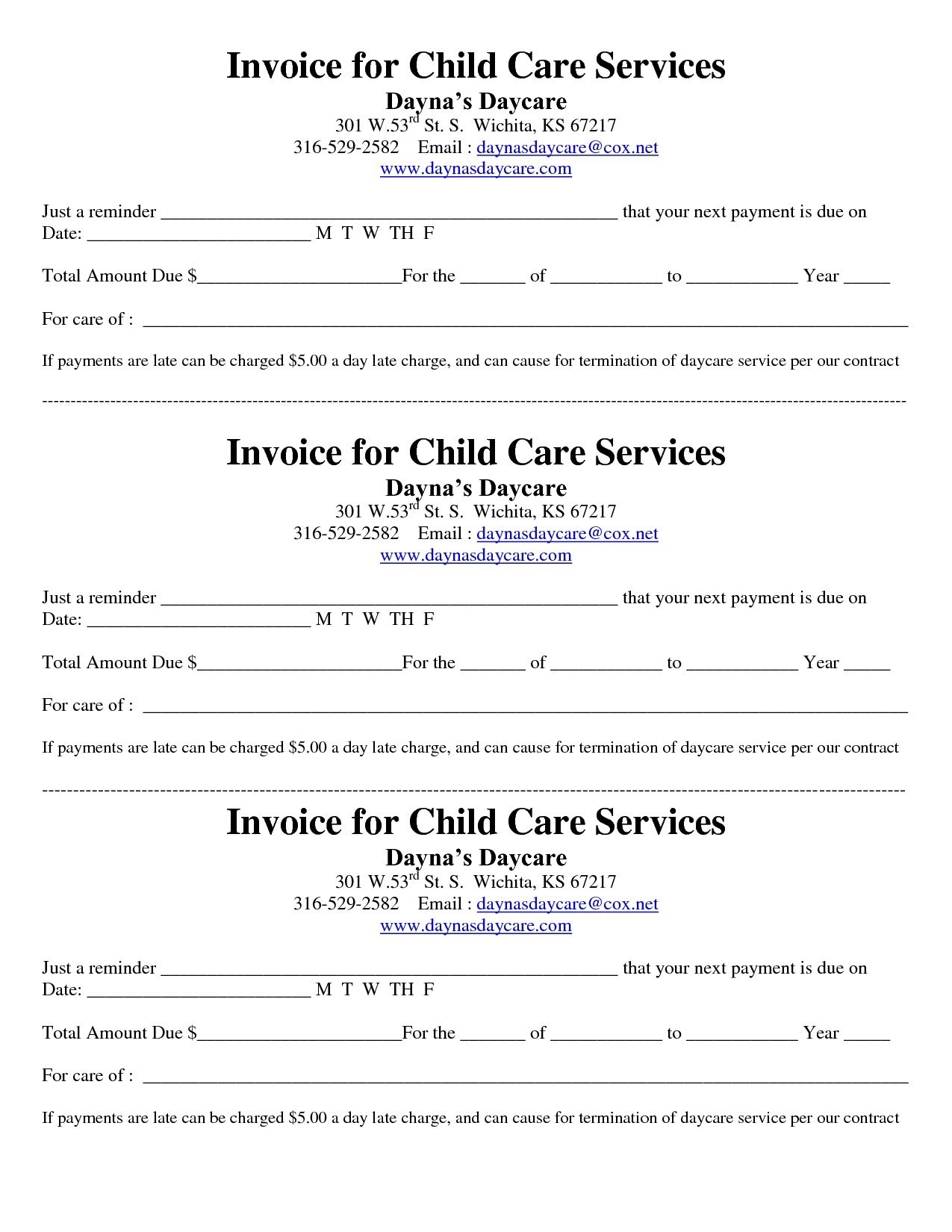

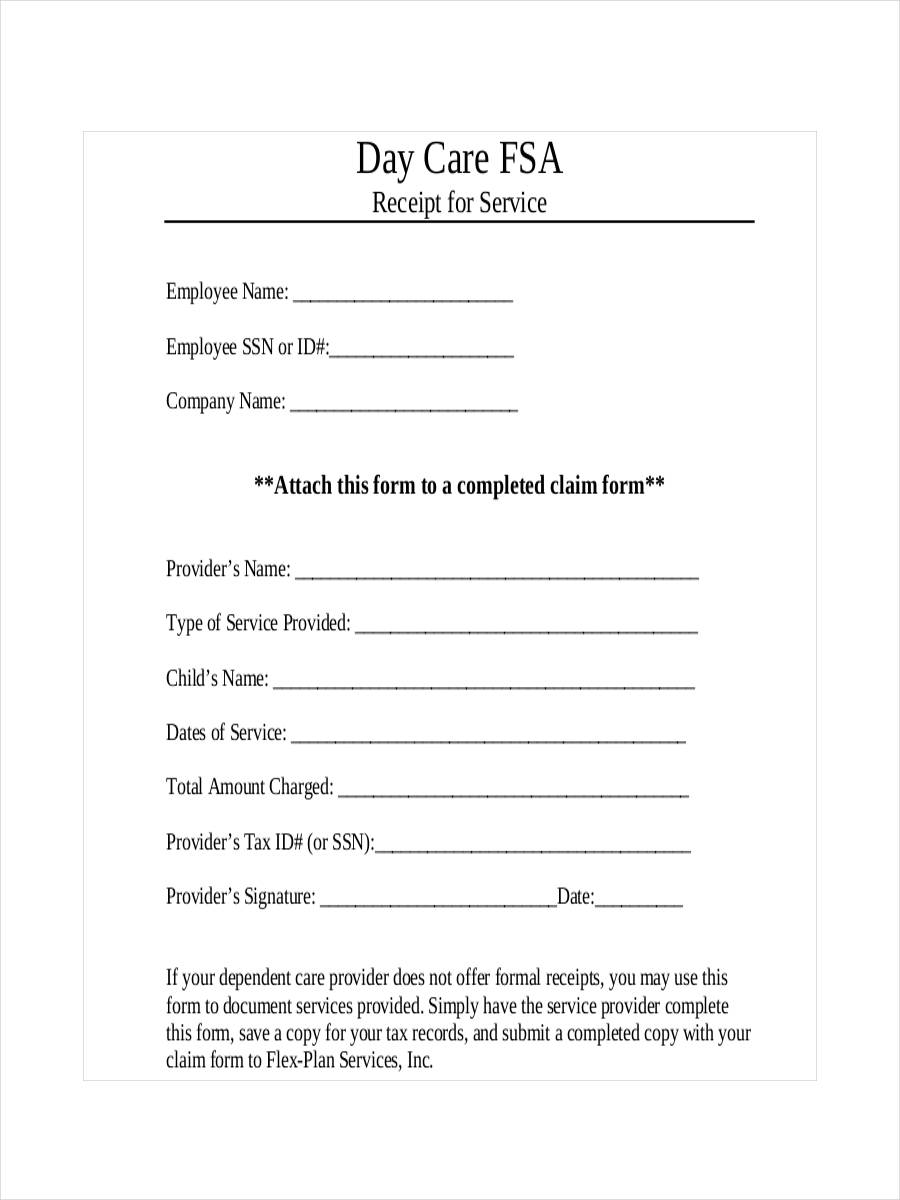

Daycare Receipt Template Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/100/405/100405299/large.png

Free Printable Daycare Receipt Printable Word Searches

https://images.examples.com/wp-content/uploads/2017/05/Receipt-for-Dependent-Daycare.jpg

Free Printable Daycare Receipts Free Printable

https://freeprintablejadi.com/wp-content/uploads/2019/07/child-care-receipt-invoice-jordi-preschool-invoice-template-free-printable-daycare-receipts.jpg

While claiming daycare expenses toward a tax credit won t defray all the costs associated with child care it can help reduce them significantly This article will break down what the daycare tax credit is how to qualify and how Form 2441 is a tax form used to claim the child and dependent care tax credit This credit is designed to provide tax relief to individuals or couples who have incurred expenses for the care of qualifying children or dependents

Do you pay someone to care for your child or another dependent while you work or look for work If so you could qualify for the Child and Dependent Care Credit CDCC a tax The IRS allows you to deduct certain childcare expenses on your 2024 and 2025 tax return If you paid for a babysitter a summer camp or any care provider for a disabled

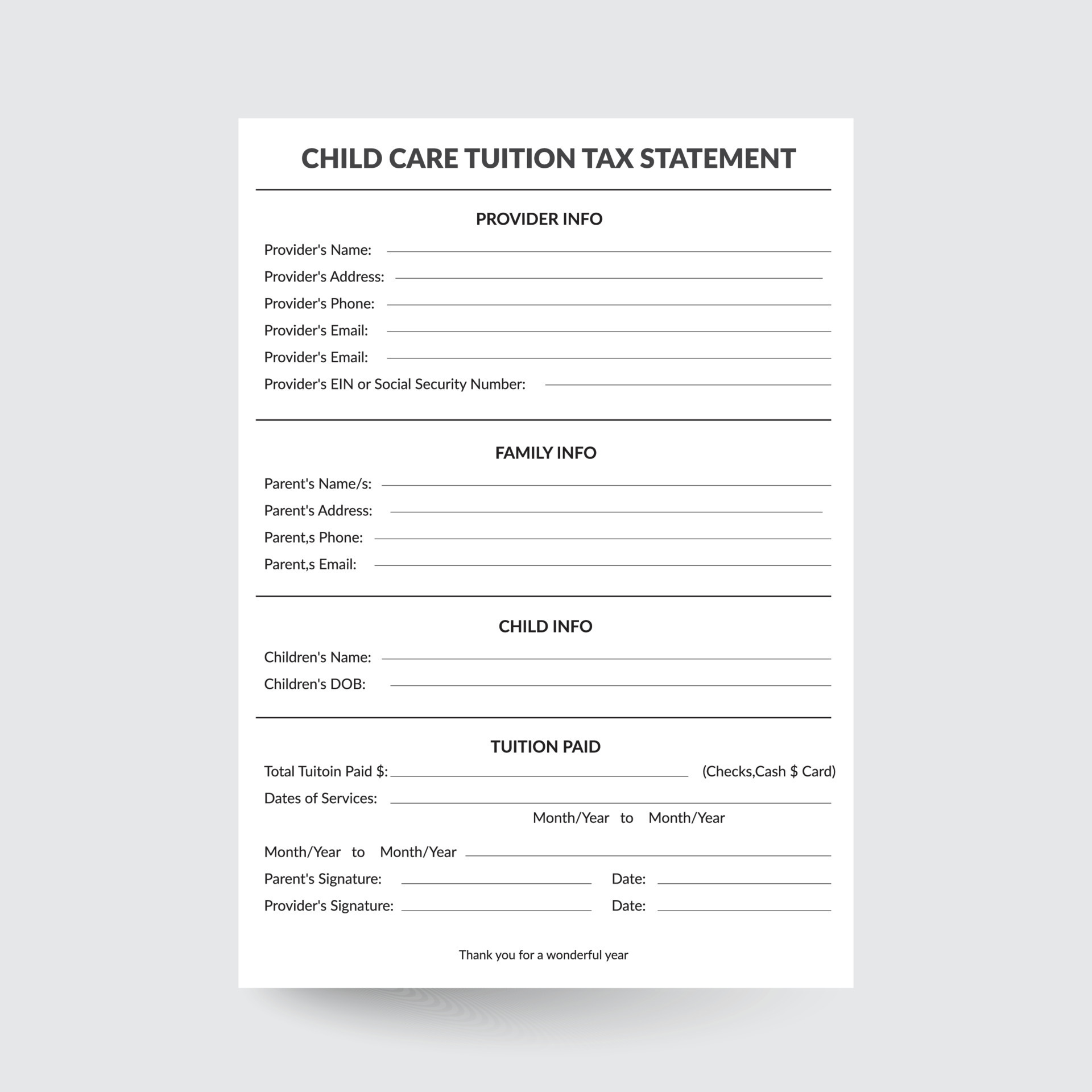

A Daycare Tax Statement Must Be Given To Parents At The End Of The Year

https://i.pinimg.com/736x/89/c2/d4/89c2d4b145d349a6140a6c87599b86ff.jpg

Fantastic Daycare Receipt For Taxes Template Google Awesome Receipt

https://images.sampletemplates.com/wp-content/uploads/2017/05/Daycare-Payment-Invoice.jpg

https://www.investopedia.com

Form 2441 Child and Dependent Care Expenses is an Internal Revenue Service IRS form used to report child and dependent care expenses on your tax return in order to

https://www.irs.gov › newsroom › child-and-dependent-care-credit-faqs

To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income tax return In

FREE 8 Sample Child Care Expense Forms In PDF MS Word

A Daycare Tax Statement Must Be Given To Parents At The End Of The Year

Daycare Receipt Template Free

Childcare Receipts For Parents Taxes Daycare Receipts For Parents Taxes

Pin On Simple Receipt Templates Samples

Business Spreadsheet For Taxes Pertaining To Daycare Expense

Business Spreadsheet For Taxes Pertaining To Daycare Expense

Free Printable Daycare Receipt Printable Word Searches

ChildCare Tax Statement Child Tax Statement Daycare Tax Form Daycare

Family Day Care Tax Spreadsheet Printable Spreadshee Family Day Care

Day Care Tax Form - Provide details of the income of the children for whom you claim child home care allowance or private day care allowance Income that a child may have includes for instance child support