Deadline For Submitting Vat Return The deadline for submitting the VAT return online and the payment deadline for that quarter is 7 May 2023 Customers need to allow time for payment to reach HMRC s account

The deadline for submitting VAT returns and making payment is usually one calendar month and seven days after the end of your VAT accounting period The accounting period is the period covered by the VAT return and is ordinarily three months in length What is the deadline for filing my VAT Return The deadline for submitting your VAT return is usually one calendar month and seven days after the end of the accounting period This includes the time for your payment to reach HMRC so enough time needs to be allowed

Deadline For Submitting Vat Return

Deadline For Submitting Vat Return

https://uwm.co.uk/wp-content/uploads/2021/11/deadline-for-vat-return-1536x1024.jpg

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

How To Submit A VAT Return Fleximize

https://images.fleximize.com/images/SubmittingVATReturn_RT_28-03-22_pexels-mikhail-nilov-8296970.jpg

VAT Return deadline There are 12 months in your VAT accounting period Your VAT Return is due once a year 2 months after the end of your accounting period Most businesses now need to keep The deadline for both submitting a return and paying the VAT owing is one calendar month plus seven days after the VAT period has ended

The filing deadline for your return depends on the type of VAT scheme you are signed up for and the VAT period chosen on registration VAT returns are due quarterly monthly or annually Quarterly VAT return dates are due for submission 1 Quarterly monthly or yearly returns for VAT are required Quarterly VAT return dates are due for submission 1 month and 7 days after the end of a VAT quarter Annual VAT returns are due two months after the end of your VAT period

Download Deadline For Submitting Vat Return

More picture related to Deadline For Submitting Vat Return

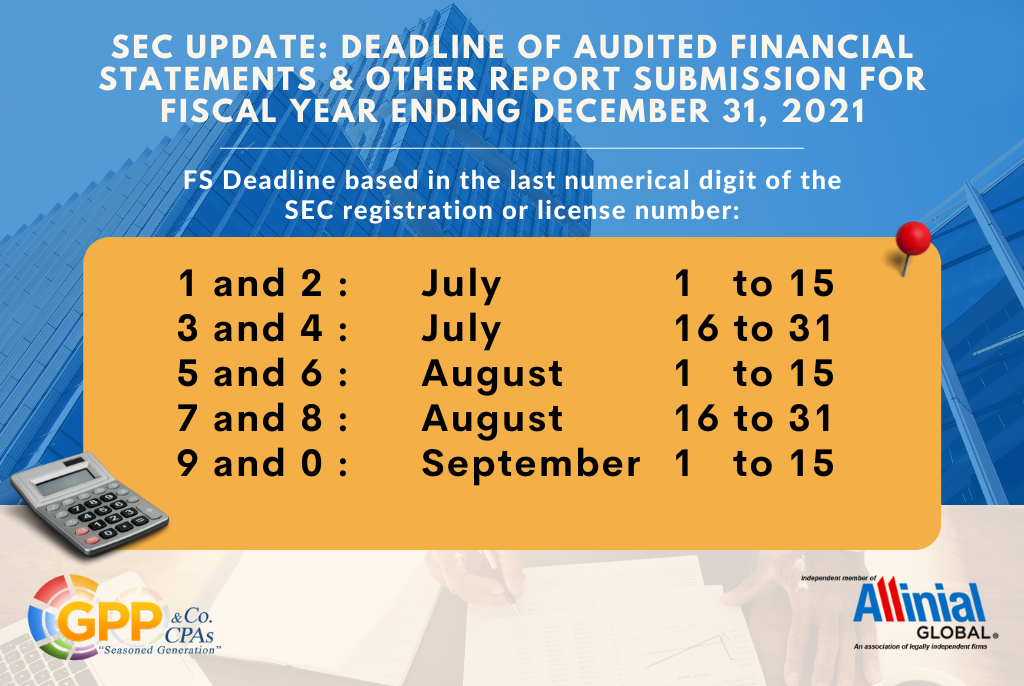

SEC Report Filing Deadline For Fiscal Year December 31 2021 G

https://gppcpas.com.ph/wp-content/uploads/2022/04/BIR-UPDATE-4.png

GAZT Announces New Dates For Submitting VAT Return

https://argaamplus.s3.amazonaws.com/31619802-b738-4d86-a61c-21eaacd65d53.png

Penalty For VAT Tax Return Deadline Halved

https://new-media.dhakatribune.com/en/uploads/watermarked/1654774374226/penalty-for-vat-tax-return-deadline-halved-r164631.jpeg

The deadline for submitting a return may not be later than 2 months after the end of the return period Do I have to make annual returns as well as returns for shorter periods In some EU countries yes VAT Deadlines and Penalties The deadline for submitting your VAT return online is usually one calendar month and 7 days after the end of a VAT accounting period To help you keep on top of the deadlines you can go to your online account and tick to receive email reminders of your VAT return being due

[desc-10] [desc-11]

VAT Return Dates Payment Deadlines Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2017/08/vat-return-deadline.jpg

Tax Return Deadline ATO Issues New Warning

https://s.yimg.com/os/creatr-uploaded-images/2020-10/db5c83f0-197a-11eb-adef-e8044db9fca8

https://www.gov.uk/government/news/hmrc-reminds...

The deadline for submitting the VAT return online and the payment deadline for that quarter is 7 May 2023 Customers need to allow time for payment to reach HMRC s account

https://www.bdo.co.uk/en-gb/insights/tax/vat-and...

The deadline for submitting VAT returns and making payment is usually one calendar month and seven days after the end of your VAT accounting period The accounting period is the period covered by the VAT return and is ordinarily three months in length

Submitting VAT Return Error 400 INVALID MONETARY AMOUNT Issue

VAT Return Dates Payment Deadlines Goselfemployed co

Ask The Tax Whiz How Can I File For The Quarterly VAT Starting

FTA Submitting The VAT Return YouTube

New Penalties For VAT

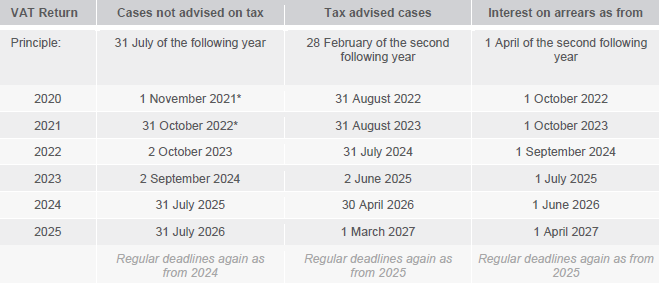

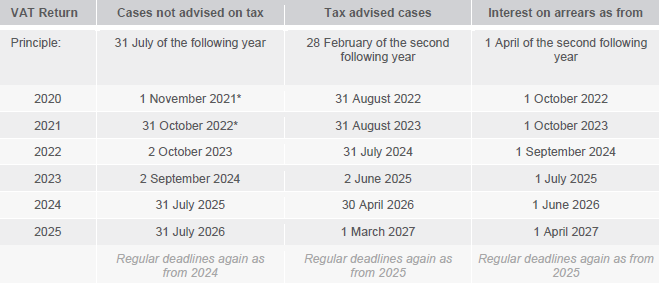

Extended Deadlines For Submitting VAT Returns 2020 To 2025 KMLZ

Extended Deadlines For Submitting VAT Returns 2020 To 2025 KMLZ

Fine Warning As Tax Return Deadline Looms 3FM Isle Of Man

VAT Rates Chart With H S Code FY 2022 23 In Bangladesh

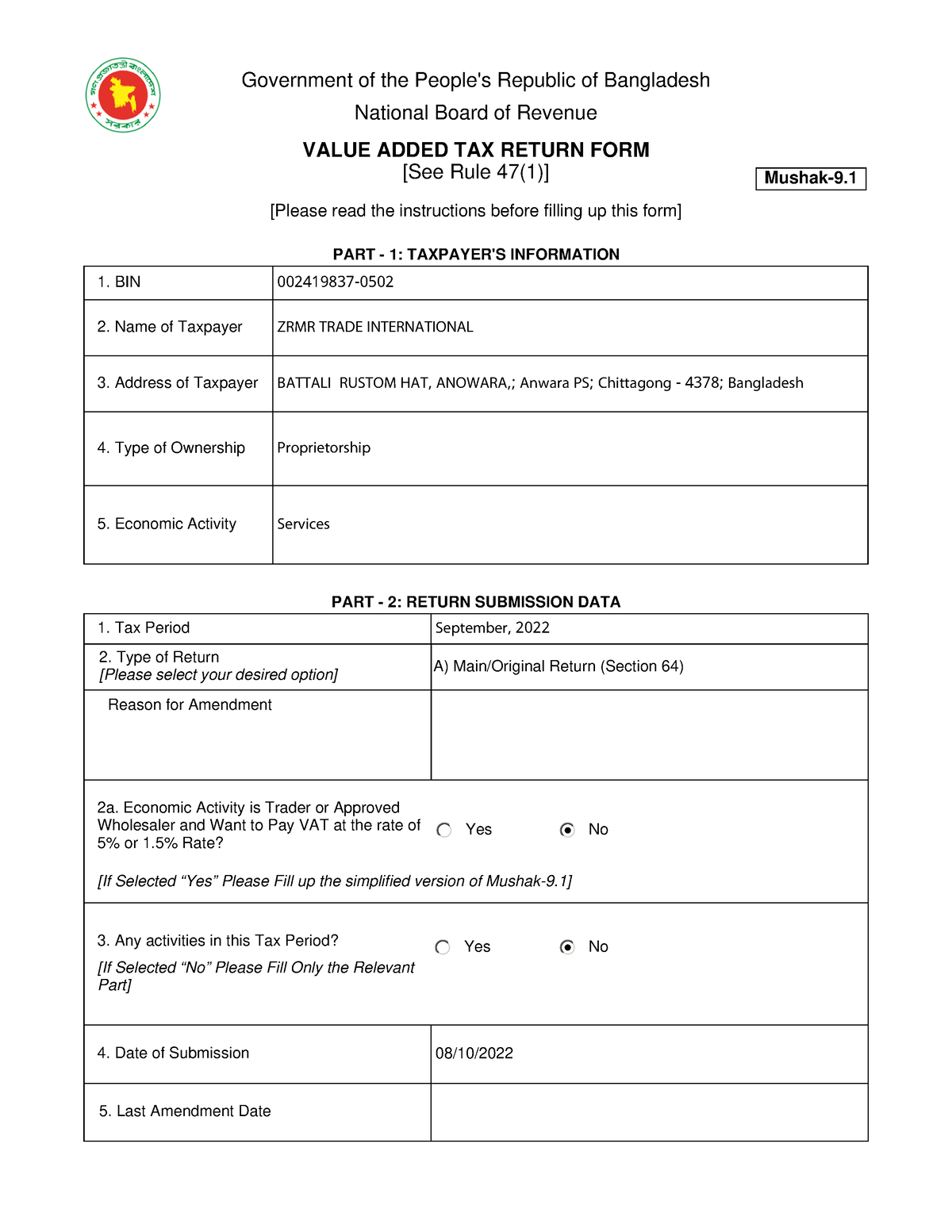

Mushak 9 1 VAT Return On 08 OCT 2022 Government Of The People s

Deadline For Submitting Vat Return - [desc-14]