Deduction From Gross Total Income Notes Step 1 Compute adjusted total income i e the gross total income as reduced by the following 1 Deductions under Chapter VI A except under section 80G 2 Short term

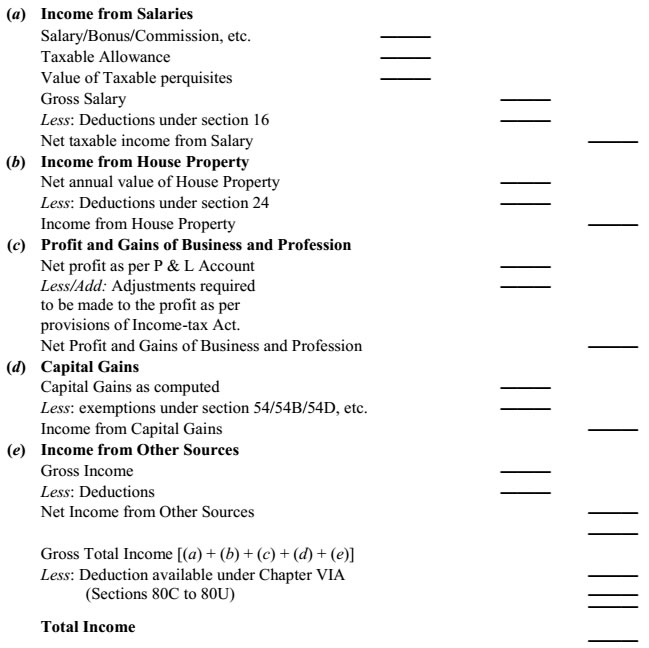

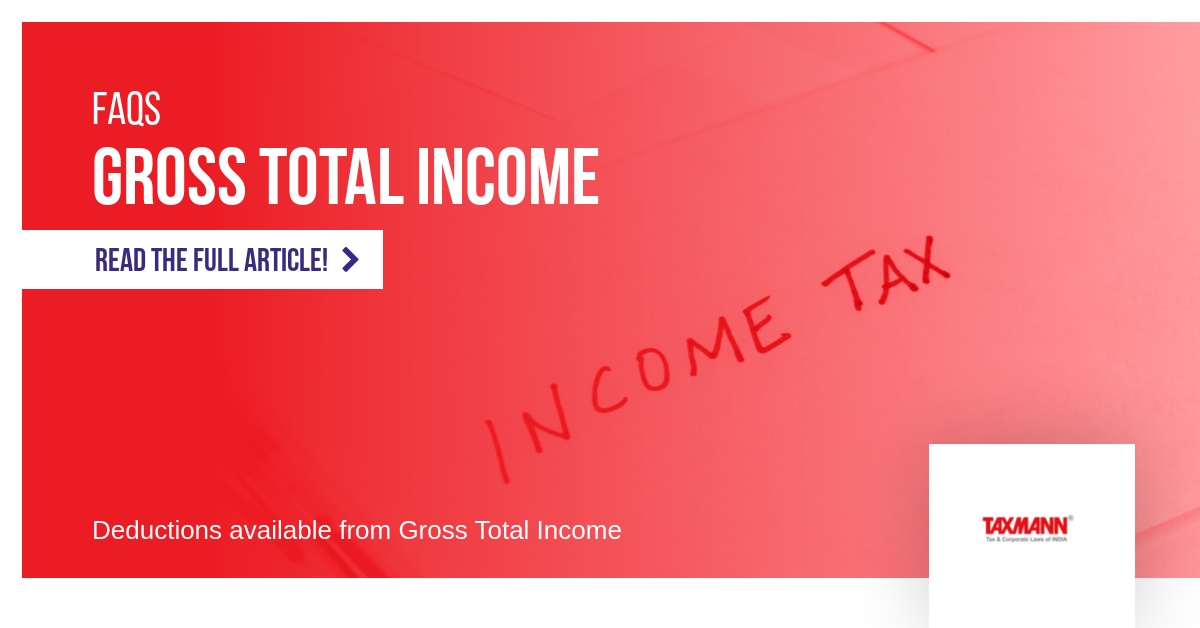

Gross Total Income Less Deduction under Chapter VI A Section 80C to 80 U Total Income Deductions should be claimed by assessee Allowed deductions are In computing the total income of an assessee certain deductions are permissible under sections 80C to 80U from Gross Total Income These deductions are however not

Deduction From Gross Total Income Notes

Deduction From Gross Total Income Notes

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Deduction From Gross Total Income

https://cdn.slidesharecdn.com/ss_thumbnails/deductionfromgrosstotalincome-130202224234-phpapp02-thumbnail-4.jpg?cb=1359845120

Computation Of Total Income With Deduction U s 80G Other Deductions

https://i.ytimg.com/vi/8ZsKLdEaGRo/maxresdefault.jpg

Under this Section deduction can be claimed up to 1 50 000 from gross total income on savings in specified modes of investments This deduction is only for individuals and Deductions from gross total income PPT Oct 3 2018 Download as PPTX PDF 14 likes 7 342 views AI enhanced description P Ravichandran

Deductions from section 80C to 80U are deducted from Gross Total Income to arrive at total income of the assessee which is also known as taxable income However What are the Deductions from Gross Total Income Deduction from gross total income classifies amounts subtracted from the total income or revenue The

Download Deduction From Gross Total Income Notes

More picture related to Deduction From Gross Total Income Notes

Deduction From Gross Total Income Section 80A To 80U

https://1.bp.blogspot.com/-ZwZMx8ZawEg/X8ziy9KI62I/AAAAAAAAAa0/IWeDUALcACg3ng1ojU4IIUiRghL-lVbogCLcBGAsYHQ/s1000/AdobeStock_190589702_Preview.jpeg

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Net Income In Finance Haiper

https://www.investopedia.com/thmb/kXfSkhhw0-QCdPUbrNqPeI9rpn4=/2092x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg

General Principles for Deductions from Incomes Sec 80A Deduction cannot exceed Gross Total Income Sec 80AB Deductions to be made with reference to the income included in the gross total income Sec 80AC Deduction not to be allowed unless return furnished Important Points Deduction u s 80C to 80U can never exceed Gross Total Gross total income of the assessee is not the income on which tax is to be paid From gross total income certain general deductions are allowed which are covered by

Note 4 1 20 000 Additional deduction u s 80CCD 1B Note 5 50 000 1 70 000 Total income 4 30 000 Notes i As per section 80C the deduction for principal repayment The aggregate of income computed under each head after giving effect to the provisions for clubbing of income and set off of losses is known as Gross Total Income In

Deductions From Gross Total Income 5 1 LEARNING OUTCOMES DEDUCTIONS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a592d9a114307ad79f8df40397379f9d/thumb_1200_1548.png

Chapter 9 Deductions From Gross Total Income Notes Chapter 9

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/f3bb369dbbfe3e6315a74b2489ad6a3d/thumb_1200_1697.png

https://icaiknowledgegateway.org/littledms/folder1/chapter-7-7.pdf

Step 1 Compute adjusted total income i e the gross total income as reduced by the following 1 Deductions under Chapter VI A except under section 80G 2 Short term

https://egyankosh.ac.in/bitstream/123456789/66990/3/Unit-15.pdf

Gross Total Income Less Deduction under Chapter VI A Section 80C to 80 U Total Income Deductions should be claimed by assessee Allowed deductions are

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Deductions From Gross Total Income 5 1 LEARNING OUTCOMES DEDUCTIONS

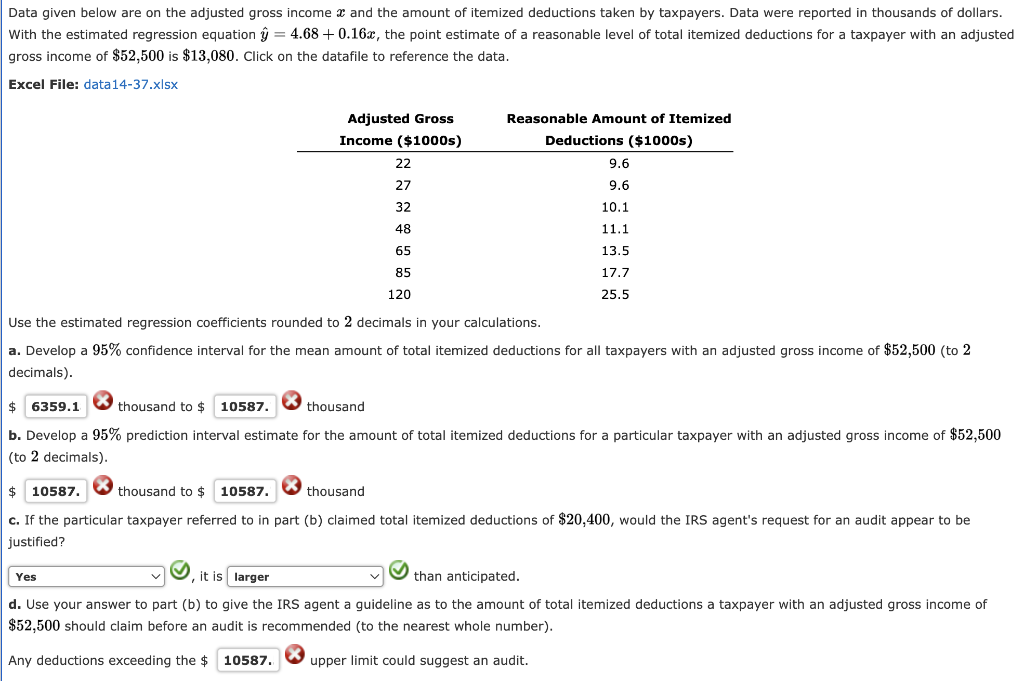

Solved Data Given Below Are On The Adjusted Gross Income X Chegg

Lecture 44 Deduction From Gross Total Income YouTube

Solved Please Note That This Is Based On Philippine Tax System Please

Gross Total Income Section 80B 5 Definations Under I Tax

Gross Total Income Section 80B 5 Definations Under I Tax

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

FAQs On Deduction Available From Gross Total Income Taxmann

Income Limits On Charitable Deductions 1 Introduction updated YouTube

Deduction From Gross Total Income Notes - Under this Section deduction can be claimed up to 1 50 000 from gross total income on savings in specified modes of investments This deduction is only for individuals and