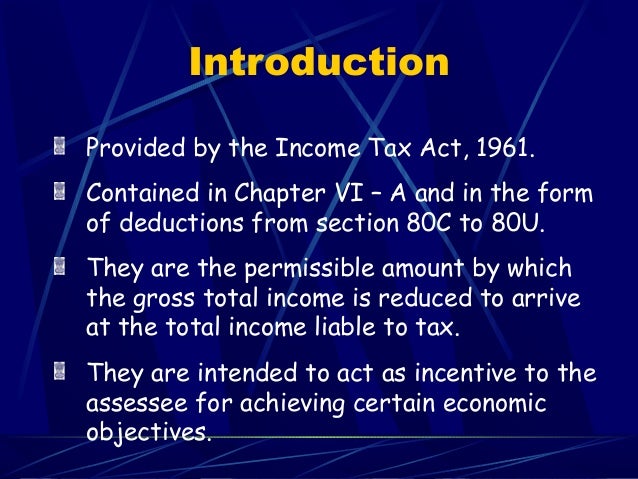

Deduction From Gross Total Income Pdf Deduction from Gross Total Income Section 80A to 80U Chapter VIA These deductions are of two types Deductions on account of certain payments and

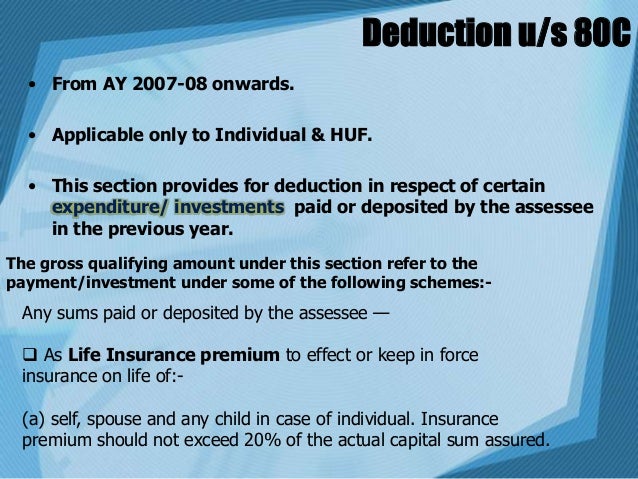

These deductions are called deductions from gross total income and are defined in Sections 80C to 80U of Income Tax Act 1961 These deductions are allowed from the GTI to DEDUCTIONS FROM GROSS TOTAL INCOME 1 Deductions in respect of certain investments contributions subscriptions etc Sec 80C 3 Own contribution to P P F in

Deduction From Gross Total Income Pdf

Deduction From Gross Total Income Pdf

https://image.slidesharecdn.com/deductionfromgrosstotalincome-130202224234-phpapp02/95/deduction-from-gross-total-income-2-638.jpg?cb=1359845120

Deduction From Gross Total Income

https://image.slidesharecdn.com/deductionfromgrosstotalincome-130202224234-phpapp02/95/deduction-from-gross-total-income-28-638.jpg?cb=1359845120

Deductions From Gross Total Income

https://image.slidesharecdn.com/deductionsfromgrosstotalincome-140315015815-phpapp01/95/deductions-from-gross-total-income-3-638.jpg?cb=1394848754

Gross Total Income Less Deduction under Chapter VI A Section 80C to 80 U Total Income Deductions should be claimed by assessee Allowed deductions are From gross total income certain general deductions are allowed which are covered by Chapter VIA of the Income Tax Act Chapter VIA covers section 80 and these

5 1 LEARNING OUTCOMES DEDUCTIONS FROM GROSS TOTAL INCOME After studying this chapter you would be able to appreciate the types of deductions Under this Section deduction can be claimed up to 1 50 000 from gross total income on savings in specified modes of investments This deduction is only for individuals and

Download Deduction From Gross Total Income Pdf

More picture related to Deduction From Gross Total Income Pdf

Deduction From Gross Total Income Section 80A To 80U

https://1.bp.blogspot.com/-ZwZMx8ZawEg/X8ziy9KI62I/AAAAAAAAAa0/IWeDUALcACg3ng1ojU4IIUiRghL-lVbogCLcBGAsYHQ/s1000/AdobeStock_190589702_Preview.jpeg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Deductions From Gross Total Income 5 1 LEARNING OUTCOMES DEDUCTIONS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a592d9a114307ad79f8df40397379f9d/thumb_1200_1548.png

GRoSS ToTAL INcoMe RebATe AND ReLIeF Amount that can be claimed by him as deduction out of income in AY 2021 22 is a 50 of 3 50 000 b 1 50 000 u s 80c Gross Total Income a Short term capital gain under sec 111A b Long term capital gain c Lotteries d Income under Sections 115A 115AB 115AC 115ACA 115AD 115BBA

Deduction shall be allowed from the gross total income of an individual who is a senior citizen in respect of income by way of deposit in the savings bank account included in Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under section 80c for FY 2020

Lecture 44 Deduction From Gross Total Income YouTube

https://i.ytimg.com/vi/xBgqekzmPZk/maxresdefault.jpg

Deductions From Gross Total Income

https://image.slidesharecdn.com/d4mgti-181004013618/95/deductions-from-gross-total-income-2-638.jpg?cb=1538622203

https://incometaxmanagement.com/Pages/Tax-Ready...

Deduction from Gross Total Income Section 80A to 80U Chapter VIA These deductions are of two types Deductions on account of certain payments and

https://cwmindia.com/wp-content/uploads/2021/04/...

These deductions are called deductions from gross total income and are defined in Sections 80C to 80U of Income Tax Act 1961 These deductions are allowed from the GTI to

Salary Income Perquisite Valuation Exempt Allowances Deductions

Lecture 44 Deduction From Gross Total Income YouTube

FAQs On Deduction Available From Gross Total Income Taxmann

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Deduction FROM Gross Total Income DEDUCTION FROM GROSS TOTAL INCOME

Deduction From Gross Total Income

Deduction From Gross Total Income

Dr RAVNEET KAUR ARORA PUNJAB Deductions From The Gross Total Income

Tax Savings Deductions Under Chapter VI A Learn By Quicko

SOLUTION Deductions From Gross Total Income Studypool

Deduction From Gross Total Income Pdf - Gross Total Income Less Deduction under Chapter VI A Section 80C to 80 U Total Income Deductions should be claimed by assessee Allowed deductions are