Deduction Of Tax At Source And Rebates And Reliefs Web 2 mars 2023 nbsp 0183 32 A tax deduction reduces your taxable income for the year thereby lowering your tax bill Taxpayers can take the standard deduction or itemize their deductions on Schedule A of Form 1040

Web This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax It allows one to deduct an amount from the total income of the person A tax rebate also Web 20 ao 251 t 2022 nbsp 0183 32 In simple terms rebate is deduction from income tax payable Here Income Tax Payable Tax Payable Cess Surcharge Interest if any TDS Note that

Deduction Of Tax At Source And Rebates And Reliefs

Deduction Of Tax At Source And Rebates And Reliefs

https://wirc-icai.org/wirc-reference-manual/part4/images/TDSPART4.1.jpg

Tax Deduction At Source TDS Tax And Accounting Services For

https://gkmtax.in/wp-content/uploads/2020/04/Tax-Deduction-at-Source.jpg

9 Deduction Of Tax At Source YouTube

https://i.ytimg.com/vi/zeDn0puIi7I/maxresdefault.jpg

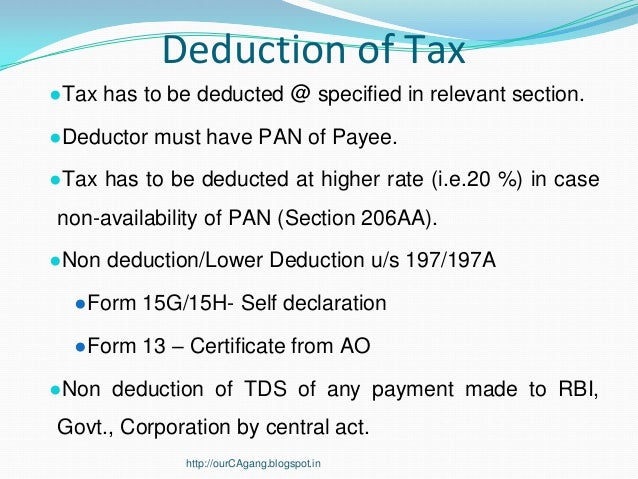

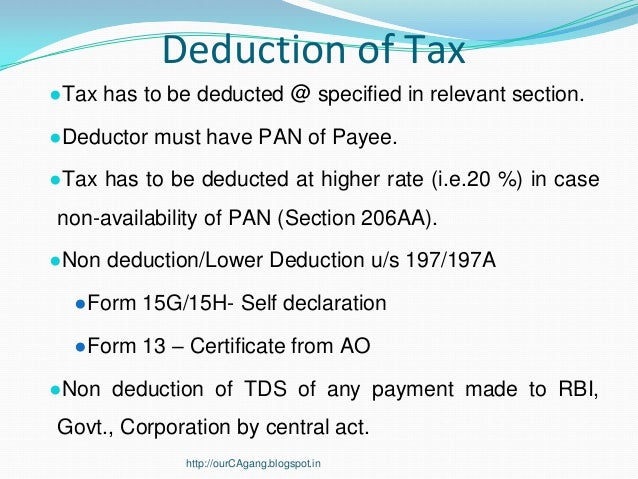

Web TDS stands for tax deducted at source As per the Income Tax act any company or person making a payment is required to deduct tax at source if the payment exceeds certain Web Tax deductions will be automatically granted for qualifying donations Deductions for self employed partnership trade business profession or vocation Claim deductions

Web 30 avr 2023 nbsp 0183 32 Tax Deduction A tax deduction is a reduction in tax obligation from a taxpayer s gross income Tax deductions can be the result of a variety of events that the taxpayer experiences over the Web Open all Who pays tax at source How is tax deducted at source How much can you expect to pay To find out more A service of the Confederation cantons and communes

Download Deduction Of Tax At Source And Rebates And Reliefs

More picture related to Deduction Of Tax At Source And Rebates And Reliefs

GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF REVENUE CENTRAL

https://i.pinimg.com/originals/48/2e/8b/482e8b89ee188818d1c074c04a487047.jpg

Taxmann s Deduction Of Tax At Source TDS With Advance Tax And Refunds

https://law-all.com/image/cache/catalog/data/Book Images/Taxmann/2022/9789356220867-500x500.jpg

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/Difference-between-exemption-and-deduction-and-rebate-768x1256.png

Web 10 f 233 vr 2023 nbsp 0183 32 Under the new tax regime the rebate is available if the taxable income is less than 7 lakhs Therefore tax exemption and tax deductions help in saving money Web 1 mars 2023 nbsp 0183 32 Deduction A deduction is any item or expenditure subtracted from gross income to reduce the amount of income subject to income tax It is also referred to as

Web 3 sept 2020 nbsp 0183 32 Elaborate the deduction of tax at source and rebates and reliefs Get the answers you need now Web There are two types of tax relief paid into workplace pensions the net pay arrangement and relief at source Find out how this affects what you see on your payslip and when

TDS Tax Deducted At Source

https://image.slidesharecdn.com/tdsppt-140323114023-phpapp02/95/tds-tax-deducted-at-source-6-638.jpg?cb=1395575014

Overview Of Rates For Deduction Of Tax At Source TDS Under The Income

https://www.taxmann.com/post/wp-content/uploads/2023/04/Overview-of-Rates_April23.jpg

https://www.investopedia.com/terms/t/tax-reli…

Web 2 mars 2023 nbsp 0183 32 A tax deduction reduces your taxable income for the year thereby lowering your tax bill Taxpayers can take the standard deduction or itemize their deductions on Schedule A of Form 1040

http://www.differencebetween.info/difference …

Web This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax It allows one to deduct an amount from the total income of the person A tax rebate also

Taxmann s Deduction Of Tax At Source With Advance Tax And Refunds

TDS Tax Deducted At Source

Demystifying Tax Deduction At Source TDS Interest On Securities

PPT TAX DEDUCTION AT SOURCE TDS PowerPoint Presentation Free

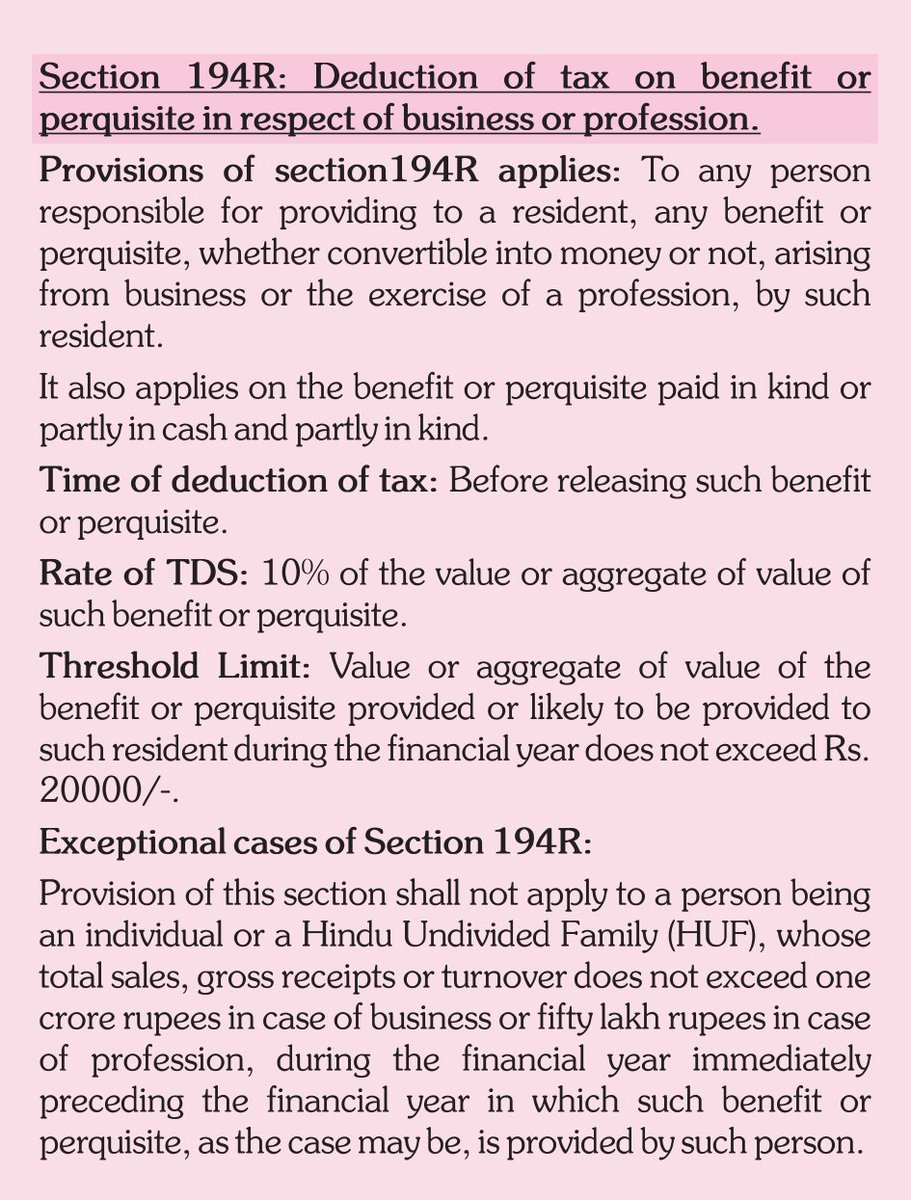

Taxation Updates Mayur J Sondagar On Twitter Section 194R N

TDS Deduction Of Tax At Source Under Section 194J Vakilsearch

TDS Deduction Of Tax At Source Under Section 194J Vakilsearch

Deduction Of Tax At Source With Advance Tax Refunds AY 2023 24 I

Deduction Of Tax At Source With Advance Tax And Refunds As Amended By

PPT TAX DEDUCTED AT SOURCE PowerPoint Presentation Free Download

Deduction Of Tax At Source And Rebates And Reliefs - Web Open all Who pays tax at source How is tax deducted at source How much can you expect to pay To find out more A service of the Confederation cantons and communes