Invite to Our blog, a room where interest satisfies information, and where day-to-day topics come to be interesting conversations. Whether you're seeking insights on way of living, innovation, or a bit of whatever in between, you've landed in the right area. Join us on this exploration as we dive into the worlds of the ordinary and phenomenal, making sense of the globe one blog post each time. Your journey right into the interesting and varied landscape of our Deduction On Home Loan Interest As Per Section 24 starts right here. Check out the fascinating material that awaits in our Deduction On Home Loan Interest As Per Section 24, where we unwind the complexities of different subjects.

Deduction On Home Loan Interest As Per Section 24

Deduction On Home Loan Interest As Per Section 24

Best Home Loan Rates Mint

Best Home Loan Rates Mint

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Gallery Image for Deduction On Home Loan Interest As Per Section 24

Debt Recovery Interest Calculator HussanRomano

Claiming The Student Loan Interest Deduction

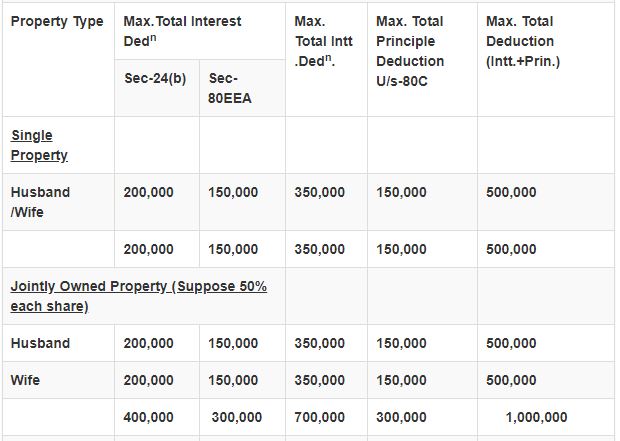

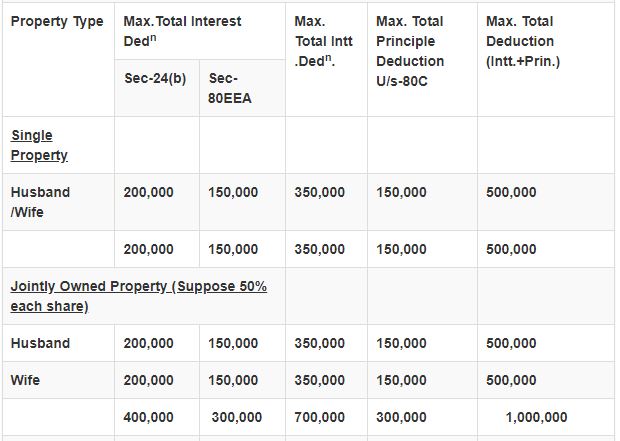

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

All About Section 80EEA For Deduction On Home Loan Interest

Section 24 Of Income Tax Act House Property Deduction

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Deduction Of Interest On Housing Loan In Case Of Co ownership

Thanks for picking to explore our web site. We best regards hope your experience surpasses your expectations, which you discover all the information and sources about Deduction On Home Loan Interest As Per Section 24 that you are seeking. Our commitment is to offer an easy to use and useful system, so feel free to browse with our web pages easily.