Deduction Under Income Tax Act Verkko 12 marrask 2020 nbsp 0183 32 Deductions under Income Tax Act Although a New tax structure is introduced for the individual taxpayers from F Y 2020 21 onwards with a lower tax slabs broadly famous as New Personal Income Tax Regime or New Tax Regime under which individual can pay lower taxes if they forego their deductions amp exemptions

Verkko 28 jouluk 2023 nbsp 0183 32 Such taxpayers can opt for the reduced income tax slab for the FY 2022 23 AY 2023 2024 under the new tax regime Explore the comprehensive list of Income Tax Deductions for FY 2022 23 AY 2023 24 under Sections 80C 80CCC 80CCD and 80D Maximize your tax savings with this detailed guide Verkko Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under section 80c for FY 2020 21 AY 2021 22 File Now

Deduction Under Income Tax Act

Deduction Under Income Tax Act

https://instafiling.com/wp-content/uploads/2023/01/Medical-Expenses-Deduction-Under-Income-Tax-Act-1080x675.png

![]()

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Verkko Section 80TTA of the Income Tax Act 1961 offers a deduction of up to Rs 10 000 on income earned from savings account interest This exemption is available for Individuals and HUFs In case the income from bank interest is less than Rs 10 000 the whole amount will be allowed as a deduction Verkko Deductions allowed under the income tax act help you reduce your taxable income You can avail the deductions only if you have made tax saving investments or incurred eligible expenses There are a number of deductions available under various sections that will bring down your taxable income The most popular one is section 80C of Chapter

Verkko 26 hein 228 k 2018 nbsp 0183 32 As per Income Tax Act deductions are the payments or investments made by the assessee through which a specific amount or percentage is reduced from their gross total income to arrive at total taxable income Verkko Standard Deduction Rs 50 000 or the amount of salary whichever is lower Individual Salaried Employee amp Pensioners 16 ii Entertainment allowance actual or at the rate of 1 5th of salary whichever is less limited to Rs 5 000 Government employees 16 iii Employment tax Salaried assessees

Download Deduction Under Income Tax Act

More picture related to Deduction Under Income Tax Act

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

https://i.ytimg.com/vi/8HNLhtLpIbA/maxresdefault.jpg

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/section-10-under-income-tax-act.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

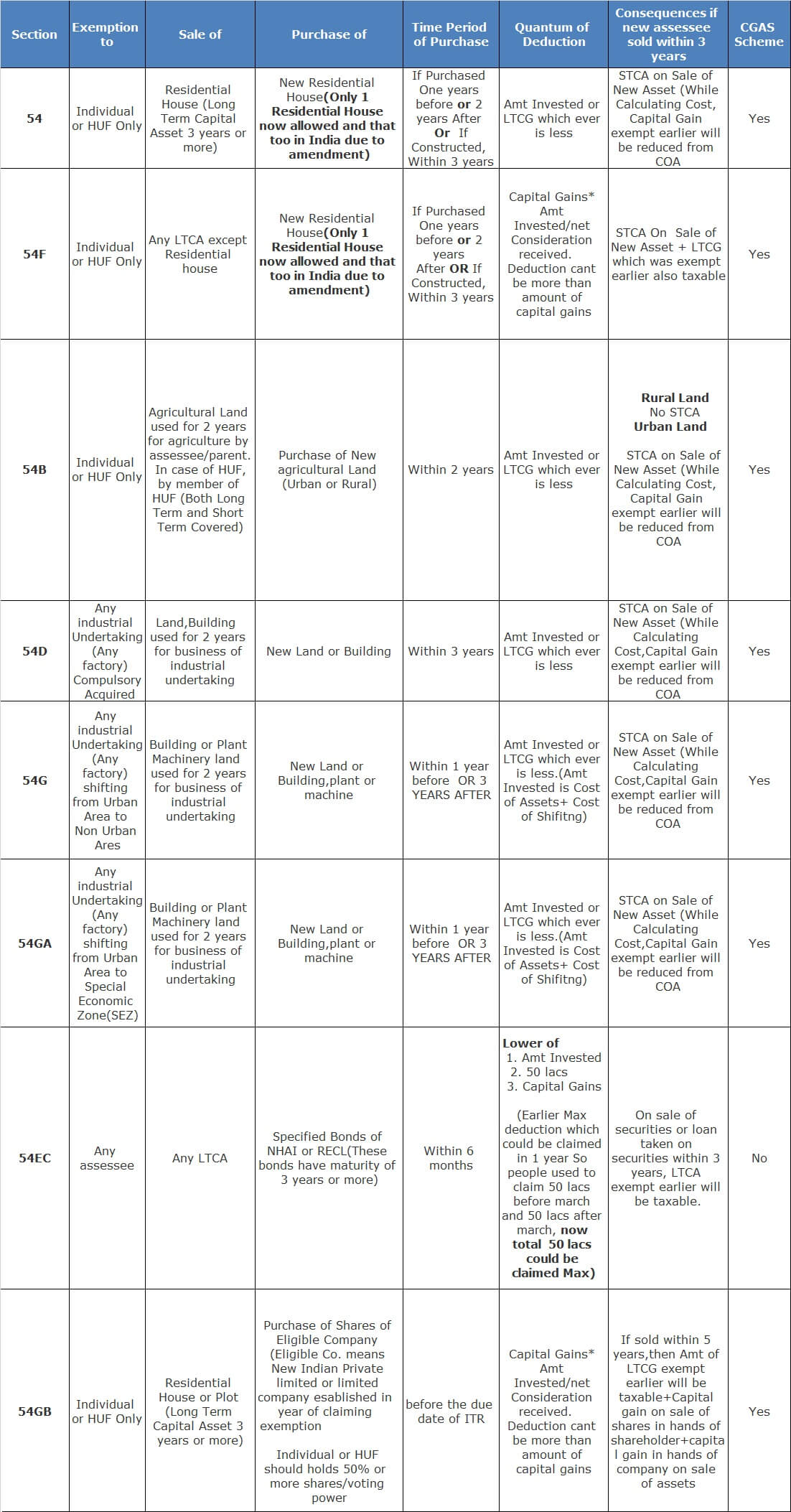

Verkko 30 jouluk 2023 nbsp 0183 32 gt Standard deduction under New Tax Regime The standard deduction of Rs 50 000 Taxpayers can claim deductions for this under Section 54 and Section 54F of the Income tax Act 1961 Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 Tax deductions and tax credits are ways to whittle down what you owe to Uncle Sam Both can lower your tax bill but do so in different ways While tax deductions reduce the amount of your income

Verkko 19 huhtik 2023 nbsp 0183 32 Some of the popular deductions and exemptions available under the Income Tax Act of 1961 include the standard deduction deduction for interest paid on a home loan deduction for health insurance premiums deduction for contributions to the National Pension System NPS and exemption for long term capital gains on the Verkko 11 tammik 2023 nbsp 0183 32 The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income Tax Act talks about those exemption provisions and the terms and conditions on which one can avail a tax exemption Here s more on this matter

Section 24 Of Income Tax Act House Property Deduction

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03125718/Deduction-us-24b-2-782x1024.jpg

Section 54 To 54H Of Income Tax Act Download Chart Teachoo

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/576b54f6-1ee4-4666-afef-508fe3b1808d/section-54-income-tax-act---capital-gain-chart.jpg

https://taxguru.in/income-tax/deductions-income-tax-act.html

Verkko 12 marrask 2020 nbsp 0183 32 Deductions under Income Tax Act Although a New tax structure is introduced for the individual taxpayers from F Y 2020 21 onwards with a lower tax slabs broadly famous as New Personal Income Tax Regime or New Tax Regime under which individual can pay lower taxes if they forego their deductions amp exemptions

https://tax2win.in/guide/deductions

Verkko 28 jouluk 2023 nbsp 0183 32 Such taxpayers can opt for the reduced income tax slab for the FY 2022 23 AY 2023 2024 under the new tax regime Explore the comprehensive list of Income Tax Deductions for FY 2022 23 AY 2023 24 under Sections 80C 80CCC 80CCD and 80D Maximize your tax savings with this detailed guide

Section 24 Of Income Tax Act Types Deductions Exceptions And How To

Section 24 Of Income Tax Act House Property Deduction

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Information On Section 80G Of Income Tax Act Ebizfiling

Standard Deduction 2019

The 6 Best Tax Deductions For 2020 The Motley Fool

The 6 Best Tax Deductions For 2020 The Motley Fool

What Is Section 80G Tax Deductions On Your Donations Deduction U s

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

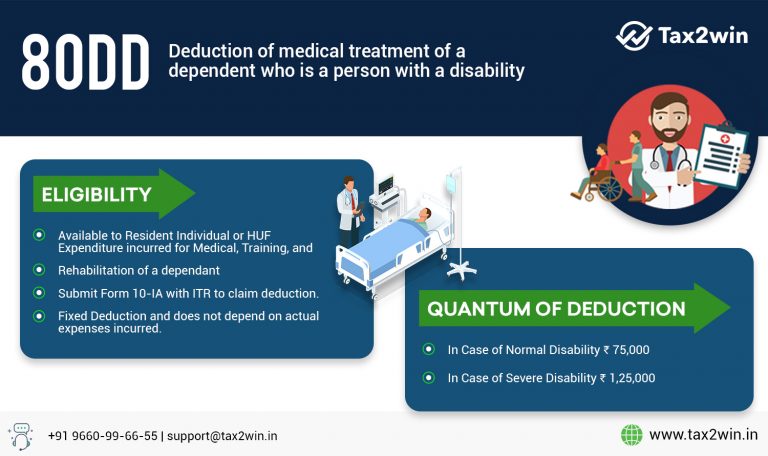

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Deduction Under Income Tax Act - Verkko Deductions from Salary Section 16 Income tax Act allows three deductions from the salary income i e Standard Deduction Deduction for Entertainment Allowance and Deduction for Professional Tax Standard Deduction is allowed to every employee whose income is taxable under the head salary In