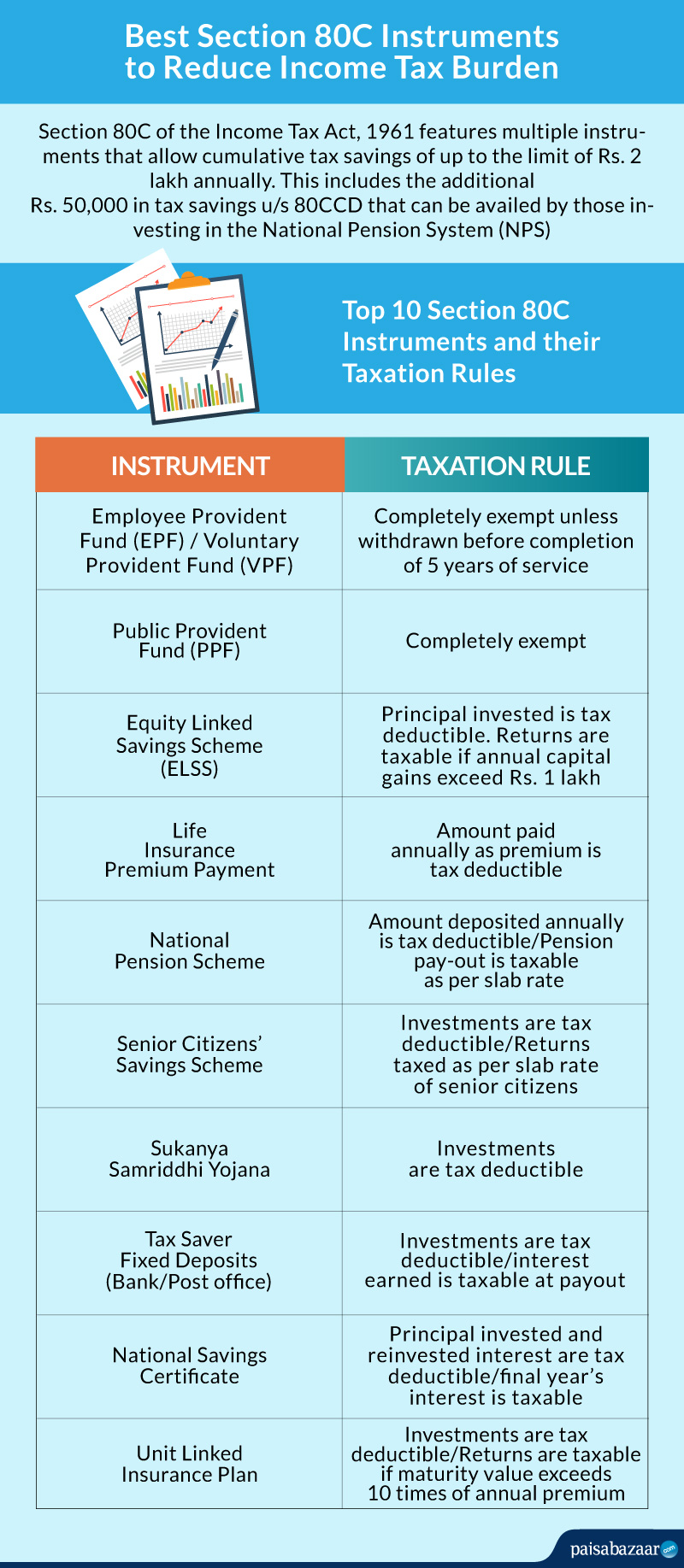

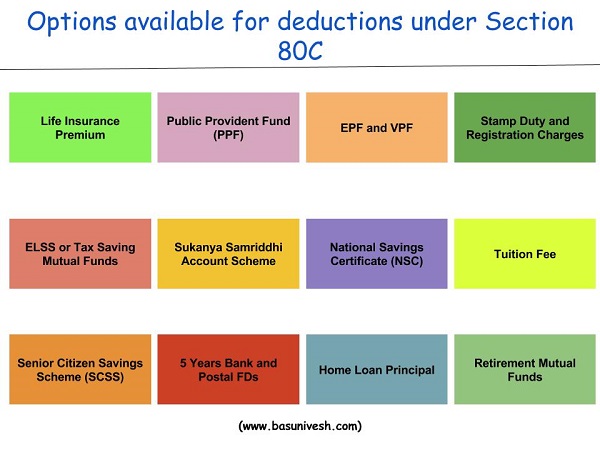

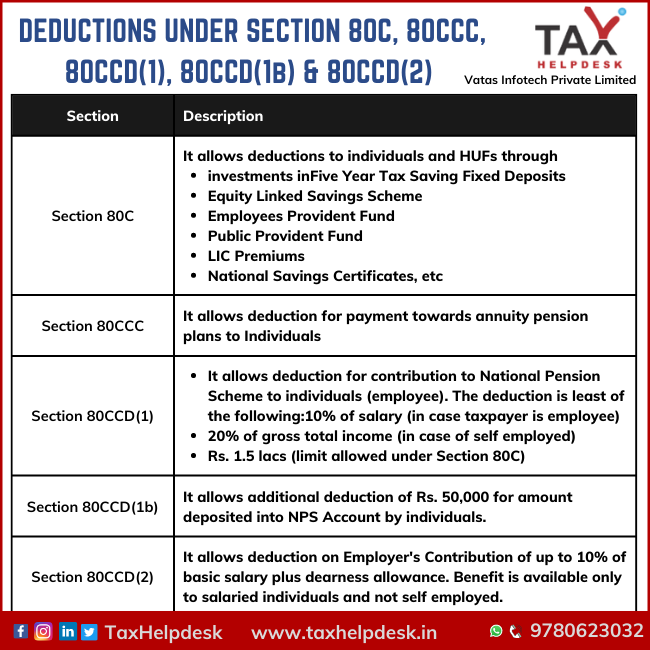

Deduction Under Section 80c To 80u Pdf Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

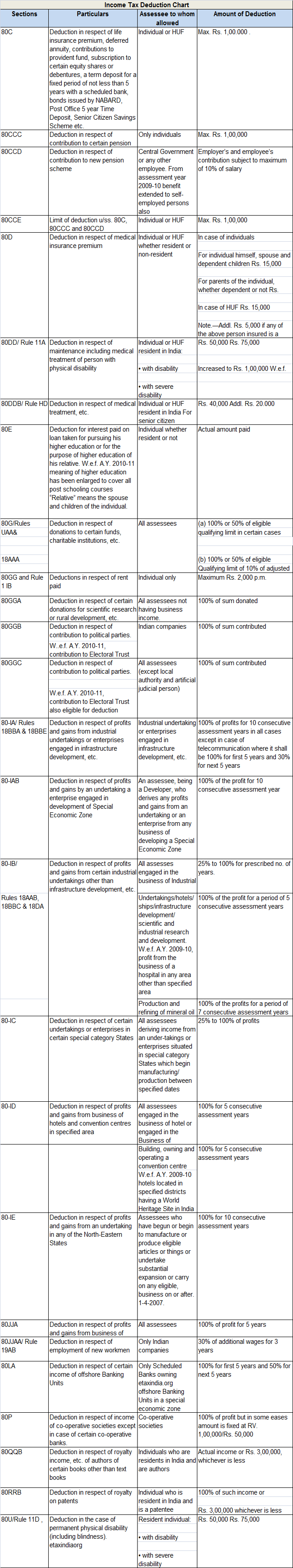

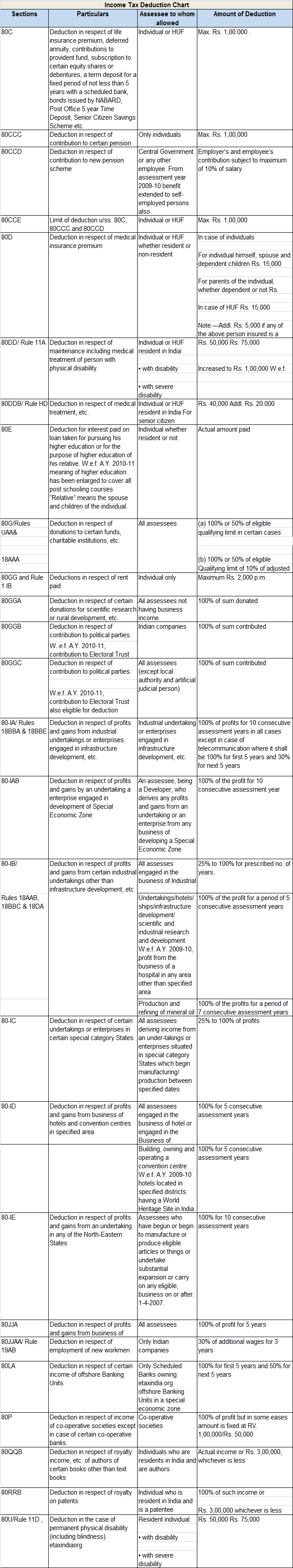

Income Tax Deductions under section 80C to 80U ARUSHI MITTAL Income Tax Articles Download PDF 12 Aug 2018 110 922 Views 9 comments Sec 80AC Deduction not to be allowed unless return furnished Important Points 1 Deduction u s 80C to 80U can never exceed Gross Total Income 2 Deduction u s 80C

Deduction Under Section 80c To 80u Pdf

Deduction Under Section 80c To 80u Pdf

https://image.slidesharecdn.com/deductionunderchaptervi-asection80c-80uincometax1961-170226104645/85/deduction-under-chapter-via-section-80c-80u-income-tax-1961-8-638.jpg?cb=1666644671

INCOME TAX DEDUCTION UNDER SECTION 80C TO 80U PDF

https://moneyexcel.com/images/incometaxchart.png

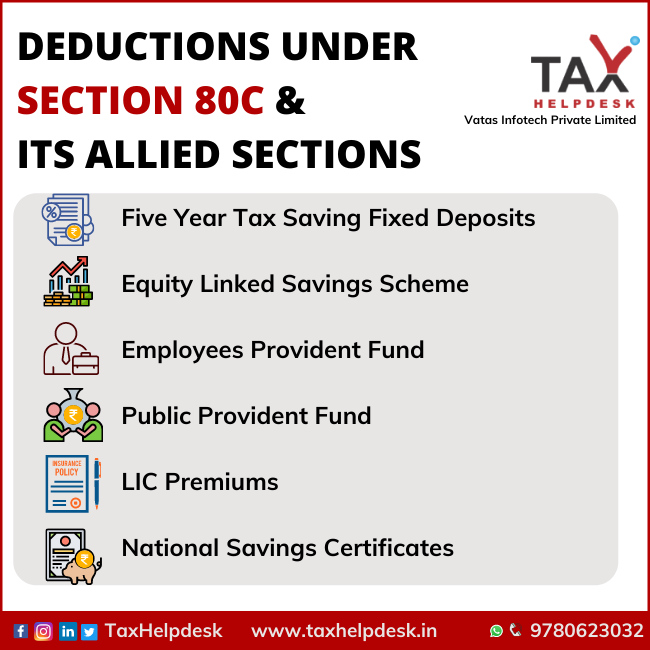

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Deductions-under-Section-80C-its-allied-sections.png

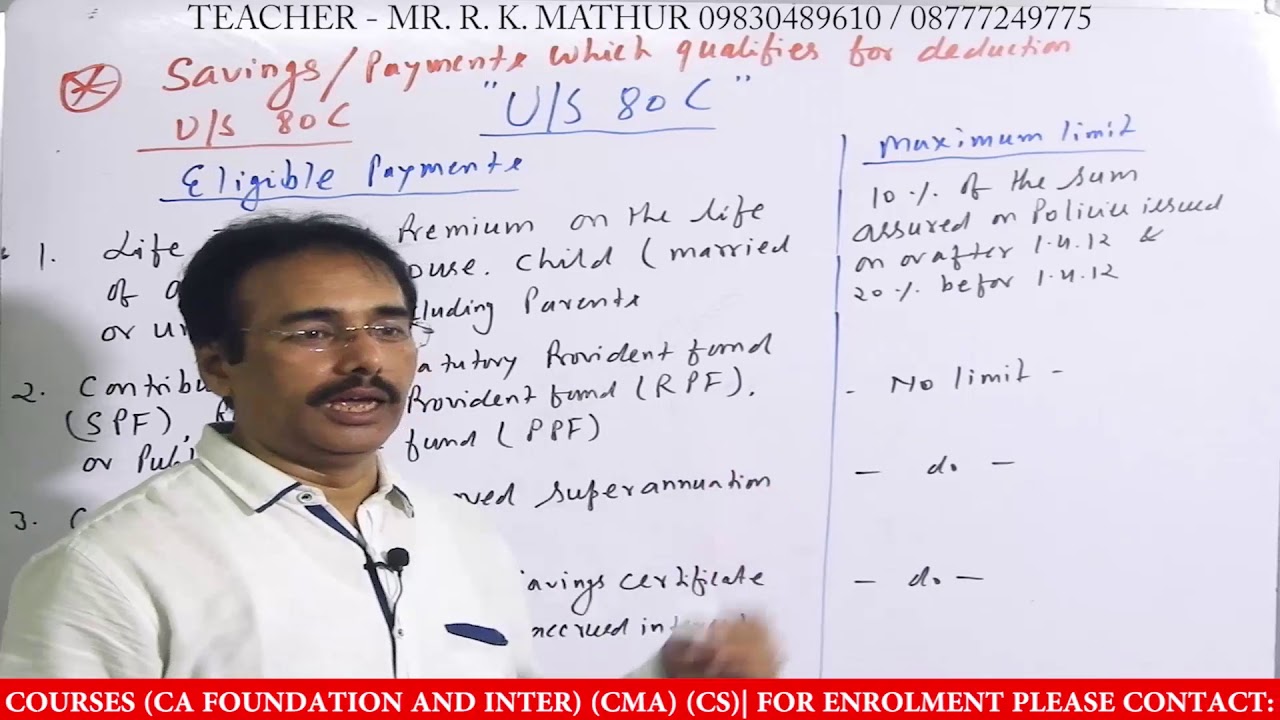

DEDUCTIONS U S 80C 80U 1 Can not exceed GTI 2 Can not claim from casual LTCG STCG 111A LT 112A PART A PART B Name Amt Other 1 80D AMT Nature Medical Section 80C i Deduction in respect of investment contributions Section 80C provides for a deduction from the Gross Total Income of savings in specified modes of

Income Tax Deductions under Section 80C to 80U Individuals can claim tax deduction benefits for payments made towards life insurance policies fixed deposits 16 May 2022 Income Tax Section 80 of the Income Tax Act offers a range of savings and investments that you can use to lower your taxable income Section 80C to 80U covers

Download Deduction Under Section 80c To 80u Pdf

More picture related to Deduction Under Section 80c To 80u Pdf

Section 80C Deduction Under Section 80C In India Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

Module 05 Deduction Under Section 80C TO 80U Theory Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/281727b78d2cf4b9a82526ef57813f70/thumb_1200_1553.png

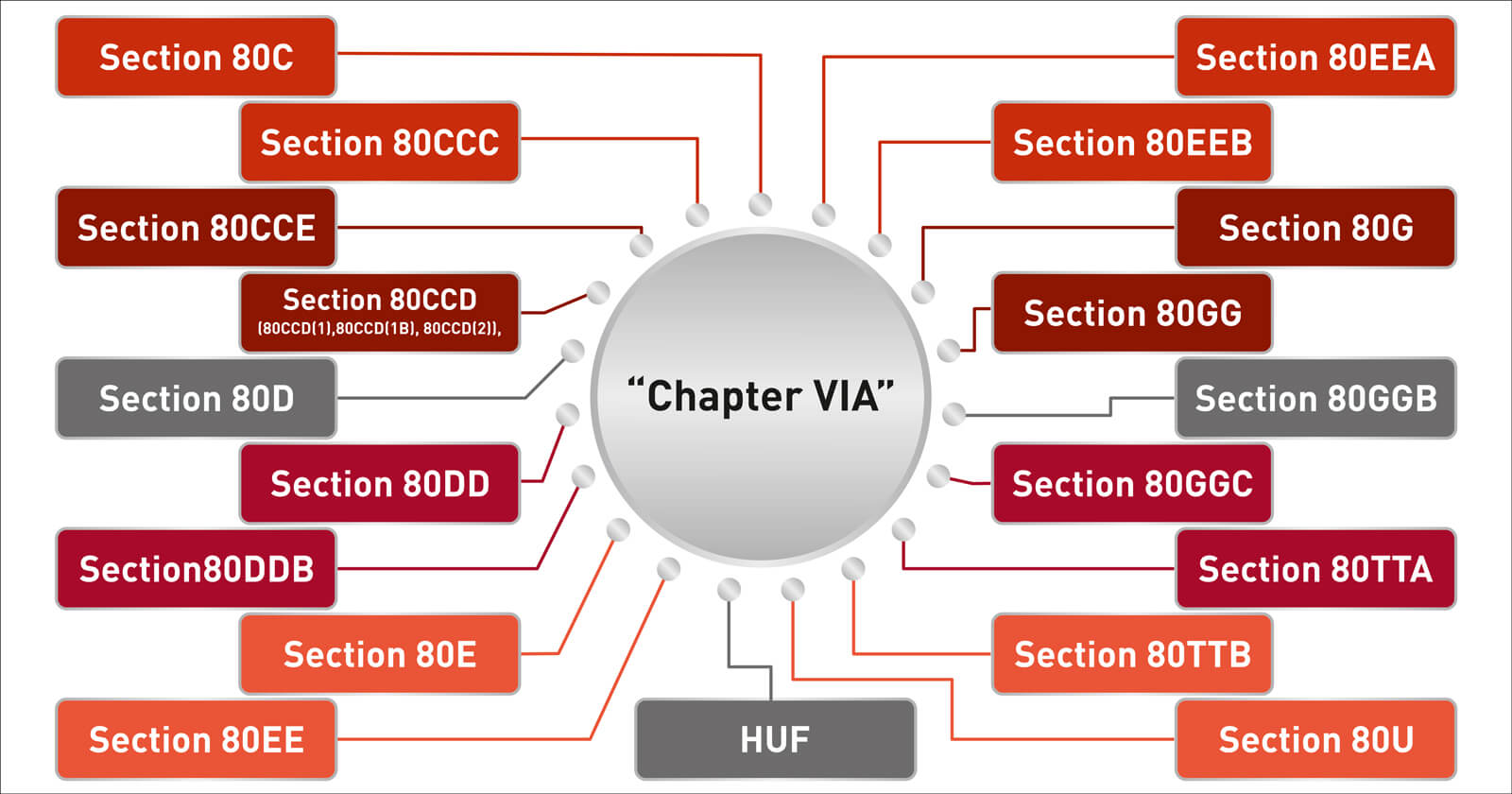

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Allowed from sec 80C to 80GGC DEDUCTION IN RESPECT OF LIFE INSURANCE PREMIUM DEFERRED ANNUITY CONTRIBUTION TO PROVIDENT FUND etc Deduction claimed under 80CCD 1 Deduction limit of 50 000 80CCD 2 Deduction towards contribution made by an employer to the Pension Scheme of Central

A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions Deduction covered under sec 80C to 80U Deduction refers to one must account their income then through the income he do get the benefit by allowing deduction which are

Deduction US 80C Deduction Under Section 80C Everything About

https://i.ytimg.com/vi/784UGSm-7B0/maxresdefault.jpg

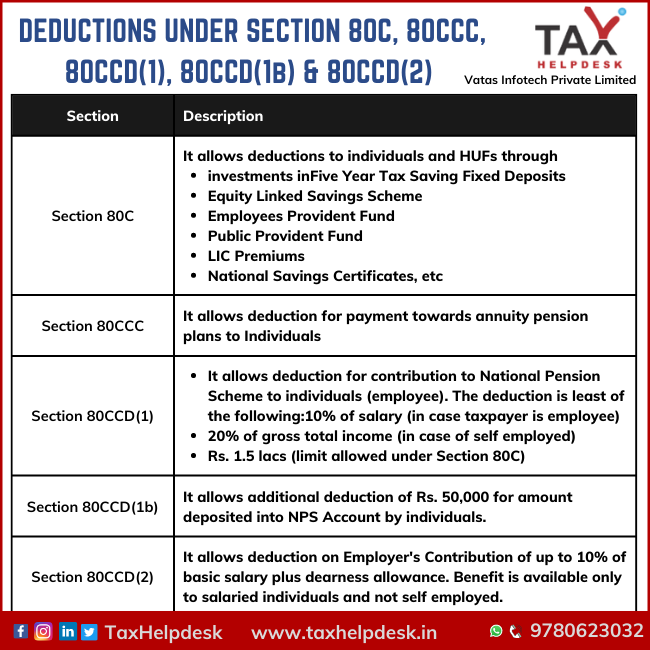

Deduction Under Section 80C To 80U YouTube

https://i.ytimg.com/vi/aVOngu2L6VM/maxresdefault.jpg

https://tax2win.in/guide/deductions

Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

https://taxguru.in/income-tax/income-tax-deductions-section-80c-80u.html

Income Tax Deductions under section 80C to 80U ARUSHI MITTAL Income Tax Articles Download PDF 12 Aug 2018 110 922 Views 9 comments

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Deduction US 80C Deduction Under Section 80C Everything About

Deductions Under Section 80C Its Allied Sections

DEDUCTION UNDER SECTION 80C TO 80U PDF

Deduction Under Section 80C A Complete List BasuNivesh

A Quick Look At Deductions Under Section 80C To Section 80U

A Quick Look At Deductions Under Section 80C To Section 80U

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Income Tax Deduction Under Section 80C To 80U FY 2022 23

DEDUCTION UNDER SECTION 80C TO 80U PDF

Deduction Under Section 80c To 80u Pdf - As per the current income tax laws the total investment amount under sections 80C 80CCC and 80CCD 1 cannot exceed Rs 1 5 lakh for FY 2019 20 If your