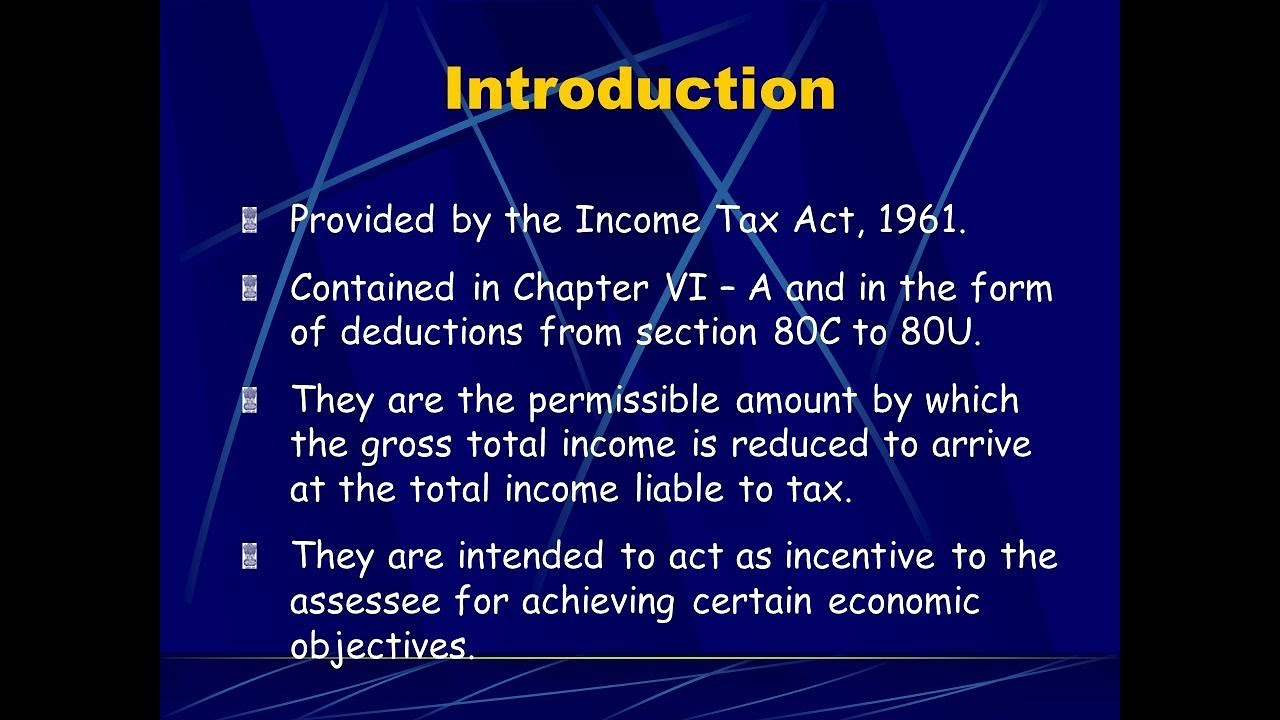

Deduction Under Section 80ccc Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023

Under Section 80CCC of the Income Tax Act 1961 a taxpayer can claim tax deductions against the monetary contributions made towards Deduction under Section 80CCD According to this section deduction is available to individuals for contributions made to the National Pension Scheme NPS or The Atal Pension Yojna APY Mandatory to

Deduction Under Section 80ccc

Deduction Under Section 80ccc

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ccc.jpg

Deduction Under Section 80CCC Tutorial In Tamil YouTube

https://i.ytimg.com/vi/S3Er3V37f9c/maxresdefault.jpg

Who Can Claim Tax Deduction Under Section 80CCC IndianWeb2

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjoBND5RA5o473AlqsIAnwSh5r1DRlysukjw2c5uX5rIk4RtH4Ao05qzpKnmjNJYvSUJUDBHNKaxbT1wO3Pf9UkKpmUTZk8zcCRDCqnMERZlv4lzZTc4cjvQNmTP-fpxNS5tXuQTPViDqsbhZfLropM6-2OEiyYZi86T96T8wK92weS0W94D7cJ6Fez/s16000/euro-g19ca545e5_1280.jpg

Eligibility Criteria Under Section 80CCC Any individual resident as well as non resident is allowed to claim tax deduction under section 80CCC subject to making Section 80CCC provides tax deductions on buying a new policy or continuing a policy that pays pension with deductions going up to Rs 1 lakh per year on any expenses incurred in buying or

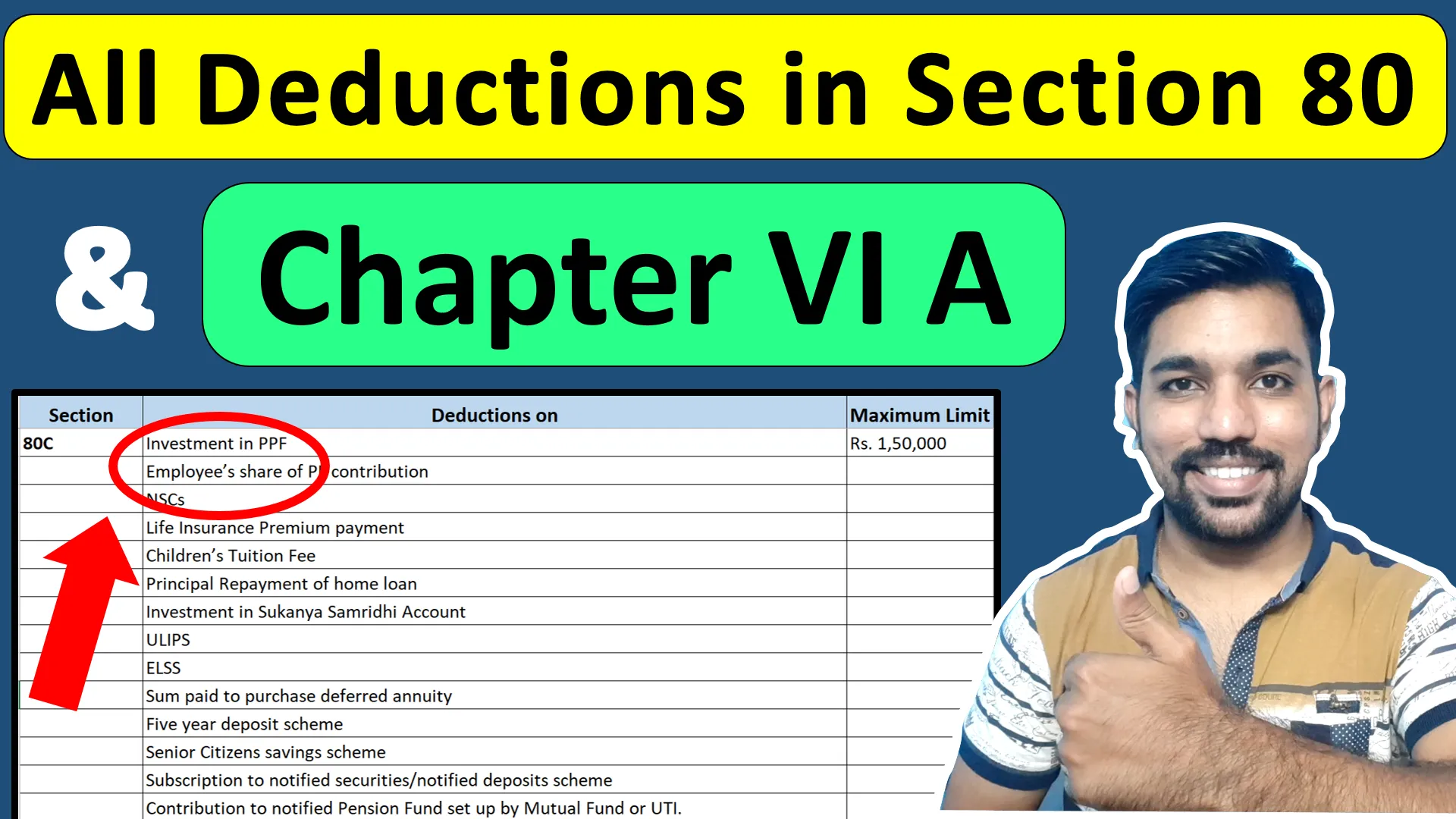

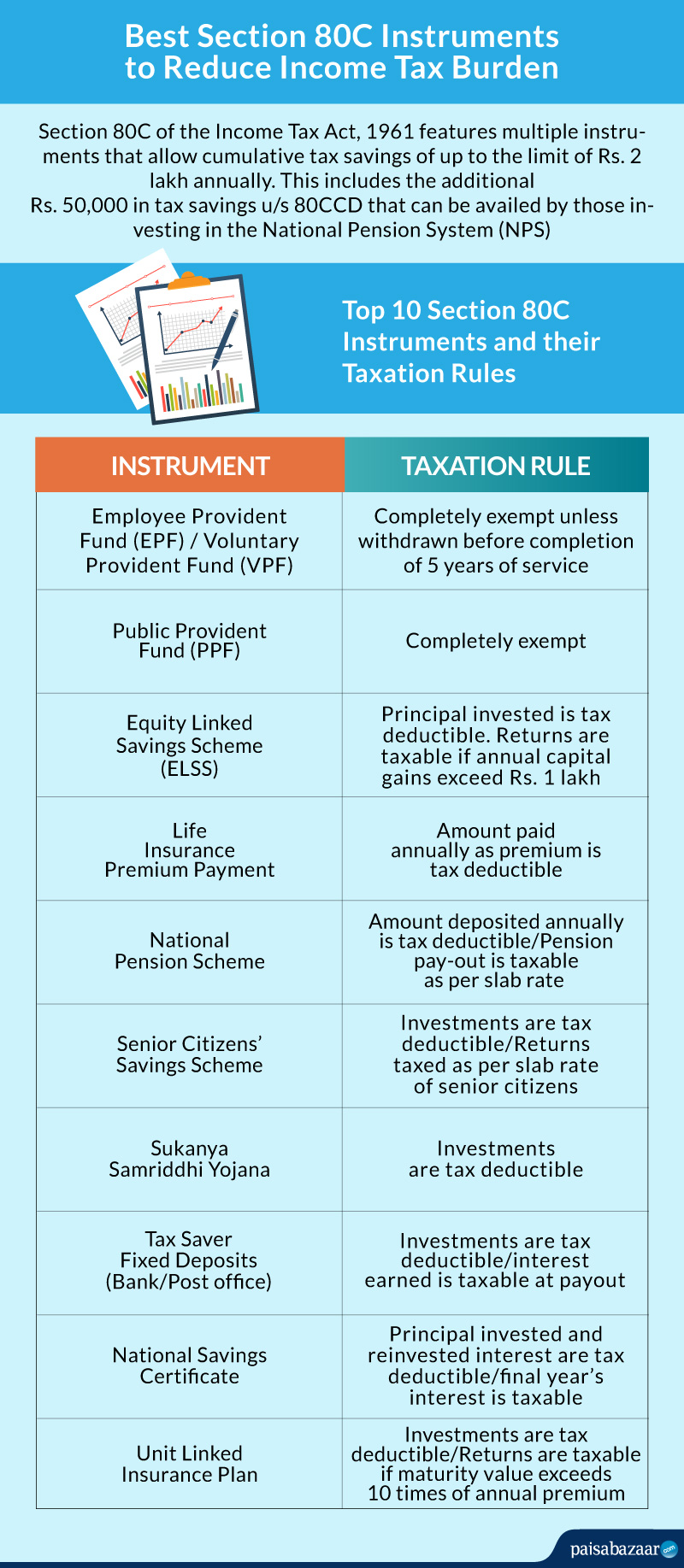

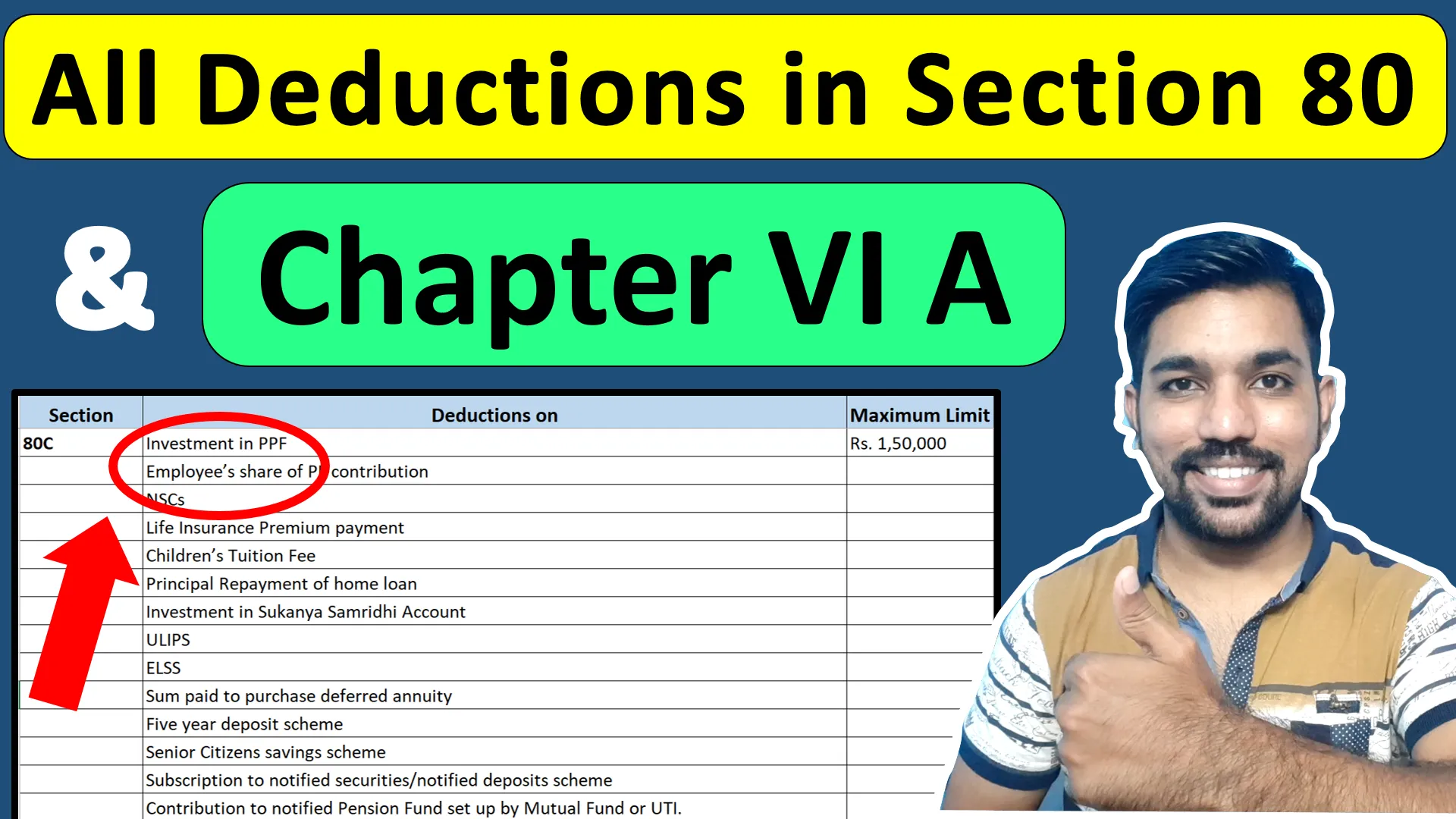

Section 80CCC of the Income Tax Act of 1961 is part of the larger 80C category which offers a cumulative tax deduction of up to Rs 1 5 lakh per year for investments in PPF With effect from assessment year 2016 17 sub section 1A of Section 80CCD which laid down maximum deduction limit of Rs 1 00 000 under sub section 1 has been deleted Further a new sub section 1B is inserted

Download Deduction Under Section 80ccc

More picture related to Deduction Under Section 80ccc

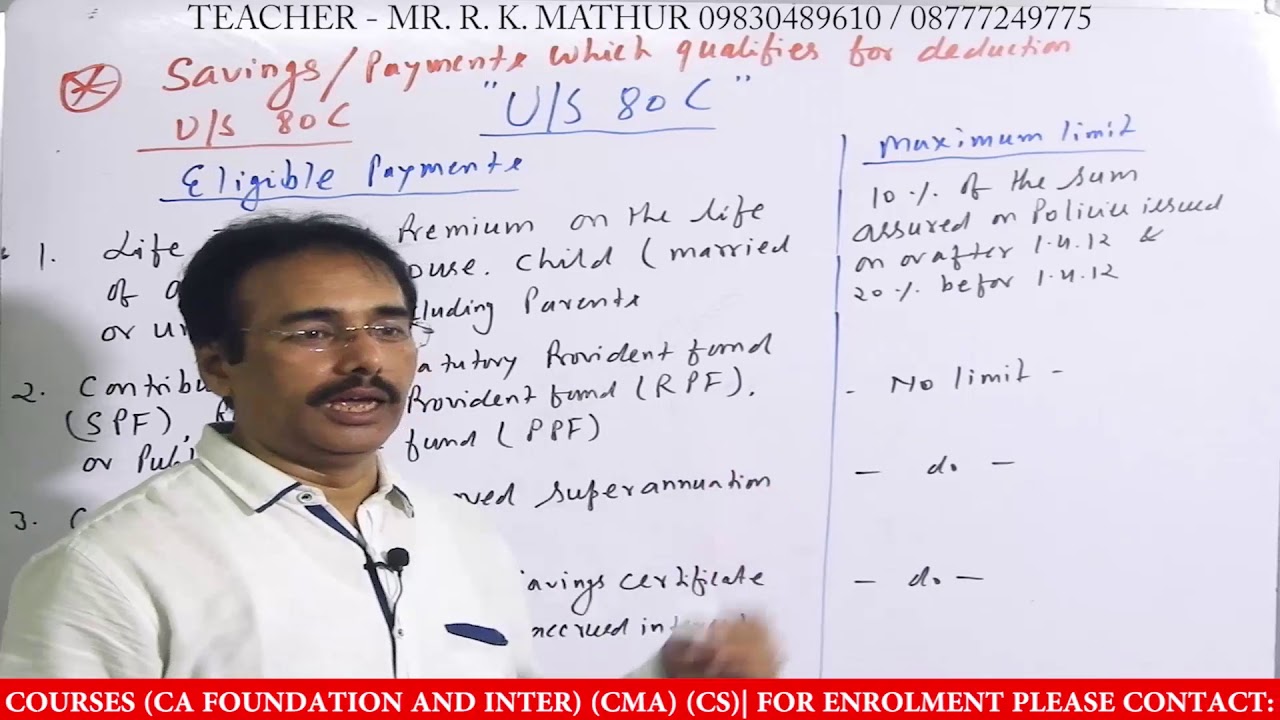

Deduction Under Section 80C 80CCC 80CCD 1 And 80CCE Under Chapter VI

https://i.ytimg.com/vi/6uBM-gUyQWw/maxresdefault.jpg

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

Deduction Under Section 80C To 80U YouTube

https://i.ytimg.com/vi/aVOngu2L6VM/maxresdefault.jpg

Section 80CCC of the Income Tax Act 1961 offers tax deductions up to Rs 1 5 Lakhs per year for contributions made by a person towards certain pension funds offered by a life insurance Section 80CCC of the Income Tax Act provides tax deductions when you invest in certain types of pension funds Read the article to understand why it is important features eligibility criteria for section 80ccc deductions

Deduction is allowed if the assessee has paid any amount towards any annuity plan of Life Insurance Corporation of India LIC or any other insurer for receiving pension from What is the difference between deduction under Section 80C and deduction under Section 80CCC Section 80CCC mandates that the amount of contribution should be paid out

All Deductions In Section 80C Chapter VI A FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/03/All-Deductions-in-Section-80C-80CCC-80CCD-80D-in-Hindi-Chapter-VI-A-1.webp

Section 80C Deduction Under Section 80C In India Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

https://cleartax.in/s/80c-80-deductions

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023

https://tax2win.in/guide/section-80ccc

Under Section 80CCC of the Income Tax Act 1961 a taxpayer can claim tax deductions against the monetary contributions made towards

Deduction Section 80CCC YouTube

All Deductions In Section 80C Chapter VI A FinCalC Blog

DEDUCTION UNDER SECTION 80C TO 80U PDF

Deduction Under Section 80G Part 2 YouTube

Section 80CCC Deduction Of Income Tax IndiaFilings

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils

Section 80CCC Deduction Income Tax IndiaFilings

Section 80CCC Indian Income Tax Act 1961 Dialabank

Deduction US 80C Deduction Under Section 80C Everything About

Deduction Under Section 80ccc - Section 80CCC provides tax deductions on buying a new policy or continuing a policy that pays pension with deductions going up to Rs 1 lakh per year on any expenses incurred in buying or