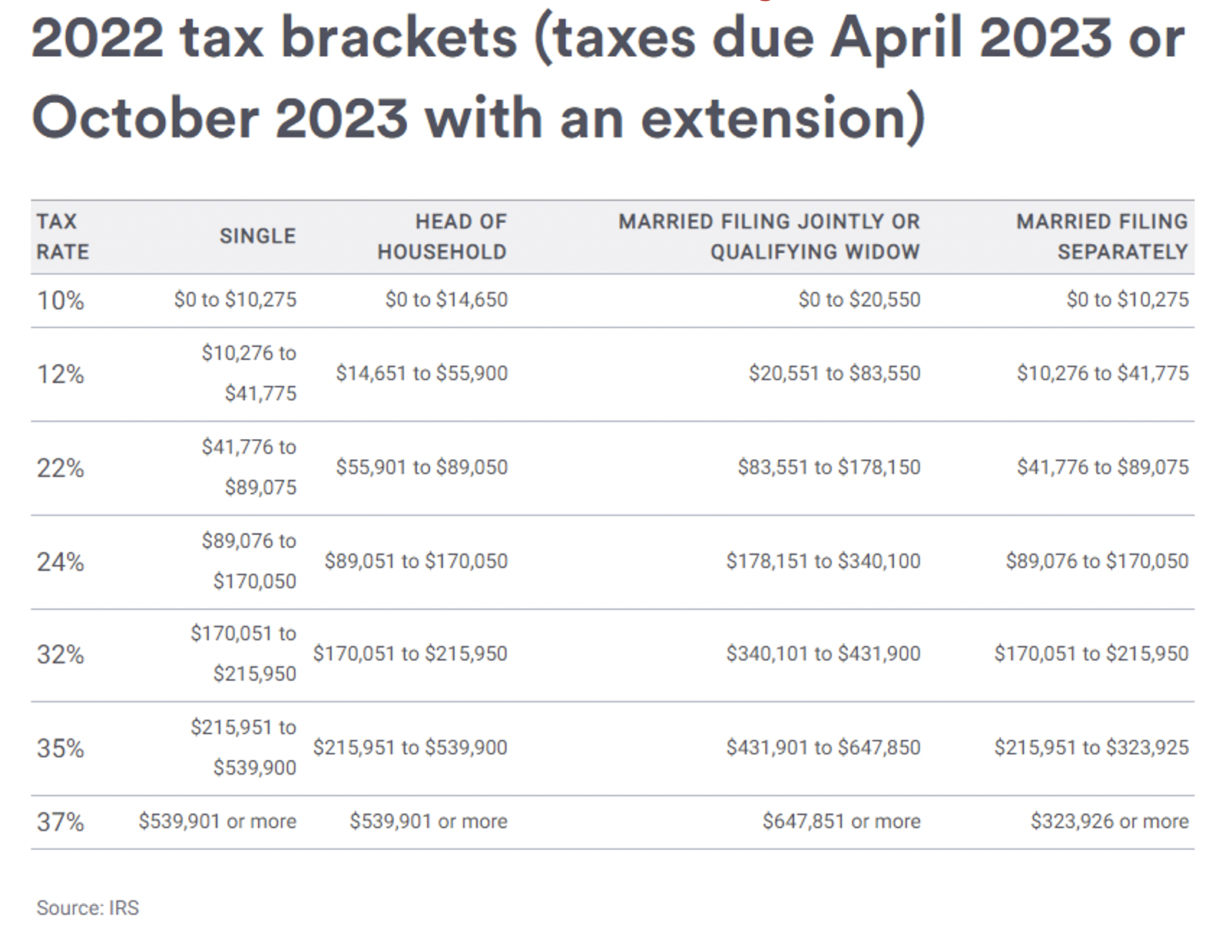

Deductions For Income Tax 2022 Verkko 21 helmik 2022 nbsp 0183 32 There are two main types of tax deductions the standard deduction and itemized deductions The IRS allows you to claim one type of tax deduction but

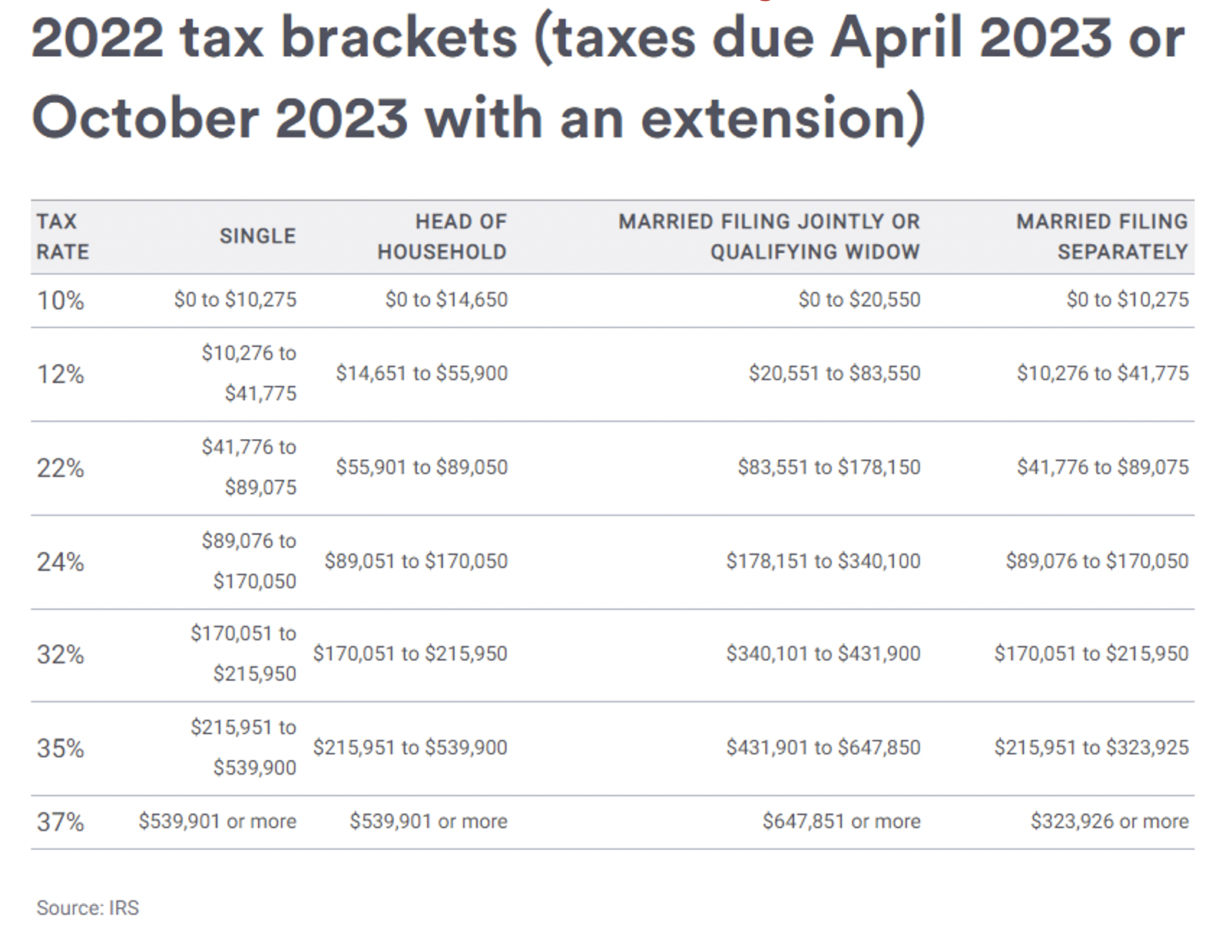

Verkko 27 helmik 2023 nbsp 0183 32 These are the standard deduction amounts for tax year 2022 Married couples filing jointly 25 900 an 800 increase from 2021 Single taxpayers Verkko 10 marrask 2021 nbsp 0183 32 The Internal Revenue Service has announced annual inflation adjustments for tax year 2022 meaning new tax rate schedules and tax tables and

Deductions For Income Tax 2022

Deductions For Income Tax 2022

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

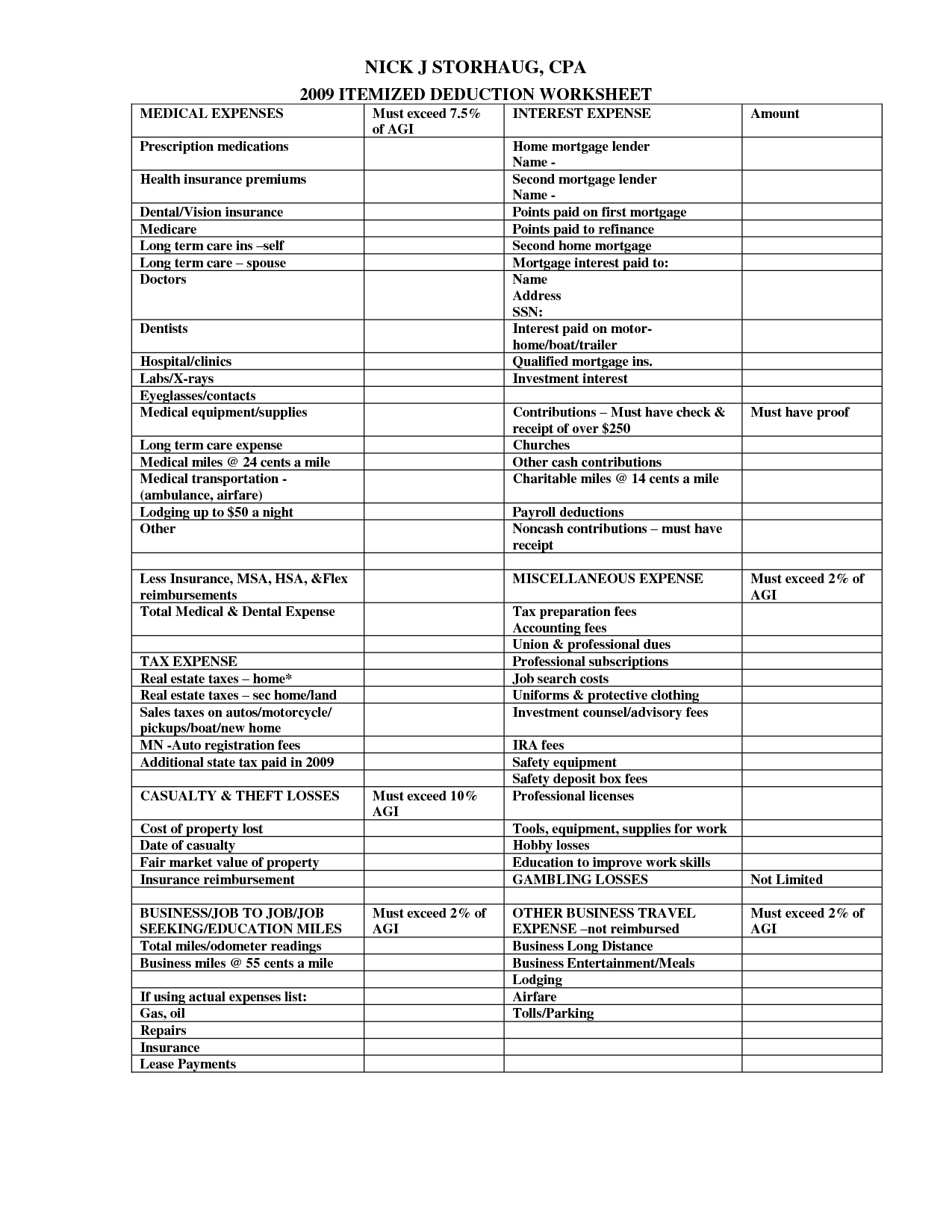

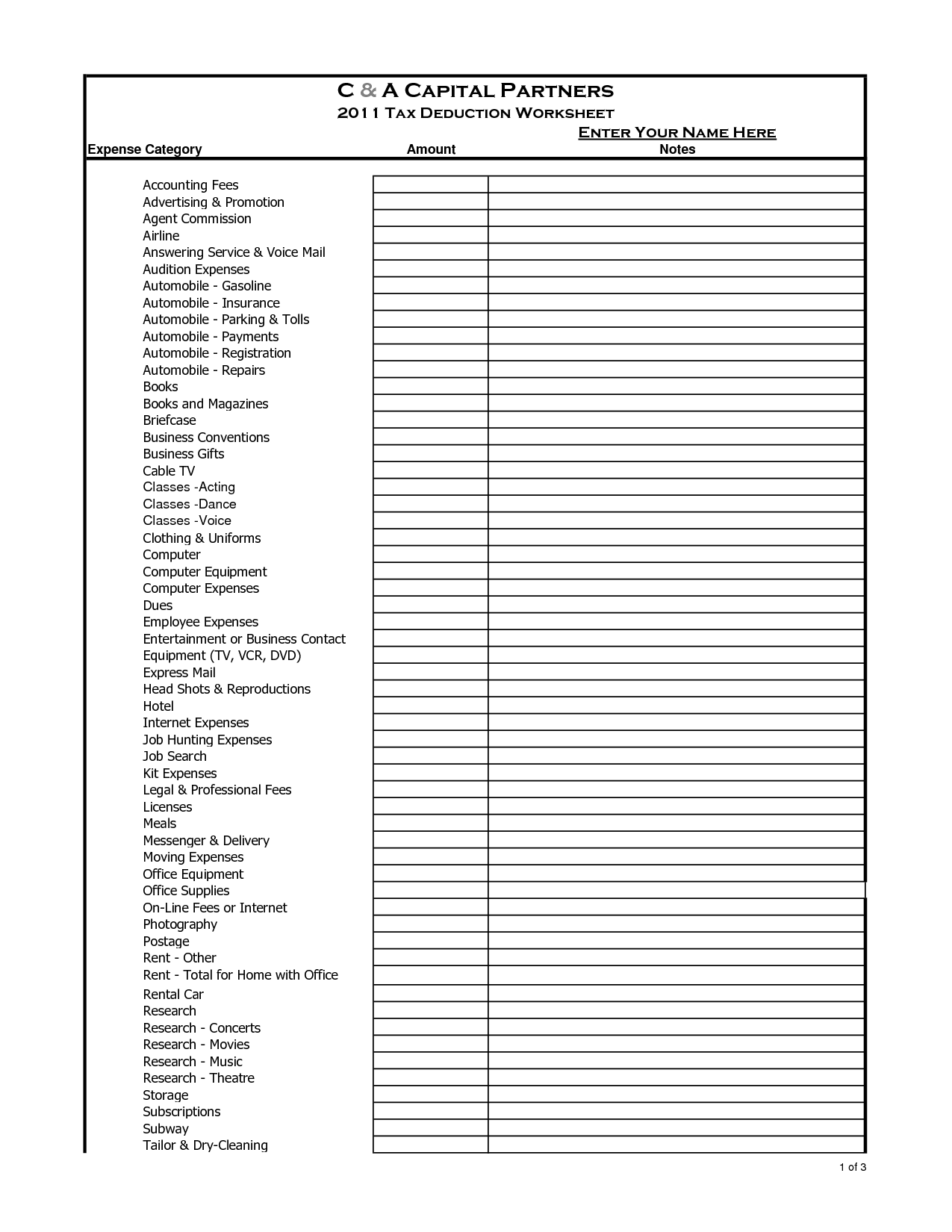

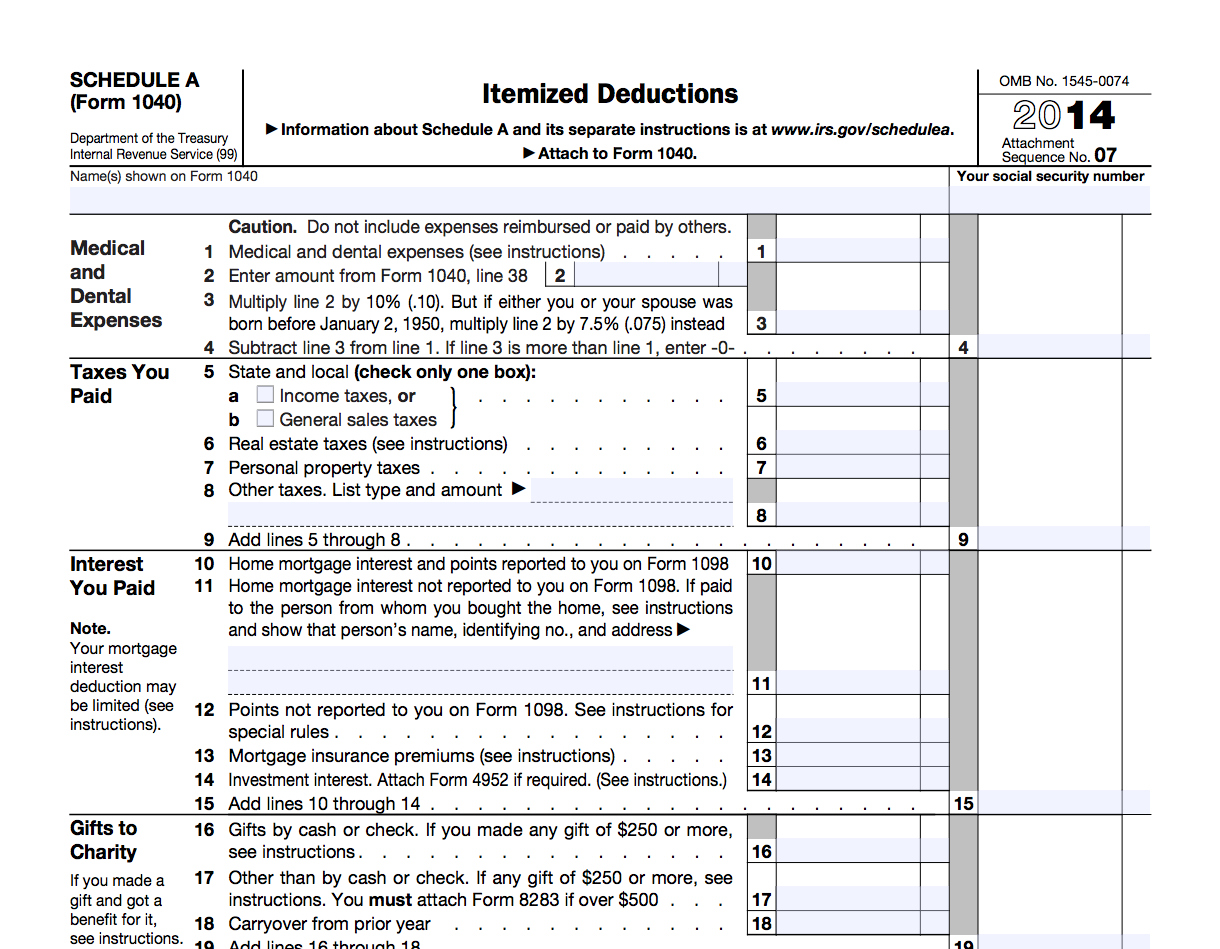

10 2014 Itemized Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/12/tax-deduction-worksheet_449398.png

Standard Business Deduction 2022 Home Business 2022

https://taxguru.in/wp-content/uploads/2020/05/Tax-Deductions-1280x720.jpg

Verkko 1 marrask 2023 nbsp 0183 32 Credits and Deductions for Individuals It s important to determine your eligibility for tax deductions and tax credits before you file Deductions can Verkko 4 jouluk 2023 nbsp 0183 32 Advertiser disclosure Standard Deduction 2023 2024 How Much It Is When to Take It The 2023 standard deduction is 13 850 for single filers 27 700 for joint filers or 20 800 for heads of

Verkko 10 marrask 2021 nbsp 0183 32 The IRS also announced that the standard deduction for 2022 was increased to the following Married couples filing jointly 25 900 Single taxpayers and Verkko 2 jouluk 2021 nbsp 0183 32 Standard Deduction for 2022 25 900 Married filing jointly and surviving spouses 19 400 Head of Household 12 950 Unmarried individuals 12 950 Married filing separately The

Download Deductions For Income Tax 2022

More picture related to Deductions For Income Tax 2022

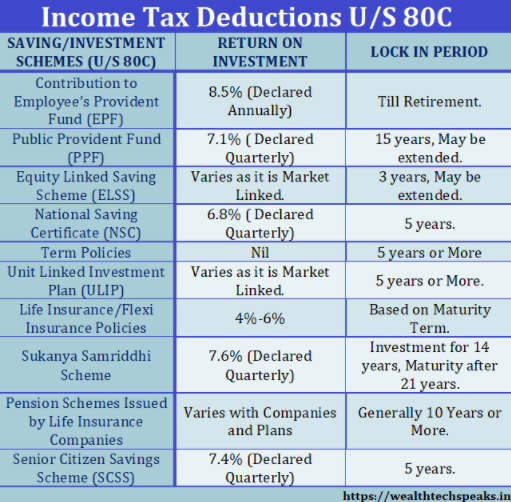

Income Tax Deductions Financial Year 2020 21 Business League

https://www.businessleague.in/wp-content/uploads/2020/09/income-tax-deductions-financial-year-2020-21.png

Trucking Expenses Spreadsheet 2020 2022 Fill And Sign Printable

https://www.pdffiller.com/preview/100/94/100094081/large.png

Income And Expense Statement Template Beautiful Monthly In E Statement

https://i.pinimg.com/originals/17/aa/13/17aa1305e4407351a8b951e0b826f2e3.jpg

Verkko 4 jouluk 2023 nbsp 0183 32 20 popular tax deductions and tax breaks Here are some of the most popular tax breaks for the 2023 2024 tax filing season and links to our other content Verkko 19 tammik 2023 nbsp 0183 32 Here s what you can take on your 2022 federal income tax return The Standard Deduction and Personal Exemptions The standard deduction for 2022

Verkko 10 marrask 2021 nbsp 0183 32 For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households Verkko 26 jouluk 2023 nbsp 0183 32 Explore the comprehensive list of Income Tax Deductions for FY 2022 23 AY 2023 24 under Sections 80C 80CCC 80CCD and 80D Maximize your

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM.png

Tax Form Itemized Deduction Worksheet

https://i.pinimg.com/originals/d1/cc/34/d1cc3440c2d9554d9b23652b32649ea1.jpg

https://www.irs.com/en/2022-federal-income-tax-brackets-rates-standard...

Verkko 21 helmik 2022 nbsp 0183 32 There are two main types of tax deductions the standard deduction and itemized deductions The IRS allows you to claim one type of tax deduction but

https://money.usnews.com/.../taxes/articles/your-guide-to-tax-deductions

Verkko 27 helmik 2023 nbsp 0183 32 These are the standard deduction amounts for tax year 2022 Married couples filing jointly 25 900 an 800 increase from 2021 Single taxpayers

Printable Itemized Deductions Worksheet

11 MMajor Tax Changes For 2022 Pearson Co CPAs

Printable Itemized Deductions Worksheet

Itemized Deductions List Fill Out Sign Online DocHub

What Is A Tax Deduction Definition Examples Calculation

No Itemizing Needed To Claim These 23 Tax Deductions Don t Mess With

No Itemizing Needed To Claim These 23 Tax Deductions Don t Mess With

Sales Tax Deduction 2021

8 Tax Preparation Organizer Worksheet Worksheeto

IRS 2022 Tax Tables Deductions Exemptions Purposeful finance

Deductions For Income Tax 2022 - Verkko 2 jouluk 2021 nbsp 0183 32 Standard Deduction for 2022 25 900 Married filing jointly and surviving spouses 19 400 Head of Household 12 950 Unmarried individuals 12 950 Married filing separately The