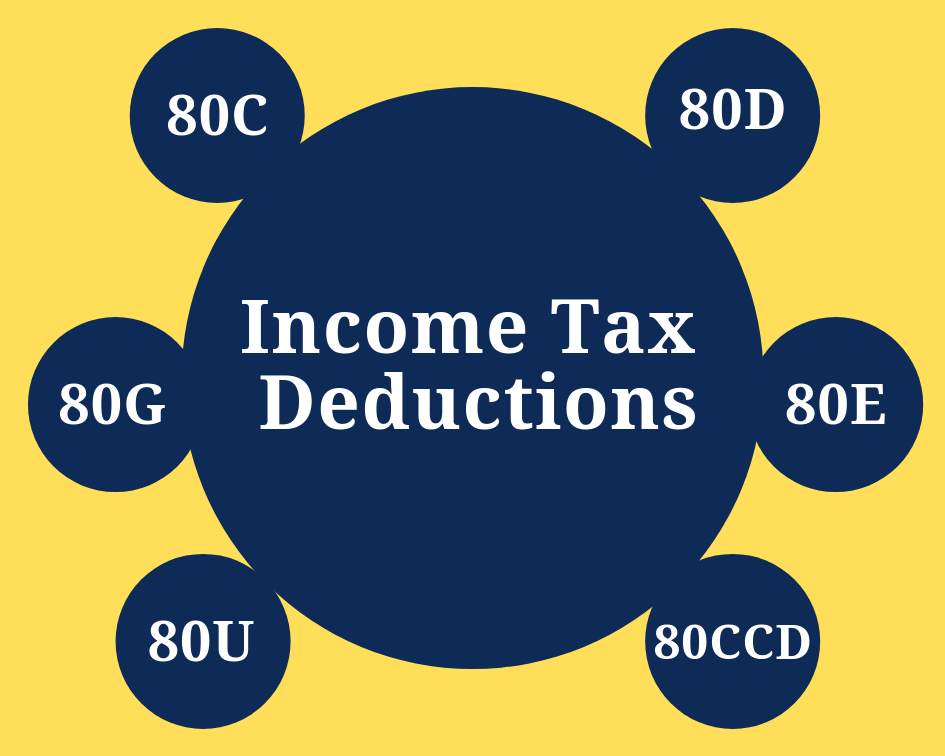

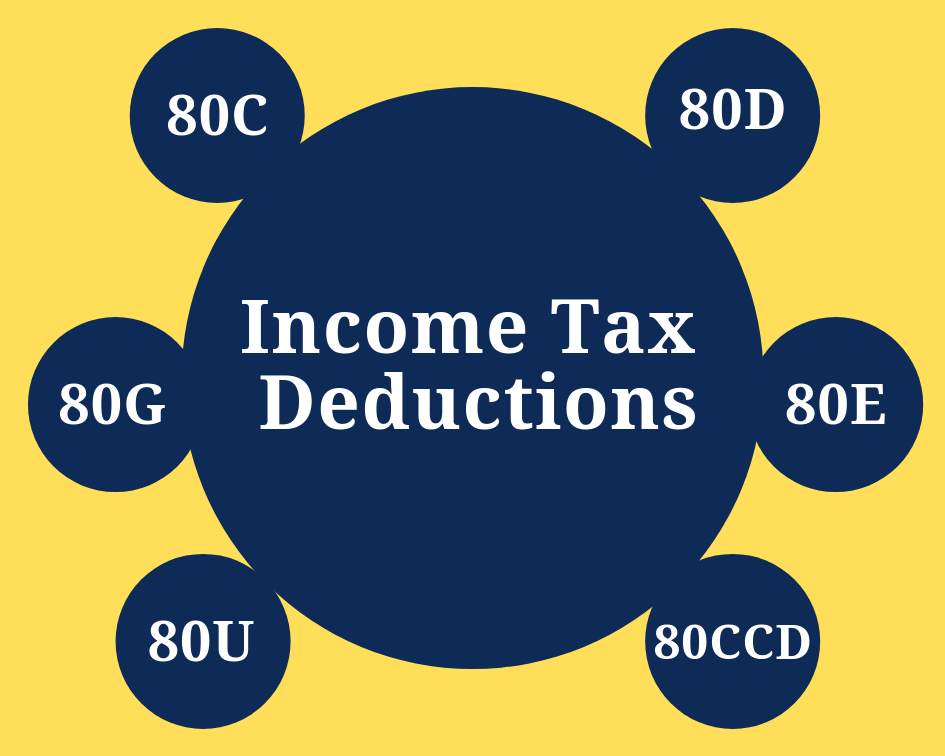

Deductions In Income Tax 2022 23 Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under section 80c

Deduction of WHT AIT and APIT has been made mandatory with effect from January 01 2023 1 1 WHT AIT on Certain Payments In terms of Section 84A and 85 of the IRA as Salaried taxpayers are eligible for the standard deduction of Rs 50 000 under the old and new tax regime from FY 2023 24 There has been no update in Budget 2024 Standard Deduction in New Tax

Deductions In Income Tax 2022 23

Deductions In Income Tax 2022 23

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

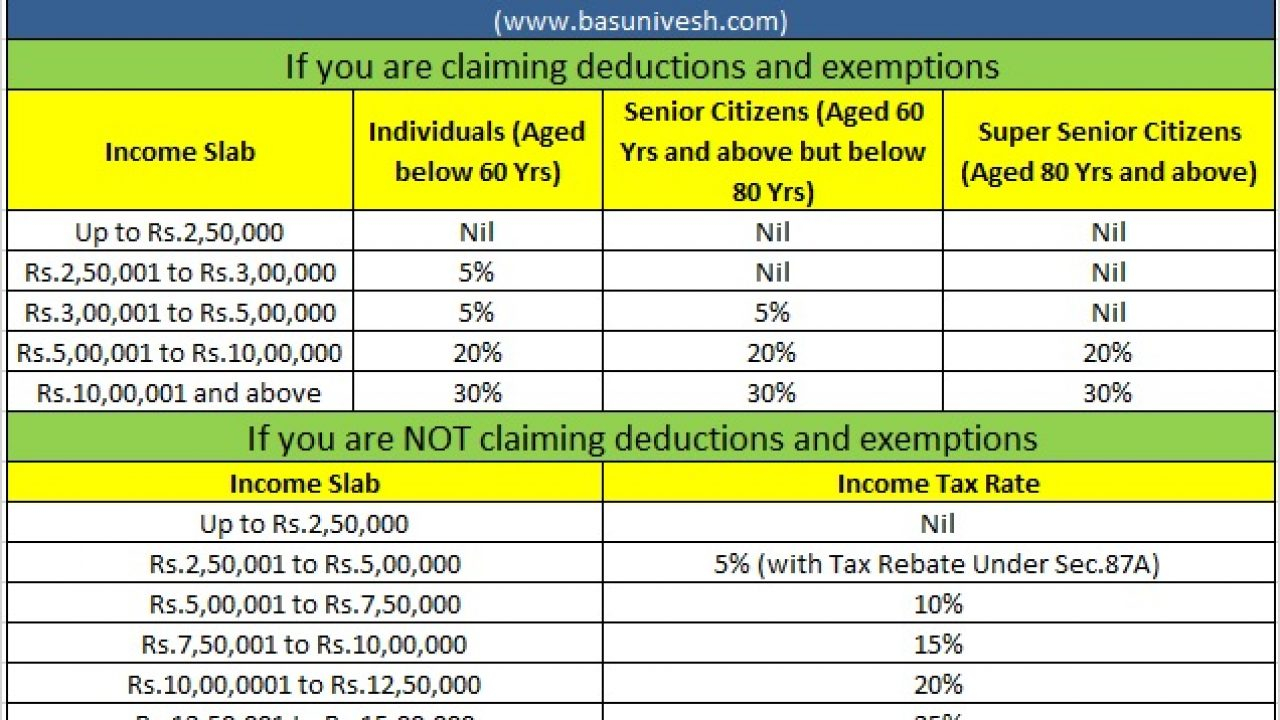

Regime taxpayers have the option to claim various tax deductions and exemptions In case of non business cases option to choose the regime can be exercised every year The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800

The Financial Secretary proposed a one off reduction of profits tax salaries tax and tax under personal assessment for the year of assessment 2021 22 by 100 subject to a Section 115BAC introduces a new tax regime with lower rates and less exemptions Tax rates for FY 2022 23 and 2023 24 are outlined Individuals can opt for

Download Deductions In Income Tax 2022 23

More picture related to Deductions In Income Tax 2022 23

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

https://www.bmp-cpa.com/wp-content/uploads/2019/01/tax-deductions.jpg

Guidance Rates and thresholds for employers 2022 to 2023 English Cymraeg Use these rates and thresholds when you operate your payroll or provide Latest Income Tax Slab Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax regime

You can also claim the proportion of your pre paid expenses from a previous income year that relate to 2022 23 Deductions for prepaid expenses 2023 will help you work out The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits

Income Tax Deductions In India Capitalante

https://capitalante.com/wp-content/uploads/2019/02/Income-Tax-Deductions-In-India.png

Tuition Fees Exemption In Income Tax 2023 Guide

http://instafiling.com/wp-content/uploads/2023/01/Topic-58-Tuition-fees-exemption-in-income-tax-2022-23.png

https://cleartax.in/s/80c-80-deductions

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under section 80c

http://www.ird.gov.lk/en/Lists/Latest News Notices...

Deduction of WHT AIT and APIT has been made mandatory with effect from January 01 2023 1 1 WHT AIT on Certain Payments In terms of Section 84A and 85 of the IRA as

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

Income Tax Deductions In India Capitalante

How Much Taxes Are Taken Out Of A Paycheck In Ky Teressa Robles

Standard Deduction For Fy 2023 24 In New Tax Regime Printable Forms

Uk Tax Calculator 2022 23 How To Calculate Your Taxes With Hmrc TAX

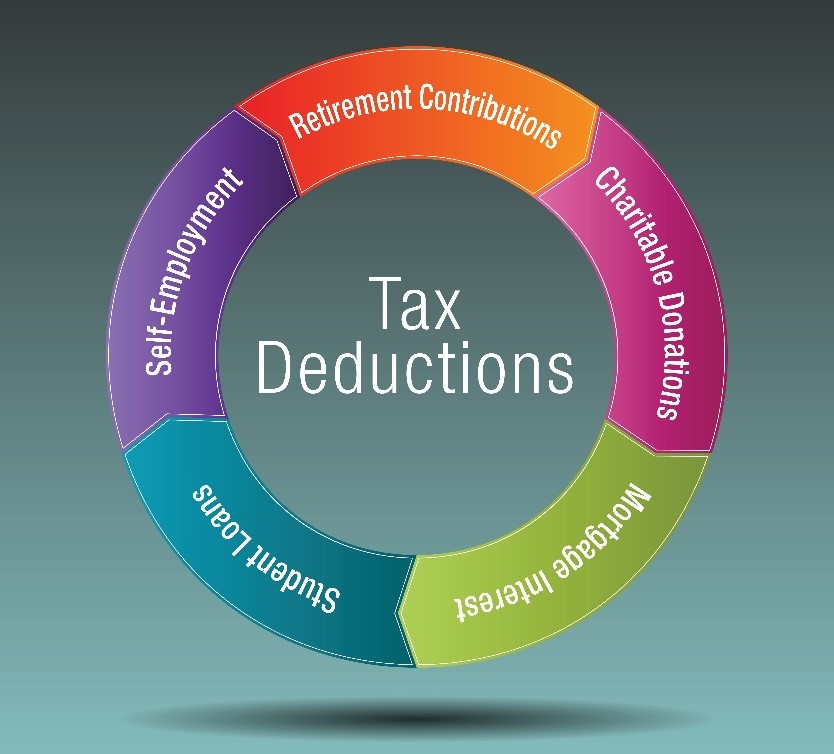

The 6 Best Tax Deductions For 2020 The Motley Fool

The 6 Best Tax Deductions For 2020 The Motley Fool

Income Tax Delhi Recruitment 2021

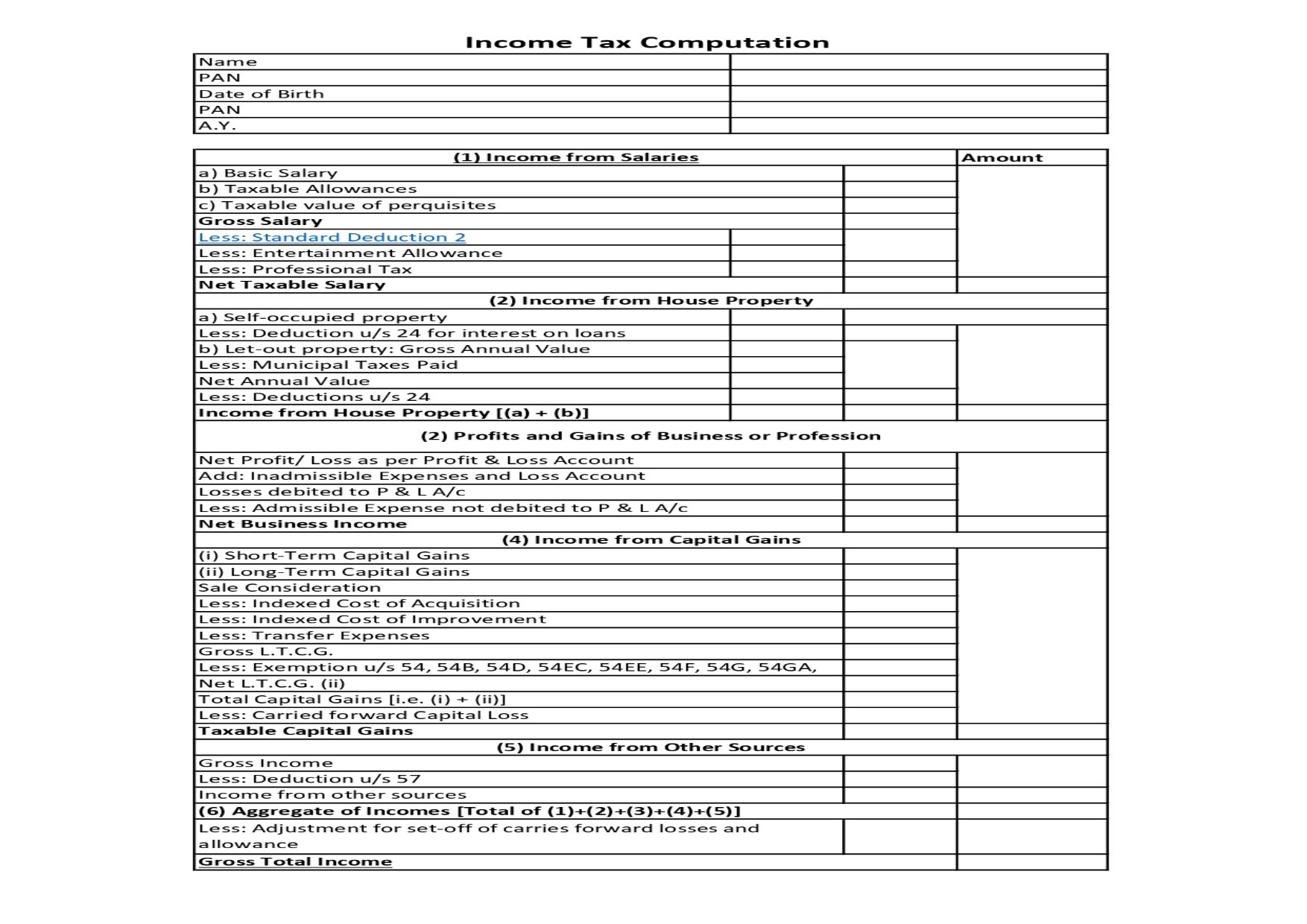

Income Tax Computation Format PDF A Comprehensive Guide

Standard Deduction In Income Tax 2022

Deductions In Income Tax 2022 23 - Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance pensions and student loans Updated