Deductions Of Income Tax Expenses for the production of income are deducted from your wage income and they decrease the amount of taxable earned income If you have wage

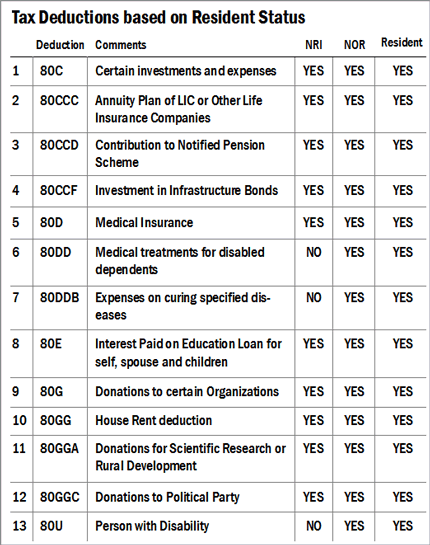

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25 A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a single deduction of a fixed amount or

Deductions Of Income Tax

Deductions Of Income Tax

https://carajput.com/blog/wp-content/uploads/2020/10/24297_20140103_tax_deductions__w430__.png

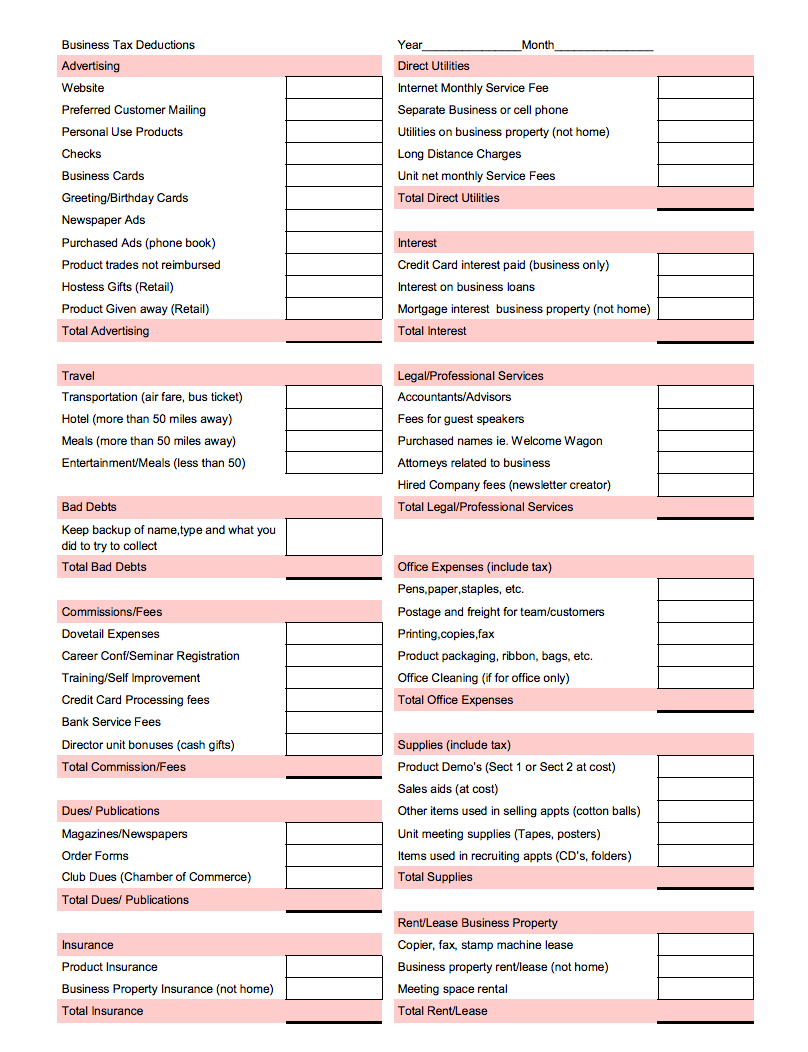

Business Tax List Of Business Tax Deductions

https://www.qtoffice.com/ckfinder/userfiles/images/1312/Tax Deductions.png

How To Calculate Income Tax Return 2018 19 Tax Walls

https://www.relakhs.com/wp-content/uploads/2018/04/Impact-of-Standard-Deduction-Rs-40000-on-income-tax-calculation-tax-liability-tax-savings-benefit-additional-tax.jpg

A deduction allows a taxpayer to reduce their total taxable income You can either itemize deductions or take a large single deduction known as the standard deduction Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include

When it comes to deductions the IRS offers individual tax filers the option to claim the standard deduction or a list of itemized deductions Itemized deductions include interest paid on Tax deductions enable you to reduce your taxable income Each year you can take the standard deduction or itemize your deductions

Download Deductions Of Income Tax

More picture related to Deductions Of Income Tax

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

https://www.bmp-cpa.com/wp-content/uploads/2019/01/tax-deductions.jpg

Printable Tax Deduction Cheat Sheet

https://i.pinimg.com/originals/c6/6c/36/c66c36ac209edd0f430465859899061c.png

Legal Aspects On The Deductions From Income From Business And

https://blog.ipleaders.in/wp-content/uploads/2020/11/Tax-Deduction-blog-1.jpg

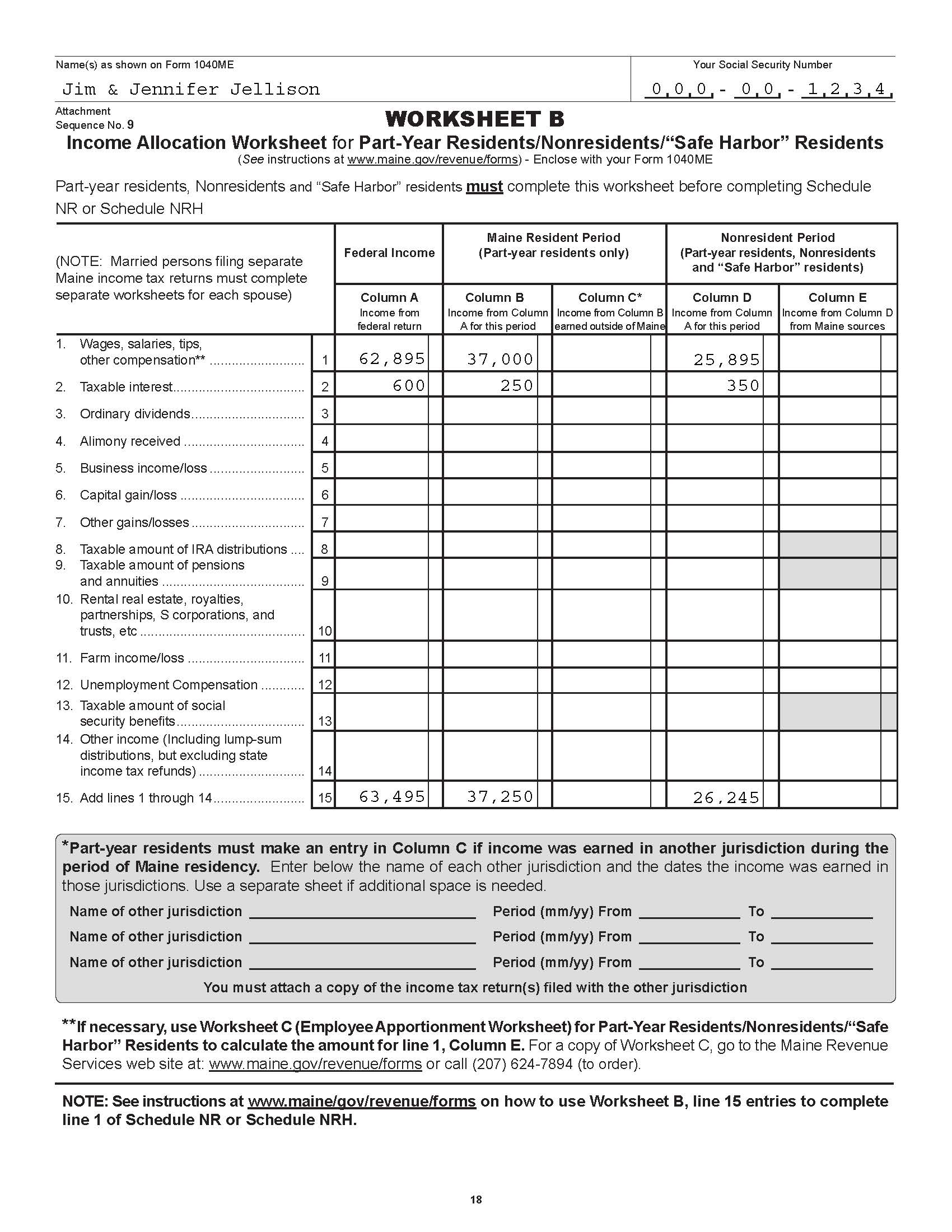

Visit the state websites to find information about income tax filing in your state Types of income credits and deductions you can claim IRS Direct File supports the following One can claim a few selective deductions under the new tax regime for FY 2023 24 such as a standard deduction of Rs 50 000 interest on Home Loan u s 24b

Deductions can reduce the amount of taxable income Credits and deductions are available for individuals and businesses The Inflation Reduction Act of 2022 provides new and A tax deduction or benefit is an amount deducted from taxable income usually based on expenses such as those incurred to produce additional income Tax deductions are a

Income Tax Deductions Available For The Financial Year 2017 18

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Itemized Deductions List Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/100/302/100302714/large.png

https://www.vero.fi/en/individuals/deductions/...

Expenses for the production of income are deducted from your wage income and they decrease the amount of taxable earned income If you have wage

https://cleartax.in/s/80c-80-deductions

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

Standard Deduction 2020 Self Employed Standard Deduction 2021

Income Tax Deductions Available For The Financial Year 2017 18

Tax Deductions You Can Deduct What Napkin Finance

Income Tax Deductions For The FY 2019 20 ComparePolicy

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

1040 Deductions 2016 2021 Tax Forms 1040 Printable

1040 Deductions 2016 2021 Tax Forms 1040 Printable

14 Best Images Of IRS Itemized Deductions Worksheet Tax Itemized

What Are The Small Business Tax Deductions How To Claim Them

What Is A Tax Deduction

Deductions Of Income Tax - Under Section 24 b of the Income Tax Act you are eligible to claim a deduction for the interest paid on money borrowed for the purchase construction