Deemed Non Resident Of Canada For Tax Purposes If you receive only other types of taxable Canadian source income such as scholarships fellowships bursaries or research grants capital gains or from a business with no permanent

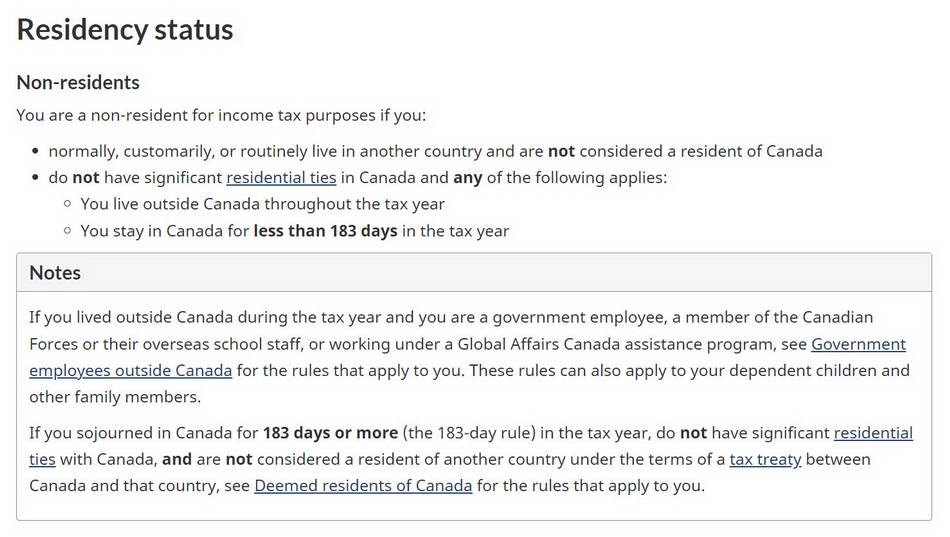

Factual or deemed non residents from the CRA s point of view are people who have some kind of tie to Canada but are considered non residents You may be a deemed non resident of Canada for tax purposes if you were a resident of Canada in the year and under a tax treaty you were considered to be a resident of another country

Deemed Non Resident Of Canada For Tax Purposes

Deemed Non Resident Of Canada For Tax Purposes

https://i.ytimg.com/vi/8NXVTGL6elo/maxresdefault.jpg

Tax Residency Factors That Decide Weather You Are A Resident Or

https://www.rkbaccounting.ca/wp-content/uploads/2022/01/resident-of-Canada.jpg

Rental And Sale Of Your Canadian Home As A Non Resident Of Canada

https://cardinalpointwealth.com/wp-content/uploads/2022/02/iStock-1270111816.jpg

Canadians or Primary Resident card holders can be considered deemed non resident if you are considered a resident of the country in which you live outside of Canada What is a deemed non resident of Canada tax return A deemed non resident is someone who despite having significant ties to Canada such as a home family or bank

Your status may be categorized as ordinarily resident or deemed resident of Canada In this article we will describe the most major common factors to give you an idea to determine whether you will be considered a or a A deemed non resident is someone who is not a resident of Canada for tax purposes but who still has income from Canadian sources This can include individuals who

Download Deemed Non Resident Of Canada For Tax Purposes

More picture related to Deemed Non Resident Of Canada For Tax Purposes

Departure Tax Becoming A Non Resident Of Canada Spectrum Lawyers

https://spectrumlawyers.ca/wp-content/uploads/2020/11/post-banner-new-02-768x261.jpg

Tax Residency Factors That Decide Weather You Are A Resident Or

https://www.rkbaccounting.ca/wp-content/uploads/2022/01/resident-of-Canada-2-1024x445.jpg

How To Become A Non Resident Of Canada

https://i0.wp.com/www.onthemovetoronto.com/wp-content/uploads/2018/06/exit-tax.jpg?w=3000&ssl=1

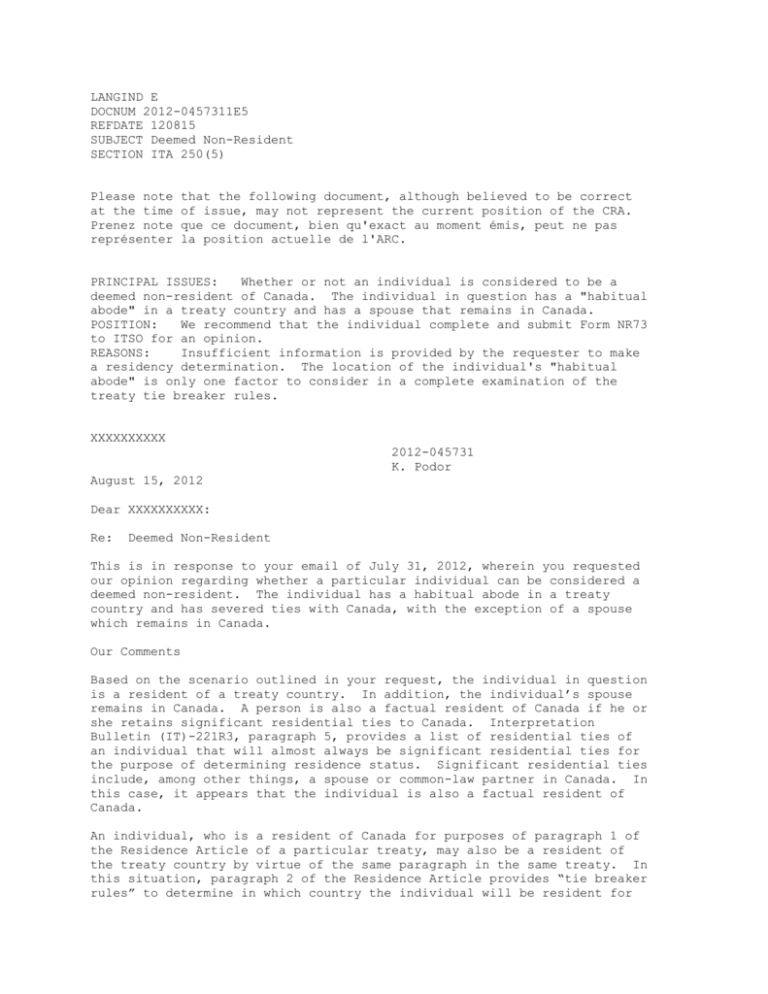

If you established ties in a country that Canada has a tax treaty with and you are considered a resident of that country but you are otherwise a factual resident of Canada meaning you maintain significant residential ties with Canada you For purposes of Canada s domestic tax laws an individual can be found resident in Canada where that taxpayer is not otherwise ordinarily resident in Canada at any point in a given taxation year that taxpayer is a deemed

You were a deemed non resident of Canada in 2024 if you were a resident including a deemed resident of Canada and under a tax treaty between Canada and another country or region For tax purposes Canadian residents are divided into two broad categories factual residents and deemed residents You re a factual resident for income tax purposes

Taxes For Canadian Non Residents The Ultimate Guide

https://nomadcapitalist.com/wp-content/uploads/Taxes-for-Canadian-Non-Residents-The-Ultimate-Guide-1-980x289.png

Canadian Resident For Tax Purposes BKCRUNCH

https://bkcrunch.com/wp-content/uploads/2021/11/ixlibrb-0.3.5q80fmjpgcropentropycstinysrgbw652h246fitcrops9a1e4b5cc1f6c669dd8099fa2399b706.jpg

https://www.canada.ca › ... › non-residents-canada.html

If you receive only other types of taxable Canadian source income such as scholarships fellowships bursaries or research grants capital gains or from a business with no permanent

https://turbotax.intuit.ca › tips › what-is-the...

Factual or deemed non residents from the CRA s point of view are people who have some kind of tie to Canada but are considered non residents

Tax Requirements For Non Residents Of Canada Earning Rental Income

Taxes For Canadian Non Residents The Ultimate Guide

How Can I Become A Permanent Resident Of Canada Aptechvisa

Foreign Corporation A Corporation Resident In Canada For Tax Purposes

Tax Residency Factors That Decide Weather You Are A Resident Or

Deemed Non Resident Status In Canada Understanding The TaxImplications

Deemed Non Resident Status In Canada Understanding The TaxImplications

Kalfa Law Firm Is My Corporation A Resident Of Canada

Potential Tax Risk To Realtors Non Resident Vendors Of Canada For Tax

TI2012 0457311E5

Deemed Non Resident Of Canada For Tax Purposes - If you re a deemed resident you have to report your world income from all sources both inside and outside Canada for the entire tax year and you can claim all deductions and