Definition Of Tax Incentives Under this premise granting a tax incentive implies that the capital stock either of some type or in aggregate is considered too low and that either the tax system is the obstacle or other obstacles exist that can be compensated by the tax system

A tax incentive is a government measure that is intended to encourage individuals and businesses to spend money or to save money by reducing the amount of tax that they have to pay Tax incentives are exclusions exemptions or deductions from taxes owed to the government There are different types of incentives but they all revolve around reducing the amount of taxes paid It helps to be familiar with the following terms to understand tax incentives better

Definition Of Tax Incentives

Definition Of Tax Incentives

https://insidesources.com/wp-content/uploads/2017/06/tax-incentives.jpg

Tax Incentives A Guide To Saving Money For U S Small Businesses

https://www.freshbooks.com/wp-content/uploads/2022/04/tax-incentives-examples.jpg

11 Types Of Tax Incentives How They Differ In Their Functionality

https://www.fincyte.com/wp-content/uploads/2020/10/Tax-Incentives-You-Need-To-know.jpg

Tax Incentives From an Investment Tax and Sustainable Development Perspective Living reference work entry First Online 01 January 2020 pp 1 21 Cite this living reference work entry Irma Johanna Mosquera Valderrama 431 Accesses 8 Altmetric Abstract The aim of this chapter is twofold Noun C TAX GOVERNMENT uk us Add to word list a reduction in taxes that encourages companies or people to do something that will help the country s

Noun C TAX GOVERNMENT uk us Add to word list a reduction in taxes that encourages companies or people to do something that will help the country s economy Tax incentives worth millions brought dozens of companies and thousands of new jobs to the region last year Tax incentives represent an important policy tool which is widely used by the governments all over the world in pursuit of a variety of goals ranging from stimulating the economic growth and development to encourage certain behaviors or even to address market failures like for the R D incentives or those addressing Start ups

Download Definition Of Tax Incentives

More picture related to Definition Of Tax Incentives

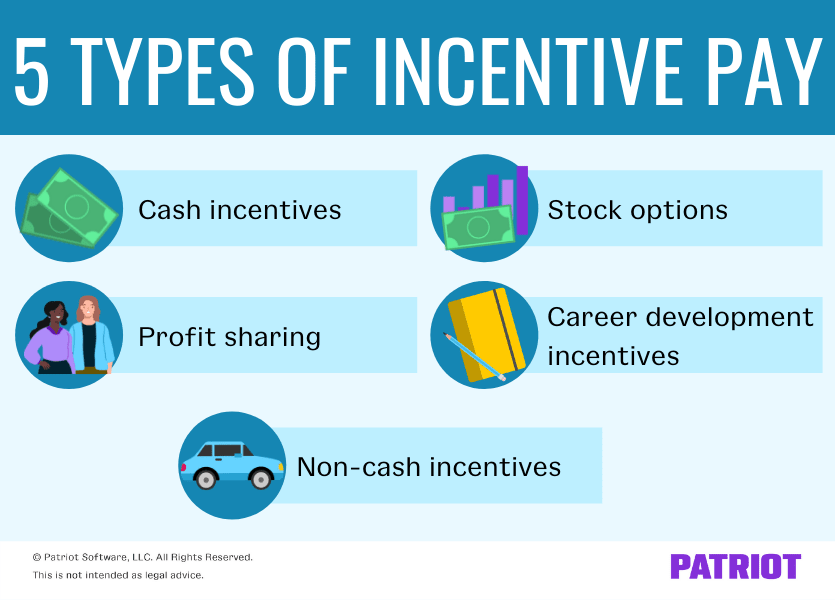

Incentives Definition Types Function Examples And Benefits 2023

https://www.marketing91.com/wp-content/uploads/2021/02/Tax-Incentives.jpg

Financial And Tax Incentives Making A Difference Works

https://makingadifference.works/wp-content/uploads/2017/05/WyJxPfUl.jpeg

Hidden Benefits Putting Your Family On The Payroll For Tax Purposes

http://www.nxtgennexus.com/wp-content/uploads/2017/08/Taxes_stock-1080x675.jpg

Definition of tax incentive for investment Possible definition Law or regulatory provision that provides for more favourable tax treatment of domestic or inbound investment in targeted activities or sectors or by certain firms Rationale for tax incentives investment Tax incentives are the concessions in tax codes that mean a conscious loss of government budgetary revenue They are usually intended by public authorities to encourage particular types of behaviour in relation to education and training in this case and or to favour specific groups certain individuals in this case

This paper considers two empirical questions about tax incentives 1 are incentives used as tools of tax competition and 2 how effective are incentives in attracting investment To answer these we prepared a new dataset of tax incentives in over 40 Latin American Caribbean and African countries for the period 1985 2004 Tax incentives can be income or expenditure based and applicable to the business its staff and or investors Ultimately the choice of incentive is policy driven in terms of being either targeted or general in nature and in terms of being either permanent or serving short term objectives

What Does It Take The Role Of Incentives In Forest Plantation

https://www.fao.org/3/ad524e/ad524e01.gif

People Respond To Incentives Adam Smith Institute

http://static1.squarespace.com/static/56eddde762cd9413e151ac92/570cb87b5bd33022b93a0272/570cc2fd5bd33022b93bc33a/1490712584313/?format=1500w

https://www.imf.org/external/pubs/ft/wp/2009/wp0921.pdf

Under this premise granting a tax incentive implies that the capital stock either of some type or in aggregate is considered too low and that either the tax system is the obstacle or other obstacles exist that can be compensated by the tax system

https://www.collinsdictionary.com/dictionary/english/tax-incentive

A tax incentive is a government measure that is intended to encourage individuals and businesses to spend money or to save money by reducing the amount of tax that they have to pay

Tax Incentives YouTube

What Does It Take The Role Of Incentives In Forest Plantation

Tax Incentives That Could Be Available For Your Business Magma

Good News For Small And Medium Enterprises In Form Of Tax Incentives

Incentives Definition Types Role Examples And Advantages Marketing91

PDF Do Tax Incentives Matter For Investment A Literature Review

PDF Do Tax Incentives Matter For Investment A Literature Review

Topic 4 Tax Incentives PDF Tax Exemption Taxes

Economics Is The Study Of Incentives

Revolutionizing Compensation The Power Of Incentives 2023

Definition Of Tax Incentives - Noun C TAX GOVERNMENT uk us Add to word list a reduction in taxes that encourages companies or people to do something that will help the country s