Definition Of Works Contract Service Under Service Tax Definition and scope of service Taxable Service means any service provided or to be provided to any person by any other person in relation to the execution of a works

DEFINITION According to Section 65 105 zzzza any service provided or to be provided to any person by any other person in relation to the execution of a works Definition of works contract service Service tax under works contract services has been imposed on the service element involved in the works contracts It

Definition Of Works Contract Service Under Service Tax

Definition Of Works Contract Service Under Service Tax

http://www.indiafilings.com/learn/wp-content/uploads/2015/08/Service-tax-for-catering-business.jpg

Works Contract Service Goods And Service Tax

https://lawbanyan.com/wp-content/uploads/2018/12/tim-gouw-83023-unsplash-1024x682.jpg

Works Contract Services Works Contract Under GST In New Delhi

https://www.taxdeal.in/assets/images/service/Valuation-In-GST1.jpg

After the Finance Act 2012 enacted Clause 54 of the newly introduced section 65B provides definition to works contract which means a contract wherein transfer of property in goods involved in the On the taxability of works contracts and construction services This paradigm shift has affected the way of functioning of persons providing works contract services The new

Definition of works contract service Service tax under works contract services has been imposed on the service element involved in the works contracts It After the insertion of Section 65B 54 in the Finance Act 1994 from 01 07 2012 onwards the definition of works contract was expanded to include repair and

Download Definition Of Works Contract Service Under Service Tax

More picture related to Definition Of Works Contract Service Under Service Tax

Exemptions Still Available In New Tax Regime with English Subtitles

https://i.ytimg.com/vi/_UAh2kQIrtc/maxresdefault.jpg

GST On Works Contract Composite Contracts Turnkey Projects

https://taxguru.in/wp-content/uploads/2020/06/works-contract-2.jpg

Free Electrical Service Contract Template Printable Templates

https://legaltemplates.net/wp-content/uploads/electrical-service-contract-1-min.jpg

A in case of works contracts entered into for execution of original works service tax shall be payable on forty per cent of the total amount charged for the works Position under GST Under GST laws the definition of Works Contract has been restricted to any work undertaken for an Immovable Property unlike the existing VAT

The service portion in the execution of a works contract and construction services are excluded in so far as they are used for construction or execution of works contract of a building or civil structure or a part Definition of works contract service Service tax under works contract services has been imposed on the service element involved in the works contracts It should be

Demand Of Service Tax Under Works Contract Service Can t Be Charged

https://www.taxscan.in/wp-content/uploads/2022/11/Demand-of-Service-Tax-Works-Contract-Service-Manufacture-and-Sale-of-Goods-CESTAT-taxscan.jpg

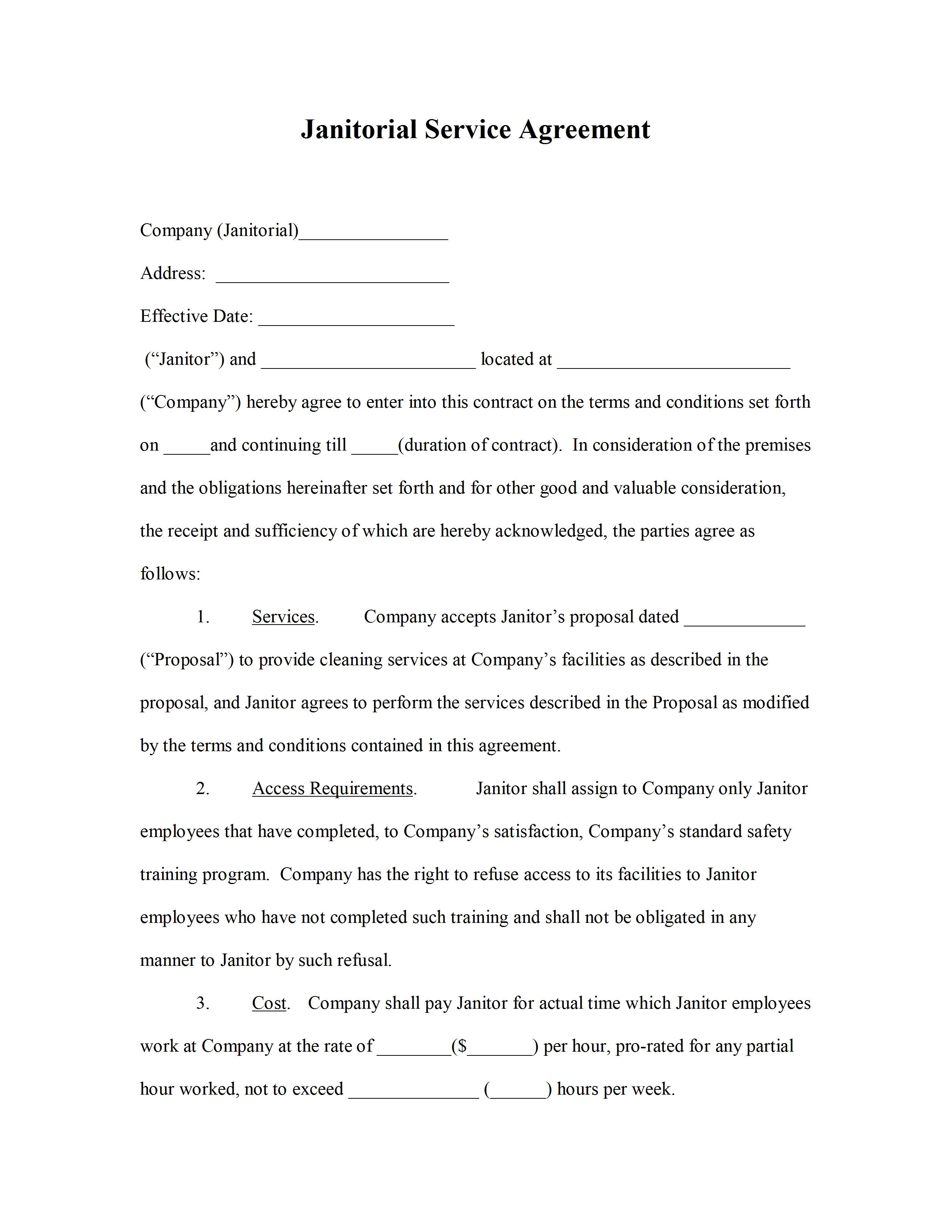

Free Printable Agreement Forms Printable Forms Free Online

https://free-printablehq.com/wp-content/uploads/2019/07/cleaning-service-agreement-template-janitorial-service-agreement-free-printable-service-contract-forms.jpg

https://old.cbic.gov.in/resources//htdocs-service...

Definition and scope of service Taxable Service means any service provided or to be provided to any person by any other person in relation to the execution of a works

https://www.servicetaxonline.com/content.php?id=337

DEFINITION According to Section 65 105 zzzza any service provided or to be provided to any person by any other person in relation to the execution of a works

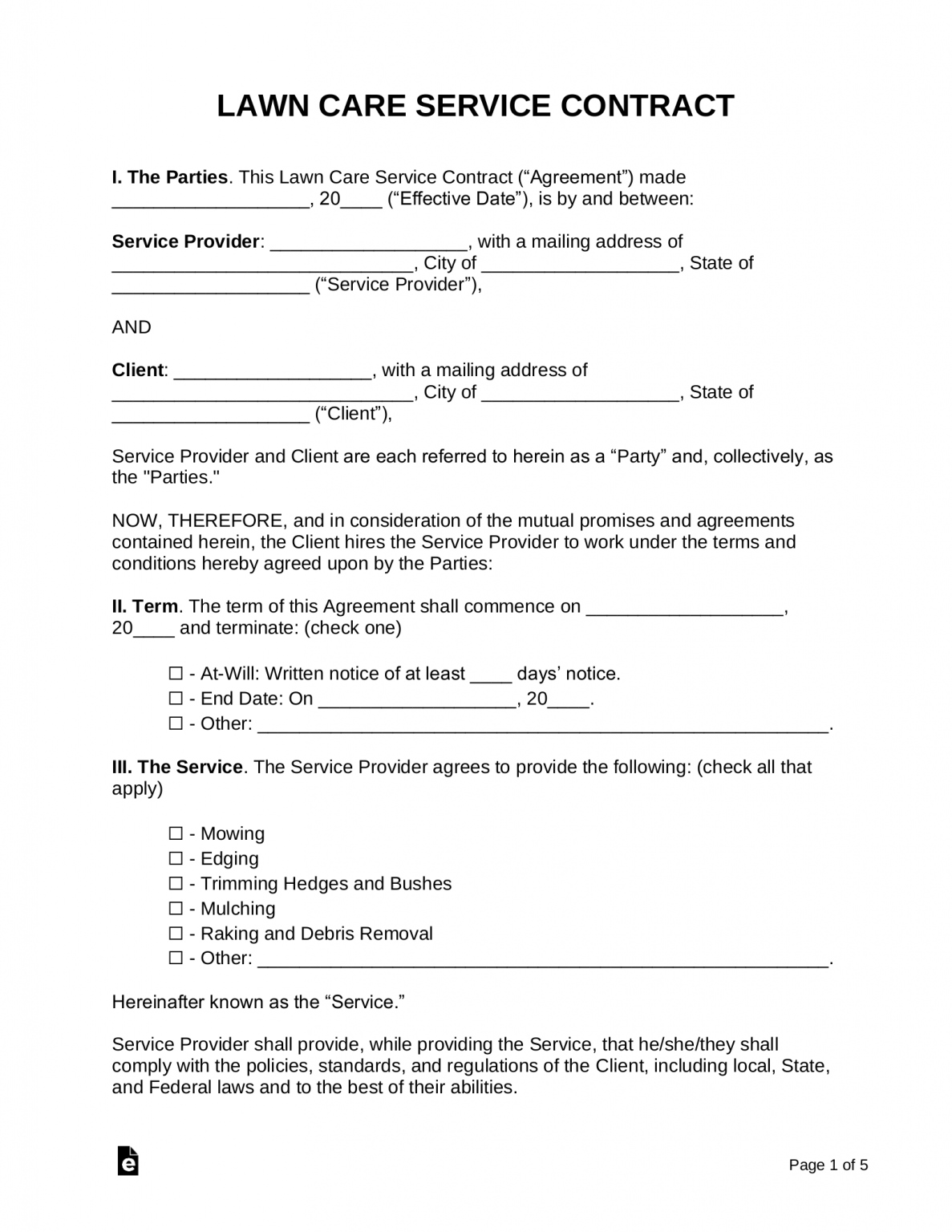

Printable Lawn Care Contract Template

Demand Of Service Tax Under Works Contract Service Can t Be Charged

GST On The Work Contractor

Printable General Contractor Contract Construction Contract Template

Apportionment Of Credit And Blocked Credit Under GST

Assessee Not Entitled To Total Contract Value And Remit Service Tax On

Assessee Not Entitled To Total Contract Value And Remit Service Tax On

Service Contract 1

12 GST On Composite Supply Of Works Contract For Metro Monorail AAR

Cenvat Credit Admissible On ECIS Services For Modernization

Definition Of Works Contract Service Under Service Tax - works contract means a contract wherein transfer of property in goods involved in the execution of such contract is leviable to tax as sale of goods and such