Dekalb Tax Rate Verkko The sales tax rate for the City of DeKalb is 8 00 The City receives 2 75 of the 8 00 Below is a breakdown of the 8 00 sales tax rate In addition to the sales tax there is a 2 restaurant bar and package tax

Verkko At this site users can view property information pay property taxes for the current tax year apply for the basic homestead exemption make address changes view tax sale information apply for excess funds and receive other general information regarding property PROPERTY TAX EXEMPTIONS VIDEO Verkko If your property is in the City of Atlanta portion of DeKalb and you are due a refund select the Atlanta Payments tab Additional Information For more information about property taxes please visit the Property Tax page at DeKalbTax

Dekalb Tax Rate

Dekalb Tax Rate

https://dekalbtax.org/sites/default/files/inline-images/Tax Bills Mailed COA-DeKalb_3.png

DeKalb County Property Tax Millage Rate Town Hall Video YouTube

https://i.ytimg.com/vi/EAgtCzfQCHo/maxresdefault.jpg

Dekalb County Property Tax Rate 2018 Property Walls

https://www.nahbclassic.org/assets/images/11HEO/SS0719_Fig3b.jpg

Verkko The median property tax in DeKalb County Georgia is 1 977 per year for a home worth the median value of 190 000 DeKalb County collects on average 1 04 of a property s assessed fair market value as property tax DeKalb County has one of the highest median property taxes in the United States and is ranked 458th of the 3143 counties Verkko 1 huhtik 2023 nbsp 0183 32 Code 000 The state sales and use tax rate is 4 and is included in the jurisdiction rates below Code Jurisdiction Rate Type Code Jurisdiction Rate Type Code Jurisdiction Rate Type 044A DeKalb Atlanta E H O8 9 M mTa 044 Dekalb Not Atlanta S8 M EH 045 Dodge L S8 E T 046 Dooly L S8 E T 047 Dougherty L S8 E T2

Verkko 15 jouluk 2023 nbsp 0183 32 The 2023 24 DeKalb County property tax levy is expected to bring in about 26 737 114 in revenue and see the rate decrease by 6 58 from 0 97 in 2022 to 0 91 for 2023 taxes according to DeKalb County documents DeKalb County Administrator Brian Gregory said because that rate decrease is larger than the Verkko 27 kes 228 k 2023 nbsp 0183 32 With DeKalb County tax rates now under consideration residents still have time to appeal their property assessments before tax bills are mailed in August The DeKalb County Governing Authority announced June 15 that it intends to keep its 2023 millage rate steady at 20 810 but taxes are expected to increase by 8 5 percent

Download Dekalb Tax Rate

More picture related to Dekalb Tax Rate

Valuation Methods Used By The DeKalb County Property Tax Assessors

https://www.fair-assessments.com/hs-fs/hubfs/DeKalb County Property Tax Assessors.jpg?width=2272&name=DeKalb County Property Tax Assessors.jpg

DeKalb Tax Commissioner Encourages Homeowners To Apply For Homestead

https://decaturish.com/wp-content/uploads/2021/03/taxcommish-624x394.jpg

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

Verkko 15 jouluk 2023 nbsp 0183 32 Adding a new higher rate income tax band in Scotland might only raise 163 60m a leading fiscal think tank has warned The Scottish government is reportedly considering introducing a new tax level Verkko 2 kes 228 k 2023 nbsp 0183 32 For homeowners in DeKalb the school board portion of their taxes can be anywhere from 60 to 80 percent of their total bill For example a home in Dunwoody assessed at 206 000 with a homestead exemption pays about 113 in city taxes and 1 600 in school taxes which is 80 percent of the total bill

Verkko Dekalb County in Georgia has a tax rate of 7 for 2024 this includes the Georgia Sales Tax Rate of 4 and Local Sales Tax Rates in Dekalb County totaling 3 You can find more tax rates and allowances for Dekalb County and Georgia in Verkko Georgia Property Tax Rates Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1 000 in assessed value Clayton County is 122 100 significantly lower than the median values in other Atlanta area counties like Fulton and DeKalb That means property tax payments are also generally lower

Blog Sempels Accountancy Tax

https://sempelsbhk.be/wp-content/uploads/2022/09/LOGO-SEMPELS.png

https://c.pxhere.com/images/38/2b/139c5771ccf68374d3fc7581ece3-1444833.jpg!d

https://www.cityofdekalb.com/271

Verkko The sales tax rate for the City of DeKalb is 8 00 The City receives 2 75 of the 8 00 Below is a breakdown of the 8 00 sales tax rate In addition to the sales tax there is a 2 restaurant bar and package tax

https://dekalbtax.org/property-tax

Verkko At this site users can view property information pay property taxes for the current tax year apply for the basic homestead exemption make address changes view tax sale information apply for excess funds and receive other general information regarding property PROPERTY TAX EXEMPTIONS VIDEO

What Is The Inheritance Tax Rate In The UK Gobernauta

Blog Sempels Accountancy Tax

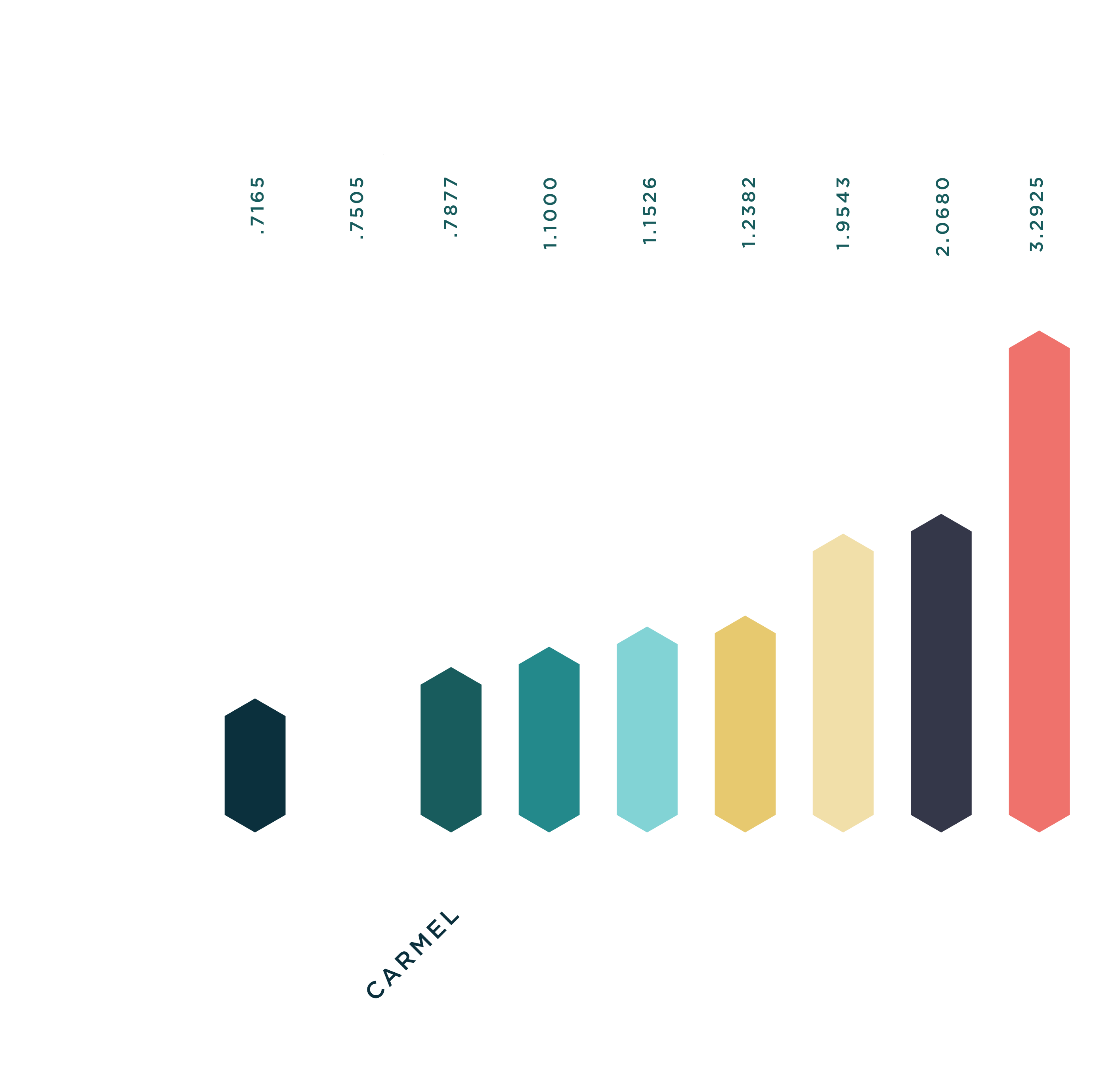

Tax Rate Let s Talk Carmel

Home DeKalb Tax Commissioner

Dekalb County Tax Assessor Gis As A High Ejournal Pictures Library

Govt Cuts Corporate Tax Rate To 22 Relief On Buyback Tax India

Govt Cuts Corporate Tax Rate To 22 Relief On Buyback Tax India

Dekalb County Tax Assessor Qpublic Natacha Peachey

Dekalb Tax Assessor Search YouTube

Product Detail

Dekalb Tax Rate - Verkko The median property tax in DeKalb County Georgia is 1 977 per year for a home worth the median value of 190 000 DeKalb County collects on average 1 04 of a property s assessed fair market value as property tax DeKalb County has one of the highest median property taxes in the United States and is ranked 458th of the 3143 counties