Dependent Care Fsa Tax Free Rebate Web 25 mai 2021 nbsp 0183 32 The IRS addressed confusion over the taxability of dependent care flexible spending account DC FSA funds for 2021 and 2022 clarifying that it won t tax amounts

Web 8 oct 2022 nbsp 0183 32 Like dependent care FSAs the dependent care tax credit is for care expenses for children younger than 13 plus minors and adults unable to care for themselves For the 2022 2023 tax year you can claim Web 10 mai 2021 nbsp 0183 32 IR 2021 105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022

Dependent Care Fsa Tax Free Rebate

Dependent Care Fsa Tax Free Rebate

https://shootersjournal.net/wp-content/uploads/2019/04/dependent-care-fsa-receipt-template-lovely-health-amp-welfare-benefits-of-dependent-care-fsa-receipt-template.png

Under The Radar Tax Break For Working Parents The Dependent Care FSA

https://uploads-ssl.webflow.com/60d06fe5295170bf4aac3c09/611ff9182df03b8ea38952de_Dyf2aM0vq8m-UvMRjk_z6r6YCziRUy8fQjaWkYTUI_pP5AMkYw1UGd_vbh2HwEtphyRncYbBSJwB62SE908VyPr25XpxVc2tADWpjOf6l5-ZchDlAMmkXgHct4na8jOUxg.jpeg

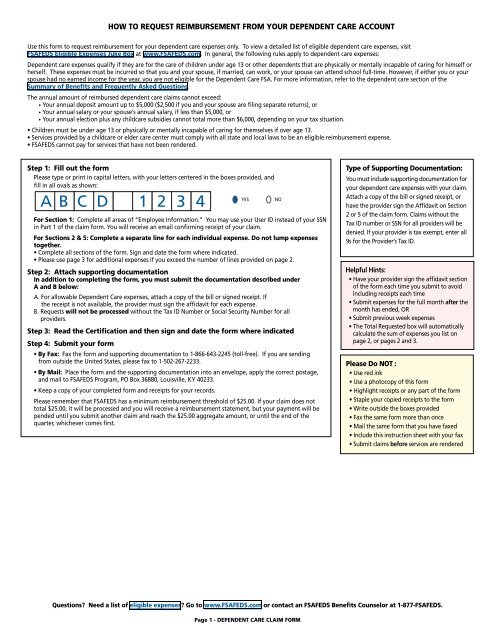

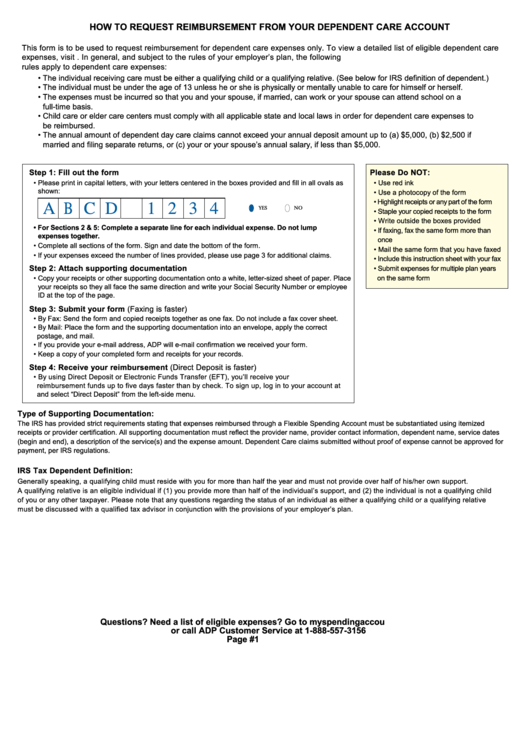

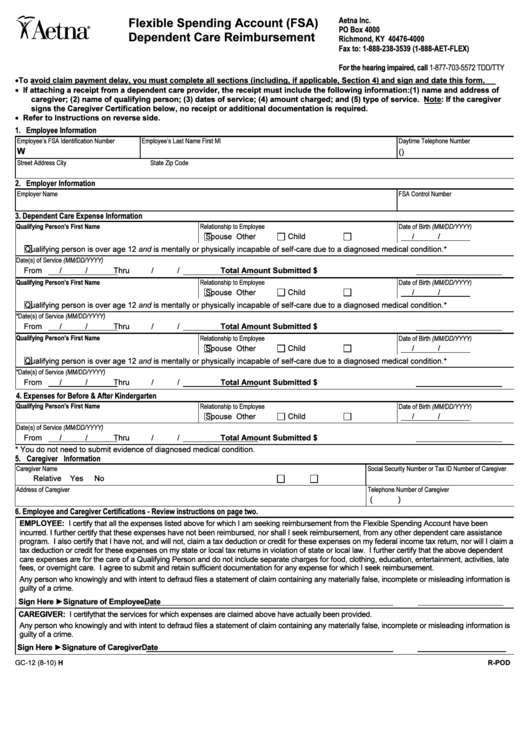

FSAFEDS Dependent Care FSA Claim Form

https://img.yumpu.com/11253298/1/500x640/fsafeds-dependent-care-fsa-claim-form.jpg

Web 4 juil 2023 nbsp 0183 32 For someone in the 24 federal tax bracket this income reduction means saving 240 in federal taxes for every 1 000 spent on dependent care with an FSA Investopedia Ellen Web 10 mai 2021 nbsp 0183 32 Instead of the normal 5 000 per year limit on tax free contributions a family can sock away up to 10 500 in a dependent care FSA this year without paying tax on

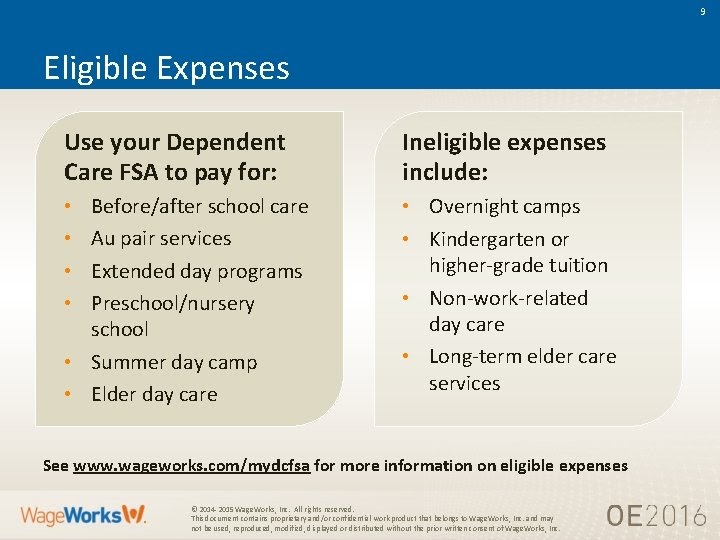

Web Why enroll in a Dependent Care FSA Save up to 30 percent on dependent care services Reduce your overall tax burden funds are withdrawn from your paycheck for deposit Web 31 mai 2021 nbsp 0183 32 Save on Child Care Costs for 2021 Dependent Care FSA vs Dependent Care Tax Credit To offset a portion of the high cost of childcare consider a Dependent Care Flexible Spending

Download Dependent Care Fsa Tax Free Rebate

More picture related to Dependent Care Fsa Tax Free Rebate

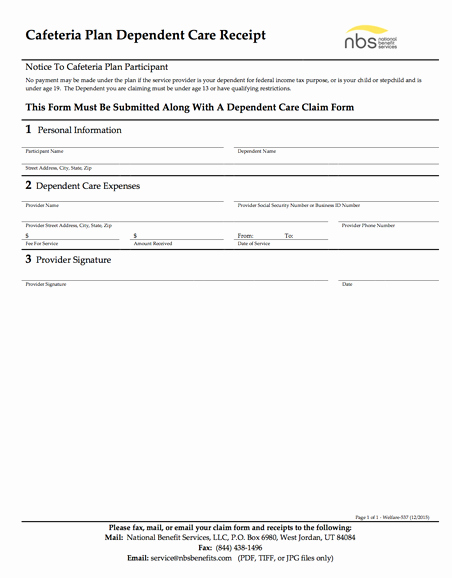

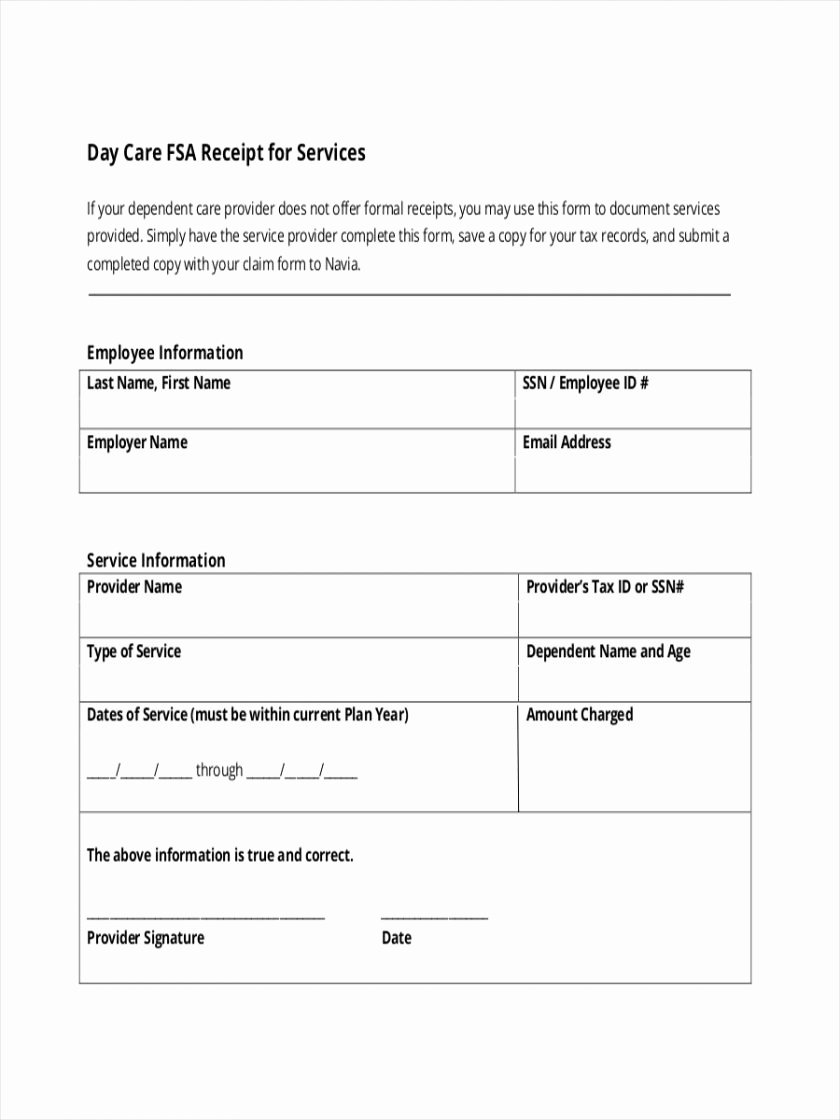

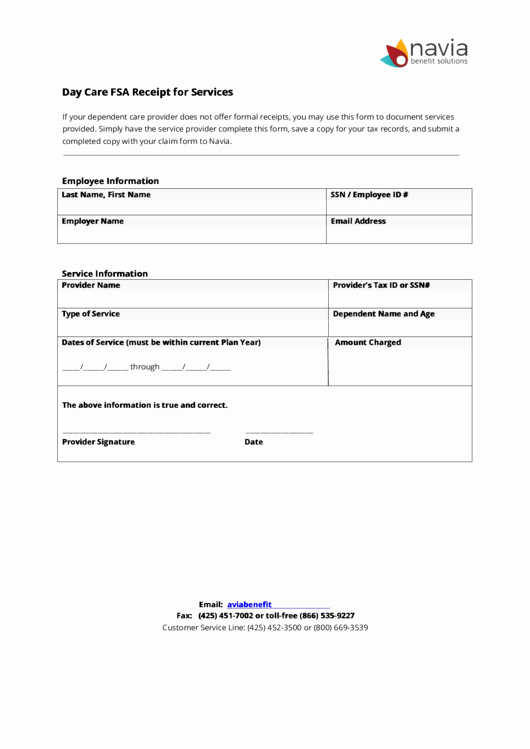

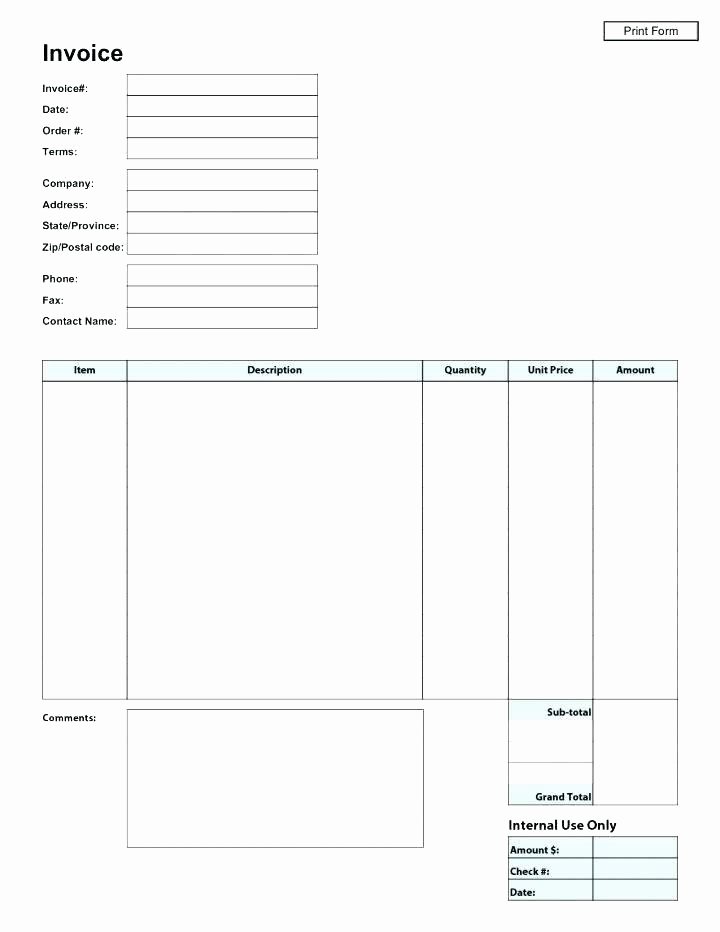

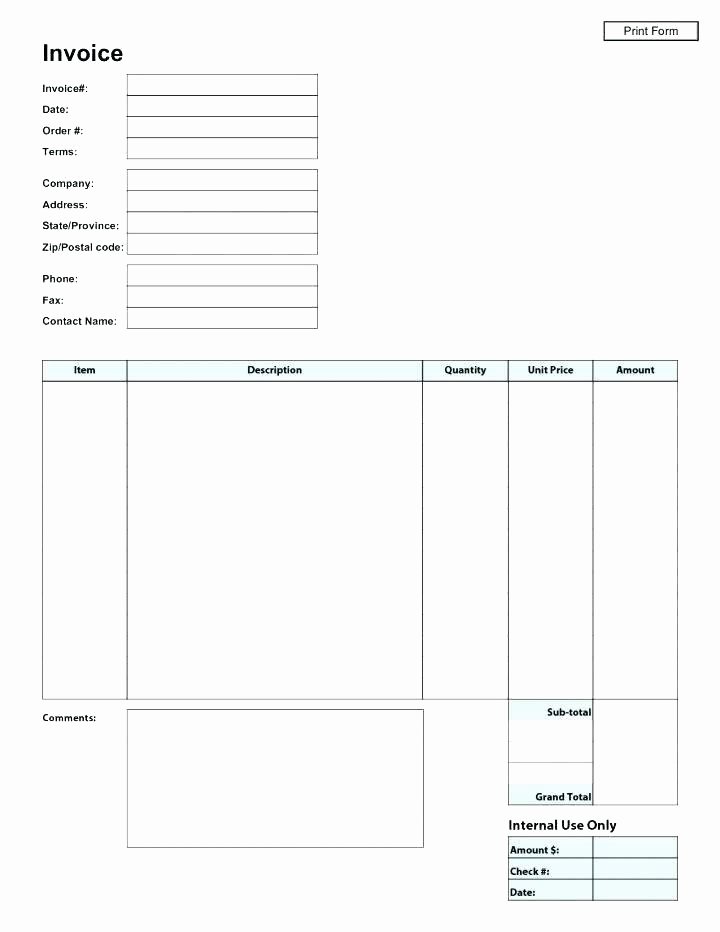

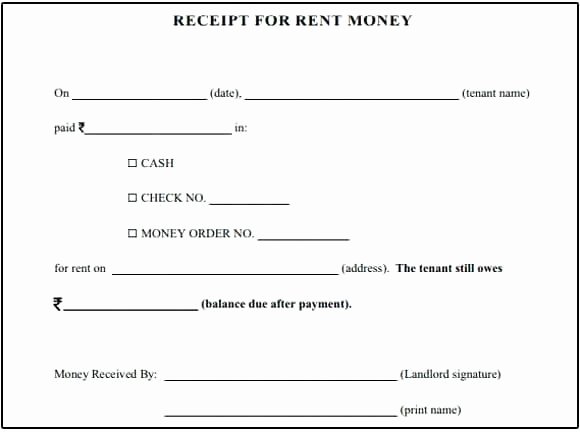

Dependent Care Fsa Receipt Template

https://shootersjournal.net/wp-content/uploads/2019/04/dependent-care-fsa-receipt-template-luxury-babysitting-receipt-babysitting-invoice-receipt-template-of-dependent-care-fsa-receipt-template.jpg

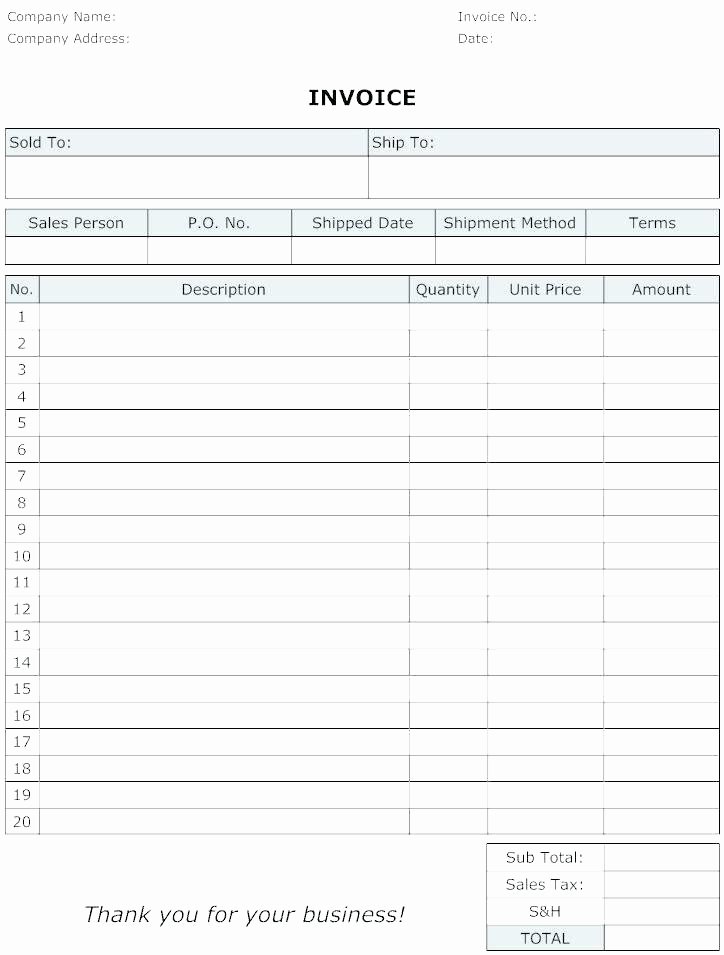

Fillable Dependent Care Fsa Claim Form Reimbursement Form 2017

https://data.formsbank.com/pdf_docs_html/129/1296/129691/page_1_thumb_big.png

Dependent Care Fsa Receipt Template

https://shootersjournal.net/wp-content/uploads/2019/04/dependent-care-fsa-receipt-template-new-daycare-year-end-tax-statement-template-of-dependent-care-fsa-receipt-template.jpg

Web 15 mars 2021 nbsp 0183 32 Elder care may be eligible for reimbursement with a dependent care FSA if the adult lives with the FSA holder at least eight hours of the day and is claimed as a Web 10 mai 2022 nbsp 0183 32 An employer can establish a DCFSA for its employees allowing the employees to reduce their salary and not pay income and payroll taxes on the salary

Web 15 juin 2023 nbsp 0183 32 You re receiving a tax benefit because under the plan you re not paying taxes on the money set aside to pay for the dependent care expenses You must Web 6 oct 2022 nbsp 0183 32 If your company is among the 40 of employers that offer this benefit you can put up to 5 000 per year into the account before taxes and take it out tax free for qualified dependent

How To Report Dependent Care Fsa On Tax Return Lectien

https://s2.studylib.net/store/data/012254232_1-a25a4c496da588df4450e5c35b054746.png

Dependent Care Fsa Receipt Template

https://shootersjournal.net/wp-content/uploads/2019/04/dependent-care-fsa-receipt-template-luxury-dependent-care-flexible-spending-account-dcfsa-of-dependent-care-fsa-receipt-template.jpg

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/irs...

Web 25 mai 2021 nbsp 0183 32 The IRS addressed confusion over the taxability of dependent care flexible spending account DC FSA funds for 2021 and 2022 clarifying that it won t tax amounts

https://smartasset.com/taxes/dependent-car…

Web 8 oct 2022 nbsp 0183 32 Like dependent care FSAs the dependent care tax credit is for care expenses for children younger than 13 plus minors and adults unable to care for themselves For the 2022 2023 tax year you can claim

Under The Radar Tax Break For Working Parents The Dependent Care FSA

How To Report Dependent Care Fsa On Tax Return Lectien

Dependent Care Fsa Receipt Template

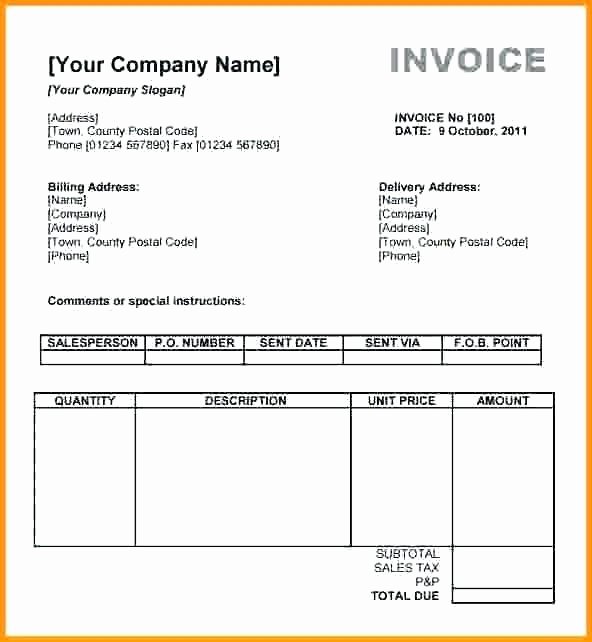

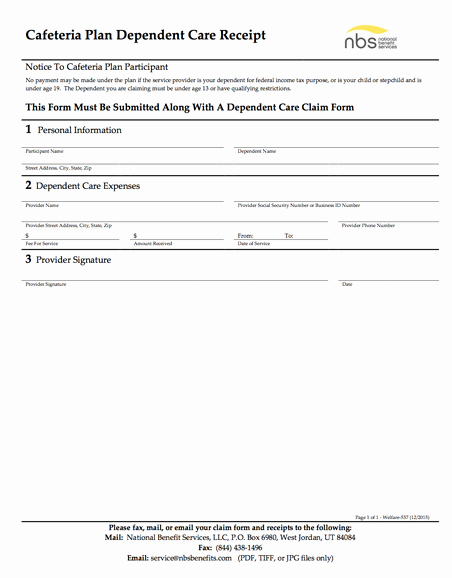

Fillable 2010 Flexible Spending Account Fsa Dependent Care

Dependent Care Fsa Receipt Template

Dependent Care Fsa Receipt Template

Dependent Care Fsa Receipt Template

Dependent Care Fsa Receipt Template

What Is A Dependent Care FSA WEX Inc

Dependent Care Fsa Receipt Template

Dependent Care Fsa Tax Free Rebate - Web 27 janv 2023 nbsp 0183 32 Dependent Care FSA vs Child Care Tax Credit You have another option for saving money on dependent care expenses via lowering your taxable income the