Dependent Child Tax Credit Ireland If you are caring for a dependent child on your own you can claim the Single Person Child Carer Credit in addition to your personal tax credit There is also an

If you maintain a dependent relative you may qualify for the Dependent Relative Tax Credit Maintaining a relative means meeting the costs of everyday living Incapacitated Child Tax Credit Single Person Child Carer Credit SPCCC Widowed Parent Tax Credit

Dependent Child Tax Credit Ireland

Dependent Child Tax Credit Ireland

https://refundyourtax.ie/wp-content/uploads/2021/02/dependent-relative-tax-credit-in-ireland.jpeg

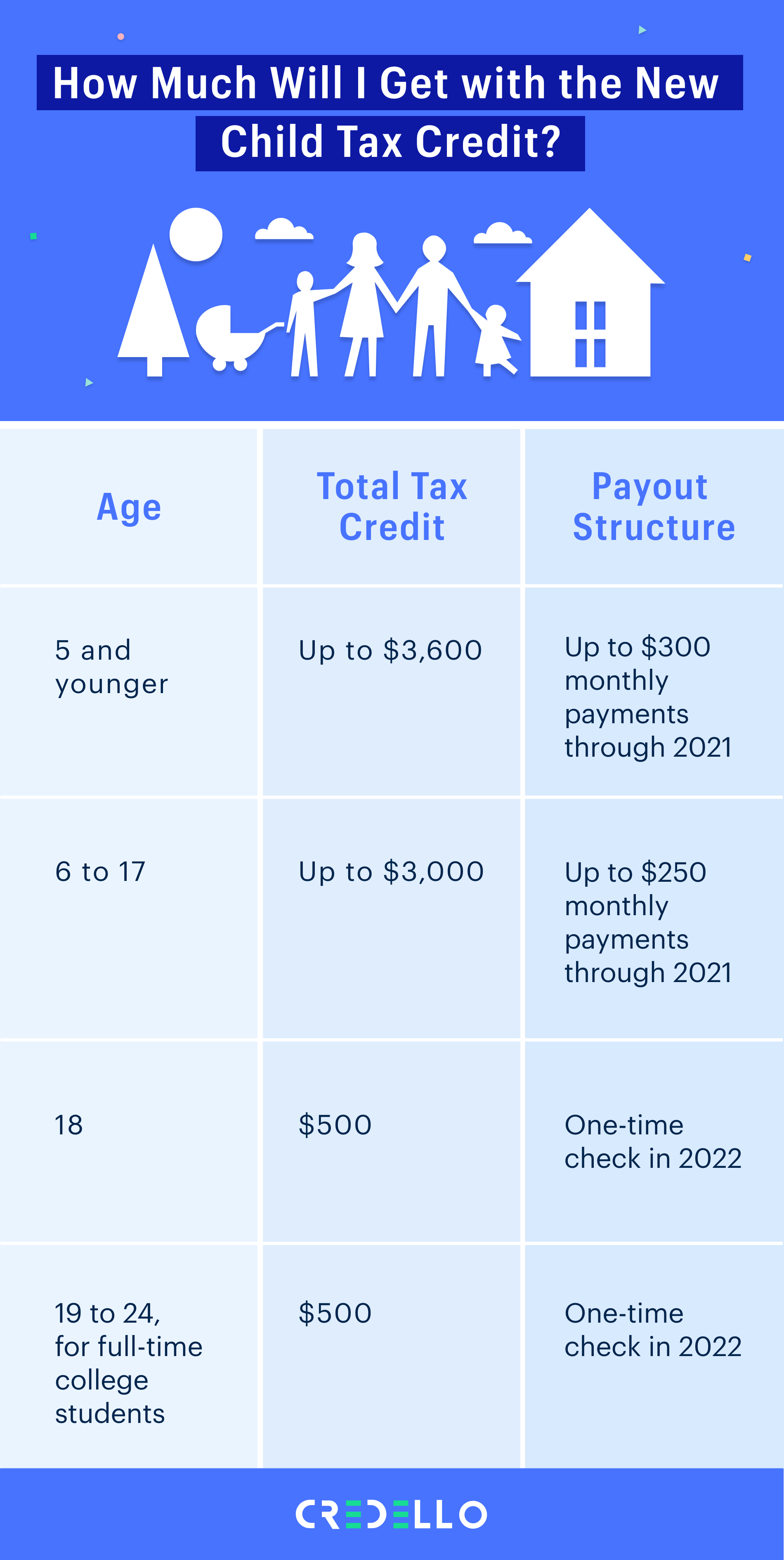

What The New Child Tax Credit Could Mean For You Now And For Your 2021

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

Child And Dependent Care Expenses Tax Credit TL DR Accounting

https://www.tldraccounting.com/wp-content/uploads/2022/08/Child-and-Dependent-Care-Expenses-Tax-Credit-1.png

DR1 Claim for Dependent Relative Tax Credit or Form DR2 Claim for a son daughter or child of your c partner on whose services you depend Self assessed individuals can The Dependent Relative Tax Credit is a tax credit in Ireland designed to reduce the income tax liability for the year for individuals caring for dependent relatives including parents

You may claim the Dependent Relative Tax Credit where you maintain any of the below at your own expense A relative or spouses relative who is unable due to old age or infirmity to maintain themselves You can get an increase in your social welfare payment for a child dependant This page explains when you can claim an Increase for a Qualified Child IQC

Download Dependent Child Tax Credit Ireland

More picture related to Dependent Child Tax Credit Ireland

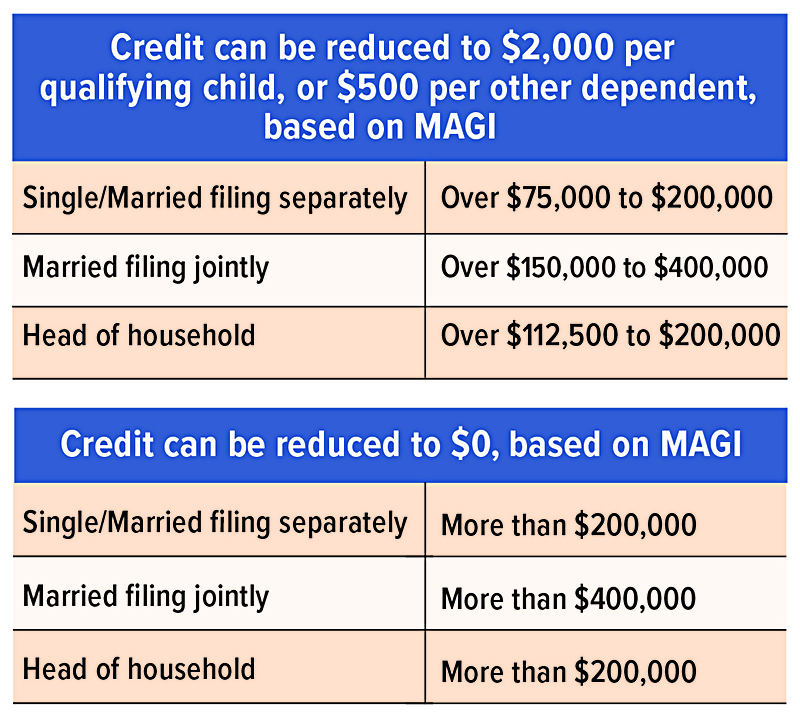

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

https://static.twentyoverten.com/5afae91ee233a94fd2b8b963/E4jh24nT7K/1616431654979.png

How To Claim Child And Dependent Care Tax Credit In 2022 Karla Dennis

https://www.karladennis.com/wp-content/uploads/2022/10/KDA-blog-cdc-scaled.jpg

CHILD DEPENDENT CARE CREDIT FAQS National Tax Office

https://www.nationaltaxoffice.com/wp-content/uploads/2021/09/Child-and-dependent-kids-stading-with-bookbag.png

What is the Dependent Relative Tax Credit If you care for a dependent relative you are likely eligible for this allowance A qualifying relative is any relation who relies on you to provide their care typically due to illness Qualifying individuals will be entitled to exclude 30 of employment earnings over EUR 100 000 effective from 1 January 2023 from the charge to Irish tax There is

For the purpose of the tax credit the following persons are dependent persons 3 Children in respect of whom child benefit is payable i e children under 16 and 16 or From 01 January 2021 onwards you can claim a tax credit of 245 per dependent which is limited to maximum of 5 dependents The value of this credit was increased in this year s

How The Child And Dependent Care Tax Credit Helps Families

https://gtm.com/household/wp-content/uploads/2022/03/child-dependent-care-tax-credit-helps-families-1024x683.jpg

Child Tax Credit Changes For 2023 Taxes PLUS Other Kiddie And Dependent

https://i.ytimg.com/vi/2fcIiqyn8Wk/maxresdefault.jpg

https://www.citizensinformation.ie/en/money-and...

If you are caring for a dependent child on your own you can claim the Single Person Child Carer Credit in addition to your personal tax credit There is also an

https://www.citizensinformation.ie/.../dependent-relative-tax-credit

If you maintain a dependent relative you may qualify for the Dependent Relative Tax Credit Maintaining a relative means meeting the costs of everyday living

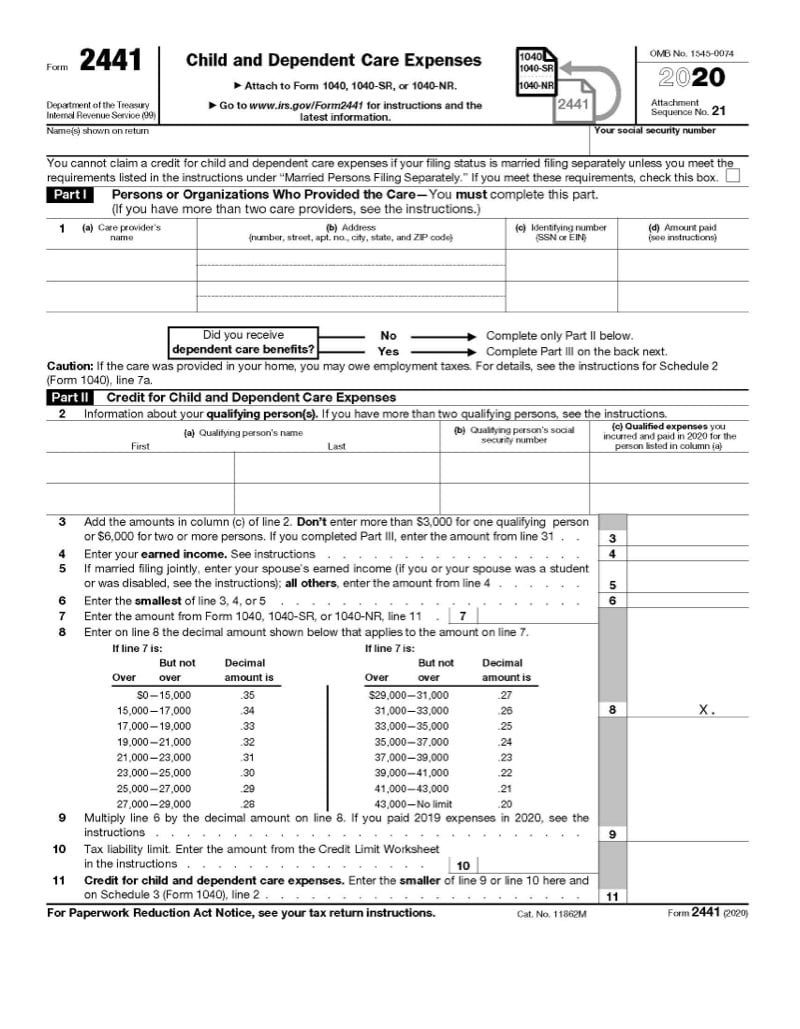

Child Dependent Care Expenses IRS Form 2441 Jackson Hewitt

How The Child And Dependent Care Tax Credit Helps Families

Learn About The Enhanced Child Tax Credit And Its Enormous Benefits For

You Can Get Up To 8 000 In Child And Dependent Care Credit For 2021

Child And Dependent Care Credit 2022 2022 JWG

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credits Form IRS Free Download

Child Tax Credit For 2021 Will You Get More

Child Tax Credit Changes Coming Soon Update From The IRS

Dependent Child Tax Credit Ireland - You receive a higher tax credit in the year of bereavement It is the same amount as the married person or civil partner credit You may claim the Widowed Parent