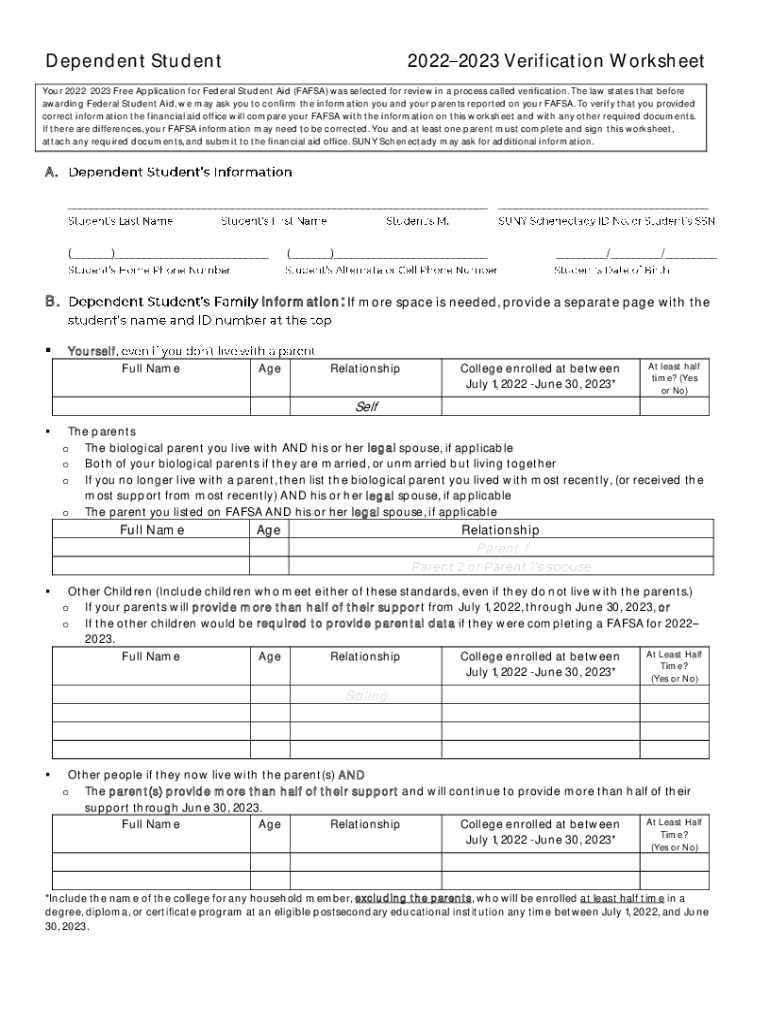

Dependent Return Filing Requirement Verkko A person who is a dependent may still have to file a return It depends on the person s earned income unearned income and gross income For details see Table 2 A

Verkko Enter the dependent s gross income If line 6 is more than line 5 the dependent must file an income tax return If the dependent is married and his or her spouse itemizes deductions on a separate return the Verkko Tax requirements for dependent children are different from those of other taxpayers A dependent child who has earned more than 13 850 of earned income tax year

Dependent Return Filing Requirement

Dependent Return Filing Requirement

https://www.pdffiller.com/preview/577/622/577622265/large.png

Requirement

https://s3-ap-south-1.amazonaws.com/baddie-exp/cms/uploads/2021/07/bai_page-0001.jpg

Requirement WEBTOON

https://swebtoon-phinf.pstatic.net/20170405_150/1491395002652Vj2Ey_JPEG/thumbnail.jpg

Verkko Single Dependents Either 65 or over or blind Under 65 and not blind Married Dependents Either age 65 or older or blind Under age 65 and not blind You must file a return if Verkko return only to get a refund of income tax withheld 2 The child must be a under age 19 at the end of the year and younger than you or your spouse if filing jointly b under

Verkko Qualifying widow er with a dependent child If you meet the single status tax filing requirements and you re under 65 you must file if your federal gross income was Verkko Yes You must file a return if any of the following apply Your unearned income is more than 2 750 4 400 if 65 or older and blind Your earned income was more than

Download Dependent Return Filing Requirement

More picture related to Dependent Return Filing Requirement

Dependent Related Options OOC2

https://ooc2.com/image/cache/catalog/Product/OpenCart/Related-Dependent-options-1200x1440.jpg.webp

What Is AAIP Dependent Authorization Form

https://angadimmigration.ca/wp-content/uploads/2023/06/Angad-Immigration-11-1024x1024.png

In 2020 David Is Age 78 Is A Widower And Is Being Claimed As A

https://img.homeworklib.com/questions/45b7ca20-13a6-11eb-affe-3be82d211681.png?x-oss-process=image/resize,w_560

Verkko 29 marrask 2023 nbsp 0183 32 To claim a child as a dependent on your tax return the child must meet all of the following conditions 1 The child has to be part of your family This is the relationship test The child must Verkko 15 kes 228 k 2023 nbsp 0183 32 An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits To find these limits refer to

Verkko 4 kes 228 k 2023 nbsp 0183 32 Example 2 Person B works in Finland and has been issued a key employee s tax card for 48 months The tax card s period of validity ends on 30 April Verkko The minimum income requiring a dependent to file a federal tax return 2022 filing requirements for dependents under 65 Earned income of at least 12 950 or

Determining Filing Status Married Or Single Fort Myers Naples MNMW

https://markham-norton.com/wp-content/uploads/2022/11/Theres-More-To-Determining-Filing-Status-Than-Being-Married-Or-Single-scaled.jpg

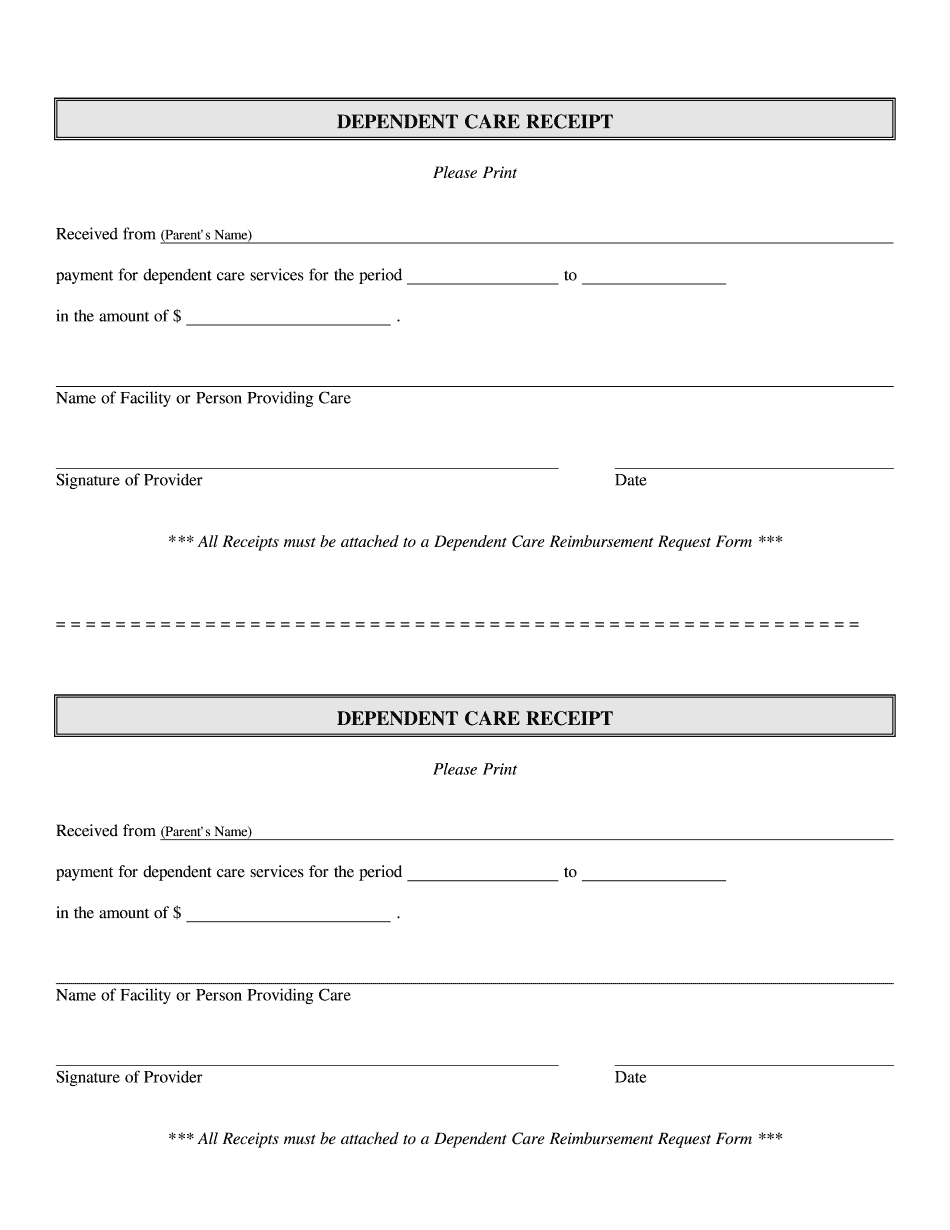

Boost Efficiency With Our Editable Form For Dependent Care Receipt Form

https://www.pdffiller.com/preview/100/276/100276528/big.png

https://www.irs.gov/publications/p501

Verkko A person who is a dependent may still have to file a return It depends on the person s earned income unearned income and gross income For details see Table 2 A

https://www.irs.gov/publications/p929

Verkko Enter the dependent s gross income If line 6 is more than line 5 the dependent must file an income tax return If the dependent is married and his or her spouse itemizes deductions on a separate return the

Know If You Are Dependent On Facebook

Determining Filing Status Married Or Single Fort Myers Naples MNMW

Independent And Dependent Variables Worksheet Worksheet QA

TDS Return Filing Services At Rs 1100 session In Kolkata

Documents Required For ITR Filing Save More Money

Independent Dependent And Controlled Variables Worksheet Wit

Independent Dependent And Controlled Variables Worksheet Wit

Build And Maintain A Secure Network What You Need To Know To Monitor

Dependent Claims Explained YouTube

Medical Claim Requirement Text Rectangular Vector Requirement Text

Dependent Return Filing Requirement - Verkko Your son in law daughter in law father in law mother in law brother in law or sister in law Your uncle aunt nephew or niece Earn less than 4 700 Receive more than