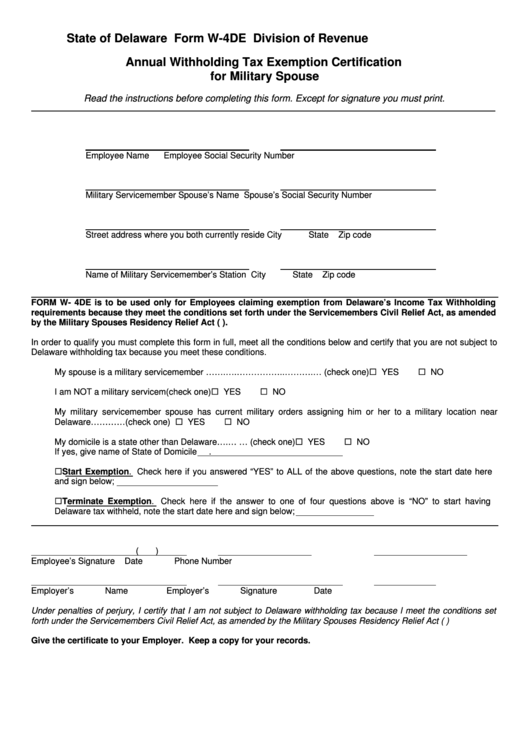

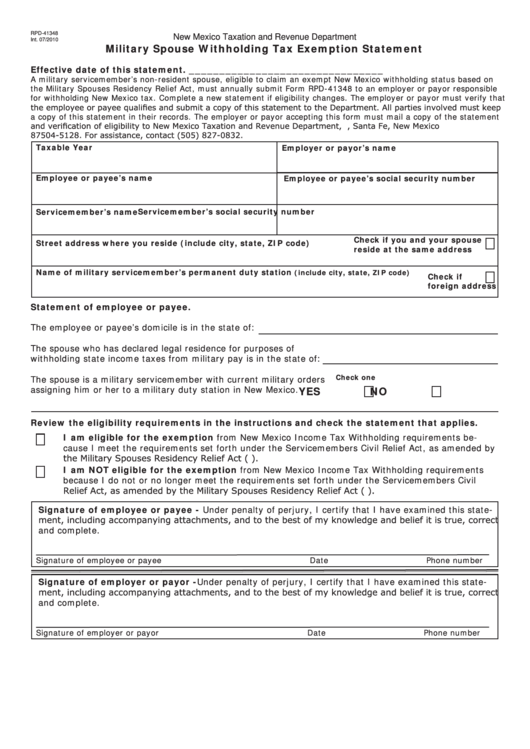

Dependent Spouse Tax Exemption You can t claim spouses as dependents whether he or she maintains residency with you or not However you can claim an exemption for your spouse in certain

Dependents can be claimed by a taxpayer to reduce the amount of taxes that will have to be paid The IRS calls this a Synopsis If your parents fall in the non taxable or a lower tax bracket you can invest in their names by gifting them money Here are other ways you can invest

Dependent Spouse Tax Exemption

Dependent Spouse Tax Exemption

https://mygrantmanagement.com/wp-content/uploads/2019/07/tax_exemption_1563850735.png

What Is Innocent Spouse Tax Relief A Lot Of Married As Well As

https://i.pinimg.com/originals/46/f8/46/46f846449750fcf2c6acf01c88640438.jpg

ITR Filing Income Tax Exemption Deduction That Home Loan Borrowers

https://img.etimg.com/thumb/msid-103082793,width-1070,height-580,imgsize-1585531/photo.jpg

The Role of Spouses in Dependency Claims In the realm of tax laws a spouse cannot be claimed as a dependent However couples filing a joint return may Income To claim your domestic partner on your tax return as a dependent under the qualifying relative rules your partner s gross

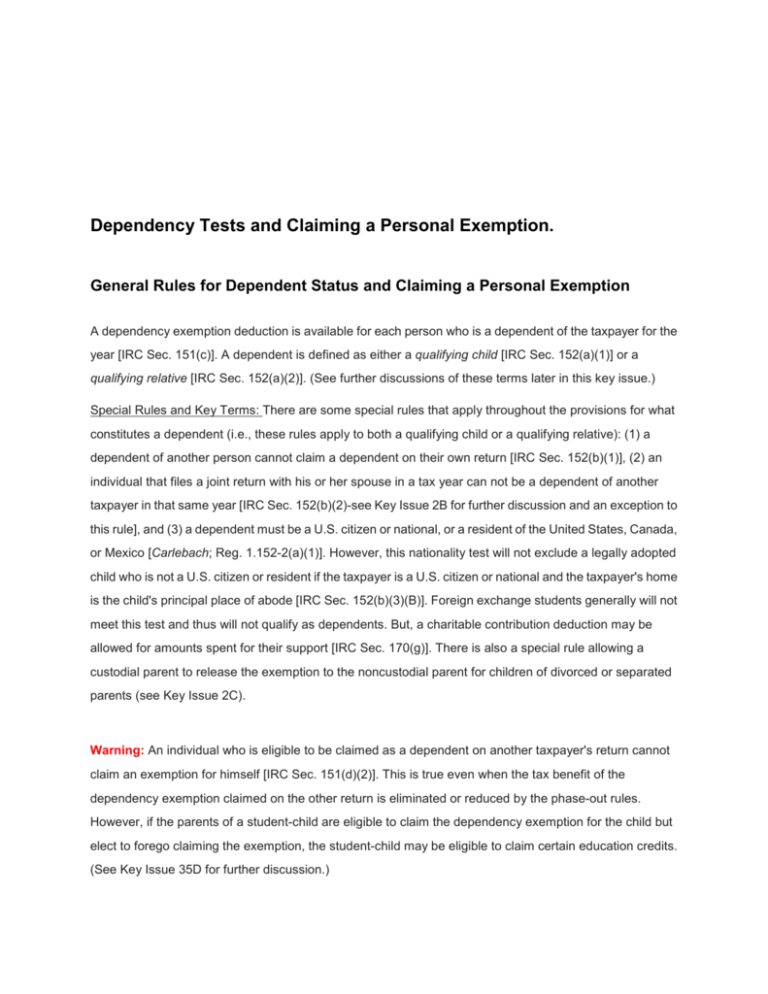

Rules for All Dependents This part of the publication discusses the filing requirements for dependents who is responsible for a child s return how to figure a dependent s standard deduction and whether a dependent can General rules for dependents A dependent must be a U S citizen resident alien or national or a resident of Canada or Mexico A person can t be claimed as a

Download Dependent Spouse Tax Exemption

More picture related to Dependent Spouse Tax Exemption

Dependency Tests And Claiming A Personal Exemption

https://s3.studylib.net/store/data/008732924_1-6b96888171628e44f18e82d05c09faf5-768x994.png

![]()

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

https://www.rebelliouspixels.com/wp-content/uploads/2020/03/tax_free_residency-1536x1066.jpg

CLLA Bankruptcy Blog Debtor Not Allowed To Claim Exemption On Proceeds

http://2.bp.blogspot.com/-9HADXqfFWY4/Vedm7zKhbxI/AAAAAAAAAiA/PDxUvb-EWP4/s1600/JWH%2Bpic%2B%25284%2529.jpg

Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax October 6 2023 Tax Deductions The IRS dependent exemption is designed to reduce the tax burden on taxpayers who are responsible for supporting a dependent People who have children are the most likely to

The personal exemption helped reduce the burden of financially supporting yourself and dependents by reducing taxable income However there were a few For tax years prior to 2018 for each person listed on your tax return you your spouse and any children or other dependents you can subtract a certain amount

IRS Innocent Spouse Relief Tax Forgiveness Debt

https://www.debt.com/wp-content/uploads/2017/07/Spouse-Tax-Debt.jpg

Military Spouse Tax Exemption Form California ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-form-w-4de-annual-withholding-tax-exemption-certification.png

https://www.hrblock.com/tax-center/filing/...

You can t claim spouses as dependents whether he or she maintains residency with you or not However you can claim an exemption for your spouse in certain

https://smartasset.com/taxes/claiming-a-depe…

Dependents can be claimed by a taxpayer to reduce the amount of taxes that will have to be paid The IRS calls this a

Claim Deduction Under Section 80DD Learn By Quicko

IRS Innocent Spouse Relief Tax Forgiveness Debt

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

How To Reduce Withholding Tax Outsiderough11

Who Can I Claim As Dependents On My Taxes Tax Tax Return Dependable

Irs Form W 4 R 2023 Printable Forms Free Online

Tax Reduction Company Inc

Tax Reduction Company Inc

IHT Spouse Exemption Other Tax Reliefs ETC Tax

Budget 2023 Check The Difference Between Income Tax Exemption

Fillable Form Rpd 41348 Military Spouse Withholding Tax Exemption

Dependent Spouse Tax Exemption - Income To claim your domestic partner on your tax return as a dependent under the qualifying relative rules your partner s gross