Dependent Spouse Tax Offset 2021 You may be able to claim a tax offset if you make an eligible super contribution on behalf of your spouse married or de facto They need to earn under 40 000 or not work Your contribution must be to either your spouse s

For the 2021 22 year the maximum Invalid and Carer Tax Offset amount available for each eligible dependent is 2 833 subject to reduction based on the amount of the dependent s Adjusted Taxable Income in excess of 11 614 Between 2018 19 and 2021 22 you may have been eligible to receive one or both of the low income tax offset if you earn up to 66 667 low and middle income tax offset if you earn up to 126 000 LMITO ended on 30 June 2022 The last year you can receive it is the 2021 22 income year

Dependent Spouse Tax Offset 2021

Dependent Spouse Tax Offset 2021

https://artwork.captivate.fm/34785155-54ea-4b86-ad90-11e478281ec0/gS3gEqrtrgJ_LBJ1GbRjrPc1.png

Maximize Small Business Income Tax Offset In 2021 Australia

https://yoursmallbusinesscoach.com.au/wp-content/uploads/small-business-income-tax-offset-scaled.jpg

What Is The Spouse Super Tax Offset Nationwide Super

https://www.nationwidesuper.com.au/wp-content/uploads/2019/10/iStock-1023159612-e1572492632484.jpg

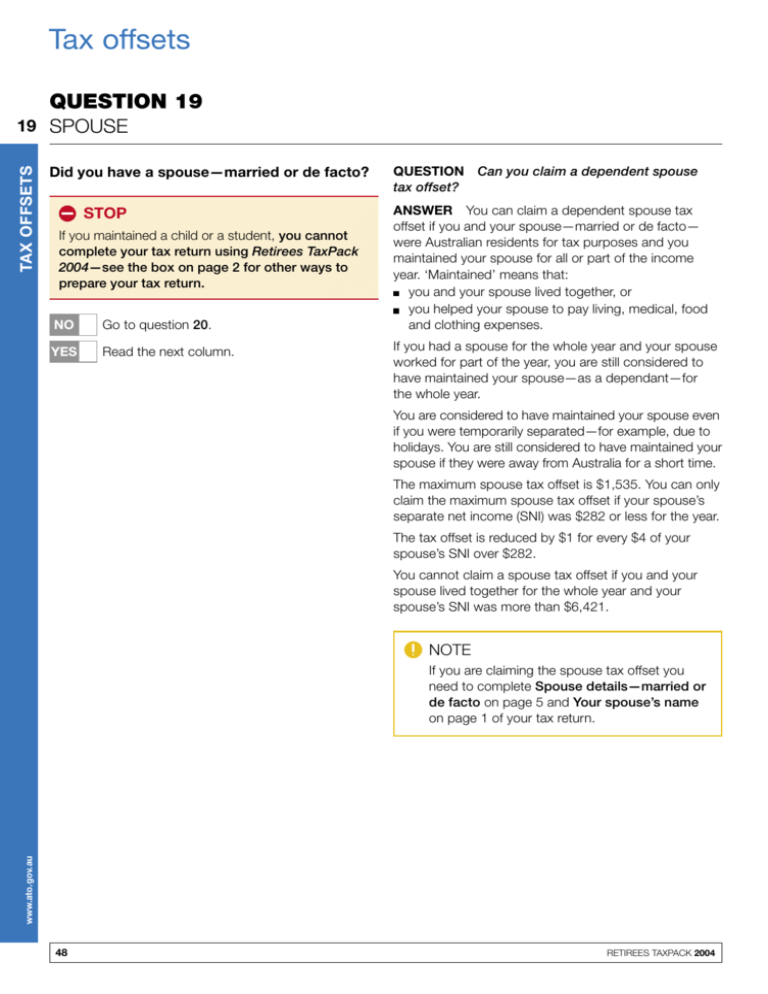

Government legislation allows your spouse to make spouse superannuation contributions for you if you earn up to 40 000 and claim a tax offset If you earn below 37 000 your spouse can claim the maximum tax offset of 540 when they contribute at least 3 000 to your super Find out more Spouse contribution tax offset If a resident spouse s assessable income and reportable fringe benefits and employer superannuation contributions does not exceed AUD 40 000 a resident may make a maximum rebatable contribution of AUD 3 000 for the spouse including a de facto spouse to a complying superannuation fund or retirement

Claiming the Canada caregiver amount for spouse or common law partner or eligible dependant age 18 or older You may be entitled to claim an amount of 2 499 in the calculation of line 30300 if your spouse or common law partner has an impairment in physical or mental functions The tax offset is calculated as 18 of the lesser of 3 000 reduced by 1 for every 1 that spouse income was more than 37 000 and the total of your contributions for your spouse for the year The effect of this formula is that the offset cuts out when the spouse income reaches 40 000

Download Dependent Spouse Tax Offset 2021

More picture related to Dependent Spouse Tax Offset 2021

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

What You Need To Know About Spouse Benefits For Railroad Retirement

https://static.twentyoverten.com/5b74784bd10c860c99acdebb/KQqLyZERwKR/Know-Spouse-Benefits-for-RRR.png

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

New offset will be called the Dependant Invalid and Carer Tax Offset 1 15 A taxpayer may only receive an amount of the Dependant Invalid and Carer Tax Offset if they contribute to the maintenance of their spouse relative or spouse s relative who is genuinely unable to work due to invalidity or care obligations A spouse super contribution is a voluntary after tax contribution into the super fund of a low income earning spouse or de facto partner The person making the payment may benefit from a tax offset reduction of up to 18 for contributions up to 3 000 per year

Tax offset for super contributions on behalf of your spouse You may be able to claim a tax offset of up to 540 per year if you make a super contribution on behalf of your spouse married or de facto if their income is below 40 000 If you can claim someone as a dependent deductions like the earned income tax credit EITC and child tax credit will lower your tax bill Learn which you can claim

Spouse Tax Offset Changes FB Wealth Management

https://www.fbwealth.com.au/wp-content/uploads/calculator-web.jpeg

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

https://www.ato.gov.au/.../tax-offsets/superannuation-related-tax-offsets

You may be able to claim a tax offset if you make an eligible super contribution on behalf of your spouse married or de facto They need to earn under 40 000 or not work Your contribution must be to either your spouse s

https://atotaxrates.info/tax-offset/dependant...

For the 2021 22 year the maximum Invalid and Carer Tax Offset amount available for each eligible dependent is 2 833 subject to reduction based on the amount of the dependent s Adjusted Taxable Income in excess of 11 614

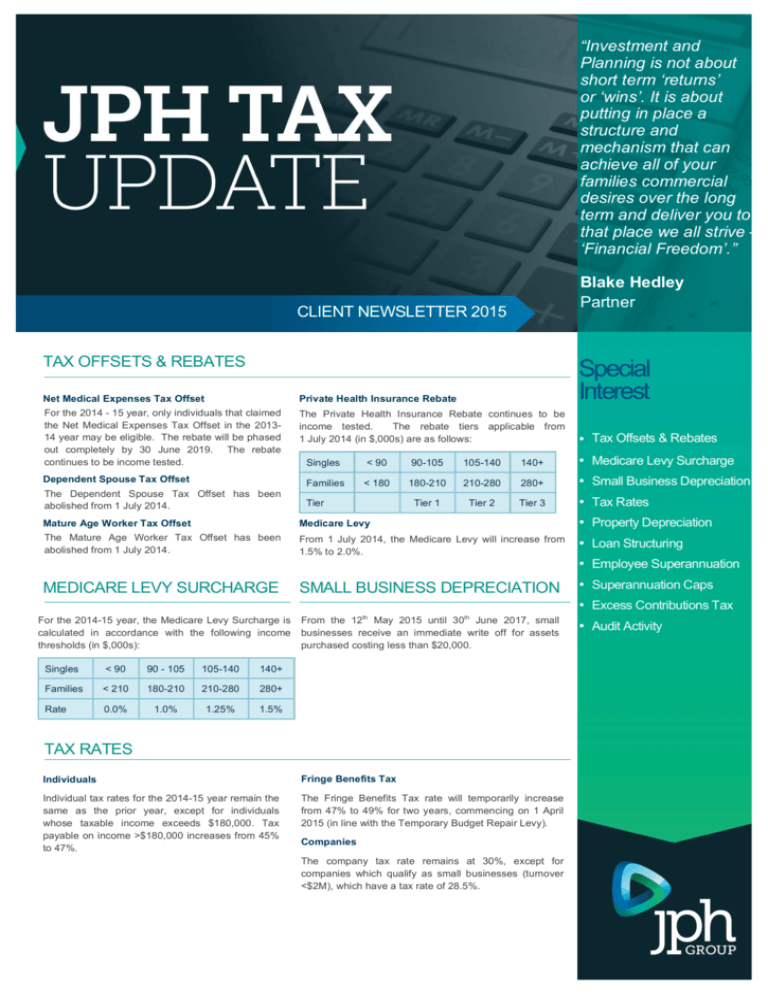

JPH Group

Spouse Tax Offset Changes FB Wealth Management

R D Tax Credits Can Fuel Auto Industry s Accelerated R D Spending

Wordly Account Gallery Of Photos

Taxwise Individual News November 2015

NFocus Tax Service LLC Clearwater FL

NFocus Tax Service LLC Clearwater FL

Parent carer Of British Child Visa Extension Full Application ZR

Tax Reduction Company Inc

Tax Offsets Australian Taxation Office

Dependent Spouse Tax Offset 2021 - Government legislation allows your spouse to make spouse superannuation contributions for you if you earn up to 40 000 and claim a tax offset If you earn below 37 000 your spouse can claim the maximum tax offset of 540 when they contribute at least 3 000 to your super Find out more