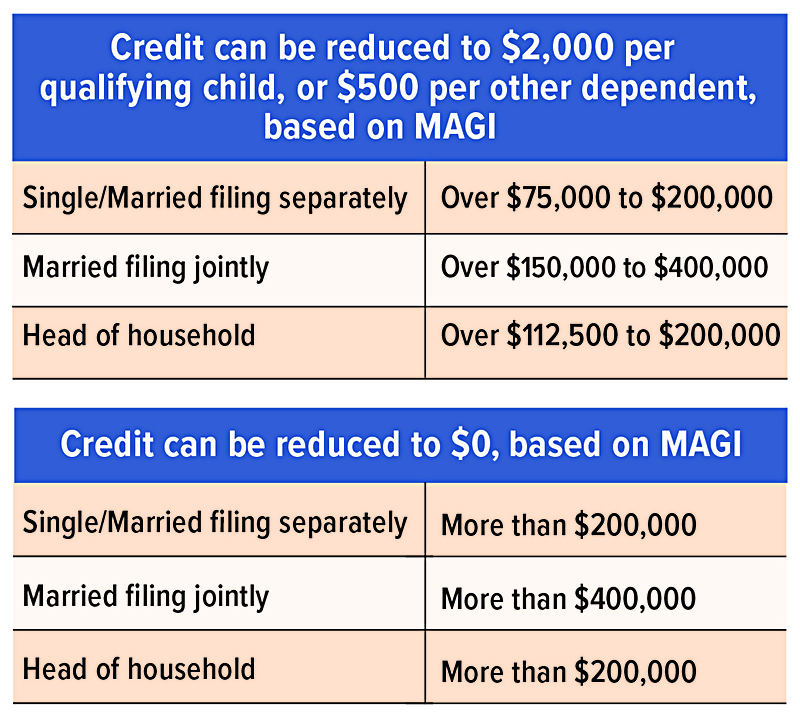

Dependent Tax Credit 2020 If you have dependents who don t qualify for the Child Tax Credit you may be able to claim the Credit for Other Dependents The maximum credit amount is 500

A dependent is a qualifying child or relative who relies on you for financial support To claim a dependent for tax credits or deductions the dependent must meet Line 30400 Amount for an eligible dependant You may be able to claim the amount for an eligible dependant if at any time in the year you supported an eligible dependant

Dependent Tax Credit 2020

Dependent Tax Credit 2020

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

IRS Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

https://specials-images.forbesimg.com/imageserve/5dc2fc6eca425400073c2a95/960x0.jpg?fit=scale

What Is A Dependent Tax Credit 2020 2021 YouTube

https://i.ytimg.com/vi/xPSPVVw4ppA/maxresdefault.jpg

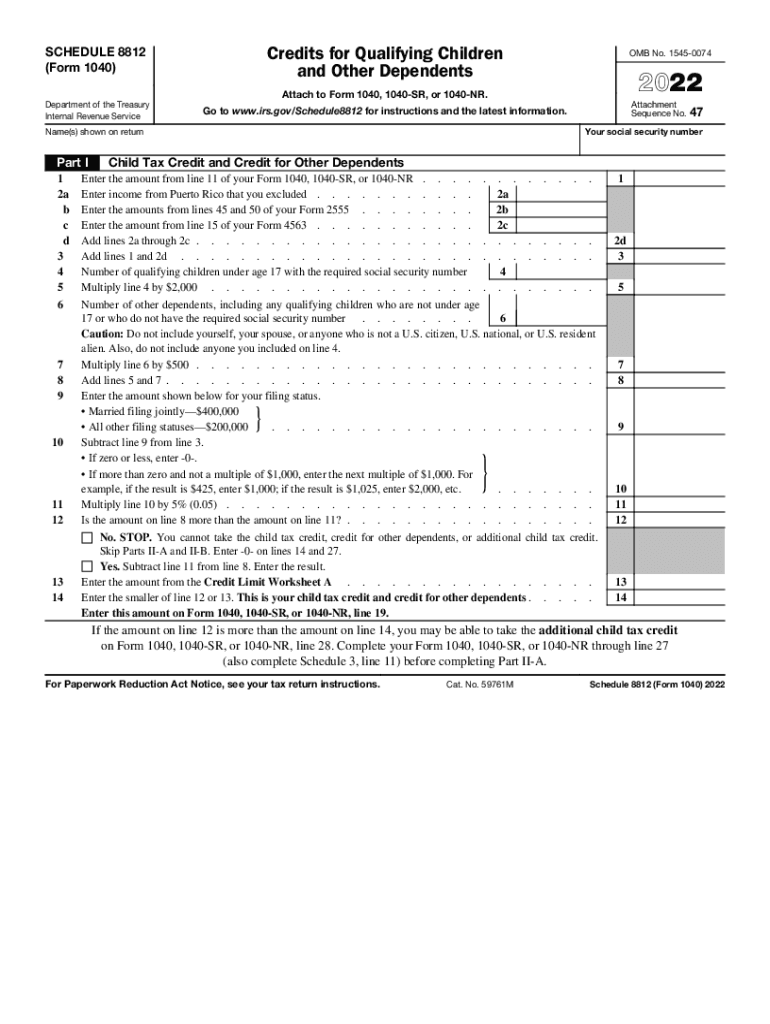

The child tax credit credit for other dependents and the additional child tax credit are entered on Form 1040 The intake and interview sheet along with the Volunteer Key Takeaways The Child Tax Credit is up to 2 000 The Credit for Other Dependents is worth up to 500 The IRS defines a dependent as a qualifying child under age 19 or under 24 if a full time student or any

A tax dependent is a qualifying child or relative who can be claimed on a tax return Dependents must meet certain criteria including residency and relation in order to qualify You can receive a tax credit of 245 with effect from 1 January 2021 70 for previous years You will not receive a tax credit if your dependent relative s income exceeds

Download Dependent Tax Credit 2020

More picture related to Dependent Tax Credit 2020

Child Tax Credit For 2021 Will You Get More Velocity Retirement

https://www.broadridgeadvisor.com/images/origres/FI3_ChildTaxCredit_0821.jpg

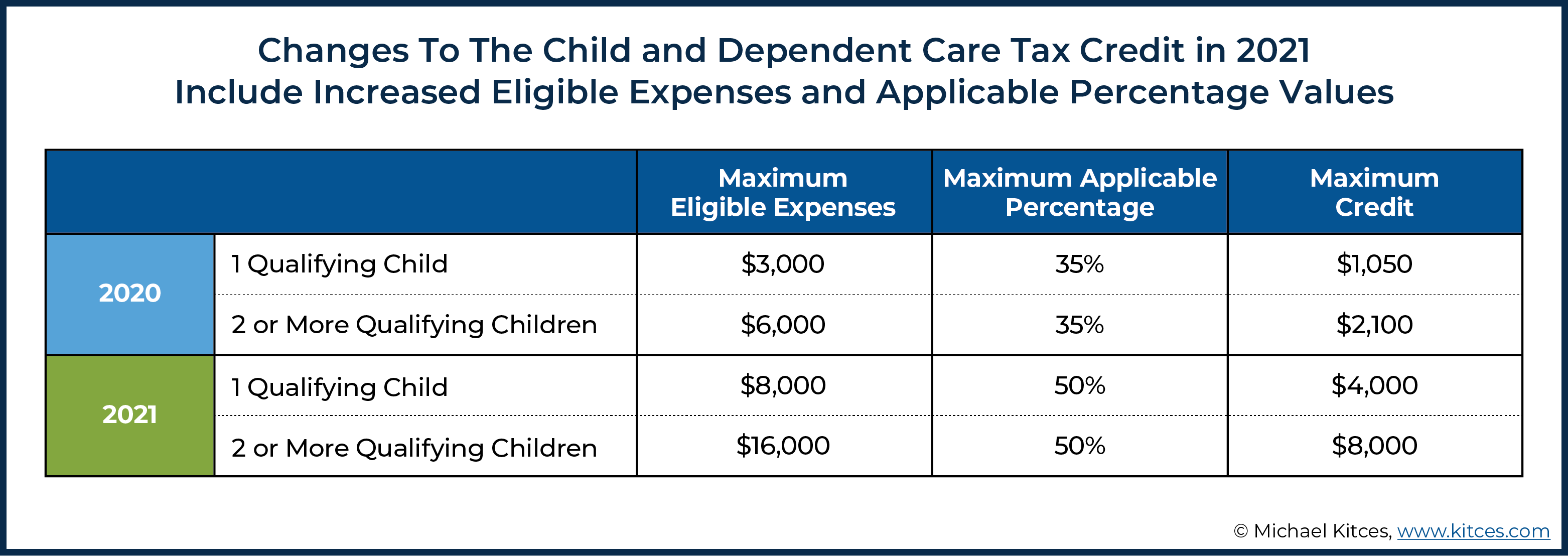

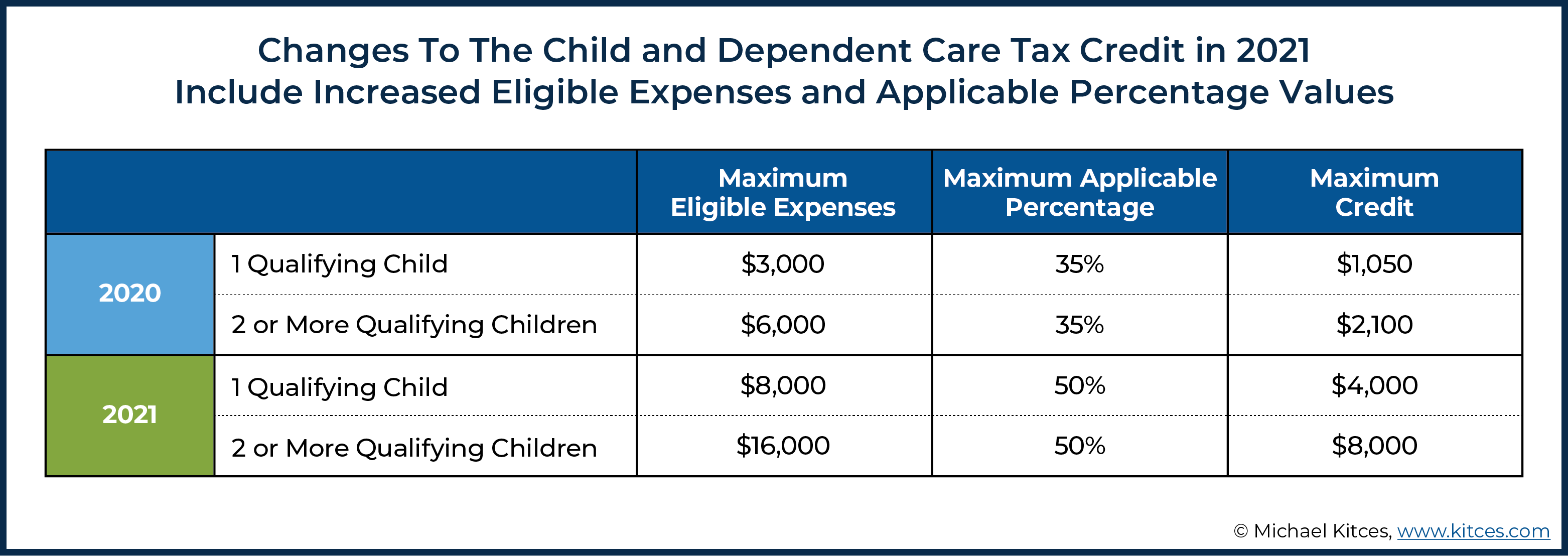

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

https://static.twentyoverten.com/5afae91ee233a94fd2b8b963/bGO8AFn9_9/1616431373979.png

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Were no longer claimed as a dependent in 2020 If you weren t claimed as a dependent in 2020 you might be eligible for the tax credit Check the eligibility criteria to see if you You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a

Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in The credit is worth 2 000 per qualifying child and households with qualifying children can claim the Child Tax Credit for every child who qualifies with no

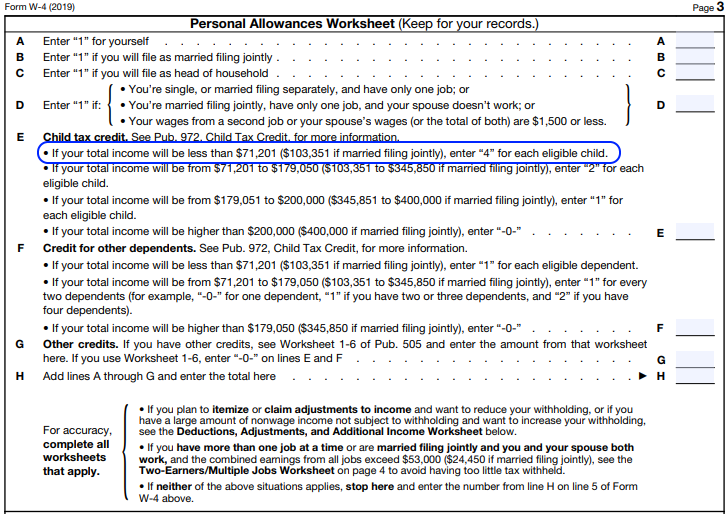

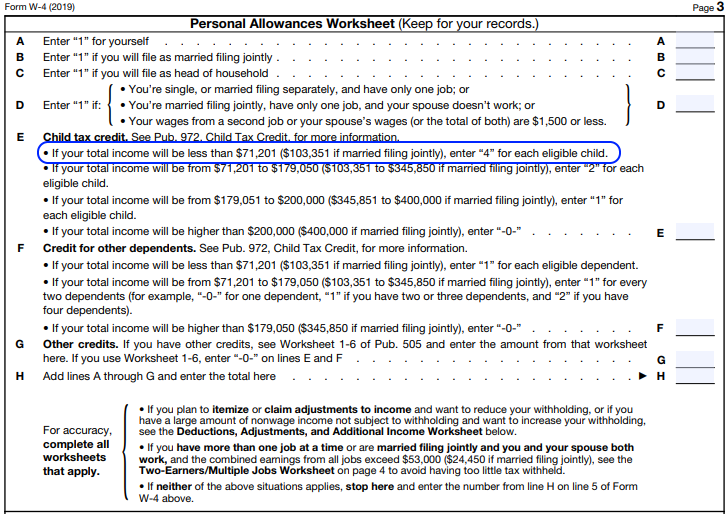

W 4 Changes Allowances Vs Credits Datatech

http://datatechag.com/wp-content/uploads/2020/06/2019-W-4-Worksheet.png

2022 Form IRS 1040 Schedule 8812 Fill Online Printable Fillable

https://www.pdffiller.com/preview/621/821/621821322/large.png

https://www.irs.gov/newsroom/you-may-benefit-from...

If you have dependents who don t qualify for the Child Tax Credit you may be able to claim the Credit for Other Dependents The maximum credit amount is 500

https://www.irs.gov/credits-deductions/individuals/dependents

A dependent is a qualifying child or relative who relies on you for financial support To claim a dependent for tax credits or deductions the dependent must meet

W 4 Changes Allowances Vs Credits Datatech

2022 Form IRS 2441 Fill Online Printable Fillable Blank PdfFiller

Dependent Care Fsa Income Limit Tricheenlight

/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif)

Tax Rules For Claiming Adult Dependents

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

Publication 972 2020 Child Tax Credit And Credit For Other

2015 Child Tax Credit Worksheet Worksheet

2024 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

Dependent Tax Credit 2020 - You can receive a tax credit of 245 with effect from 1 January 2021 70 for previous years You will not receive a tax credit if your dependent relative s income exceeds