Dependent Tax Credit Age Limit You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States To be a qualifying

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care Payments to Relatives or Dependents The care provider can t be your spouse the parent of your qualifying individual if your qualifying individual is your child

Dependent Tax Credit Age Limit

Dependent Tax Credit Age Limit

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Solved Problem 7 1 Child Tax Credit LO 7 1 Calculate The Total

https://www.coursehero.com/qa/attachment/14536840/

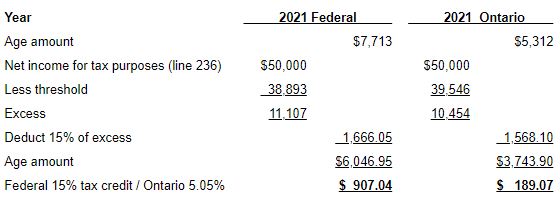

TaxTips ca Age Amount Tax Credit For Persons Aged 65 And Over

https://www.taxtips.ca/filing/age-amount-tax-credit-clawback.jpg

There s no age limit if your child is permanently and totally disabled or meets the qualifying relative test In addition to meeting the qualifying child or qualifying Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when

Here s more information to help taxpayers determine if they re eligible to claim it on their 2021 tax return The maximum credit amount is 500 for each Age Be under age 19 or under 24 if a full time student or any age if permanently and totally disabled Residency Live with you for more than half the year

Download Dependent Tax Credit Age Limit

More picture related to Dependent Tax Credit Age Limit

Rules For Claiming A Dependent On Your Tax Return TurboTax Tax Tips

https://digitalasset.intuit.com/IMAGE/A7GUqbw2k/rules-for-claiming-a-dependent-on-your-tax-return_L8LODbx94.jpg

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif)

Tax Rules For Claiming Adult Dependents

https://www.thebalance.com/thmb/FXks3aphUUVlzdXrmiOO3JpDr74=/1500x1000/filters:fill(auto,1)/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif

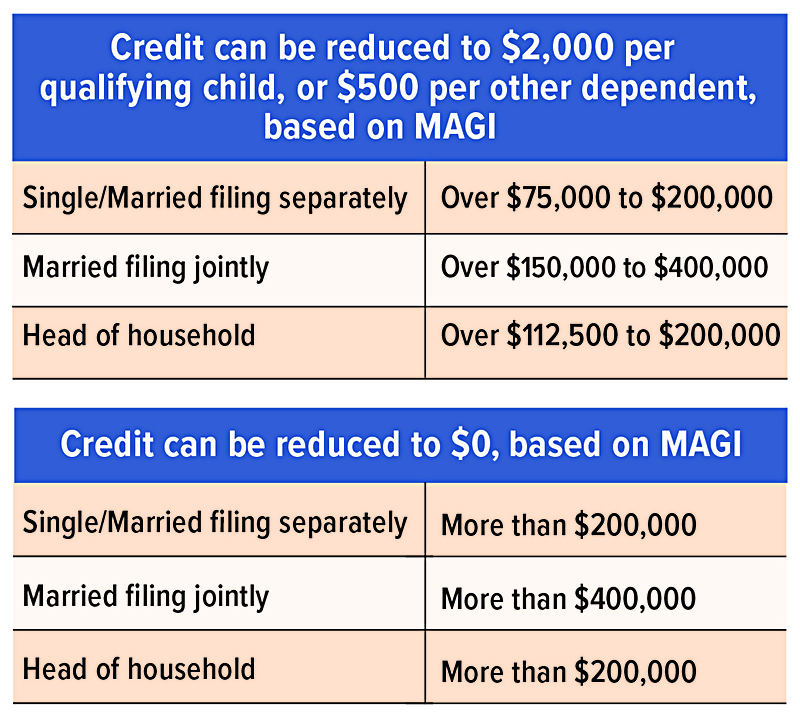

People with kids under the age of 17 may be eligible to claim a tax credit of up to 2 000 per qualifying dependent For taxes filed in 2024 1 600 of the credit is potentially The Tax Cuts and Jobs Act increased the child tax credit from the old 1 000 limit The new child tax credit results in up to a 2 000 credit per qualifying child age 16 or

Is There an Age Limit on Claiming My Child as a Dependent By Lynnette Khalfani Cox The Money Coach You can reduce you total taxes owed by claiming a child as a For most taxpayers the credit for other dependents is a flat 500 per qualifying dependent so you can simply multiply 500 by the number of qualifying other

Child Tax Credit

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Child Tax Credit For 2021 Will You Get More Velocity Retirement

https://www.broadridgeadvisor.com/images/origres/FI3_ChildTaxCredit_0821.jpg

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States To be a qualifying

https://www.nerdwallet.com/article/taxes/chil…

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care

Dependent Tax Credit Claim Eligibility And Exceptions FastnEasyTax

Child Tax Credit

531 Stretch Your College Student s Spending Money With The Dependent

Child Tax Credit Age Limit 2020 Earned Income Credit Table 2019

Child Tax Credit 2022 What Will Be Different With Your Payments

Care Credit Printable Application Printable Word Searches

Care Credit Printable Application Printable Word Searches

Income Tax Dependent Deductions Pocket Sense

T22 0123 Distribution Of Tax Units And Qualifying Children By Amount

What Is The Child Tax Credit And How Much Of It Is Refundable Brookings

Dependent Tax Credit Age Limit - Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully