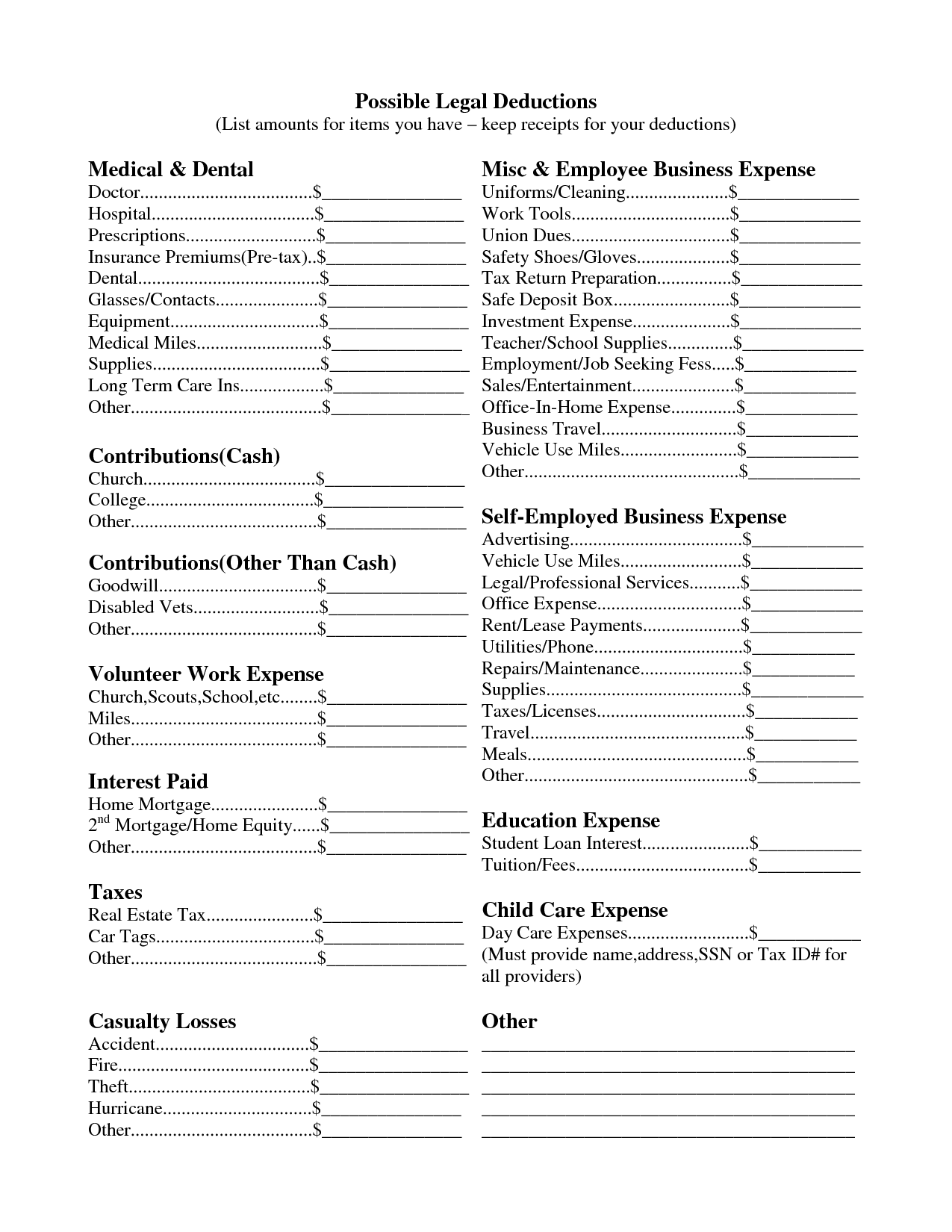

Dependent Tax Deduction Japan Here is a simple explanation of the Japanese dependent deduction This rule regarding dependent deduction is the latest information that has been

Taxpayers can claim 380 000 yen per child for children who are 16 years old or older For children who are between 16 and 22 years old the amount actually increases to 630 000 yen For Exemption for dependents is one of the largest tax deductions from income tax in amount Amount to be exempted depends on a type of dependent and income amount of a supporter

Dependent Tax Deduction Japan

Dependent Tax Deduction Japan

https://japan-law-tax.com/wp-content/uploads/2023/02/サイトの絵、電子契約DALL·E-2023-02-02-06.45.59-3D-render-of-a-cute-tropical-fish-writing-electronical-signature-digital-art.png

Japan Incentivises Salary Hikes With Tax Deduction HRM Asia HRM Asia

https://hrmasia.com/wp-content/uploads/2021/12/150668841_m-1.jpg

Tax Deduction For PF Under 80C Article VibrantFinserv

https://vibrantfinserv.com/kb/wp-content/uploads/2023/06/34.Tax-deduction-for-PF-under-80C.jpg

Resident taxpayers are allowed a deduction for each dependent who is 16 years old or older A dependant is a relative other than a spouse who is supported by the taxpayer provided that A resident who receives salary payment in Japan should submit Dependent Deduction Form to the payer of the salary a payer of the main salary if there are two or more payers by the first

In Japan if you support a relative who meets certain conditions you re entitled to a dependent deduction These deductions can significantly lower your taxable income thereby reducing The Japanese government has changed the tax laws exempting non resident dependents from tax The law came into force on 1 January 2023 The Ecovis experts explain the details Background Taxpayers in Japan are allowed to

Download Dependent Tax Deduction Japan

More picture related to Dependent Tax Deduction Japan

Tax Offset V Tax Deduction What s The Difference Sherlock Wealth

https://sherlockwealth.com/wp-content/uploads/2022/05/Tax-offset-v-tax-deduction-.jpg

Happy Tax Tax Day Tax Season Tax Deductions Party Shirts Print On

https://i.pinimg.com/originals/c1/fe/77/c1fe77bfd3a19358901fe3dcd052a853.jpg

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1588xN.5462529921_cvyy.jpg

Those who have a dependent relative who is 16 years old or older a disabled person a student or a single not currently married and have children may be eligible for the following What is dependent deduction Dependent deduction is a system that allows you to reduce the amount of tax you pay if you allow your parents siblings children or other relatives to live on

4 For non resident relatives who are under 16 years of age dependent relatives not eligible for exemption for dependents documents concerning relatives and documents concerning To use the income tax calculator individuals need to input various details including their annual income any allowable deductions or credits and additional factors such as marital status and

Cutest Little Tax Deduction Svg Graphic By Lovebeautycreation

https://www.creativefabrica.com/wp-content/uploads/2021/06/26/cutest-little-tax-deduction-svg-Graphics-13915988-1.jpg

Japan Vatcalc

https://www.vatcalc.com/wp-content/uploads/Japan-1-scaled-660x500.jpg

https://japan-law-tax.com/blog/tax-for-p…

Here is a simple explanation of the Japanese dependent deduction This rule regarding dependent deduction is the latest information that has been

https://freedomtax.jp/article/claiming-dependents...

Taxpayers can claim 380 000 yen per child for children who are 16 years old or older For children who are between 16 and 22 years old the amount actually increases to 630 000 yen For

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

Cutest Little Tax Deduction Svg Graphic By Lovebeautycreation

Example Tax Deduction System For A Single Gluten free GF Item And

Tax Deductions Guide Sunlight Tax

16 Budget Worksheet Self Employed Worksheeto

Kurzstudie Tax Deduction Scheme Belgien EUKI

Kurzstudie Tax Deduction Scheme Belgien EUKI

A Look At The Tax Deduction Potential Of Strata Rates

Dependent Tax Deductions And Credits For Families Deduction Tax Tax

Premium Photo Tax Deduction

Dependent Tax Deduction Japan - Resident taxpayers are allowed a deduction for each dependent who is 16 years old or older A dependant is a relative other than a spouse who is supported by the taxpayer provided that