Did Federal Income Tax Increase The IRS did not change the federal tax brackets for 2024 There are still seven 10 12 22 24 32 35 and a top bracket of 37 However the income thresholds for all tax

The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37 Your filing IRS provides tax inflation adjustments for tax year 2023 IR 2022 182 October 18 2022 WASHINGTON The Internal Revenue Service today announced

Did Federal Income Tax Increase

Did Federal Income Tax Increase

https://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

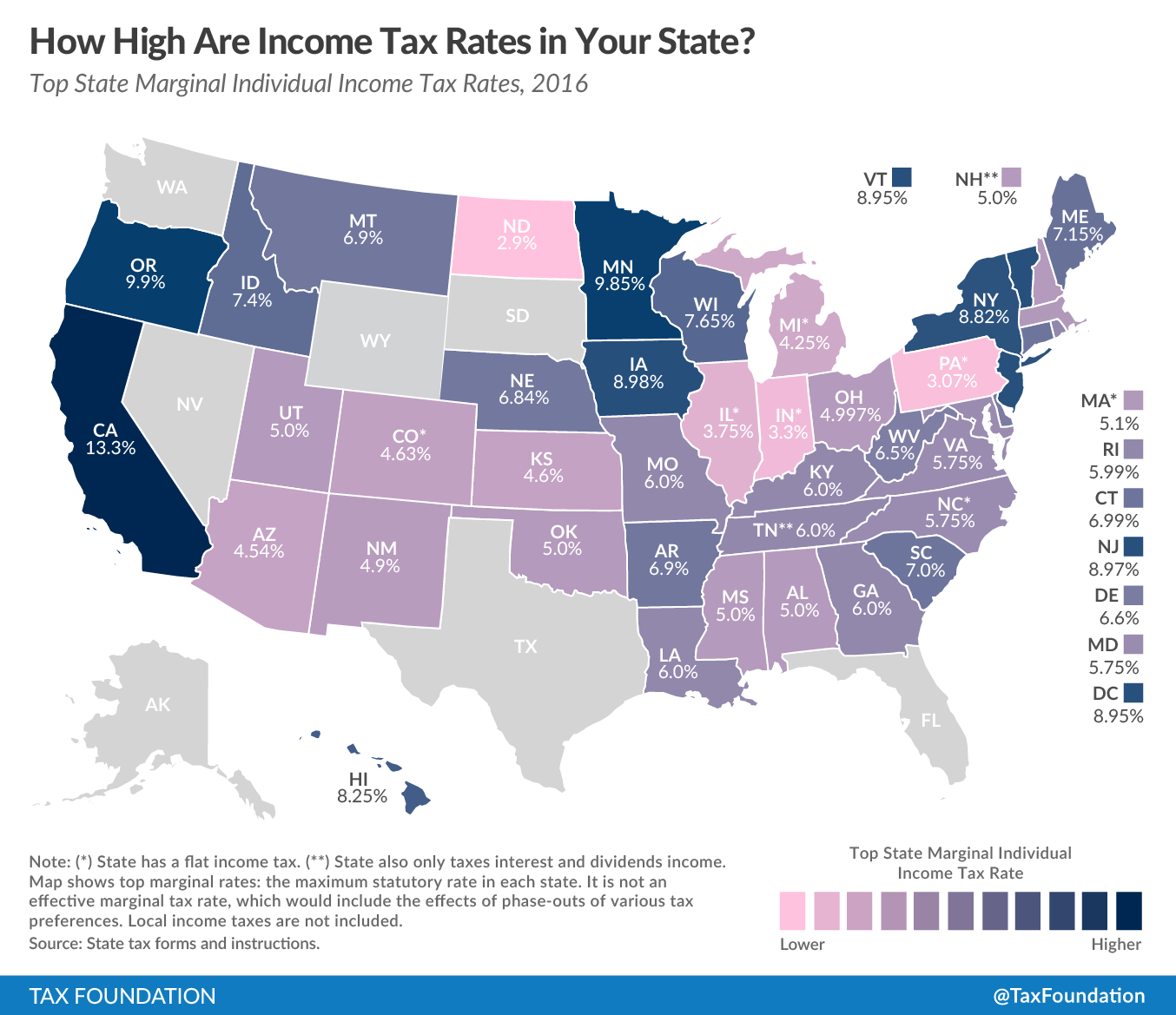

How High Are Income Tax Rates In Your State

https://www.richardcyoung.com/wp-content/uploads/2016/02/income-tax-rate-map.png

Income Tax Elimination Institute For Reforming Government

https://reforminggovernment.org/wp-content/uploads/2021/12/[email protected]

The IRS announced higher federal income tax brackets and standard deductions for 2022 amid rising inflation The consumer price index surged by 6 2 in October compared to the previous year The earned income tax credit which benefits lower income workers will rise by approximately 7 from 6 935 for the 2022 tax year to 7 430 in 2023 And the alternative minimum tax exemption

Standard deduction The standard deduction is used by people who don t itemize their taxes and it reduces the amount of income you must pay taxes on For New tax brackets and standard deductions are now in effect potentially boosting paychecks and lowering income tax for many Americans who enter the new year still reeling from sky high prices

Download Did Federal Income Tax Increase

More picture related to Did Federal Income Tax Increase

The Rich Pay A Lot In Taxes

https://files.americanexperiment.org/wp-content/uploads/2021/02/High-income-taxpayers-pay-the-highest-average-federal-income-tax-rate.-Progressive-federal-income-tax-data-2021-1024x725.png

Read Federal Income Tax Examples Explanations

https://m.media-amazon.com/images/I/41PoAvZEHEL.jpg

Nanette Guillory

https://files.taxfoundation.org/20210202175329/The-Tax-Cuts-and-Jobs-Act-lowered-average-federal-income-tax-rate-for-all-income-groups-progressive-federal-income-tax-data-2021.png

While 2023 did not see major federal tax reform legislation the IRS has adjusted ranges for tax brackets standard deductions retirement savings contributions Higher federal income tax brackets and standard deductions are now in effect potentially giving Americans a chance to increase their take home pay in 2023

The IRS has released higher federal tax brackets for 2023 to adjust for inflation The standard deduction is increasing to 27 700 for married couples filing That s up 900 from 2022 s 12 950 standard deduction For married couples filing jointly for tax year 2023 the standard deduction climbs to 27 700 That s an

Taxpayers To Gov Rauner No State Income Tax Increase Taxpayers

https://www.taxpayersunitedofamerica.org/wp-content/uploads/2014/12/tax-increase3.jpg

Personal Income Tax Has Untapped Potential In Poorer Countries

https://www.imf.org/wp-content/uploads/2022/03/FAD-Charts-income-tax-blog-1.jpg

https://www.investopedia.com/2021-tax-bra…

The IRS did not change the federal tax brackets for 2024 There are still seven 10 12 22 24 32 35 and a top bracket of 37 However the income thresholds for all tax

https://www.forbes.com/advisor/taxes/taxes …

The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37 Your filing

/taxes-increase-636251470-5a7b1367a18d9e0036f31d2c.jpg)

How Income Taxes Affect Economic Growth

Taxpayers To Gov Rauner No State Income Tax Increase Taxpayers

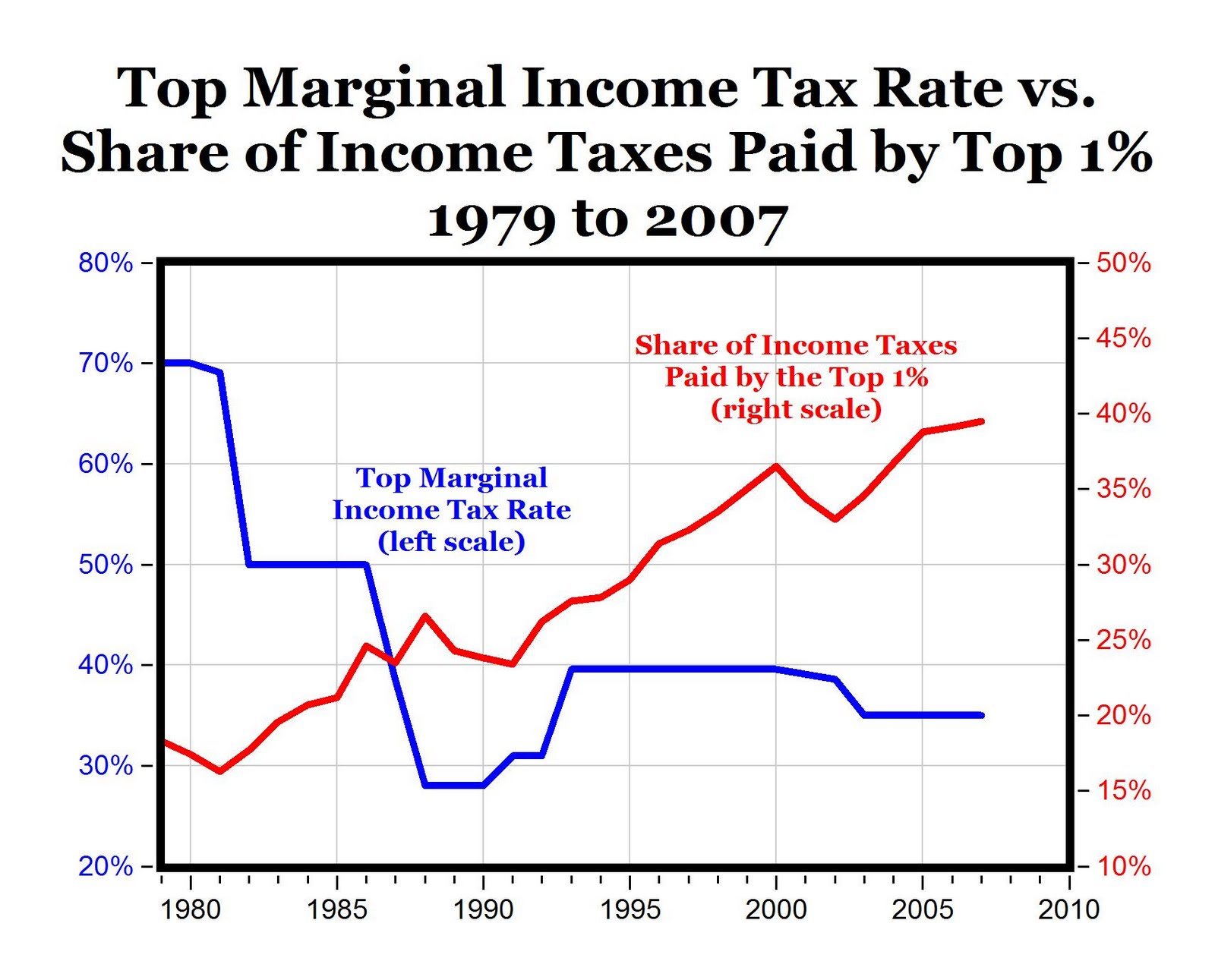

Chart Of The Day The Inverse Relationship Between The Top Marginal

When Did Income Tax Start WorldAtlas

Increasing Individual Income Tax Rates Would Impact A Majority Of U S

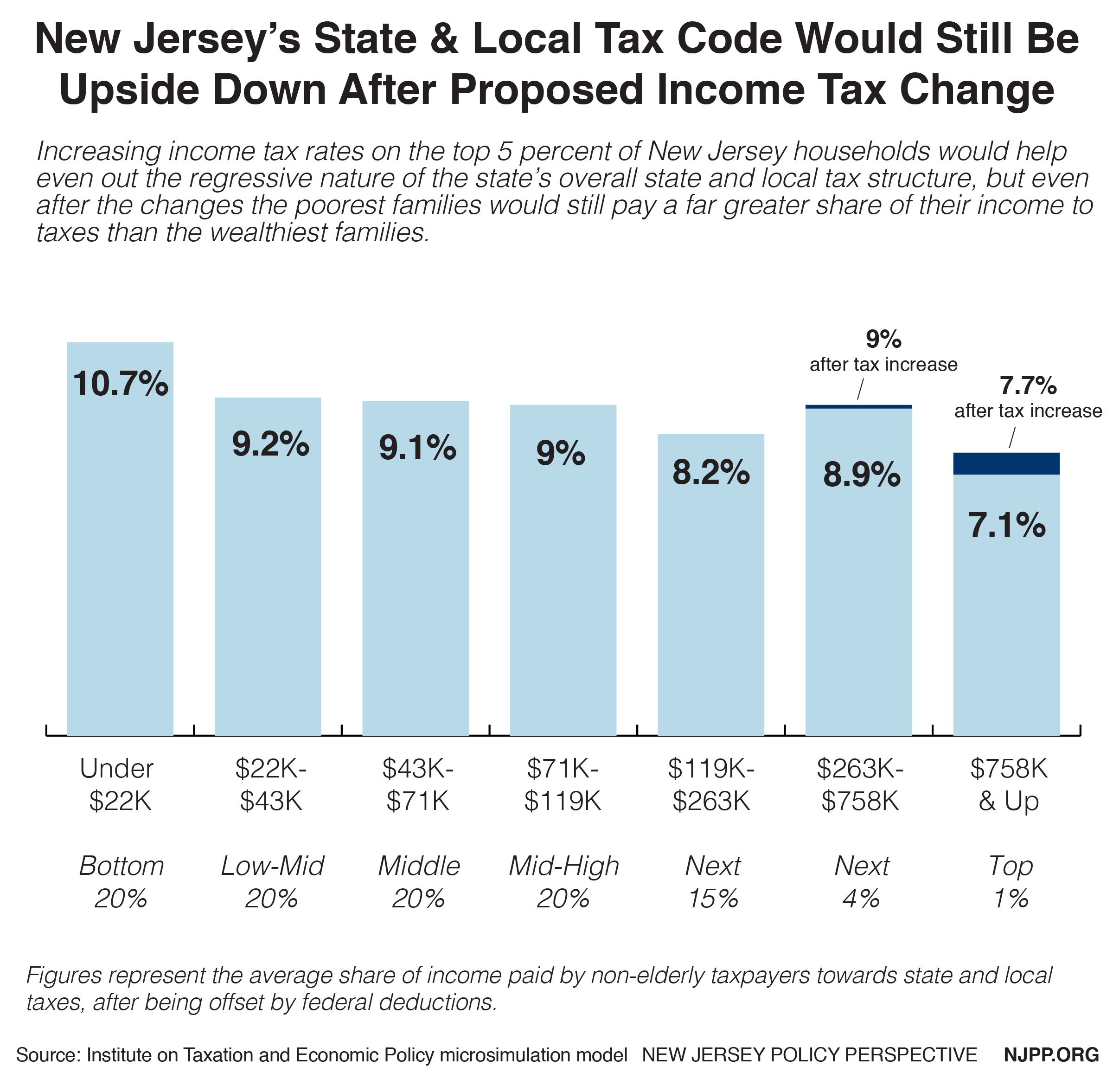

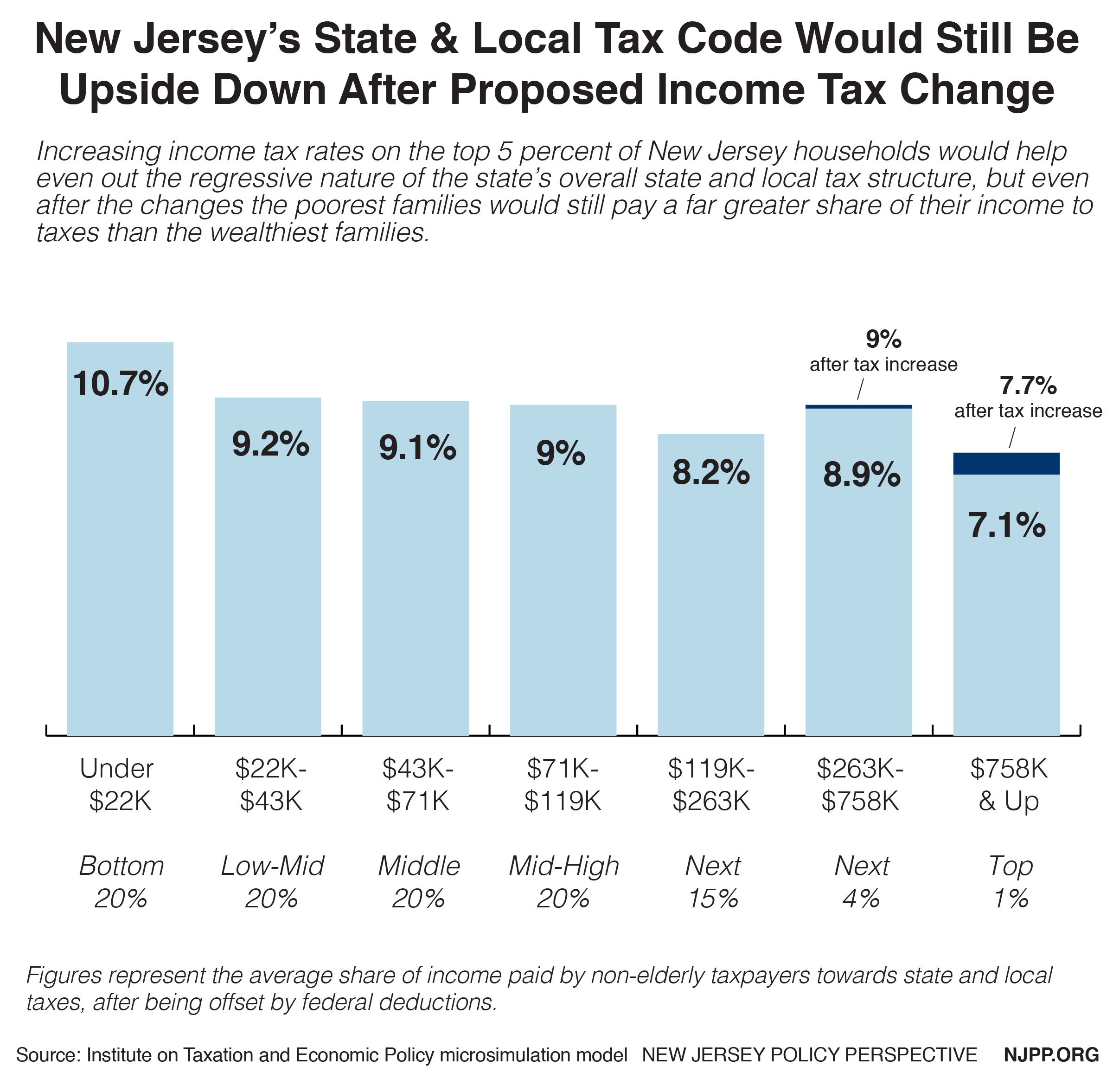

Reforming New Jersey s Income Tax Would Help Build Shared Prosperity

Reforming New Jersey s Income Tax Would Help Build Shared Prosperity

CARPE DIEM Tax Rates And Share Of Tax Revenues From Top 1

Making The Income Tax Fair Zenconomics

How Much Do People Pay In Taxes Tax Foundation

Did Federal Income Tax Increase - The earned income tax credit which benefits lower income workers will rise by approximately 7 from 6 935 for the 2022 tax year to 7 430 in 2023 And the alternative minimum tax exemption