Difference Between 80c And 80ccd 2 Both Section 80C and Section 80CCD offer significant tax savings but they serve different financial goals 80C is ideal for diversified tax saving investments whereas 80CCD is

If we Claim 1 5Lakh under Sec 80C with Insurance PF and Mutual Fund and 50k under 80CCD 1B then where can we claim the amount contributed towards 80CCD 2 And what is the limit of 80CCD 2 alone Section 80CCD 1 is for individual contributions and is part of the 1 5 lakh Section 80C limit Section 80CCD 1B offers an additional tax

Difference Between 80c And 80ccd 2

Difference Between 80c And 80ccd 2

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c-768x702.jpg

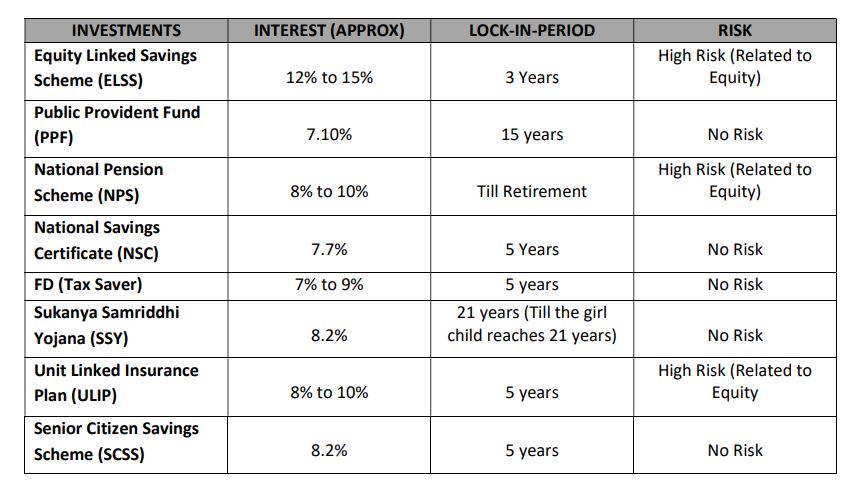

Section 80C Income Tax Deduction And Limits Under Section 80C 80CCD

https://www.forbesindia.com/media/images/2023/Jul/img_213079_80cdeductions.jpg

What Is The Difference Between Section 80C And 80CCC Tipseri

https://img.youtube.com/vi/rGsyrVqHg6U/maxresdefault.jpg

What is the difference between 80CCD 2 and 80CCD 1B These income tax deductions section is for investments made in a pension scheme notified by the central Section 80CCD 2 This section focuses on the contribution made by the employer towards an employee s pension account in a recognised scheme This maximum deduction is 10 of the employee s salary basic

Sections 80C 80CCD 80CCC and 80D of the Income Tax Act provide certain deductions that are subject to various restrictions The above deductions are a form of government relief that aids citizens in reducing their Sec 80CCC and Sec 80CCD provide deductions for the investments in the pension scheme either by yourself or by way of the employer s contribution The maximum deduction under Section 80C are 80CCC and 80CCD 1 put

Download Difference Between 80c And 80ccd 2

More picture related to Difference Between 80c And 80ccd 2

NPS Tax Benefit Examples With Calculations 80C 80CCD 1 80CCD 1B

https://i.ytimg.com/vi/6O1G8Sbl6g8/maxresdefault.jpg

Tax Deductions Sections 80C 80CCC 80CCD And 80D Can Transform Your

https://financepanga.com/wp-content/uploads/2024/01/Financepanga.jpg

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

https://i.ytimg.com/vi/PbIdrmlETqQ/maxresdefault.jpg

Under Section 80 of the Income Tax Act 1961 an individual can avail exemptions and deductions that lowers their tax liability Under Section 80CCD personal and employer For salaried class individual taxpayers the employer s contribution up to 10 of the Basic salary can be claimed as deduction under Section 80CCD 2 of the Act and the same is not covered within the overall limit of Rs 1 5

What is the difference between Section 80CCD 1 and Section 80CCD 2 For investments put into an Atal Pension Yojana or NPS account salaried and self employed Section 80CCD 1 It is concerned with tax deductions for self employed Central Government Other Employer Salaried employees are entitled to a maximum deduction of 10 of their pay

2 Deductions U s 80C 80CCC 80CCD And 80CCE Deduction On Certain

https://i.ytimg.com/vi/hXOes1Tb5rg/maxresdefault.jpg

What Is The Difference Between Section 80C And 80CCC Tipseri

https://img.youtube.com/vi/AYuf3JURtt8/maxresdefault.jpg

https://www.taxbuddy.com › blog

Both Section 80C and Section 80CCD offer significant tax savings but they serve different financial goals 80C is ideal for diversified tax saving investments whereas 80CCD is

https://taxguru.in › income-tax

If we Claim 1 5Lakh under Sec 80C with Insurance PF and Mutual Fund and 50k under 80CCD 1B then where can we claim the amount contributed towards 80CCD 2 And what is the limit of 80CCD 2 alone

Summary Of Deductions U S 80C 80CCC 80CCD 80D Rajput Jain

2 Deductions U s 80C 80CCC 80CCD And 80CCE Deduction On Certain

Income Tax Deductions While Filling ITR In India RJA

Tax Deductions Under Sections 80C 80CCC 80CCD And 80D Academy

Understanding Section 80CCD 2 Limit A Comprehensive Guide Marg ERP Blog

What Is The Difference Between Section 80C And 80CCC Tipseri

What Is The Difference Between Section 80C And 80CCC Tipseri

Deductions Under Section 80C Its Allied Sections

Income Tax Rates Slabs Under The New Tax Regime EconomicTimes

Deduction Under Section 80C 80CCC 80CCD And 80D And 80CCD 1 80CCD

Difference Between 80c And 80ccd 2 - Sec 80CCC and Sec 80CCD provide deductions for the investments in the pension scheme either by yourself or by way of the employer s contribution The maximum deduction under Section 80C are 80CCC and 80CCD 1 put