Difference Between Tax Credit And Deductible Allowance Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit valued at 1 000 for

Tax credits can lower your tax bill and may be refundable Tax deductions can lower your taxable income Learn how tax credits and deductions are different Tax deductions reduce the amount of your income subject to tax while tax credits directly reduce the amount of tax you owe Each credit and deduction have

Difference Between Tax Credit And Deductible Allowance

Difference Between Tax Credit And Deductible Allowance

https://taxsavvyjessica.com/wp-content/uploads/2022/05/Tax-Savvy-Jessica-Blog-Posts-6.png

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

The Difference Between A Tax Credit And A Tax Deduction

https://www.prestigeauditors.com/wp-content/uploads/2020/11/piggy-bank-with-golden-coins-financial-investment-TCLZ3ZP-1-scaled.jpg

When it comes to reducing your tax bill two key tools at your disposal are tax credits and deductions While both lower the amount of tax you owe they work in very What s the difference between a tax deduction and a tax credit Deductions reduce taxable income and their value thus depends on the taxpayer s marginal tax rate which rises with

Tax credits directly reduce the amount of taxes you owe while deductions only reduce your taxable income This makes credits more powerful because they directly reduce While both give you a break on taxes they do it in a very different way When determining the benefit of a tax deduction vs tax credit it s essential to understand the difference between the two

Download Difference Between Tax Credit And Deductible Allowance

More picture related to Difference Between Tax Credit And Deductible Allowance

Deductible Business Expenses For Independent Contractors Financial

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

Person Using Calculator To Compare Difference Between Tax Deduction And

https://blog.1800accountant.com/wp-content/uploads/2022/03/tax-credit-vs-tax-deduction.jpeg

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

Tax credits can reduce the amount of tax you owe the government Tax deductions can reduce your taxable income for the year Apply credits before you apply the tax Tax deductions save you money by reducing your taxable income Tax credits save you money by reducing your tax bill on a dollar for dollar basis The best way to understand

We ll break down the differences between a tax deduction and a tax credit including the qualifications and criteria for each and which of the two could be more beneficial for your Tax credits and tax deductions are two different things While they re both tax breaks that can reduce your tax liability they work in different ways

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

Deduction Vs Tax Exemption Vs Tax Rebate 2021 What Is Tax Deduction

https://i.ytimg.com/vi/zg_bWbGeYms/maxresdefault.jpg

https://www.nerdwallet.com › article › taxe…

Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit valued at 1 000 for

https://www.thebalancemoney.com

Tax credits can lower your tax bill and may be refundable Tax deductions can lower your taxable income Learn how tax credits and deductions are different

Thousands Of Americans Eligible For 5 000 Stimulus Check And Child Tax

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

What Is An R D Tax Credit

The Best Self Employed Tax Deductions And Credits In 2022

Corporation Prepaid Insurance Tax Deduction Financial Report

Investment Expenses What s Tax Deductible Charles Schwab

Investment Expenses What s Tax Deductible Charles Schwab

Difference Between Deduction And Exemption with Comparison Chart

What Is The Difference Between Taxes Duties And Tariffs TRG

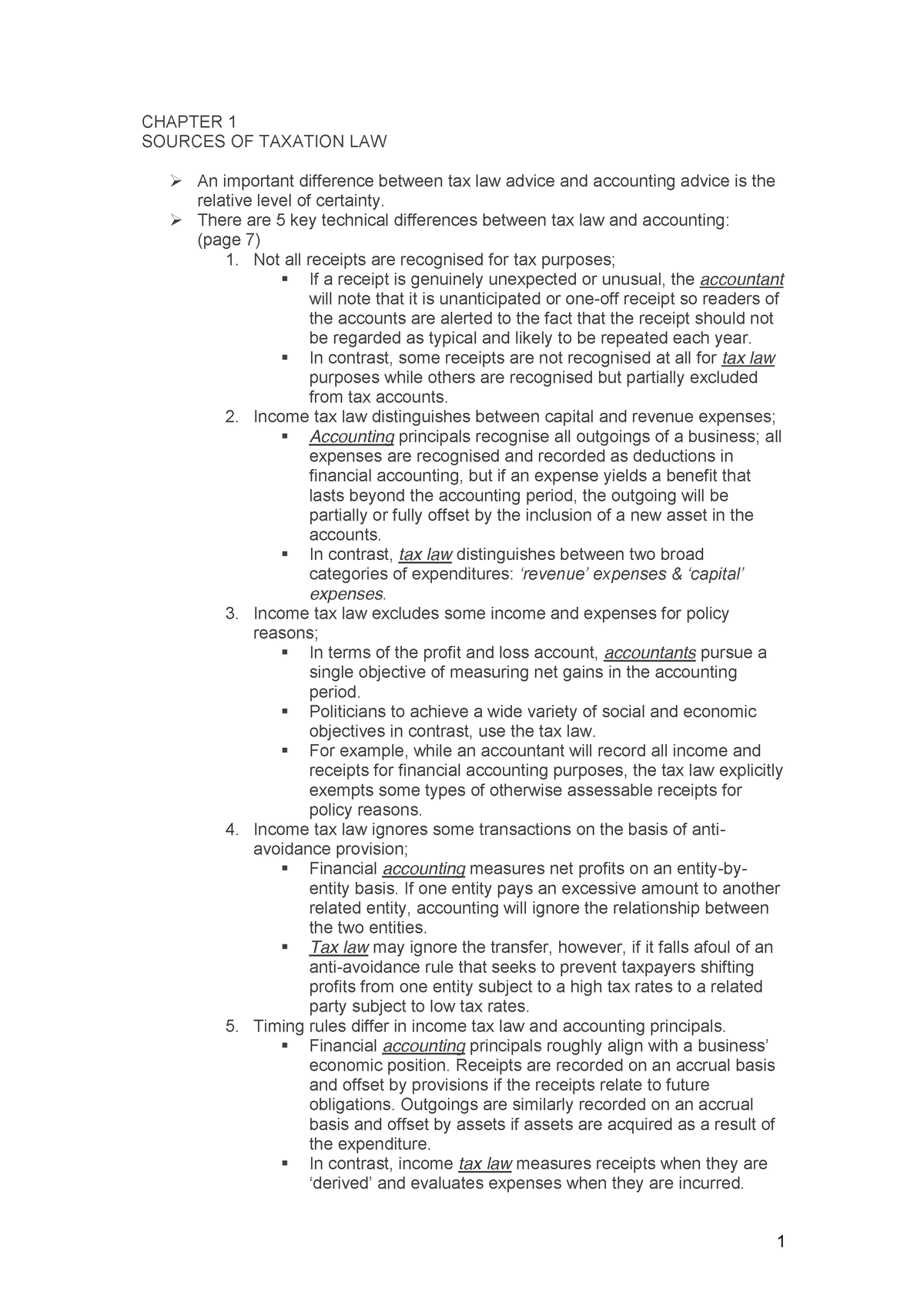

Taxation Law Notes 1 CHAPTER 1 SOURCES OF TAXATION LAW An Important

Difference Between Tax Credit And Deductible Allowance - Understanding the difference between tax deductions and tax credits is essential to managing your tax liability effectively While deductions lower your taxable income credits