Difference Between Tax Rebate And Tax Credit Web The IRS says that tax credits can reduce the amount of tax you owe or increase your tax refund They are different from deductions which reduce your taxable income Tax

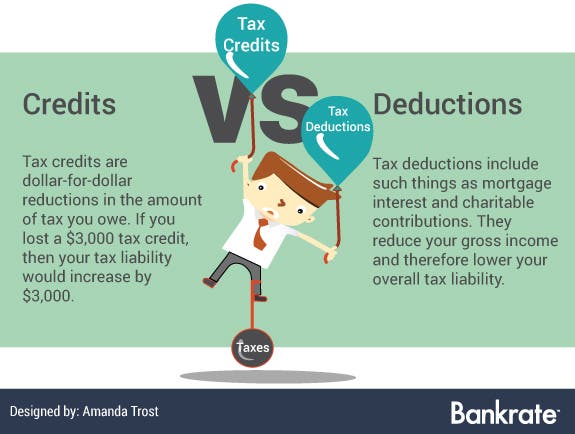

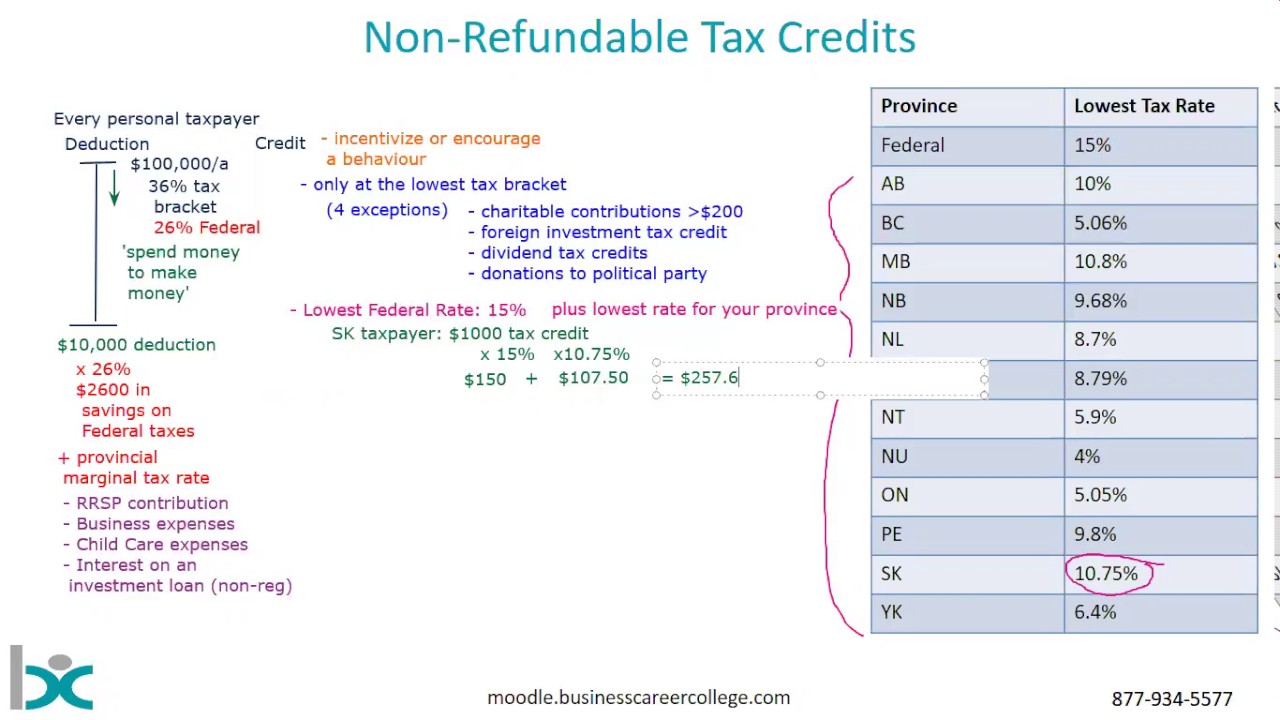

Web 24 nov 2003 nbsp 0183 32 A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions because they reduce the Web 12 juin 2015 nbsp 0183 32 Like rebates tax credits reduce your tax payable by the full amount of the credit Unlike rebates a tax credit can result in a tax refund once your tax payable

Difference Between Tax Rebate And Tax Credit

Difference Between Tax Rebate And Tax Credit

https://i.pinimg.com/originals/9f/13/5e/9f135e8d89955e3dea41d76cd0ff4d6b.jpg

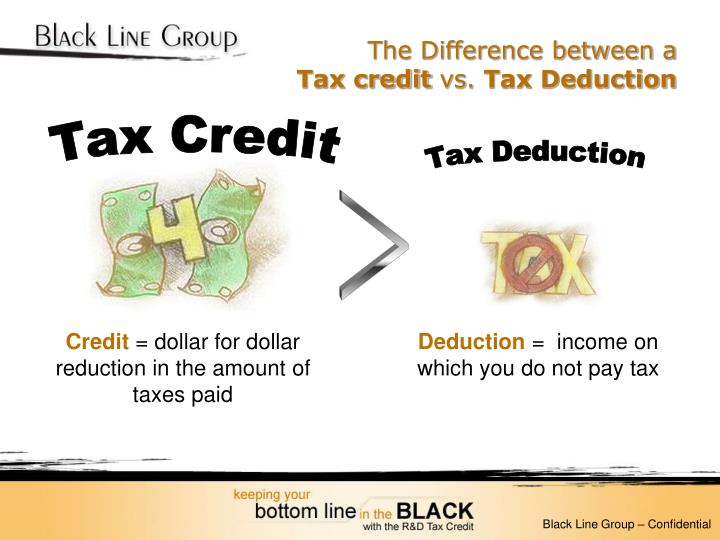

Tax Credit Vs Tax Deduction

https://www.communitytax.com/wp-content/uploads/2019/04/tax-credit-vs-tax-deductions.png

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

Web One of the biggest differences between tax credits and rebates is the frequency with which they occur Every year the tax code contains several credits that taxpayers can Web 5 mars 2009 nbsp 0183 32 Generally speaking tax credits only offset tax balances due meaning if you have low income and owe nothing in tax you get no benefit from a credit Whereas tax

Web 31 janv 2023 nbsp 0183 32 Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit valued at 1 000 for instance lowers your tax Web 4 nov 2022 nbsp 0183 32 An example of how this works If your income was 50 000 your standard deduction if single or married filing separately would reduce your taxable income by the 2022 standard deduction of 12 950 so your

Download Difference Between Tax Rebate And Tax Credit

More picture related to Difference Between Tax Rebate And Tax Credit

PPT The Difference Between A Tax Credit Vs Tax Deduction PowerPoint

https://image1.slideserve.com/1722277/the-difference-between-a-tax-credit-vs-tax-deduction-n.jpg

Used Capital Loss Carryover Will Taxes Go Up 3 000

https://media.brstatic.com/2017/07/27113248/taxes_Tax-credits-vs-tax-deductions.jpg

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

https://img.etimg.com/photo/60155156/infographic-difference-between-tax-deduction-tax-exemption-and-tax-rebate.jpg

Web 1 f 233 vr 2023 nbsp 0183 32 If you know the differences between tax exemptions rebates and deductions you can lower your tax outgo to a large extent So let s compare tax deductions with tax exemption and tax rebates Tax Web Tax deductions tax credits and tax refunds what s the difference Top line bottom line leveling line By Nancy Ashburn Nancy Ashburn Financial Writer Fact Checker As a 30

Web A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe You claim a tax credit as part of your annual tax return So if you make a Web 8 mai 2022 nbsp 0183 32 Are EV tax credits different than deductions Yes a deduction lowers your taxable income Deducting the purchase price of an EV is likely only going to work if

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

Apartments That Go By Your Income In Knoxville Tn

http://activerain.com/image_store/uploads/2/0/1/9/1/ar124348180819102.jpg

https://www.bpihomeowner.org/blog/understanding-difference-between...

Web The IRS says that tax credits can reduce the amount of tax you owe or increase your tax refund They are different from deductions which reduce your taxable income Tax

https://www.investopedia.com/terms/t/taxcred…

Web 24 nov 2003 nbsp 0183 32 A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions because they reduce the

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Tax Credit Vs Tax Deduction Difference And Comparison Diffen

What Are The Differences Between Tax Deductions And Tax Credits

First time Home Buyer Iowa Tax Credit 2020 Labeerweek

What Is The Difference Between A Tax Credit And A Tax Deduction

What Is The Difference Between A Tax Credit And A Tax Deduction

What Explains The Difference Between A Tax And A Tariff

Non Refundable Tax Credits YouTube

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Difference Between Tax Rebate And Tax Credit - Web Income tax rebate is like the final bargain that you can claim from your taxable income after you have claimed exemptions and deductions Tax rebate under Section 87A of the