Difference Between Tax Relief And Tax Rebate Singapore Web Tax Reliefs and Rebate Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second

Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR Web 10 janv 2022 nbsp 0183 32 Tax rebates unlike tax reliefs are not guaranteed and they function exactly as rebates the money will be calculated and can offset your payable income tax They are dependent on the

Difference Between Tax Relief And Tax Rebate Singapore

Difference Between Tax Relief And Tax Rebate Singapore

https://www.iras.gov.sg/media/images/default-source/uploadedimages/pages/srs-contribution-and-tax-relief.png?sfvrsn=befc84cc_3

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

A Guide To Taxes And Tax Relief R singaporefi

https://va.ecitizen.gov.sg/CSS/Hybrid/Themes/IRAS/uploads/Rebate.png

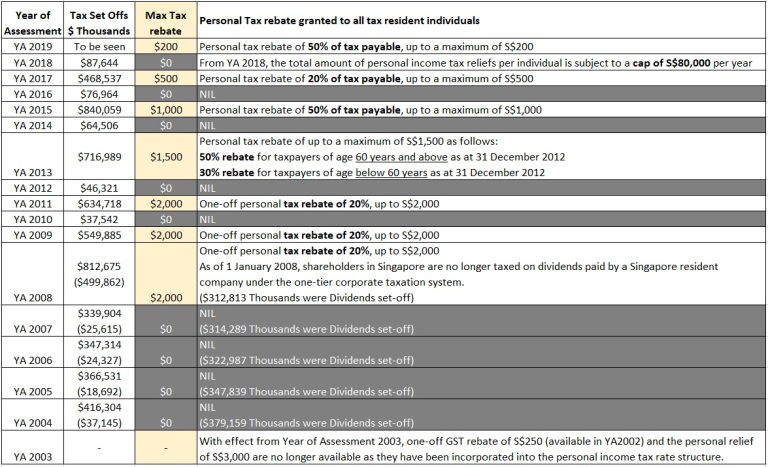

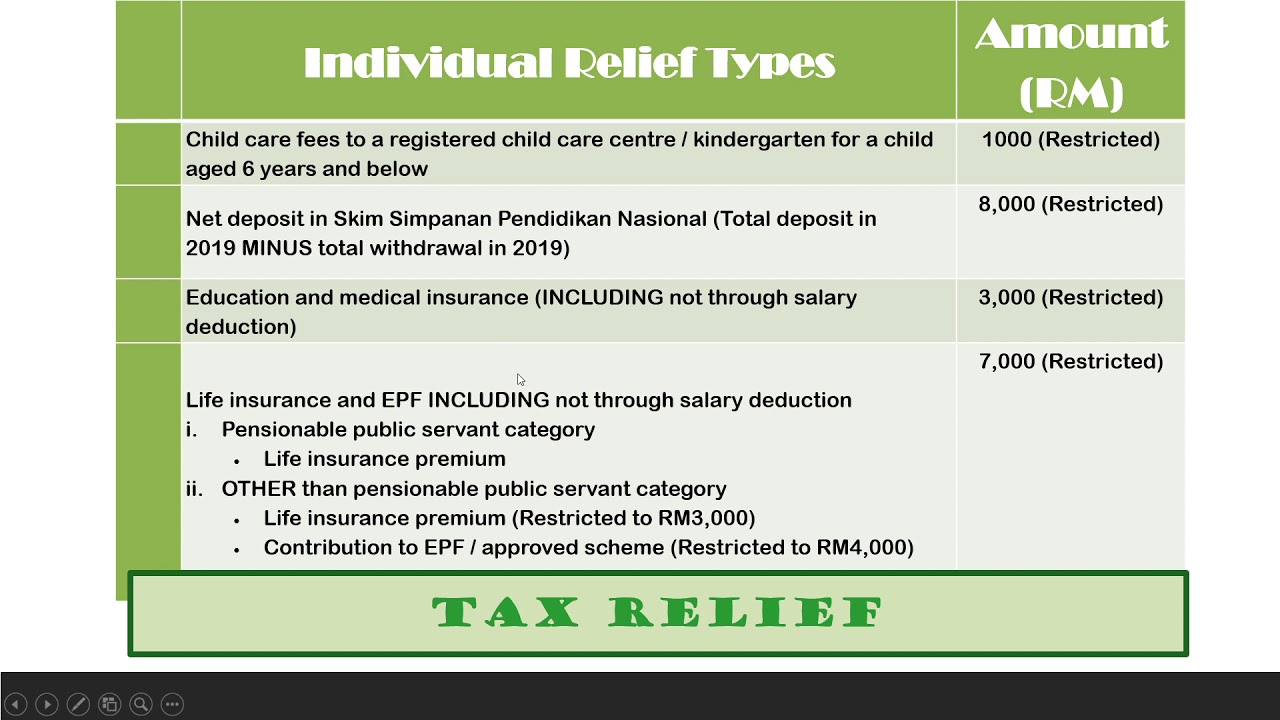

Web 1 Regional Headquarters Award 2 International Headquarters Award PWCS Tier 1 co funding ratios Mergers and Acquisitions Allowance Capital allowances Deduction on Web 15 lignes nbsp 0183 32 3 mai 2023 nbsp 0183 32 Resident individuals are entitled to certain personal reliefs and deductions and are subject to graduated tax rates ranging from 0 to 22 24 from

Web Tax reliefs and rebates in Singapore are used to encourage filial piety family formation and even the advancement of certain skills through these reliefs given in support of the Web Articles CPF amp SRS Understanding the latest Singapore income tax reliefs 2022 Updated 3 Nov 2022 published 4 Dec 2020 While Singapore has one of the lowest

Download Difference Between Tax Relief And Tax Rebate Singapore

More picture related to Difference Between Tax Relief And Tax Rebate Singapore

Freelancer Guide All You Need To Know About Your Income Taxes

https://cdn-blog.seedly.sg/wp-content/uploads/2019/02/24203255/Singapore-personal-income-tax-guide-cheat-sheet.png

Index Of wp content uploads 2022 03

https://www.theastuteparent.com/wp-content/uploads/2022/03/tax-savings.png

All Income Earned In Singapore Is Subject To Tax However Singapore

https://i.pinimg.com/originals/02/cc/ee/02cceeb8209cfe3f959b1480f37a5c15.jpg

Web 13 mars 2023 nbsp 0183 32 Tax reliefs For whom Amount Qualifying Child Relief Both parents S 4 000 per child S 7 500 if handicapped Working Mother s Child Relief Working mothers 15 for first child 20 for second child Web 24 janv 2020 nbsp 0183 32 For the second child 20 of earned income is eligible for tax relief For the third and subsequent children 25 of earned income is eligible for tax relief The percentage of tax rebate can also be added

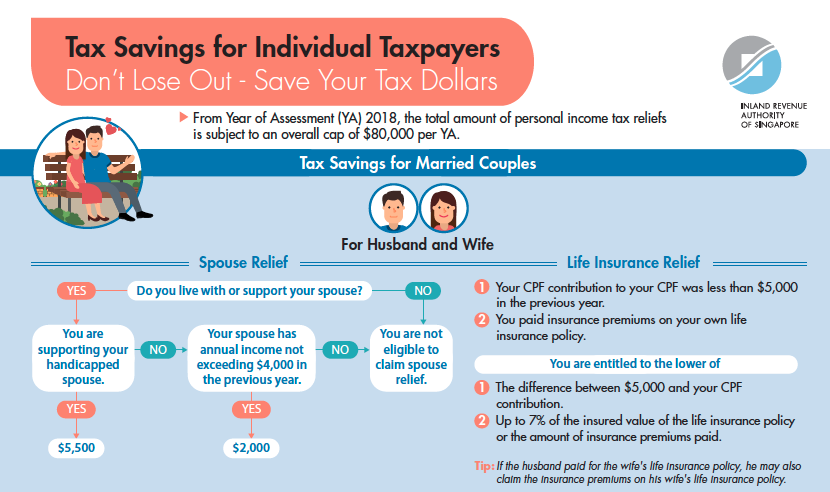

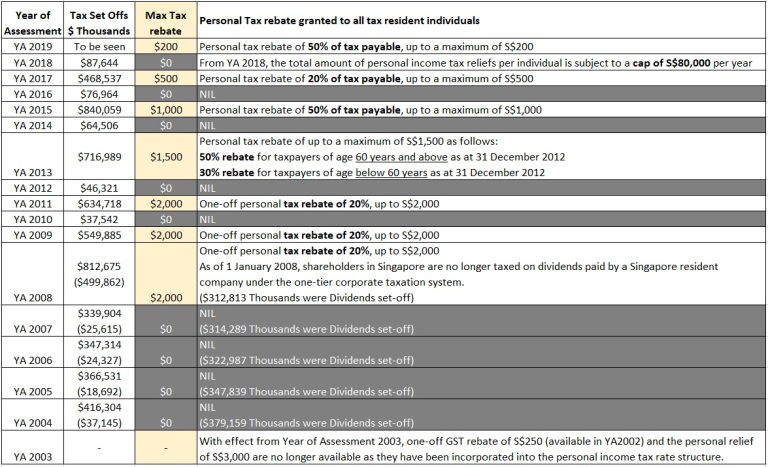

Web From Year of Assessment 2018 the total amount of personal income tax reliefs which an individual can be allowed is subject to an overall relief cap of S 80 000 per year There Web 3 mai 2023 nbsp 0183 32 Foreign tax relief As foreign income remitted into Singapore is generally not taxable for individuals double tax provided under tax treaties or unilateral tax credit

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

https://static1.squarespace.com/static/55b79c7fe4b0f338367f9329/t/56f7c11bac962c8475209b2d/1459077422156/50%25-corporate-tax-rebate-for-Singapore-companies

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

https://financialhorse.com/wp-content/uploads/2022/02/ptr-1068x464.png

https://www.madeforfamilies.gov.sg/.../tax-relief-and-rebates

Web Tax Reliefs and Rebate Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second

https://www.iras.gov.sg/.../tax-reliefs/parenthood-tax-rebate-(ptr)

Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Tax Evasion And Tax Avoidance YouTube

Difference Between Rebate And Relief Act Printable Rebate Form

Why I Stress That Working Singaporeans Should Maximise Their Tax

Why I Stress That Working Singaporeans Should Maximise Their Tax

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

Major Exemptions Deductions Availed By Taxpayers In India

ERTL 3 Tax Reliefs And Rebates Part 3 YouTube

Difference Between Tax Relief And Tax Rebate Singapore - Web 1 Regional Headquarters Award 2 International Headquarters Award PWCS Tier 1 co funding ratios Mergers and Acquisitions Allowance Capital allowances Deduction on