Disability Rebate In Income Tax Web 5 janv 2023 nbsp 0183 32 La demi part pour handicap va r 233 duire votre imp 244 t mais ne permettra pas d avoir une restitution si vous n en payez pas La baisse de l imp 244 t va d 233 pendre de vos

Web 1 nov 2022 nbsp 0183 32 If you get disability payments your payments may qualify as earned income when you claim the Earned Income Tax Credit EITC Disability payments qualify as Web 20 juil 2019 nbsp 0183 32 Section 80DD of income tax act provides flat deduction irrespective of the amount of expenditure incurred by the family of disabled dependent This is in

Disability Rebate In Income Tax

Disability Rebate In Income Tax

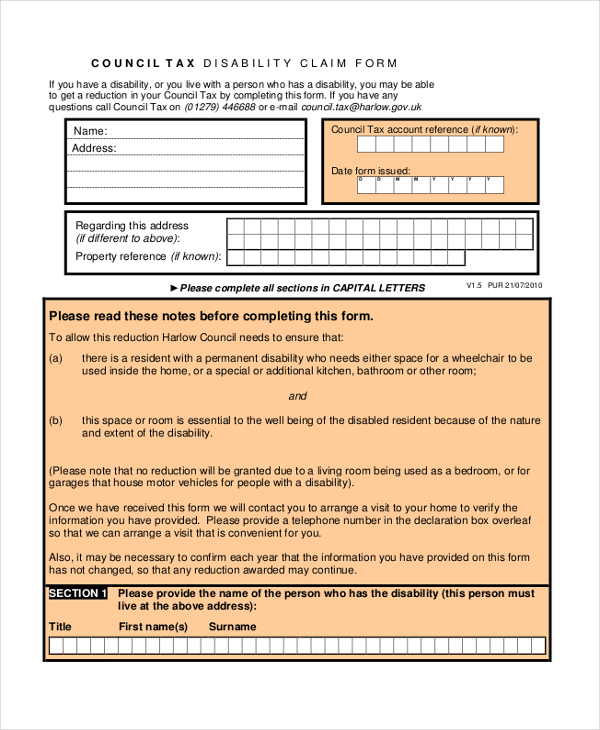

https://images.sampleforms.com/wp-content/uploads/2016/11/Tax-disability-form.jpg

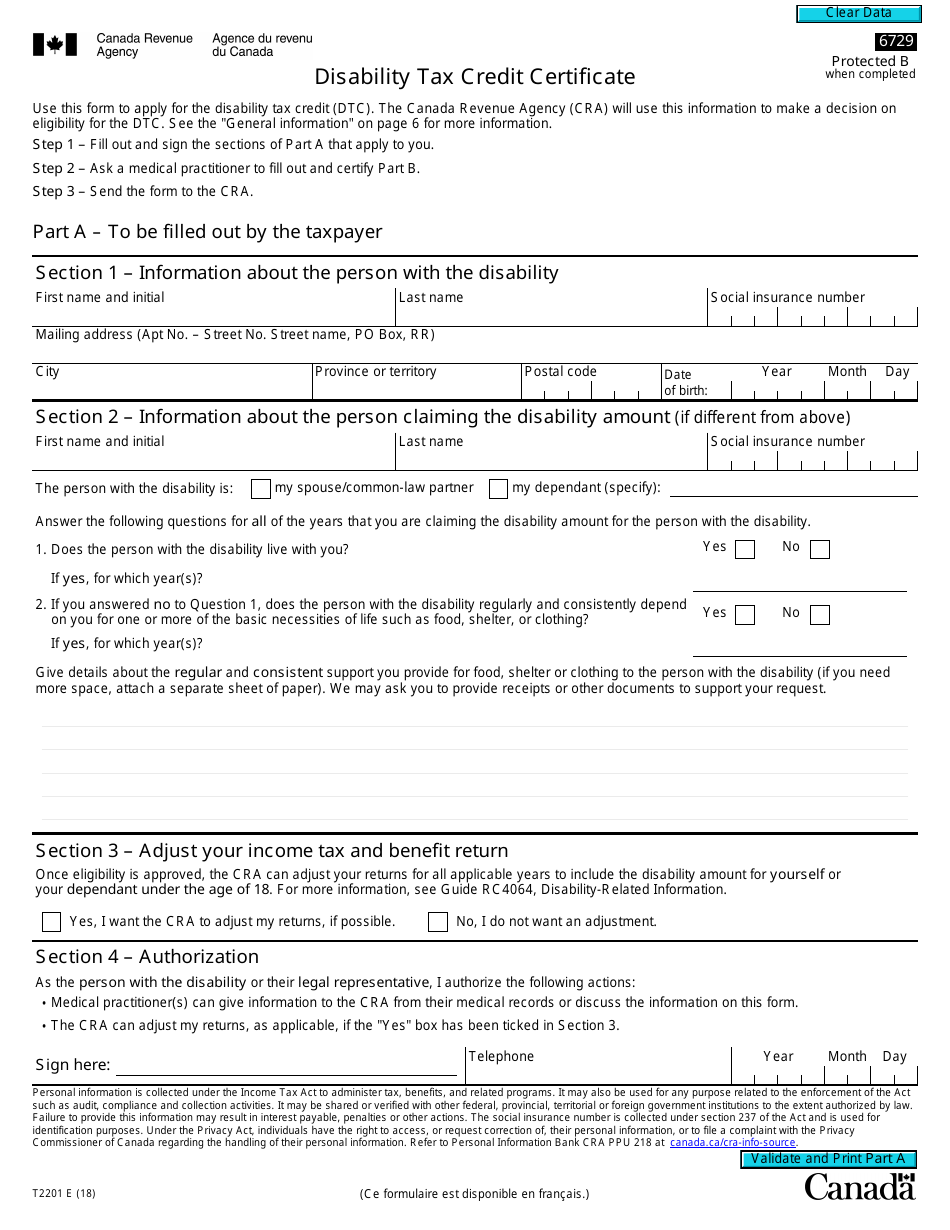

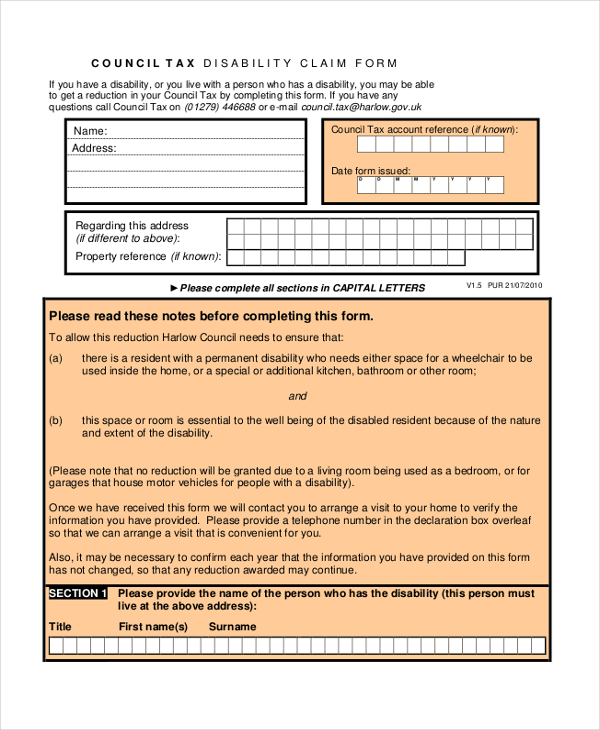

FREE 51 Disability Forms In PDF MS Word

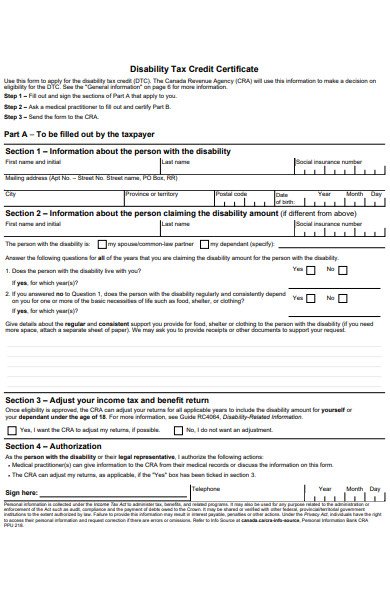

https://images.sampleforms.com/wp-content/uploads/2020/03/Disability-Tax-Form.jpg

FREE 9 Sample Social Security Disability Forms In PDF Word

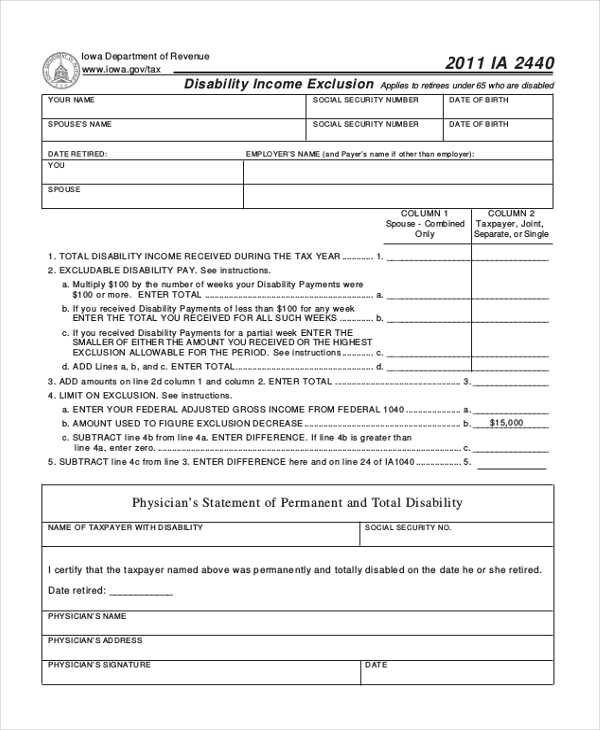

https://images.sampleforms.com/wp-content/uploads/2016/10/Social-Security-Disability-Tax-Form.jpg

Web 3 juin 2019 nbsp 0183 32 A person with a disability means a person who is suffering from at least 40 of a disability If an individual has a severe disability i e 80 or more of a disability Web 18 juil 2023 nbsp 0183 32 Section 80U Physical Disability Section 80G Donations Section 80GGB Company Contribution Section 80GGC Contribution to Political Parties Section 80RRB

Web 3 ao 251 t 2023 nbsp 0183 32 Who can claim a deduction under Section 80DDB of income tax The deduction u s 80DDB for the expenditure on the medical treatment of the specified Web 30 juil 2023 nbsp 0183 32 An individual who is certified as a person with a disability can claim tax benefits under Section 80U of the IT Act Individuals can claim tax deduction under

Download Disability Rebate In Income Tax

More picture related to Disability Rebate In Income Tax

Ssi Disability Tax Forms Universal Network

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/02/ssi-disability-tax-forms.jpg

Section 80U Deductions For The Disabled Eligibility How To Claim

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80u.jpg

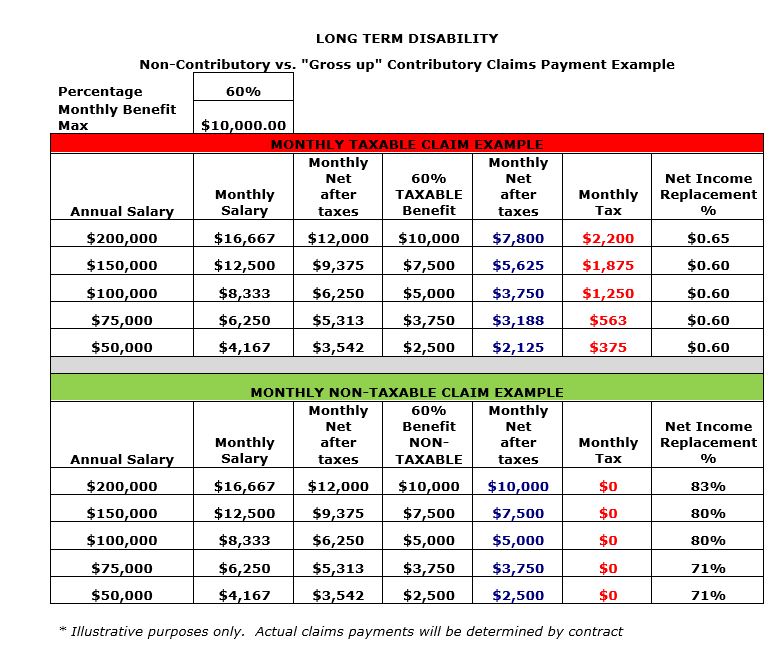

Let s Talk Taxes Disability Insurance And Taxation Philippine

https://images.benefitspro.com/contrib/content/uploads/sites/412/2020/02/disability2.jpg

Web 24 juil 2018 nbsp 0183 32 The Income Tax Act 1961 provides deduction u s 80 in pursuance of which an individual Indian citizen and foreign national who is resident of India and who Web 22 juil 2023 nbsp 0183 32 If you are looking for Disability Rebate In Income Tax you ve come to the right place We have 34 rebates about Disability Rebate In Income Tax including

Web 19 mai 2017 nbsp 0183 32 Tax benefit for a person with severe disability A person with severe disability i e someone who has 80 or above disability can deduct Rs 1 25 000 Web 17 f 233 vr 2016 nbsp 0183 32 Section 80U For the taxpayer himself Basically these are the disabilities which are considered by Income Tax Act Blindness Low vision Leprosy cured Hearing

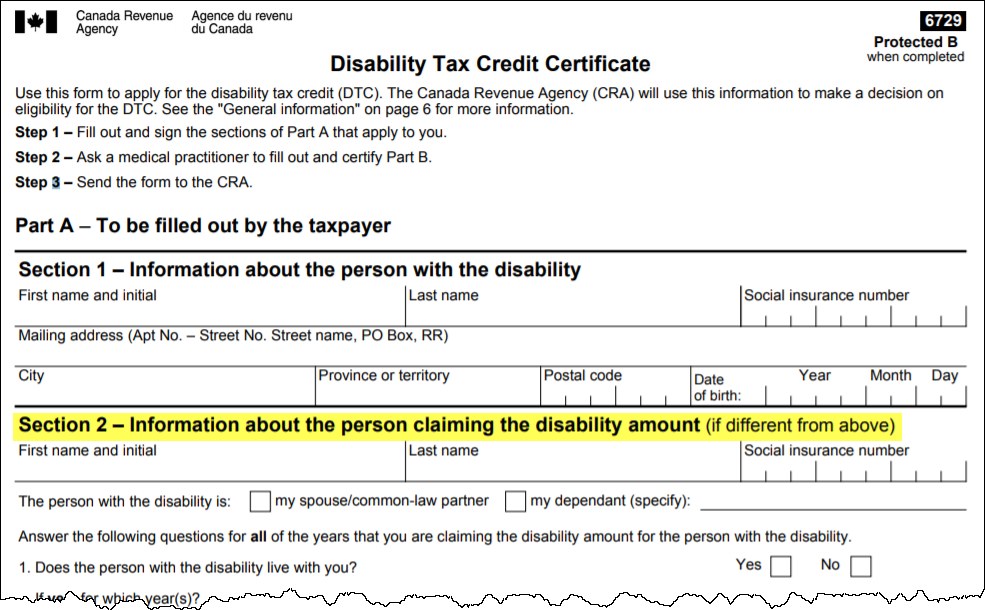

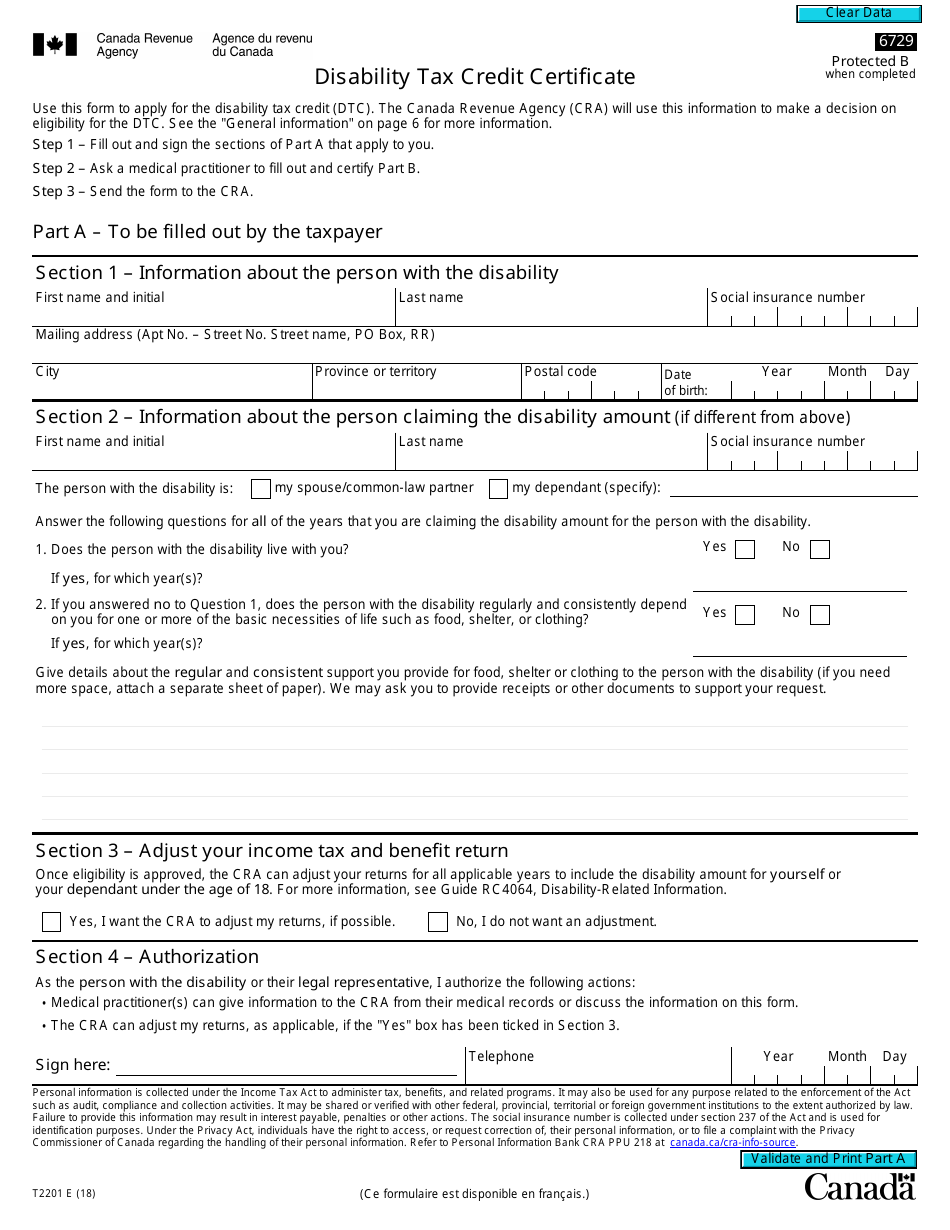

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

https://data.templateroller.com/pdf_docs_html/1868/18686/1868612/page_1_thumb_950.png

Is Social Security Disability Income Taxable By The Irs

https://www.disabilityproadvice.com/wp-content/uploads/is-social-security-taxable-income-2021-when-is-social-security-income.jpeg

https://www.corrigetonimpot.fr/impot-invalidite-demi-part-handicap

Web 5 janv 2023 nbsp 0183 32 La demi part pour handicap va r 233 duire votre imp 244 t mais ne permettra pas d avoir une restitution si vous n en payez pas La baisse de l imp 244 t va d 233 pendre de vos

https://www.irs.gov/.../disability-and-the-earned-income-tax-credit-eitc

Web 1 nov 2022 nbsp 0183 32 If you get disability payments your payments may qualify as earned income when you claim the Earned Income Tax Credit EITC Disability payments qualify as

Does The CRA Have A Disability Tax Credit Certificate form T2201 On

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

9 Form Va Disability Seven Taboos About 9 Form Va Disability You Should

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Rebates Worth Thousands Of Dollars However Qualifying For A Refund Is

2022 Form Canada T2201 EFill Online Printable Fillable Blank PdfFiller

2022 Form Canada T2201 EFill Online Printable Fillable Blank PdfFiller

Rebate In Income Tax Ultimate Guide

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Disability Rebate In Income Tax - Web 18 juil 2023 nbsp 0183 32 Section 80U Physical Disability Section 80G Donations Section 80GGB Company Contribution Section 80GGC Contribution to Political Parties Section 80RRB