Disability Rebate Tax Web 1 nov 2022 nbsp 0183 32 Find out if your disability benefits and the refund you get for the EITC qualify as earned income for the Earned Income Tax Credit EITC Find out how you can claim

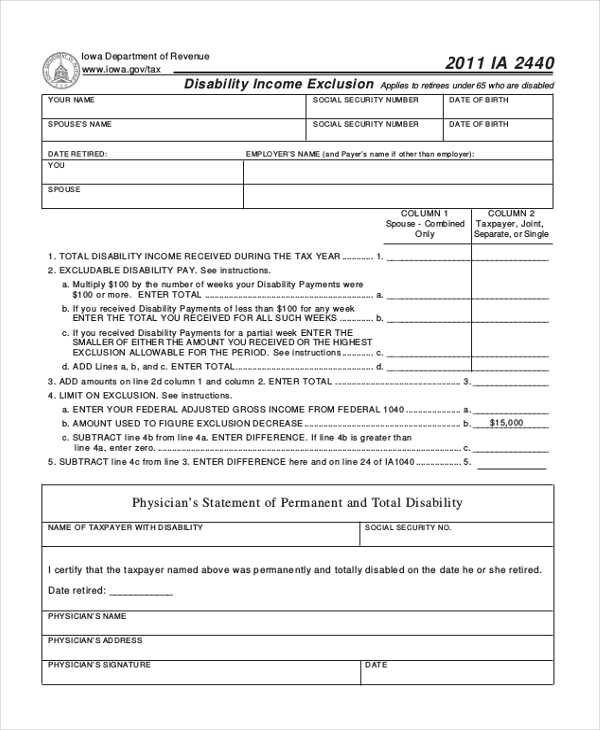

Web 20 avr 2023 nbsp 0183 32 aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year AND with an adjusted gross income OR the Web 12 oct 2022 nbsp 0183 32 Tax credits disability helpsheet TC956 English Cymraeg Find out about the conditions you must meet to qualify for the disability element of Working Tax Credit and

Disability Rebate Tax

Disability Rebate Tax

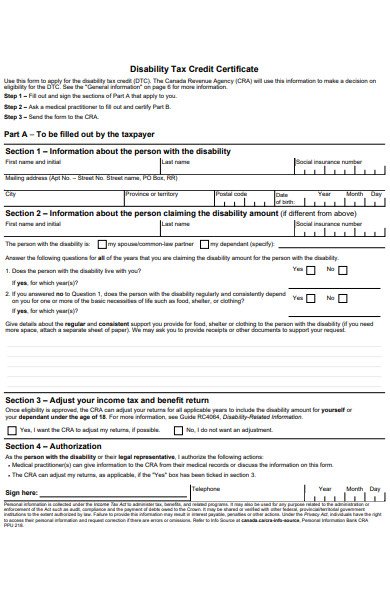

https://images.sampleforms.com/wp-content/uploads/2020/03/Disability-Tax-Form.jpg

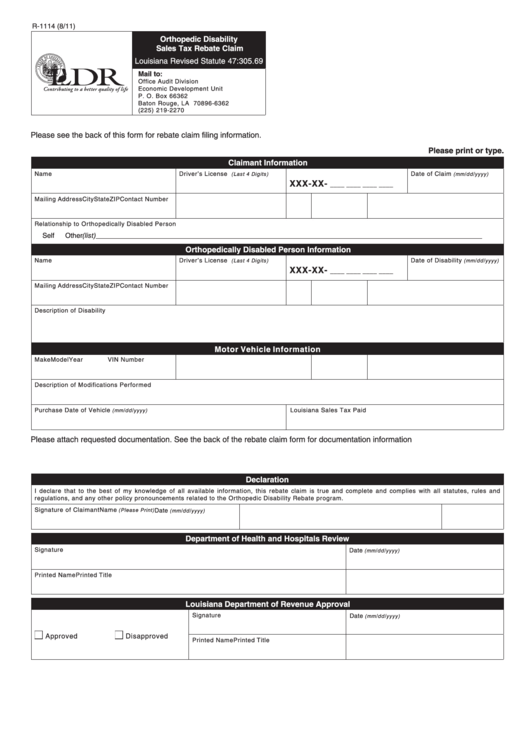

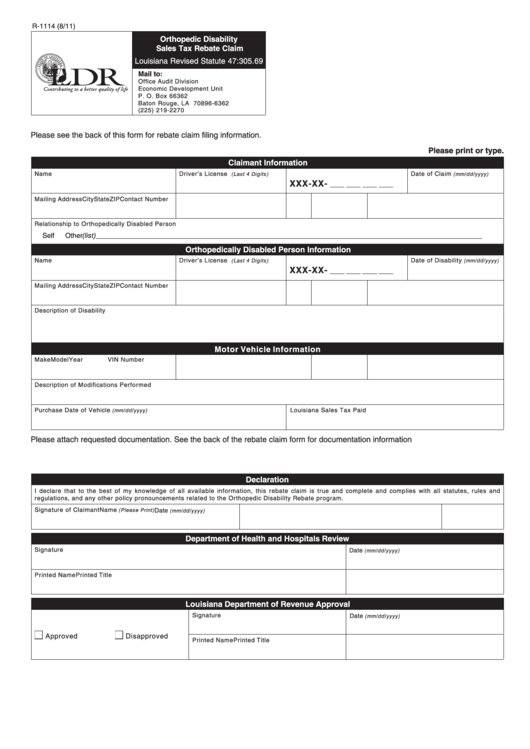

Fillable Form R 1114 Orthopedic Disability Sales Tax Rebate Claim

https://data.formsbank.com/pdf_docs_html/323/3234/323483/page_1_thumb_big.png

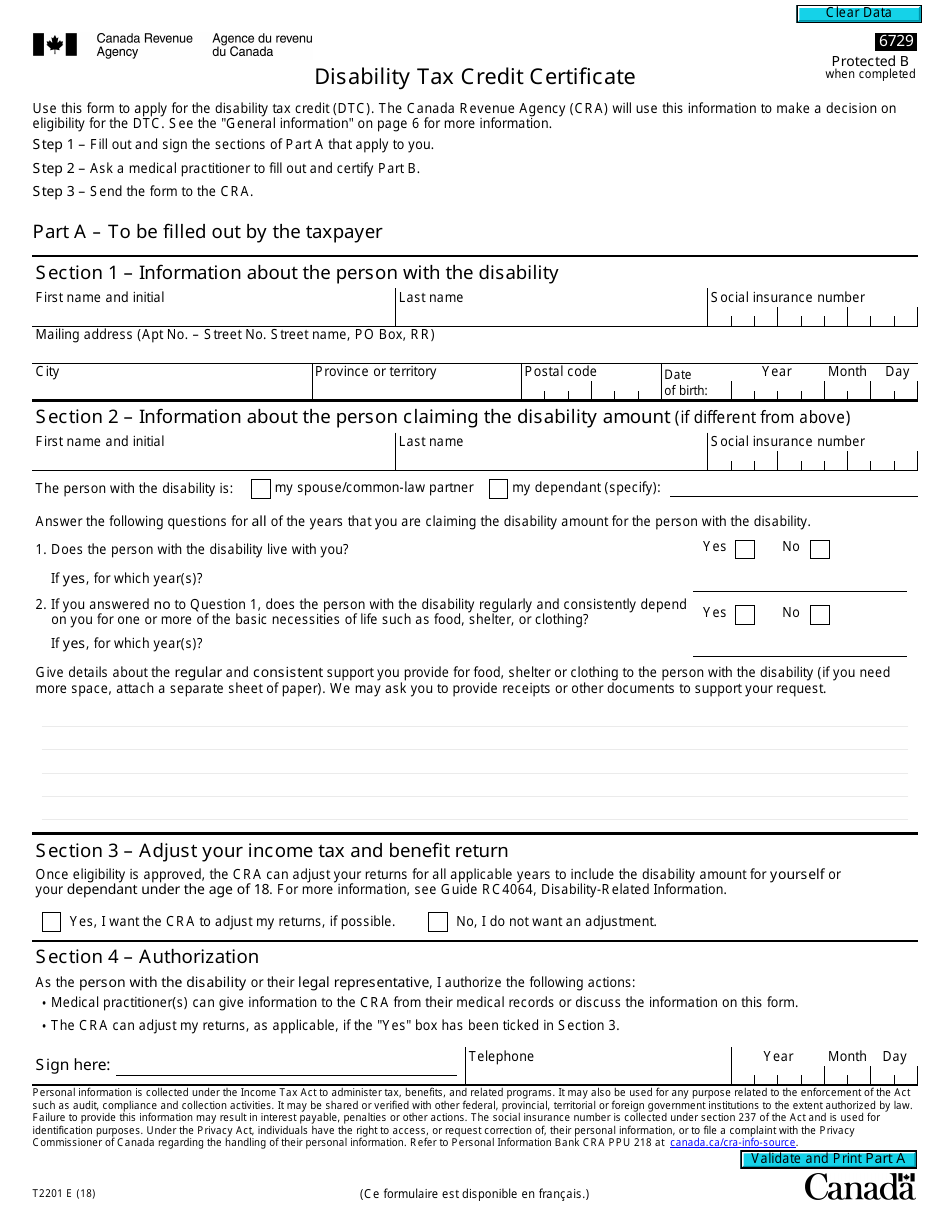

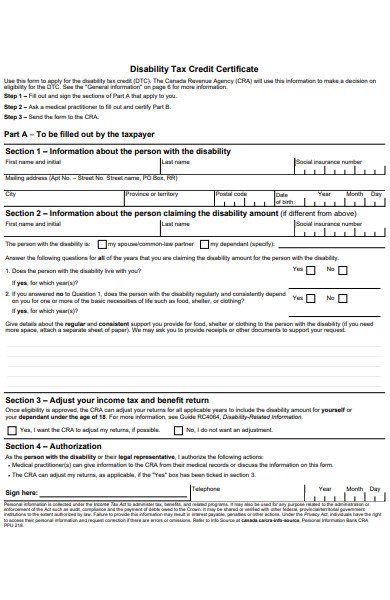

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

https://data.templateroller.com/pdf_docs_html/1868/18686/1868612/form-t2201-disability-tax-credit-certificate-canada_print_big.png

Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions Web What s New Annual contribution limit For 2022 the maximum amount that can be contributed to your ABLE account is 16 000 Certain employed ABLE account

Web 29 mai 2019 nbsp 0183 32 Supplemental Security Income or SSI is for eligible disabled adults and children and adults 65 and older who have limited income and resources The benefits you receive are based on the Web 22 juin 2023 nbsp 0183 32 The disability tax credit DTC is a non refundable tax credit that helps people with impairments or their supporting family member reduce the amount of

Download Disability Rebate Tax

More picture related to Disability Rebate Tax

FREE 9 Sample Social Security Disability Forms In PDF Word

https://images.sampleforms.com/wp-content/uploads/2016/10/Social-Security-Disability-Tax-Form.jpg

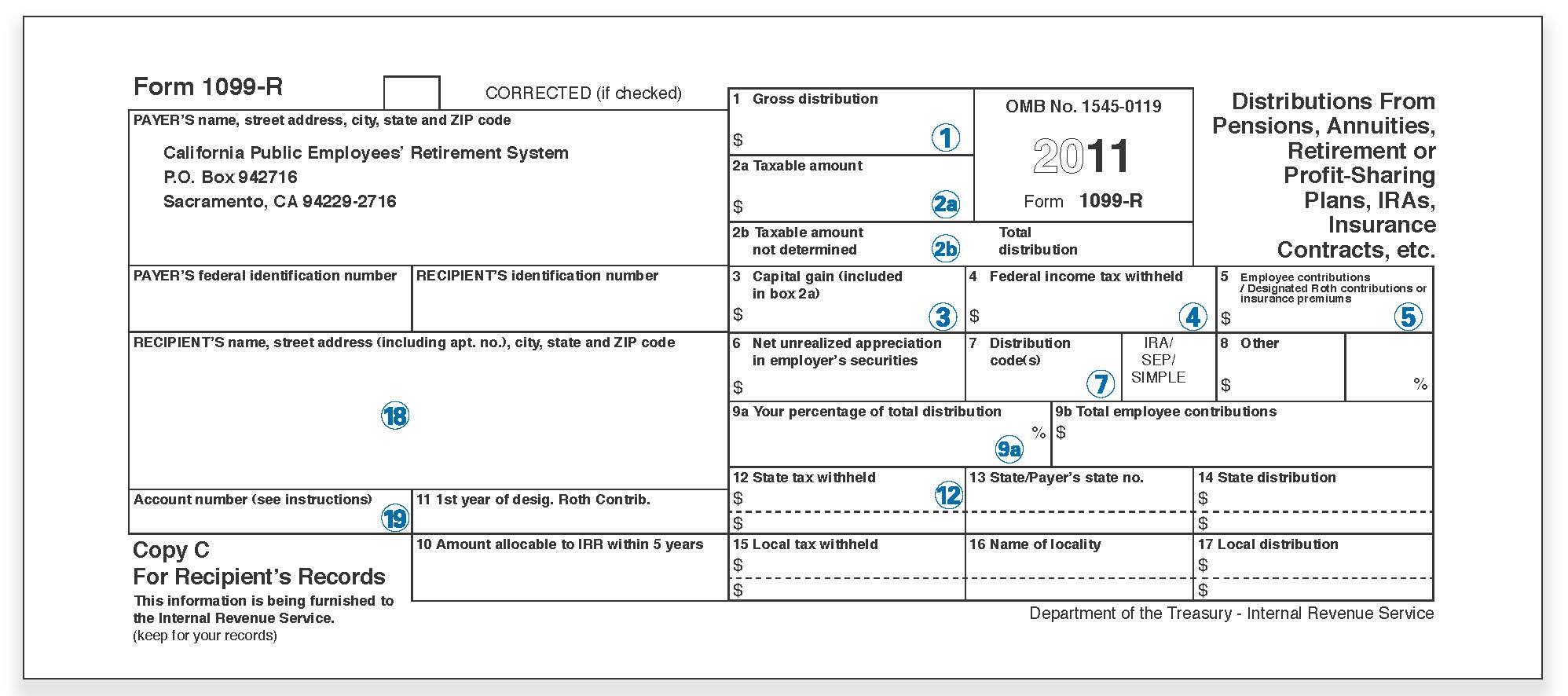

9 Form Va Disability Seven Taboos About 9 Form Va Disability You Should

https://www.calpers.ca.gov/resources/img/understanding-1099r.jpg

Are Taxes Taken Out Of Disability Disability Talk

https://www.disabilitytalk.net/wp-content/uploads/ontario-disability-forms-tax-credit.jpeg

Web The disability tax credit helps reduce the amount of income tax you may have to pay as someone living with a disability or supporting them You must apply to the Canada Web 6 janv 2015 nbsp 0183 32 If you re disabled you ll generally have to pay VAT on the things you buy but VAT relief is available on a limited range of goods and services for disabled people VAT

Web Disability amounts for the 2022 tax year 18 and older 8 870 disability amount 17 and younger 8 870 disability amount 5 174 supplement for children 14 044 How to Web The Disability Tax Credit is a valuable non refundable tax credit that has been improving the lives of hundreds of thousands of Canadians living with a disability since 1988

What Tax Form For Short Term Disability DisabilityTalk

https://www.disabilitytalk.net/wp-content/uploads/nys-disability-tax-form-universal-network.jpeg

Is Short Term Disability Taxable DisabilityTalk

https://www.disabilitytalk.net/wp-content/uploads/do-i-have-to-pay-taxes-on-short-term-disability-tax-walls.jpeg

https://www.irs.gov/.../disability-and-the-earned-income-tax-credit-eitc

Web 1 nov 2022 nbsp 0183 32 Find out if your disability benefits and the refund you get for the EITC qualify as earned income for the Earned Income Tax Credit EITC Find out how you can claim

https://www.irs.gov/credits-deductions/individuals/credit-for-the...

Web 20 avr 2023 nbsp 0183 32 aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year AND with an adjusted gross income OR the

Section 80U Deductions For The Disabled Eligibility How To Claim

What Tax Form For Short Term Disability DisabilityTalk

Fuel Tax Disability Application Form

Is Disability Income Taxable In Nj Disability Talk

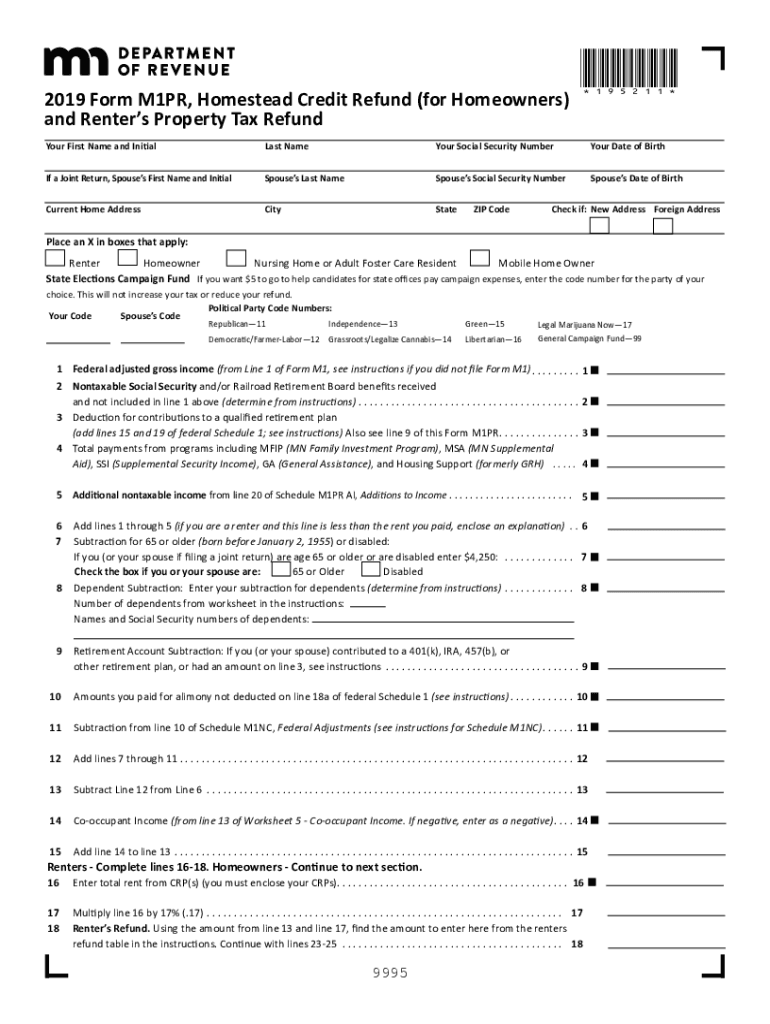

MN DoR M1PR 2019 2022 Fill Out Tax Template Online US Legal Forms

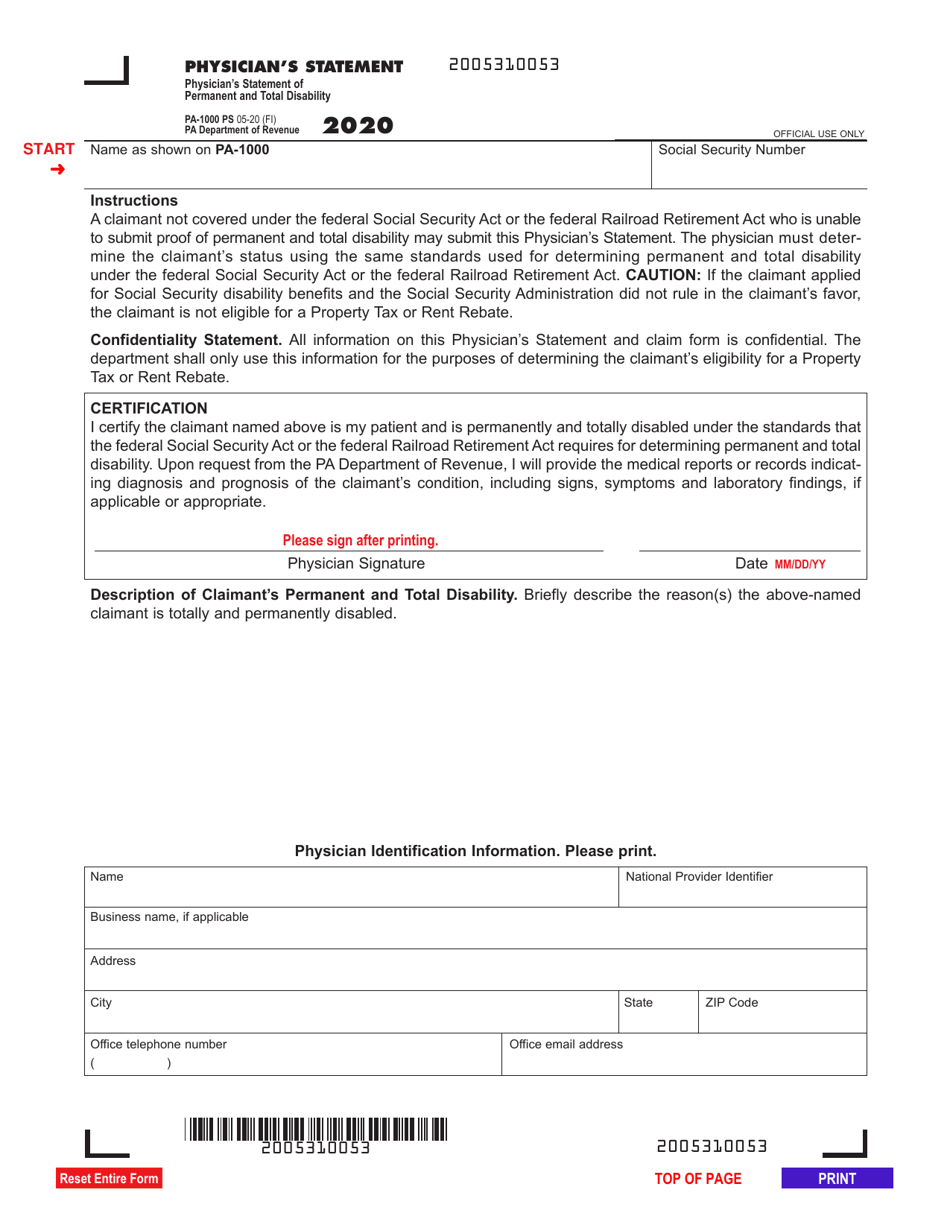

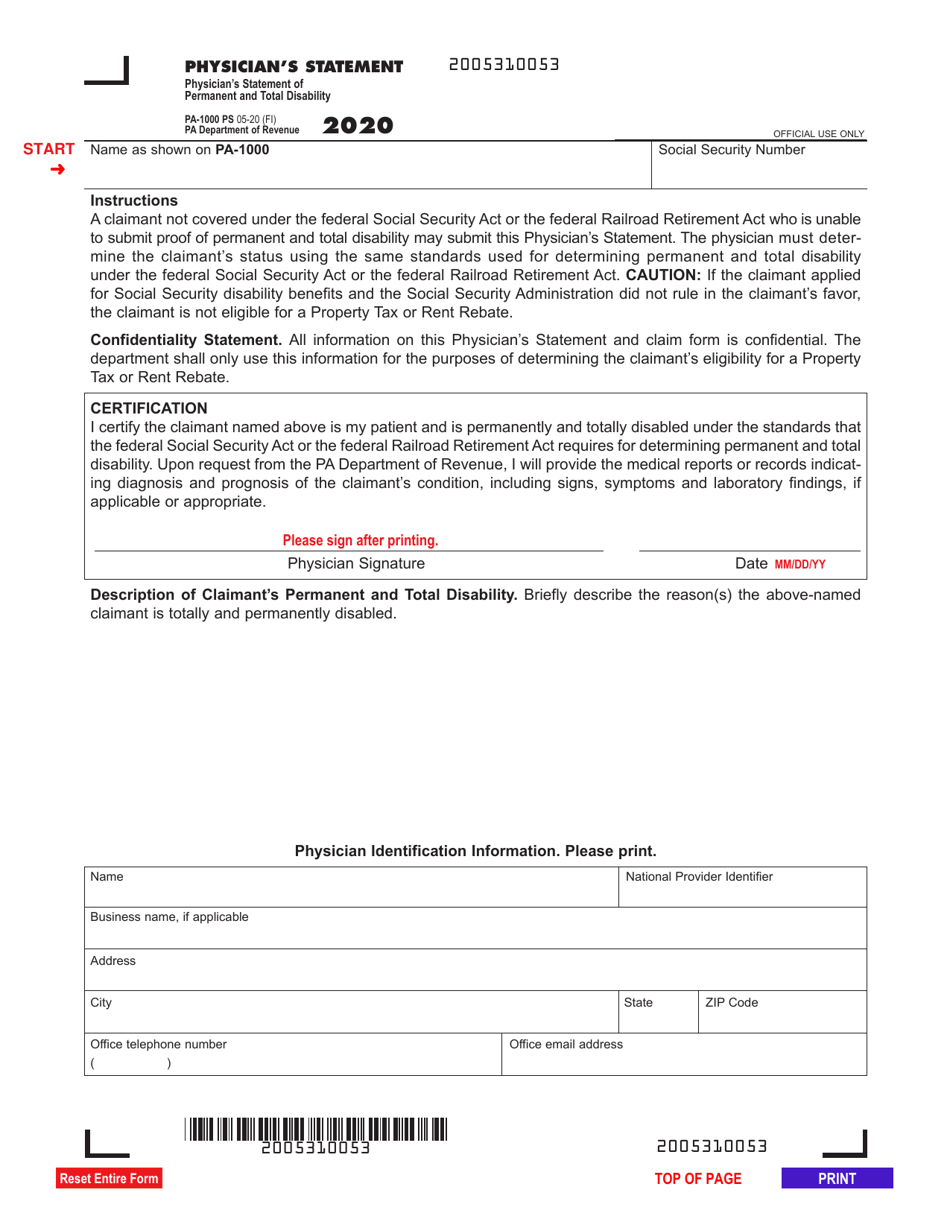

Form PA 1000 PS Download Fillable PDF Or Fill Online Physician s

Form PA 1000 PS Download Fillable PDF Or Fill Online Physician s

Can You File Taxes On Disability DisabilityTalk

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Disabled Candidates Are Treated With Disrespect And Unfairly In Terms

Disability Rebate Tax - Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions