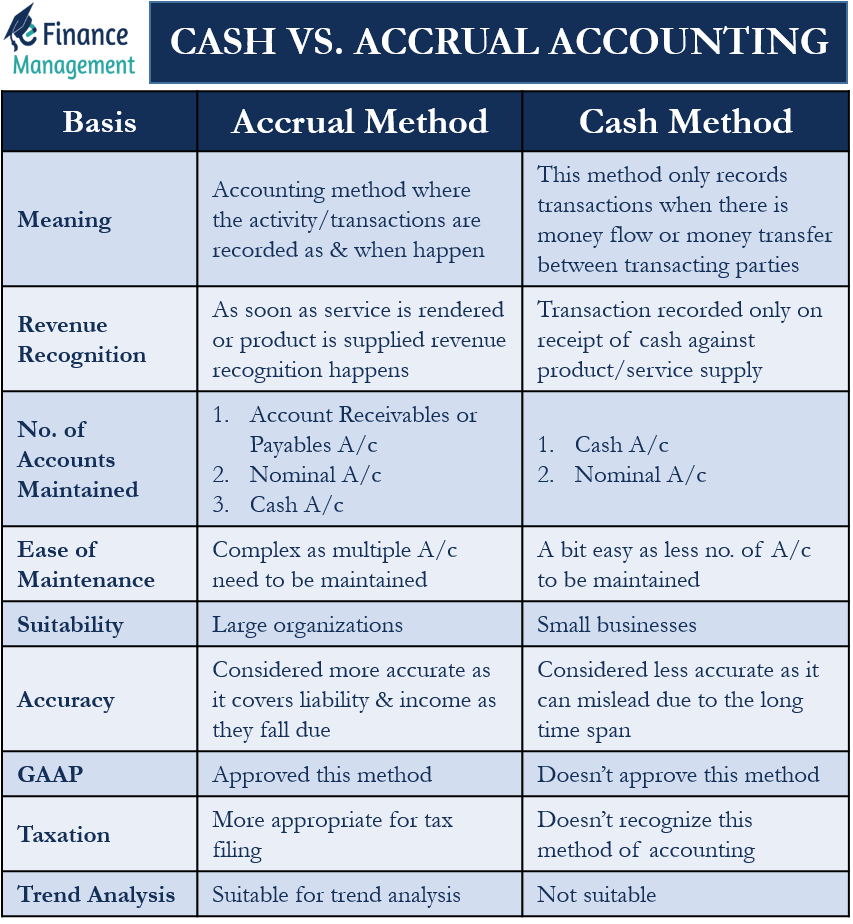

Discount Accrual Accounting Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account

In most cases troubles The reason is that discounts directly affect measurement of various items in the financial statements and potentially The purpose of accrual accounting is to match revenues and expenses to the time periods during which they were recognized and incurred as opposed to the timing of the actual

Discount Accrual Accounting

Discount Accrual Accounting

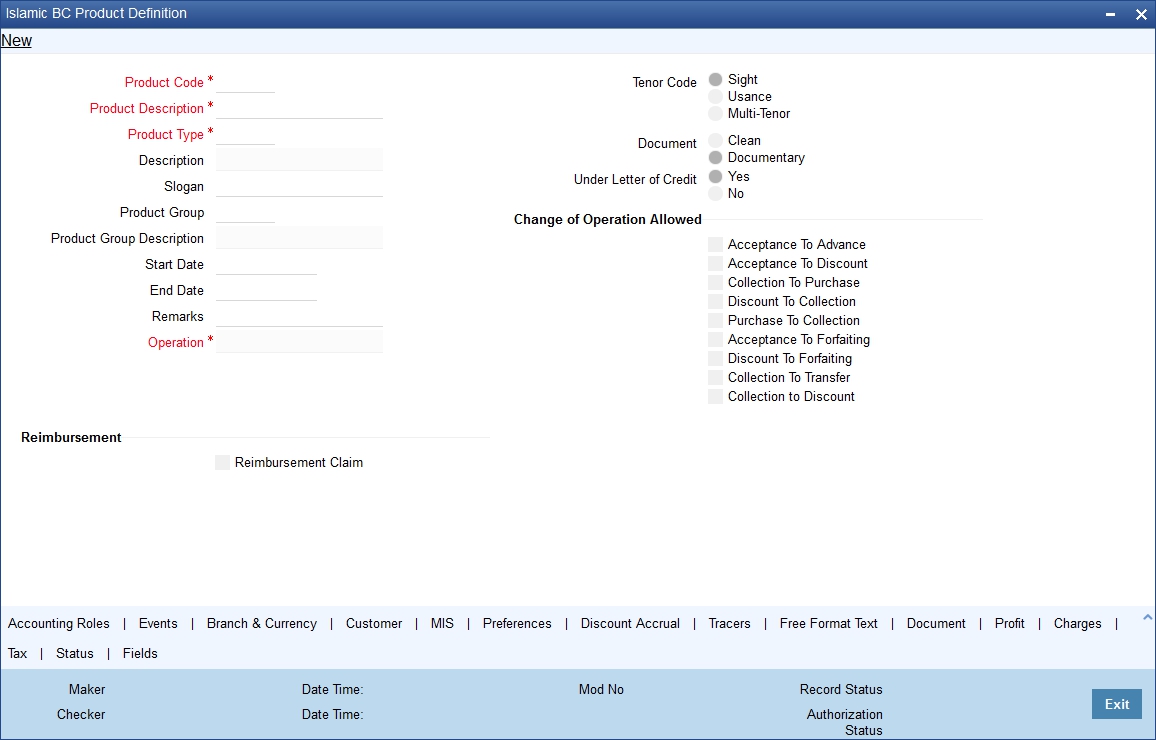

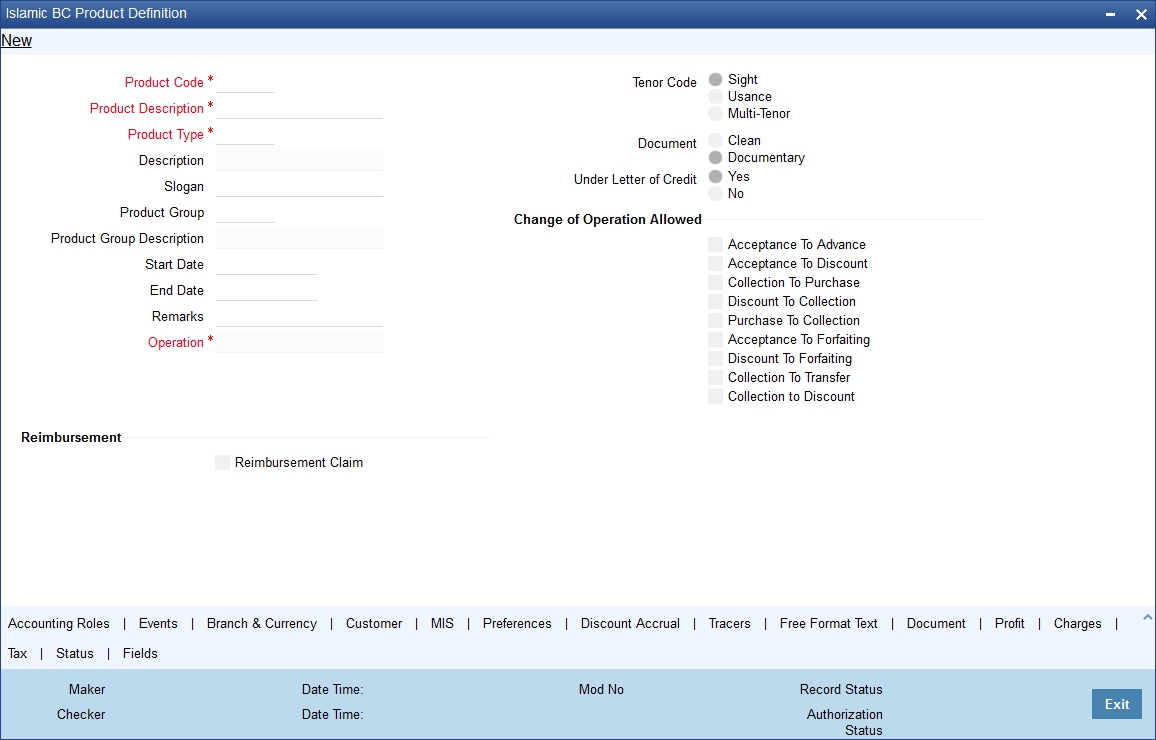

https://docs.oracle.com/cd/E94300_01/html/IB/IBDPRMNT__CVS_MAIN.jpg

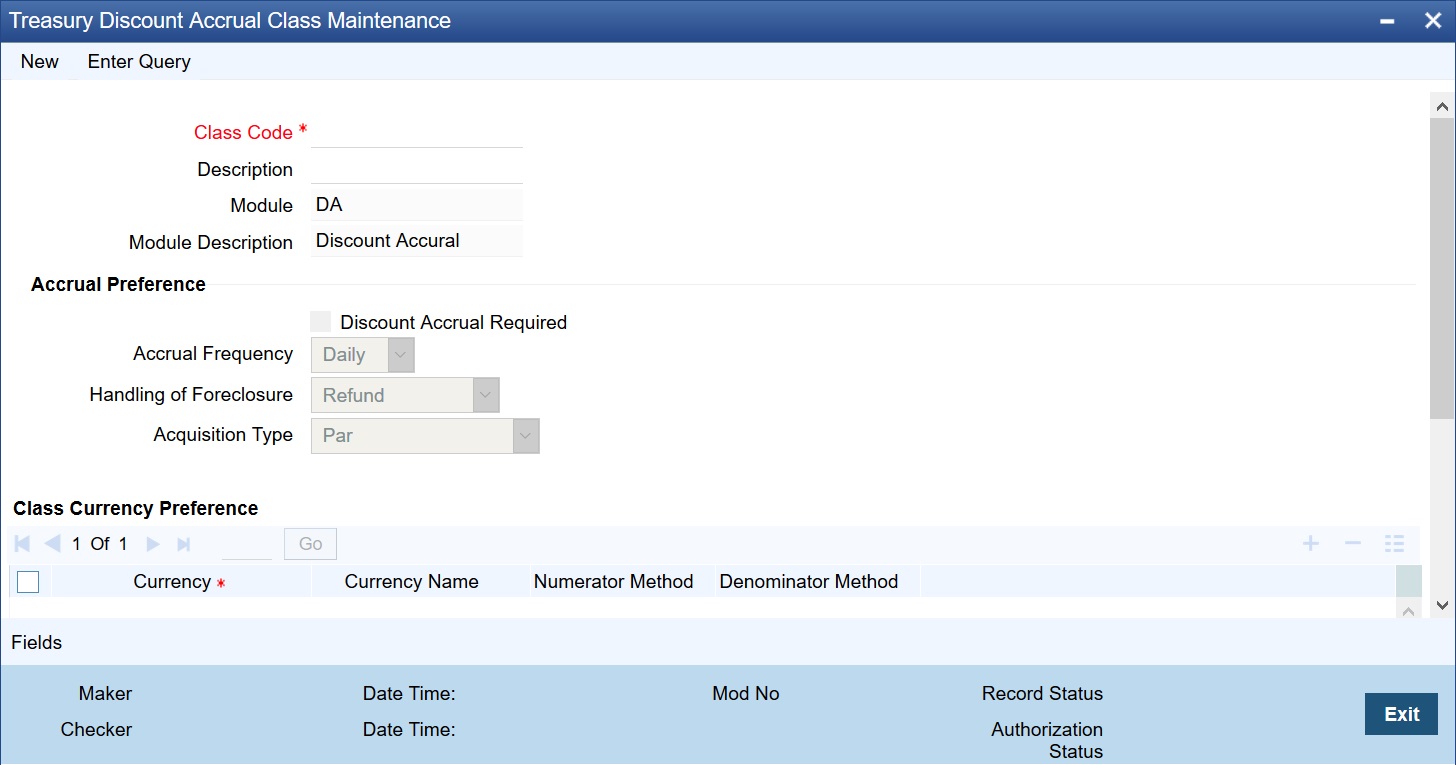

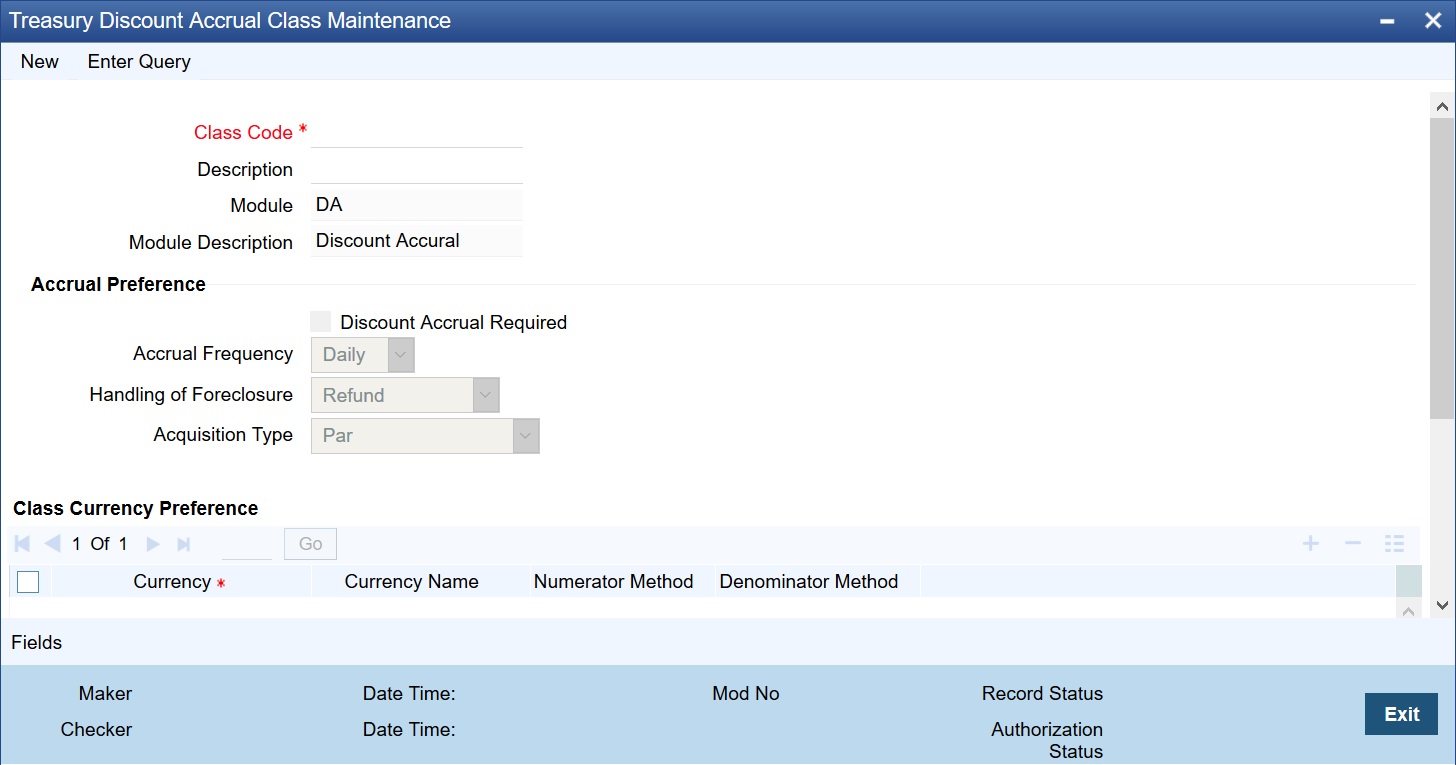

Discount Accrual Class Maintenance

https://docs.oracle.com/en/industries/financial-services/banking-treasury-management/14.7.0.0.0/trcla/img/dadacrcl__cvs_main.png

Get A Full Picture Of Your Business With Accrual Accounting

https://proteafinancial.com/wp-content/uploads/2021/07/accrual-accounting.jpg

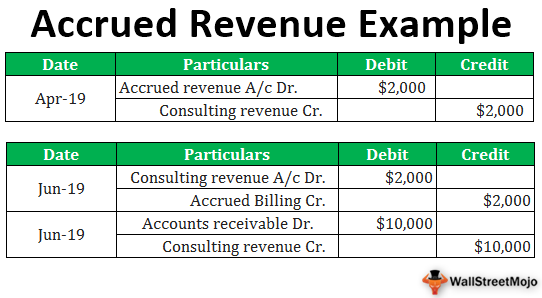

Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to early payment The sales discounts are directly Analysis Retailer has observable evidence that the 600 discount should be allocated to only the chair and couch The chair and couch are regularly sold together for 4 400

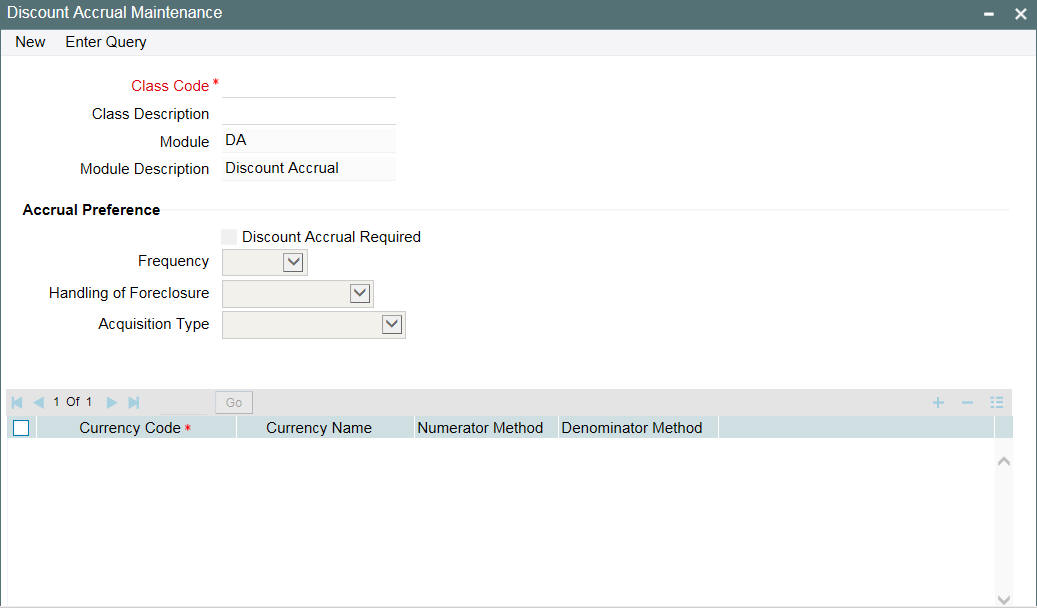

While defining the accounting entries for the Loans and MM modules you must identify the events and accounting entries that are required for discount accrual accounting One Discounts must be deducted from gross sales to report net sales revenue on the income statement This practice aligns with the accrual basis of accounting

Download Discount Accrual Accounting

More picture related to Discount Accrual Accounting

Oracle FLEXCUBE Universal Banking User Guide

https://docs.oracle.com/cd/F56379_01/html/LN/OLDACRCL__CVS_MAIN.jpg

Accounting Method Cash Vs Accrual Hot Sex Picture

https://efinancemanagement.com/wp-content/uploads/2022/07/cash-vs-accrual-accounting.png

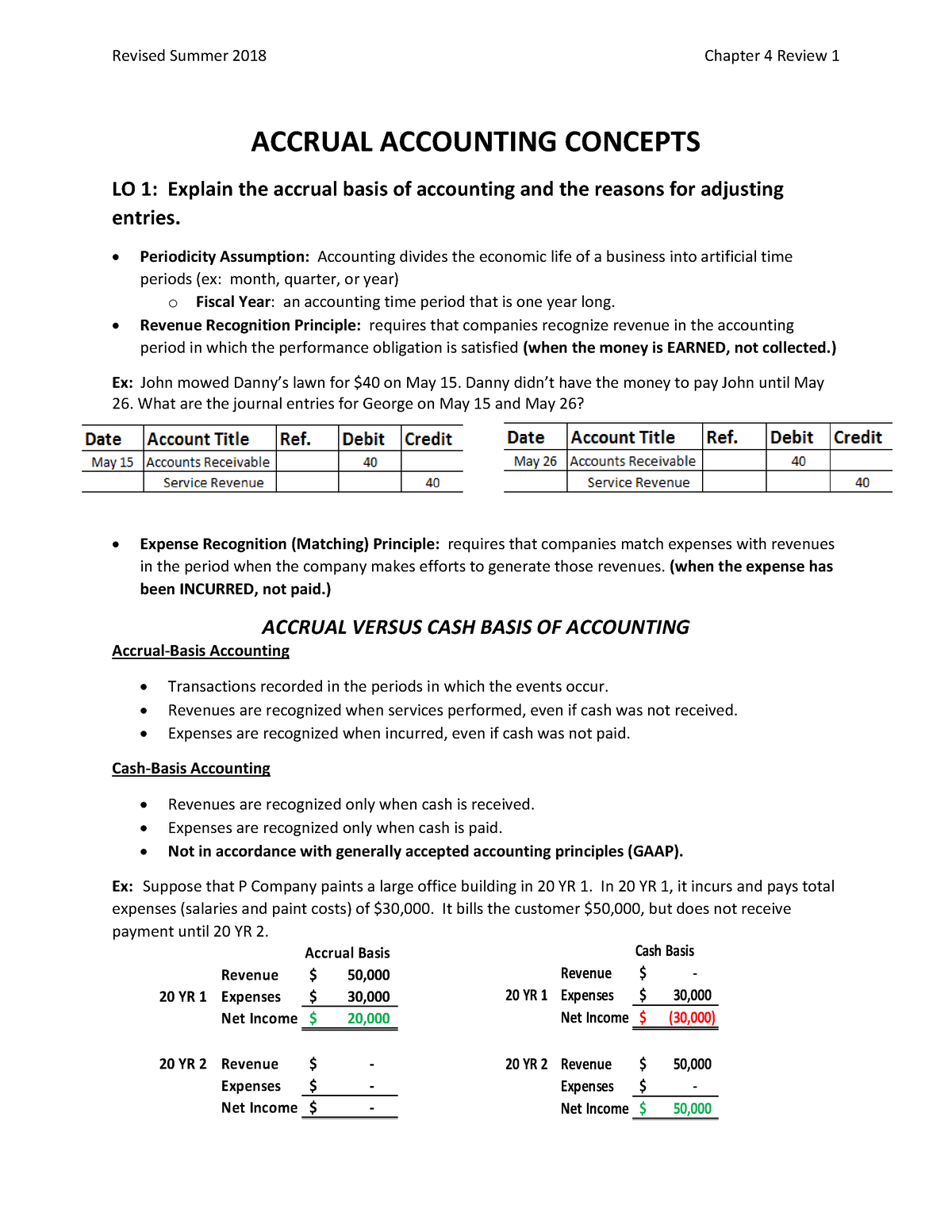

Accrual Accounting Concepts ACCRUAL ACCOUNTING CONCEPTS LO 1 Explain

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0f3279827f91e5443b3f2cedfff7e363/thumb_1200_1553.png

November 07 2023 What is a Sales Discount A is a reduction taken by a from the invoiced price of goods or services in exchange for early payment to the seller Accruals are revenues earned or expenses incurred that impact a company s net income on the income statement although cash related to the transaction has not yet changed hands Accruals also

Sales discount 2 000 x 2 5 50 Amount to pay Sales price Sales discounts Amount to pay 2 000 50 1 950 If the customer pays within 10 days IFRS For losses that meet the accrual criteria of ASC 450 an entity will generally record them at the amount that will be paid to settle the contingency without considering the

Intrare n Jurnal De Cheltuieli Acumulate Invatatiafaceri ro

https://invatatiafaceri.ro/wp-content/uploads/Intrare-in-jurnal-de-cheltuieli-acumulate.jpg

What Is Accounting Rate Of Return Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2023/01/04003343/Accounting-Rate-of-Return-Calculator-768x345.jpg

https://www.accaglobal.com/.../f3/technical-articles/discounts.html

Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account

https://www.cpdbox.com/accounting-discou…

In most cases troubles The reason is that discounts directly affect measurement of various items in the financial statements and potentially

Double Entry Accounting 2022

Intrare n Jurnal De Cheltuieli Acumulate Invatatiafaceri ro

Which Of The Following Is An Example Of Accrued Revenue

Accrued Expenses Journal Entry How To Record Accrued Expenses With

How To Convert Accrual To Cash Basis Accounting Accounting Education

Treatment Of Cash Discounts Explanation Journal Entry And Examples

Treatment Of Cash Discounts Explanation Journal Entry And Examples

Types Of Revenue Accounts Revenue Examples In Business

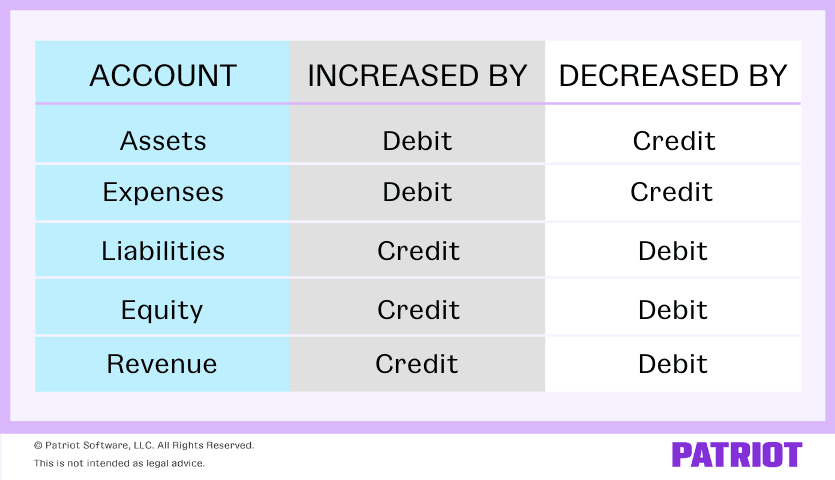

What Are Debits And Credits In Accounting

Accounting Concepts And Principles Transtutors Accounting Accrual

Discount Accrual Accounting - Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to early payment The sales discounts are directly