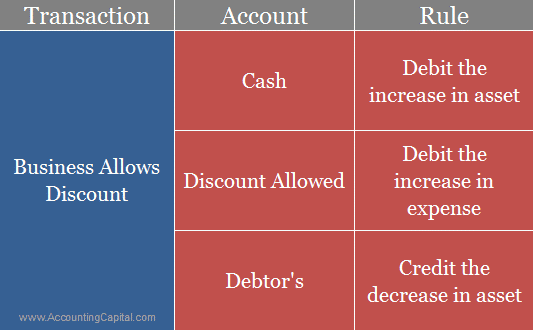

Discount Allowed Example When the seller allows a discount this is recorded as a reduction of revenues and is typically a debit to a contra revenue account For example the seller

This journal entry will reduce both total assets on the balance sheet and the net sales revenue on the income statement by the amount of discount allowed Discount allowed The following examples explain the use of journal entry for discount allowed in real world events Examples Journal Entry for Discount Allowed

Discount Allowed Example

Discount Allowed Example

https://media.geeksforgeeks.org/wp-content/uploads/20220414185625/discallowq-660x316.PNG

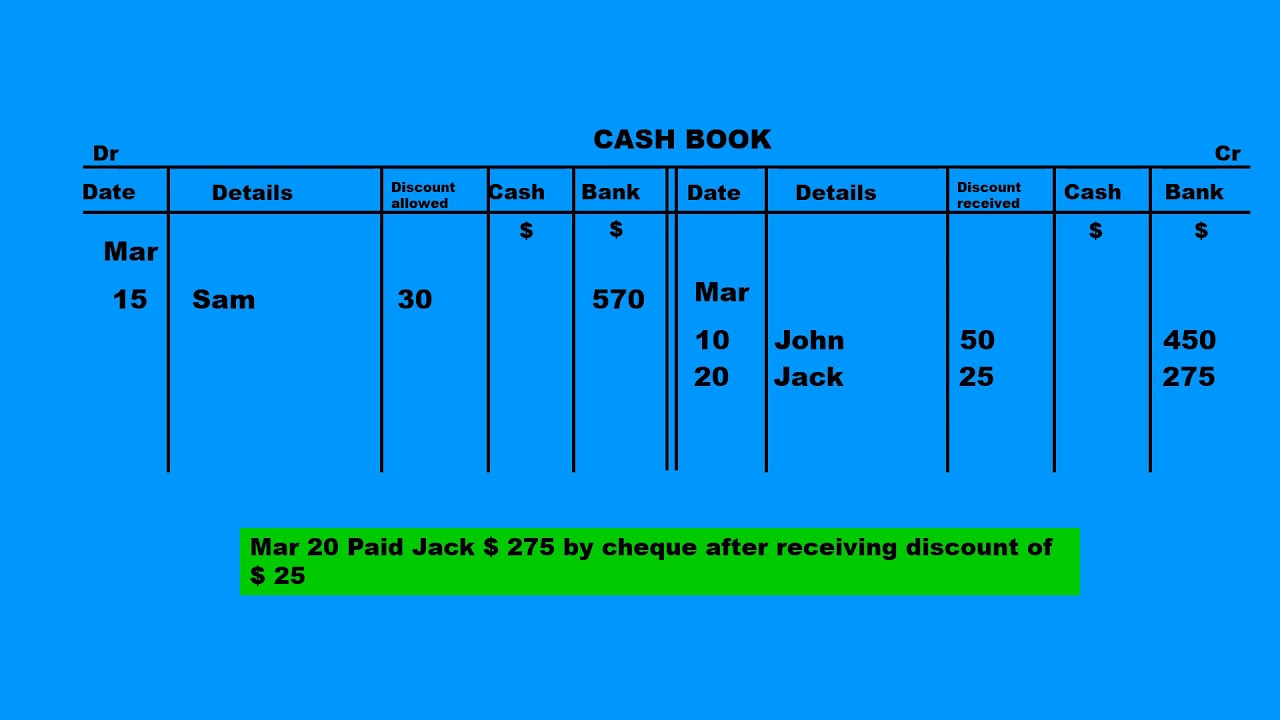

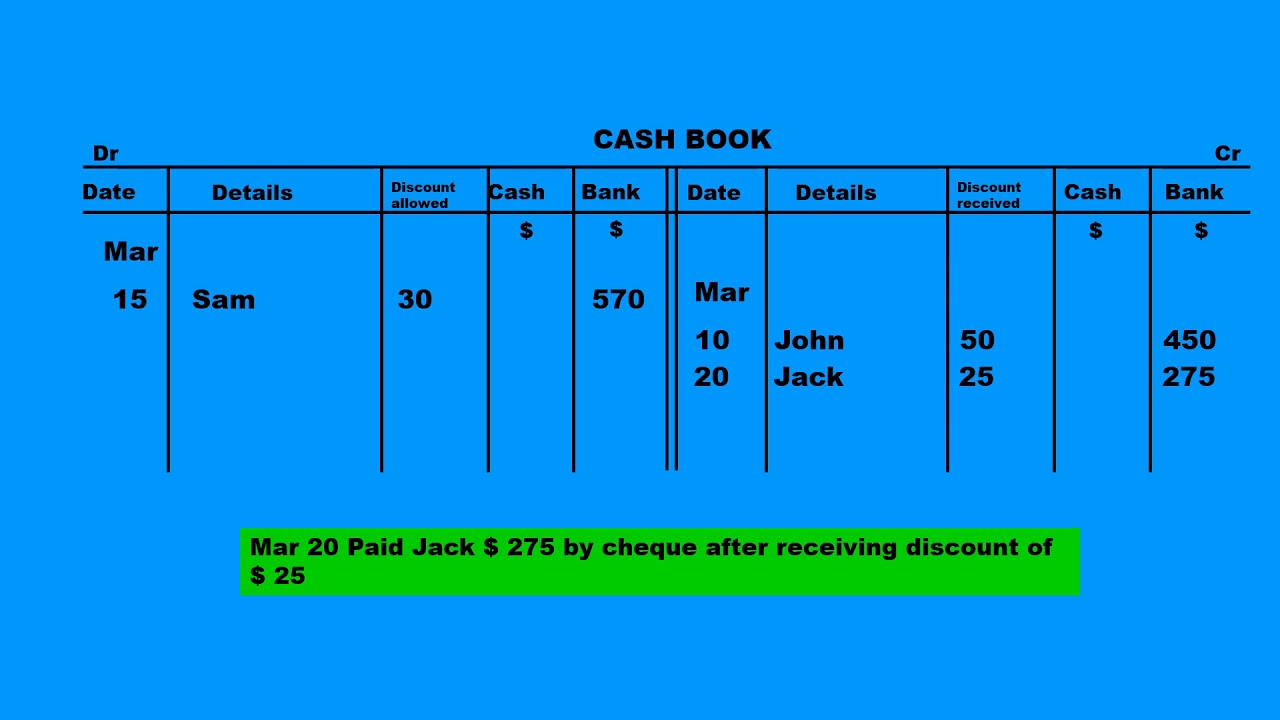

Cash Discount Discount Allowed And Discount Received YouTube

https://i.ytimg.com/vi/iNdpSQEATEg/maxresdefault.jpg

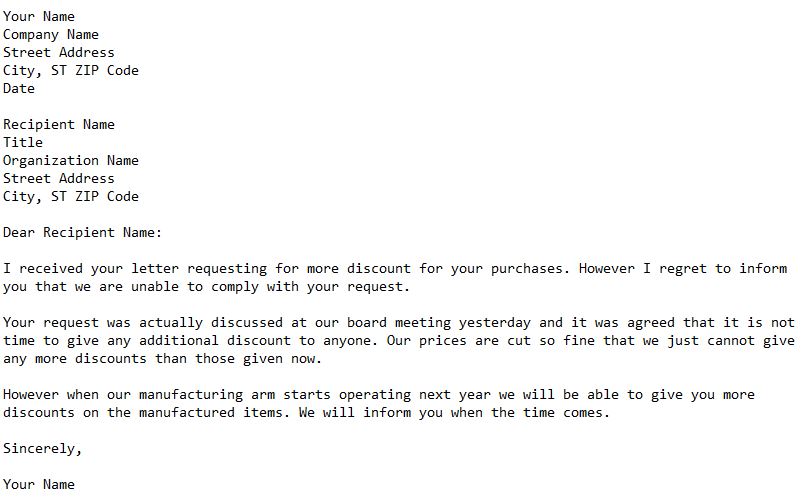

Letter Discount Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/497/329/497329174/large.png

Let s consider an example of a seller who offers a 5 discount on an invoice that is due in 30 days i e 5 10 Net 30 In case the buyer pays the invoice within 10 days he she Discount Allowed Journal Entry Examples Example 1 For example XYZ Ltd company gets payment for a product it sold on credit for 3 000 the week before Because the

When the entity expects that the customer will accept the discount revenue should be recorded net of the discount EXAMPLE 1 J Co sold goods with a list price of 2 000 on The sales discount is based on the sales price of the goods and is sometimes referred to as a cash discount on sales settlement discount or discount allowed Sales Discount Example For example if

Download Discount Allowed Example

More picture related to Discount Allowed Example

What Is The Journal Entry For Discount Allowed Accounting Capital

https://www.accountingcapital.com/wp-content/uploads/2018/08/Explanation-and-rules-for-journal-entry-for-discount-allowed.png

Discount Allowed Double Entry

https://keydifferences.com/wp-content/uploads/2014/12/journal-entry1.jpg

Discount Allowed Double Entry

https://i.pinimg.com/736x/43/38/42/4338428635c0f30c67a724377fd91af0.jpg

Discount Allowed Example 1 A furniture shop might offer a discount allowed to its customers to encourage repeat business or to sell off old inventory For Example Roberts Inc is a trader that sells office furniture Johnson who is a professional purchases 30 office chairs from Roberts for his office on January 01

Discount Allowed Original Selling Price X Discount Rate For example if a product is originally priced at 100 and the discount rate is 10 then the final Example for Discount Allowed Office Supplies Ltd sells office furniture to XYZ Corporation for 10 000 To encourage prompt payment Office Supplies Ltd offers a 5 discount if

Difference Between Discount Allowed And Discount Received Compare The

https://www.differencebetween.com/wp-content/uploads/2017/03/Difference-Between-Discount-Allowed-and-Discount-Received-2.png

How To Calculate Discount Allowed In Accounting Haiper

https://www.coursehero.com/qa/attachment/7051045/

https://www.accountingtools.com/articles/what-is...

When the seller allows a discount this is recorded as a reduction of revenues and is typically a debit to a contra revenue account For example the seller

https://accountinginside.com/discount-allowed-journal-entry

This journal entry will reduce both total assets on the balance sheet and the net sales revenue on the income statement by the amount of discount allowed Discount allowed

Vendor Discount Letter Template

Difference Between Discount Allowed And Discount Received Compare The

Letter Refusing To Give More Discount 101 Business Letter

Journal Entry For Discount Allowed Examples Journal Tutor s Tips

Cash Discount Point Of Sale Rezku POS

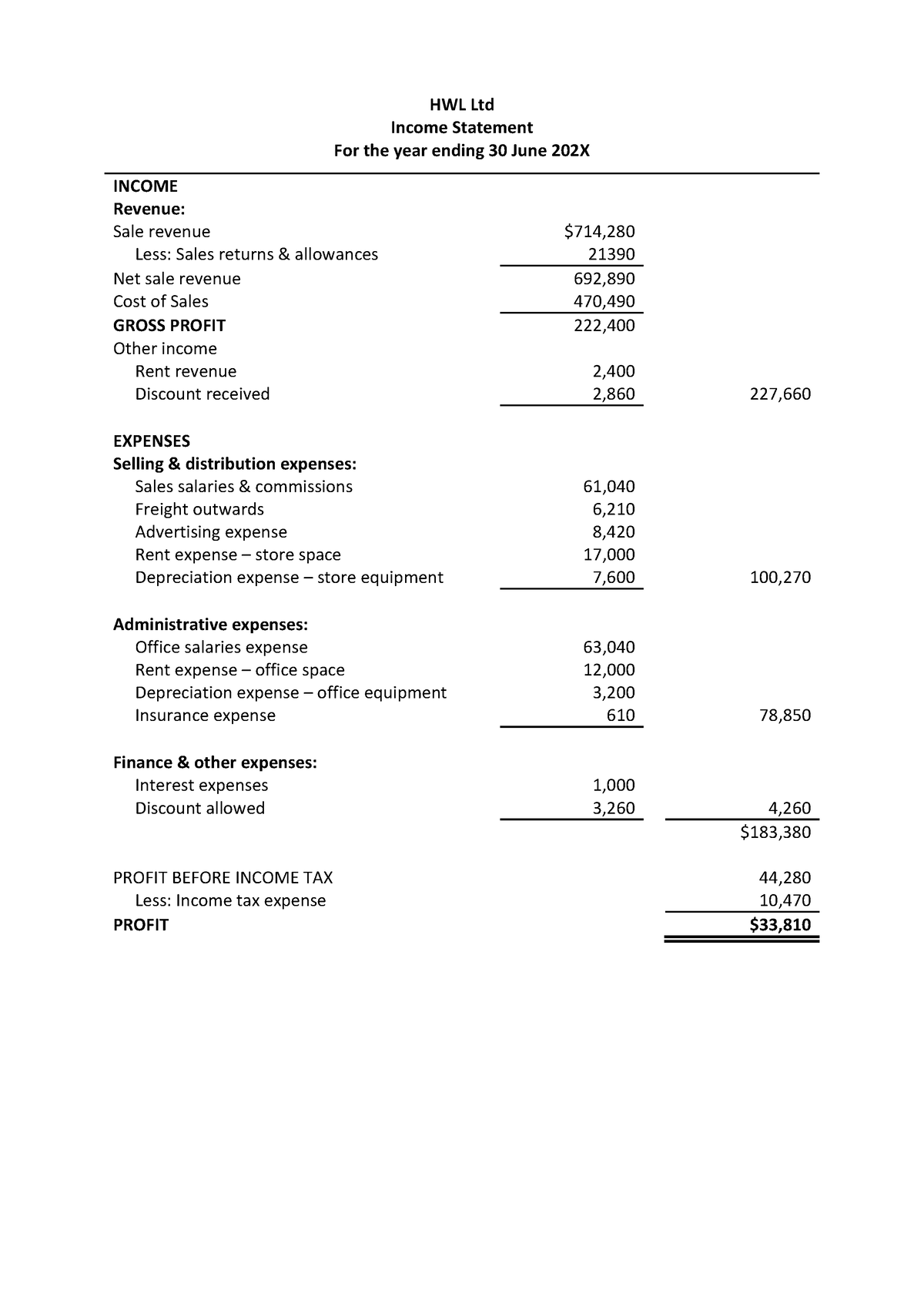

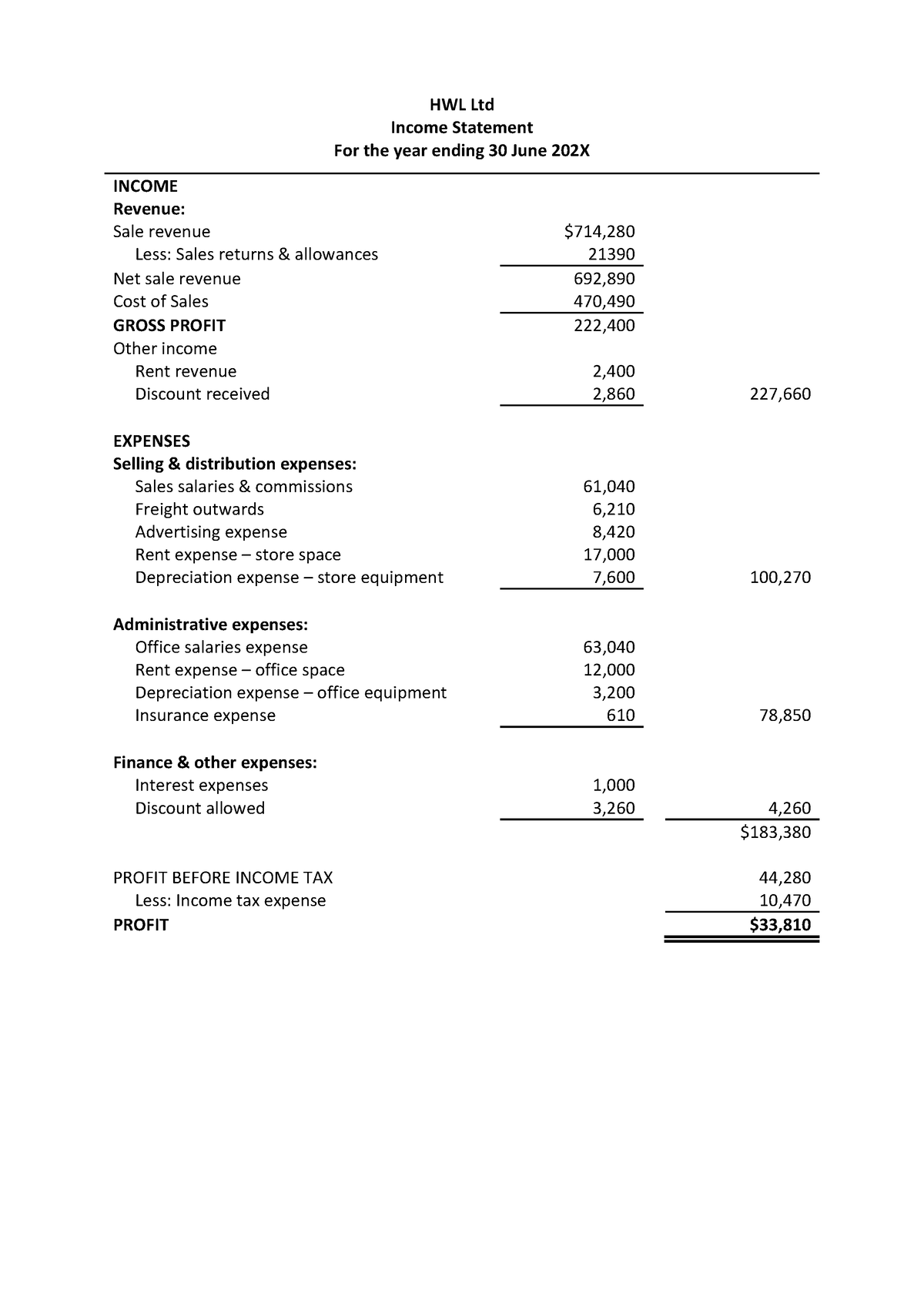

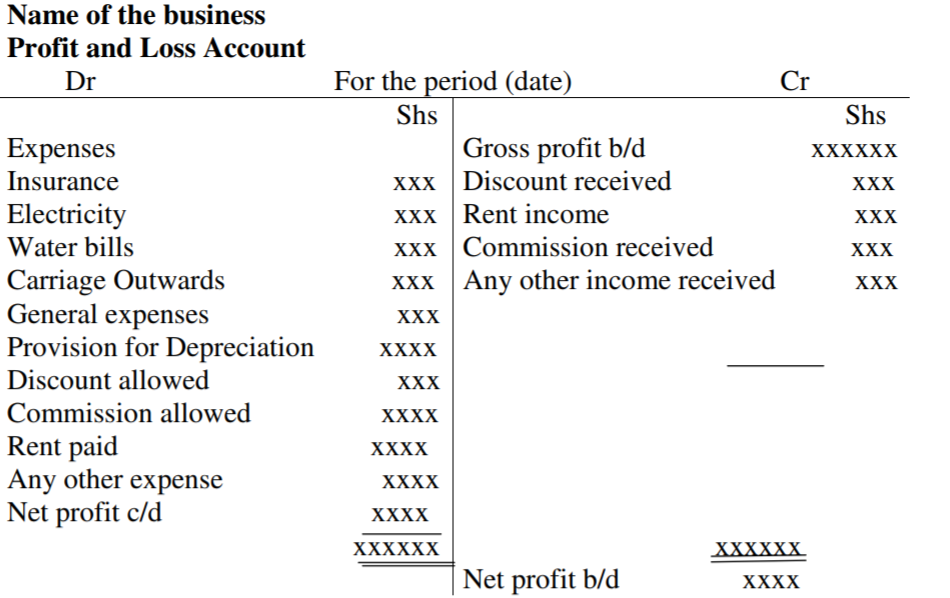

Handout 2 2 2 Practice Applying Standards To The Internal Income

Handout 2 2 2 Practice Applying Standards To The Internal Income

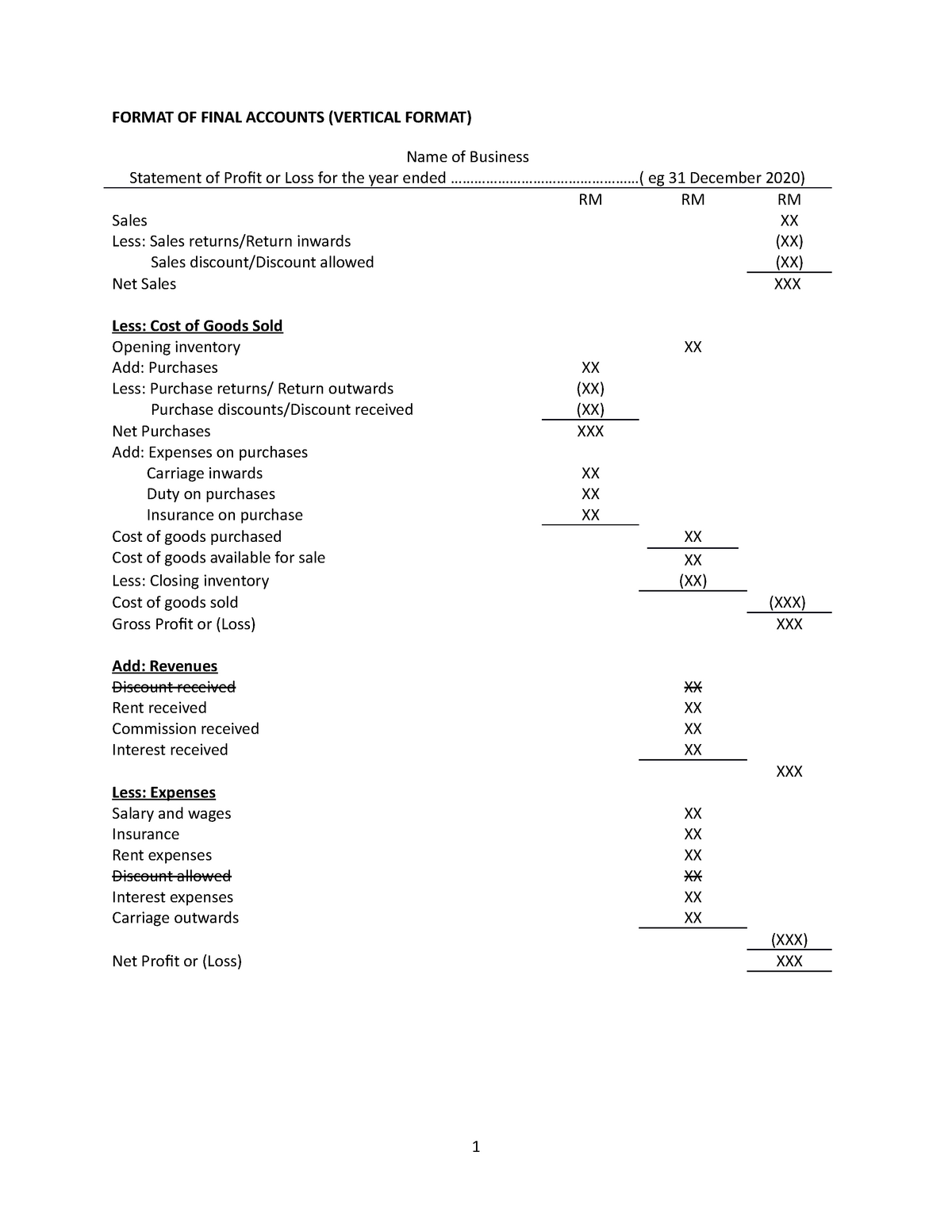

Fomat Statement Of Profit Loss Details FORMAT OF FINAL ACCOUNTS

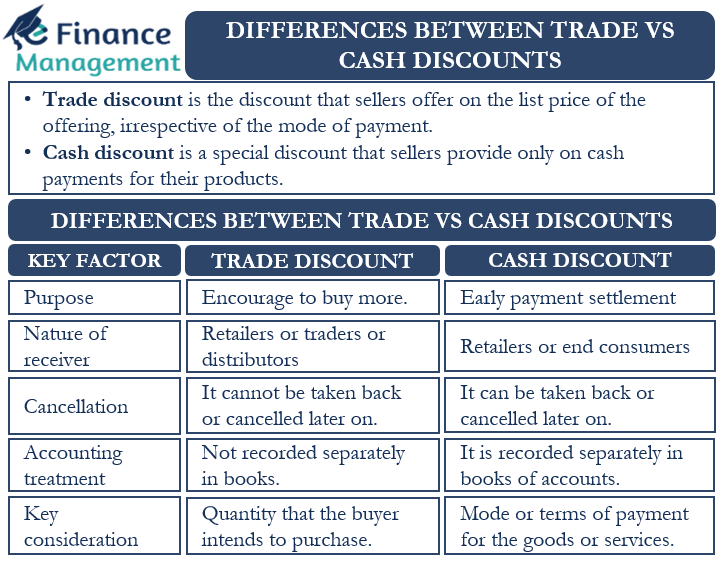

Differences Between Trade Discounts And Cash Discounts EFM

Discount Allowed In Income Statement

Discount Allowed Example - Discount Allowed Journal Entry Examples Example 1 For example XYZ Ltd company gets payment for a product it sold on credit for 3 000 the week before Because the