Discount Payment Meaning In Accounting Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account

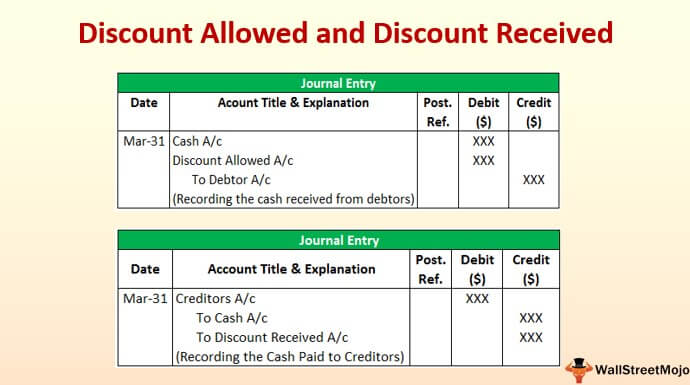

A discount allowed is when the seller grants a payment discount to a buyer A discount received is when the buyer is granted a discount by the seller What is Accounting for Sales Discounts Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to early payment The sales discounts are directly deducted from the gross sales at

Discount Payment Meaning In Accounting

Discount Payment Meaning In Accounting

https://www.double-entry-bookkeeping.com/wp-content/uploads/purchase-discount-in-accounting.png

Cash Discount Received Double Entry Bookkeeping

https://www.double-entry-bookkeeping.com/wp-content/uploads/cash-discount-received-accounting-equation.png

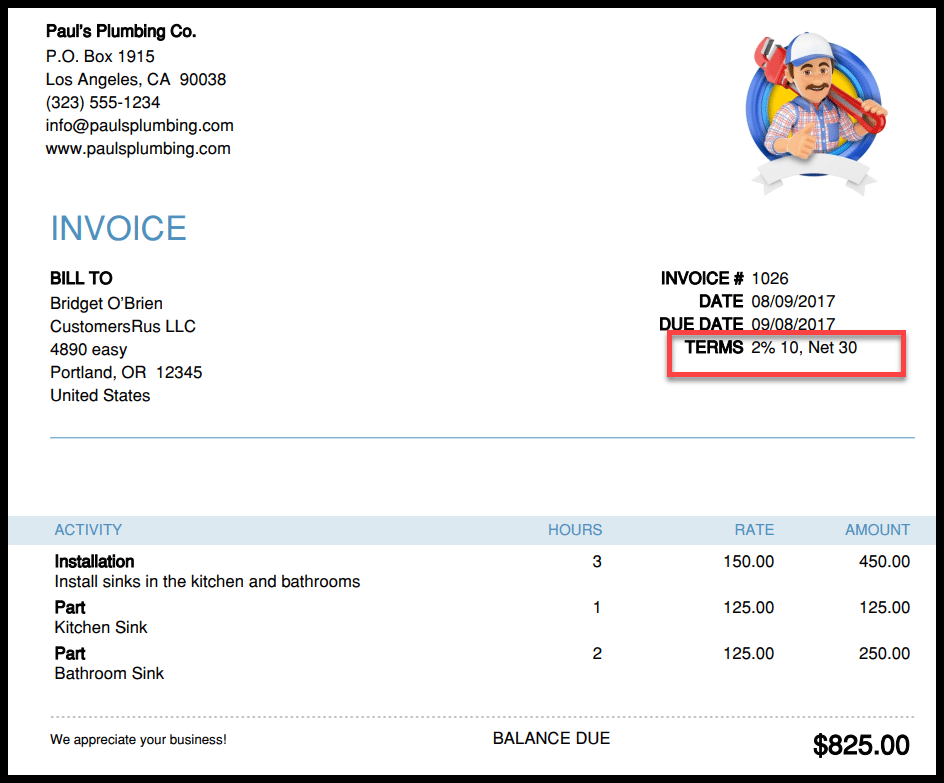

Understanding Early Payment Discounts On Invoices

https://fitsmallbusiness.com/wp-content/uploads/2017/08/early-payment-discount.png

Cash discounts also known as prompt payment discounts are incentives offered to customers for early payment of their invoices These discounts are typically expressed in terms like 2 10 net 30 meaning a 2 A Cash or Sales discount is the reduction in the price of a product or service offered to a customer by the seller to pay the due amount within a specified time period This is one of the best ways most of the sellers could improve the cash flow for their operations

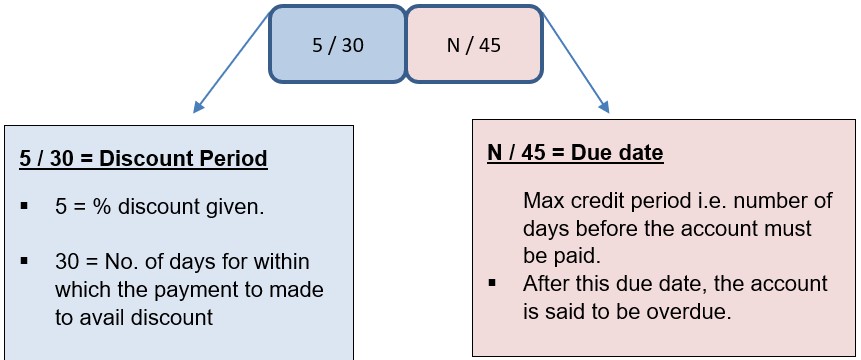

Discount Allowed it is a reduction of cash to be paid by a debtor for prompt payment When discount is allowed the amount is usually entered on the debit column of the discount allowed cash book Discount Received this is the value of discount received off accounts paid by a trader or a creditor Purchase discounts are mainly explained using terminology a b net c In this a is the percentage discount offered if the payment is made within b days and if the payment is not made in b days then the remaining amount is due in c days For example

Download Discount Payment Meaning In Accounting

More picture related to Discount Payment Meaning In Accounting

Purchases With Discount gross Principlesofaccounting

https://www.principlesofaccounting.com/wp-content/gallery/Illustrative-Entries/purchasedisc3.png

What Is Cash Discount Definition Methods Examples Tally Solutions

https://resources.tallysolutions.com/wp-content/uploads/2020/02/Term-Discount.jpg

Discount Allowed And Discount Received Journal Entries With Examples

https://www.wallstreetmojo.com/wp-content/uploads/2020/07/Discount-Allowed-and-Discount-Received.jpg

Learn the proper accounting methods for sales discounts to ensure accurate financial reporting and compliance with revenue recognition standards Sales discounts are a common strategy businesses use to incentivize prompt payments or move inventory quickly In order to encourage early payment each business normally provides a sales discounts if customers make payment within the discount period In this article we cover the accounting for sales discounts

In any transaction involving a discount one party allows a discount and another receives the discount For the buyer the discount received is an income of the buyer and the discount allowed is the seller s expense Prompt payment discount is different to the other two It s a percentage of an invoice total that is deducted by the customer if the invoice is paid within a specific timescale PPD is offered to customers to encourage them to pay invoices earlier than the

Amortizing Bond Discount Using The Effective Interest Rate Method

https://www.accountingcoach.com/wp-content/uploads/2013/10/89X-journal-18.png

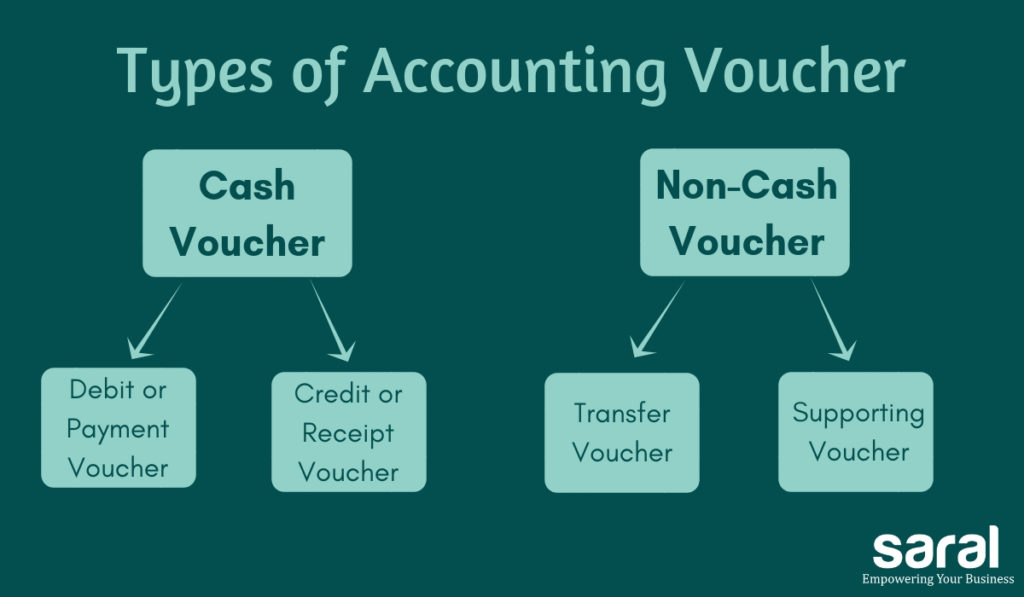

Different Types Of Vouchers In Accounting Meaning And Benefits

https://www.saralaccounts.com/wp-content/uploads/2019/05/Types-of-Vouchers-in-Accounting.-1024x597.jpg

https://www.accaglobal.com › ... › technical-articles › discounts.html

Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account

https://www.accountingtools.com › articles › what-is...

A discount allowed is when the seller grants a payment discount to a buyer A discount received is when the buyer is granted a discount by the seller

DISCOUNT Question Discount Examples Types Of Discount Discount

Amortizing Bond Discount Using The Effective Interest Rate Method

What Is 2 10 N 30 What Is 2 10 Net 30 Discount Term In

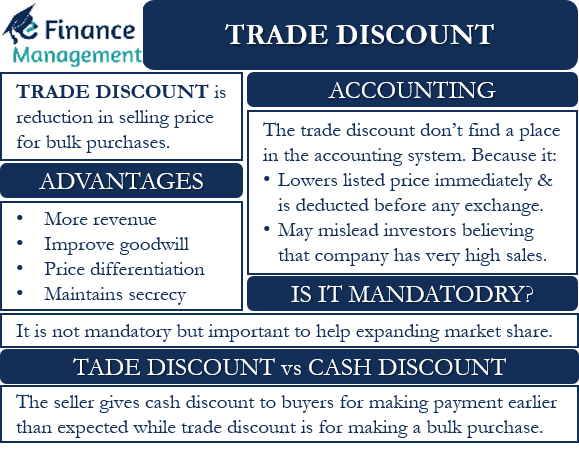

Trade Discounts Meaning Benefits Accounting And More

Gross And Net Methods Of Accounting For Cash Discounts Purchase

Net 30 And Other Invoice Payment Terms InvoiceBerry Blog

Net 30 And Other Invoice Payment Terms InvoiceBerry Blog

How To Show An Advance Payment Discount On A Commercial Invoice

Cash Discount Accounting Accounting For Cash Discount On Sales 2022

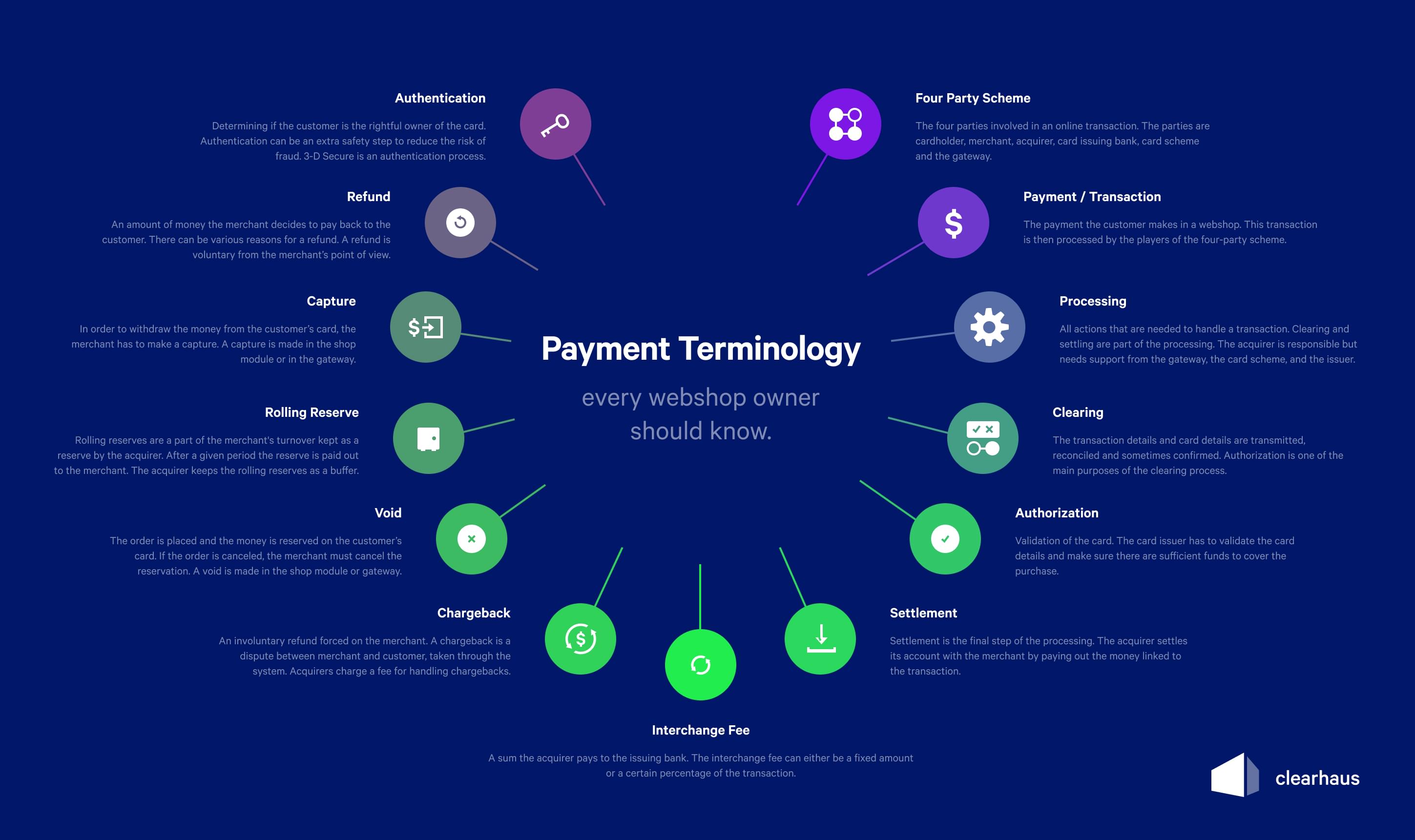

Dictionary Payment Terms You Should Know Clearhaus Blog

Discount Payment Meaning In Accounting - In part 2 discount calculations we looked at how each type of discount is shown on an invoice how those invoices are entered into the accounting records at the point they are sent to the customer and then how the accounts are updated once a payment is received