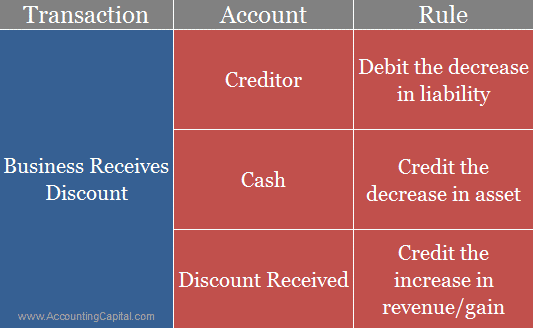

Discount Received Journal Entry Debit Or Credit The discount received is received by the buyer from the seller The discount allowed is the expense of the seller Discount Received is an

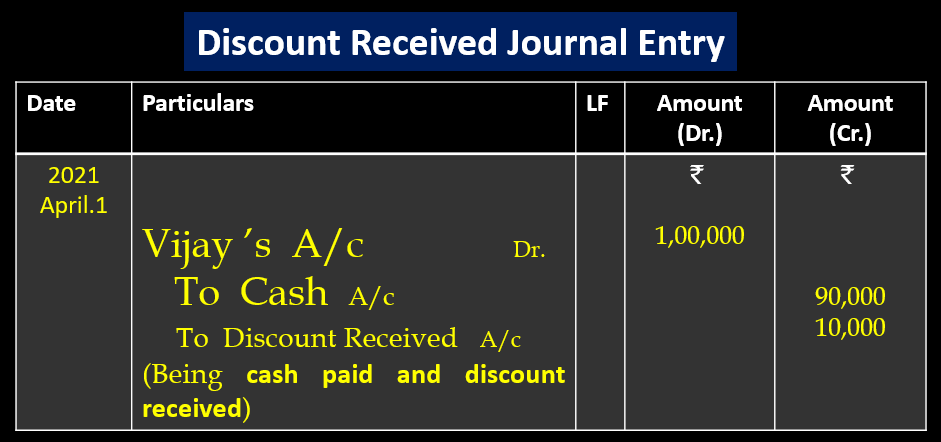

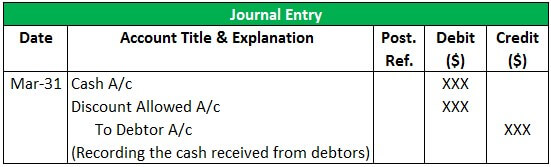

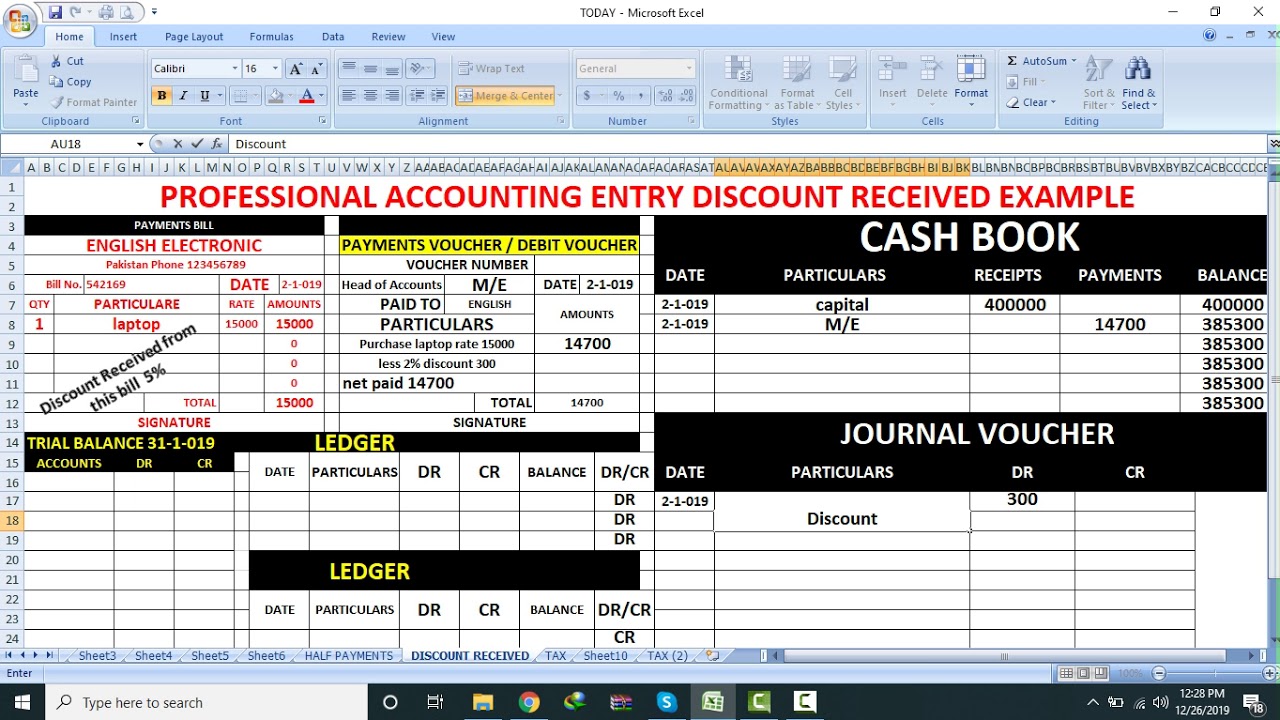

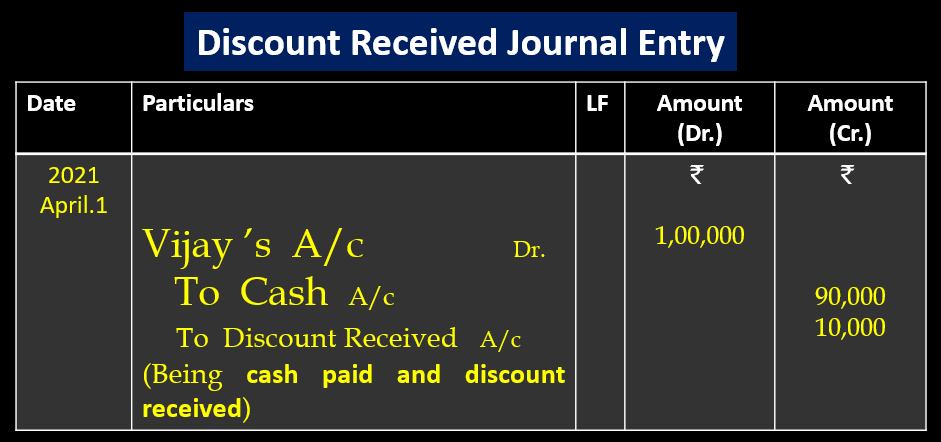

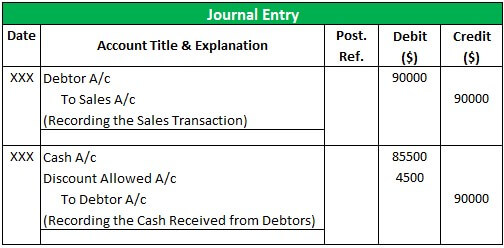

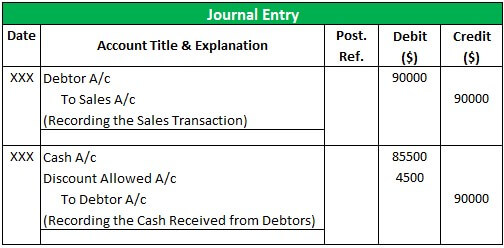

Discount received journal entry The company can make the discount received journal entry by debiting the accounts payable and crediting the discount received account The entry to record the receipt of cash from the customer is a debit of 950 to the cash account a debit of 50 to the sales discount contra revenue account and a

Discount Received Journal Entry Debit Or Credit

Discount Received Journal Entry Debit Or Credit

https://jkbhardwaj.com/wp-content/uploads/2022/02/Screenshot-815.png

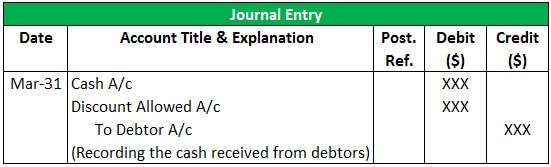

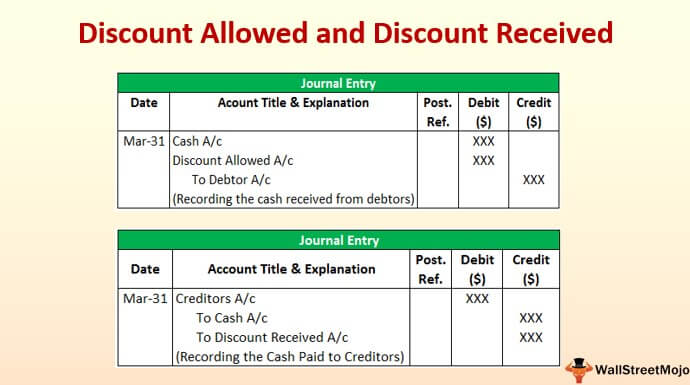

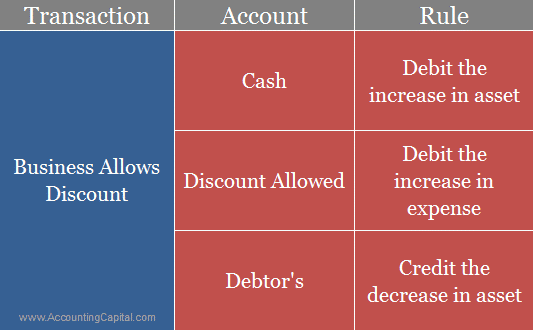

Discount Allowed And Discount Received Journal Entries With Examples

https://www.wallstreetmojo.com/wp-content/uploads/2020/07/Discount-Allowed-and-Discount-Received-Journal-Entry-1.4.jpg

Journal Entries DISCOUNT RECEIVED JOURNAL ENTRY YouTube

https://i.ytimg.com/vi/FiV643Gikio/maxresdefault.jpg

Credit Discount Received Income Statement Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received Consequently At the payment date within 10 days debit of 28 000 to Accounts Payable credit of 27 720 to Cash credit of 280 to Purchases Discounts a contra account to

The journal entry for discount received will depend on the type of discount and the accounting method used but generally it will involve a debit to the Credit Discount Received income statement Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received Consequently

Download Discount Received Journal Entry Debit Or Credit

More picture related to Discount Received Journal Entry Debit Or Credit

Discount Received Journal Entry KaydenceminJoyce

https://www.accountingcapital.com/wp-content/uploads/2018/08/Explanation-and-rules-for-journal-entry-for-discount-received.png

What Is Double Entry Bookkeeping Debit Vs Credit System

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/21012213/Double-Entry-Accounting-System-Chart-960x380.jpg

Debits And Credits Debits And Credits Cheat Sheet Used In Bookkeeping

https://i.pinimg.com/736x/c1/5a/ee/c15aeea266ea29ebbc8ba814b9cb1537.jpg

Basically the cash discount received journal entry is a credit entry because it represents a reduction in expenses The exceptions to this rule are the accounts Sales Returns Sales Allowances and Sales If a customer takes advantage of these terms and pays less than the full amount of an invoice the seller records the discount as a debit to the sales discounts

Credit Note for Discount Allowed Journal Entry Explained Debit The debit entry to discount allowed represents the expense reduction in revenue to the business of issuing the customer with a 150 Purchase discounts journal entry Account Debit Credit Account payable 1 500 Purchase discount 30 Cash 1 470 Total 1 500 1 500

Discount Received Journal Entry CArunway

https://www.carunway.com/wp-content/uploads/2023/02/Discount-Received-Journal-Entry-Snips-1024x512.png

Cash Discount CA Ambition

https://keydifferences.com/wp-content/uploads/2014/12/journal-entry1.jpg

https://www.wallstreetmojo.com/discount-allo…

The discount received is received by the buyer from the seller The discount allowed is the expense of the seller Discount Received is an

https://accountinginside.com/discount-received-journal-entry

Discount received journal entry The company can make the discount received journal entry by debiting the accounts payable and crediting the discount received account

Discount Allowed And Discount Received Journal Entries With Examples

Discount Received Journal Entry CArunway

Accounting Basics Part 1 Accrual DoubleEntry Accounting Debits

Discount Received Journal Entry KaydenceminJoyce

Purchases With Discount gross Principlesofaccounting

Discount Allowed And Discount Received Journal Entries With Examples

Discount Allowed And Discount Received Journal Entries With Examples

LO 3 5 Use Journal Entries To Record Transactions And Post To T

Cash Discount Received Double Entry Bookkeeping

What Are Debits And Credits In Accounting

Discount Received Journal Entry Debit Or Credit - Whenever cash is received debit Cash Whenever cash is paid out credit Cash With the knowledge of what happens to the Cash account the journal entry to record the debits