Do Active Duty Military Pay Taxes On Vehicles No you cannot buy a new car tax free You will pay the appropriate sales tax for the state in which you purchase it regardless of whether or not you are deemed on active duty guard

Active duty military members are typically exempt from paying sales tax on cars when purchasing a vehicle in their home state This benefit is provided as a way to show Active duty military members are required to pay taxes properly ad valorem assessed by the state in which their vehicle is already registered This is often a military member s state

Do Active Duty Military Pay Taxes On Vehicles

Do Active Duty Military Pay Taxes On Vehicles

https://i.pinimg.com/736x/30/40/96/3040960db40e8635e6e93adc99f63275.jpg

Army Rcp Dates Army Military

https://usmcinfantrybrothers.files.wordpress.com/2020/01/screen-shot-2020-01-09-at-13.36.10.png?w=736

US Military Service Members Likely To Pay Double In FICA Taxes For

https://d1ndsj6b8hkqu9.cloudfront.net/link_data_pictures/images/000/586/897/original/image.jpg

No 95 Feb 16 1966 concluding that non resident military personnel stationed in Missouri may obtain a certificate of no tax due often called a waiver from the collector and license their When a motor vehicle is purchased outside of Texas and brought into Texas for use by a military member whose home of record is Texas the 6 25 percent Texas motor vehicle use tax is due

You don t have to report any nontaxable military pay on your income taxes such as basic pay earned in a combat zone imminent danger pay hazardous duty pay earned in combat Basic Allowance for Housing BAH or Active duty military members are required to pay taxes on their vehicles just like any other citizen They must register their vehicles and pay any necessary taxes in the state

Download Do Active Duty Military Pay Taxes On Vehicles

More picture related to Do Active Duty Military Pay Taxes On Vehicles

Army Reserve Weekend Pay Army Military

https://usmcinfantrybrothers.files.wordpress.com/2020/01/screen-shot-2020-01-09-at-13.16.38.png?w=1472

Army Continuation Pay 2022 Army Military

https://i2.wp.com/military-paychart.com/wp-content/uploads/2020/12/air-force-reserve-officer-pay-chart-2019-in-2020-army-pay-1536x905.png

Air Force Pay Chart 2023 Airforce Military

https://savingtoinvest.com/wp-content/uploads/2022/07/image-4.png

Motor vehicles registered in Tennessee are exempt from sales and use tax if the vehicle is sold to any of the following military service members A A member of a uniformed service in active No active military members do not have to pay personal property taxes on their vehicles even if they are stationed in a different state This is thanks to the Servicemembers

Service members who served or are serving on active duty in time of war are eligible for an exemption of up to 1 500 worth of taxable property they own The exemption Texas however does not require non Texas military members to register vehicles in state Texas law also states that military members that chose to register their vehicle in Texas pay the

Car Insurance For Active Duty Military

https://www.carinsurancecompanies.com/wp-content/uploads/AdobeStock_49225111-1600x1600.jpg

Dd Form 2875 Air Force Airforce Military

https://www.militarycostcutters.com/Includes/Images/dd214example.gif

https://www.reddit.com › MilitaryFinance › comments › ...

No you cannot buy a new car tax free You will pay the appropriate sales tax for the state in which you purchase it regardless of whether or not you are deemed on active duty guard

https://thegunzone.com › does-active-duty-military...

Active duty military members are typically exempt from paying sales tax on cars when purchasing a vehicle in their home state This benefit is provided as a way to show

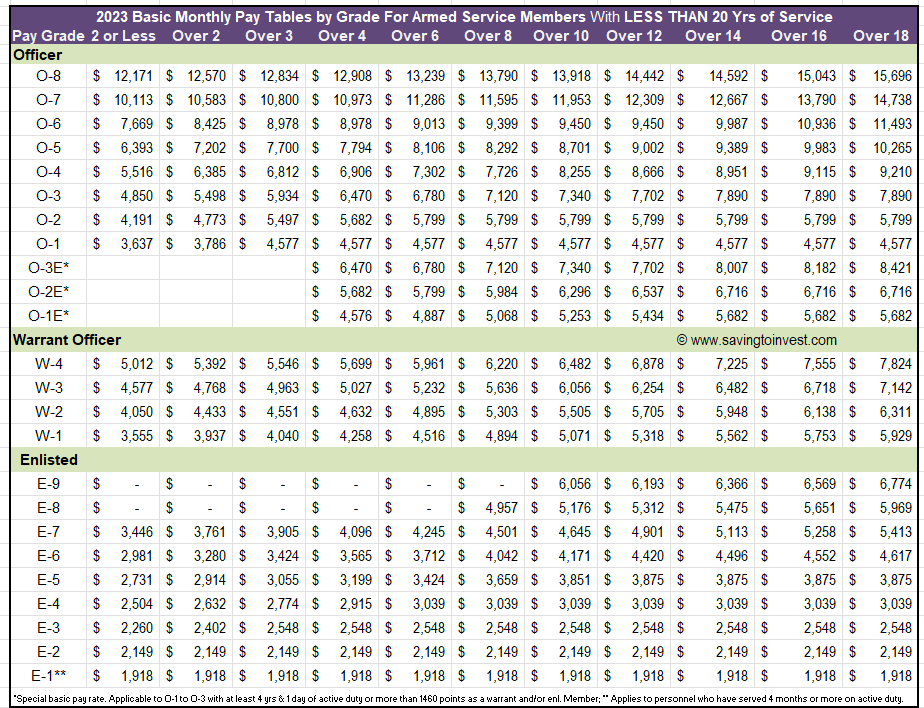

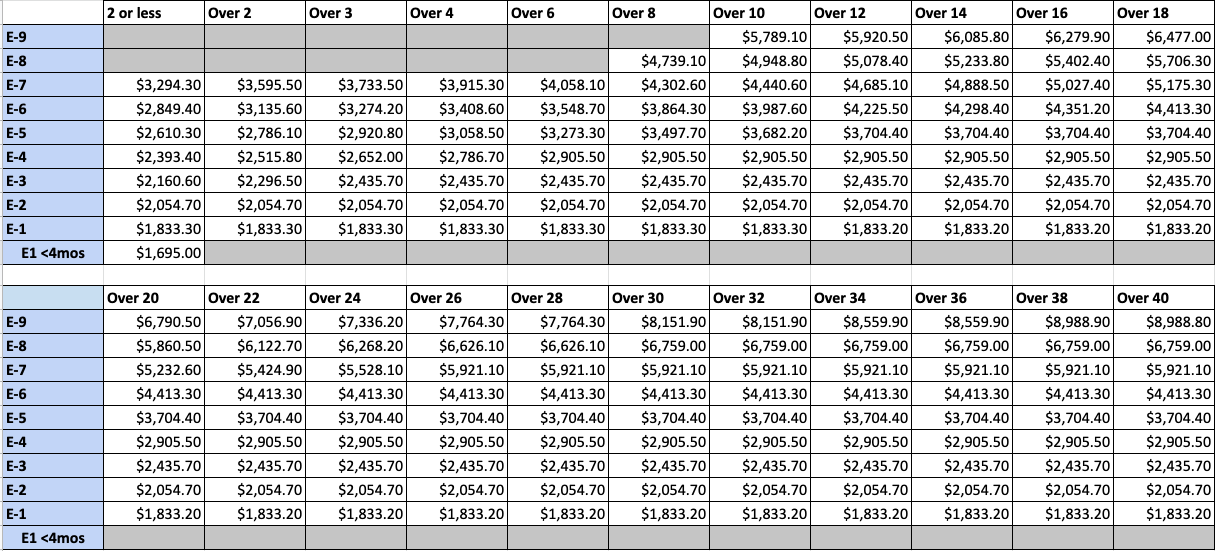

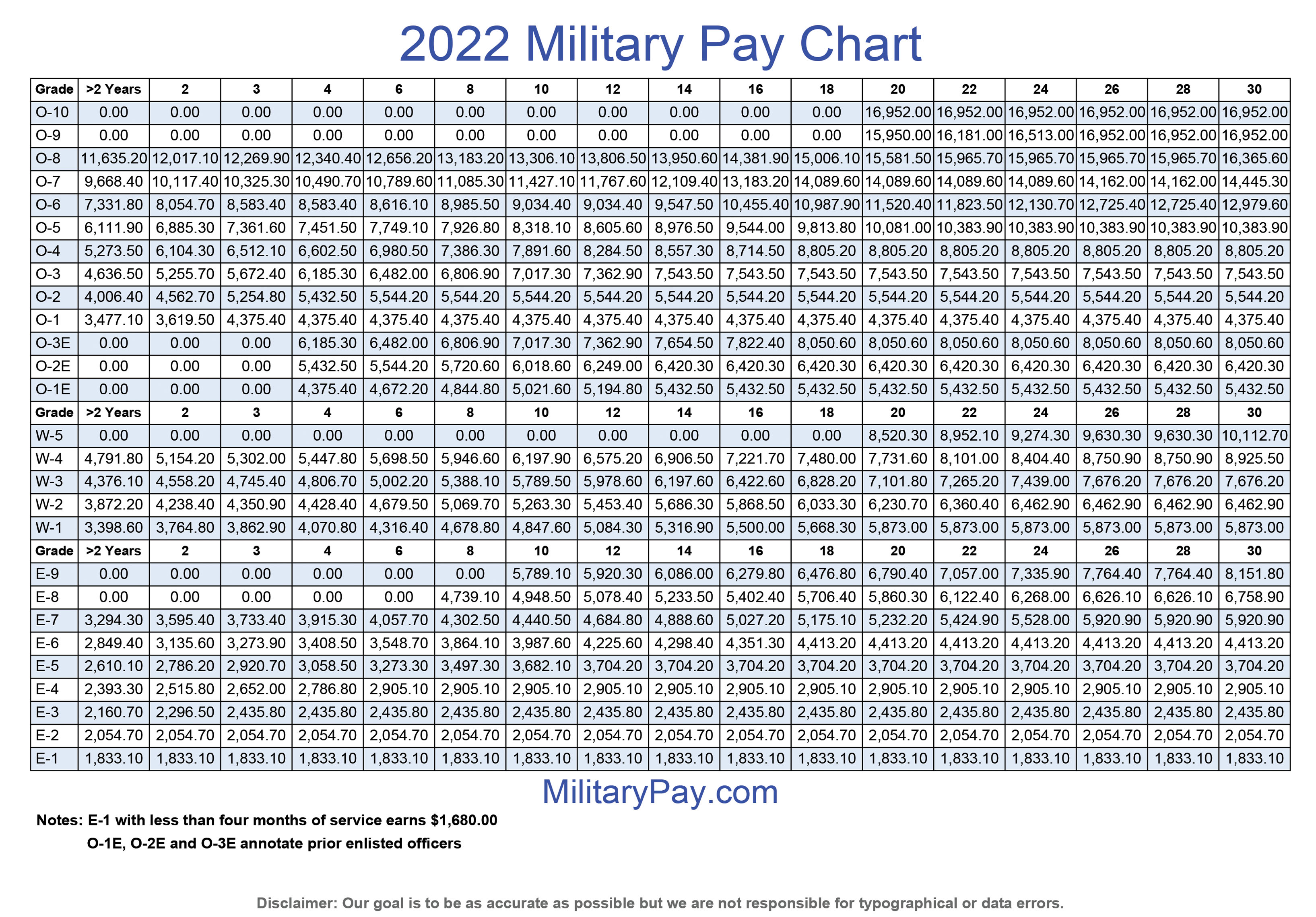

2023 Military Pay Tables 2023

Car Insurance For Active Duty Military

Military Orders Example Fill And Sign Printable Template Online US

How To Pay Military Taxes While Deployed Credello

Active Duty Retirees And Civilians Robins AFB Library Guides At

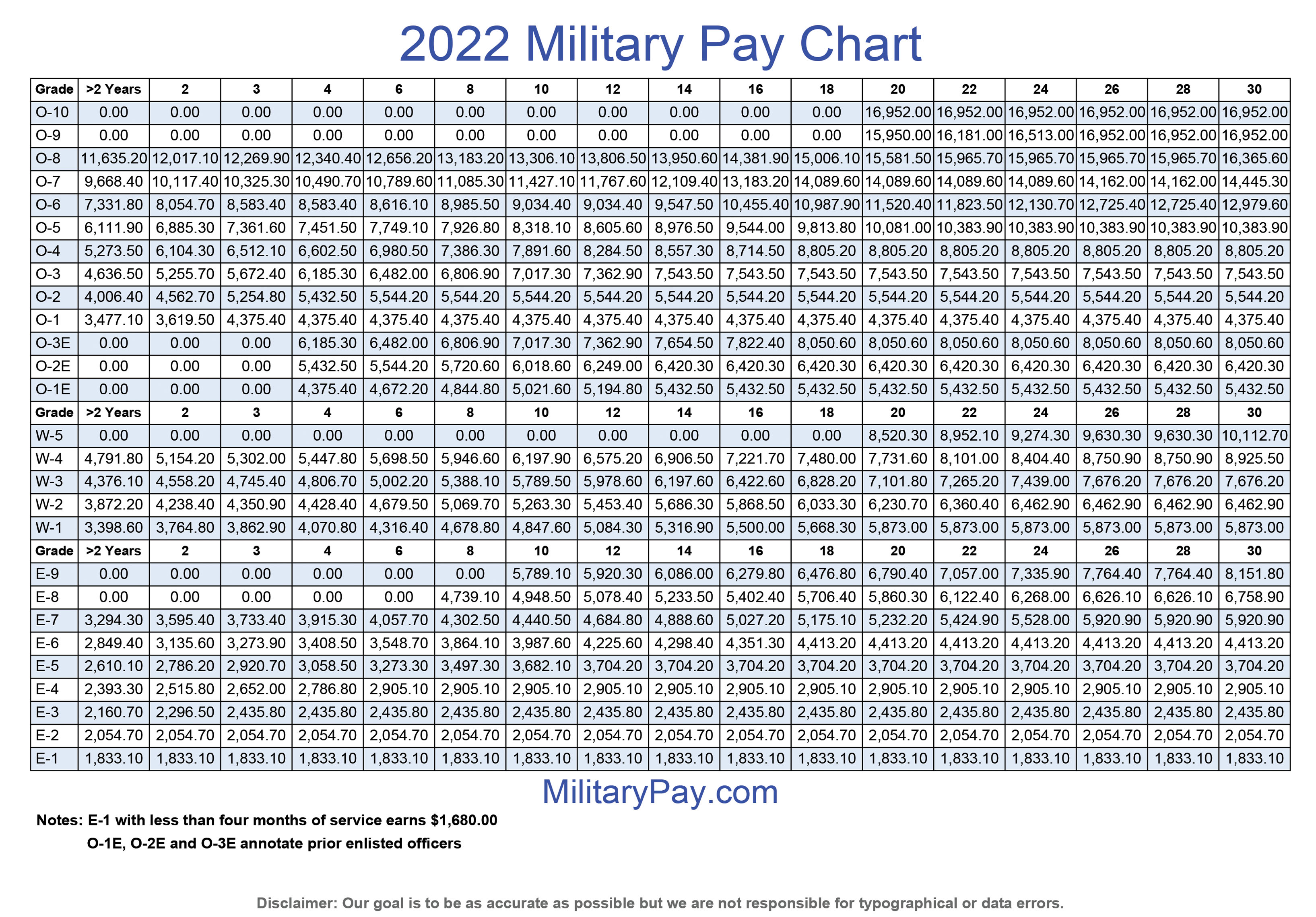

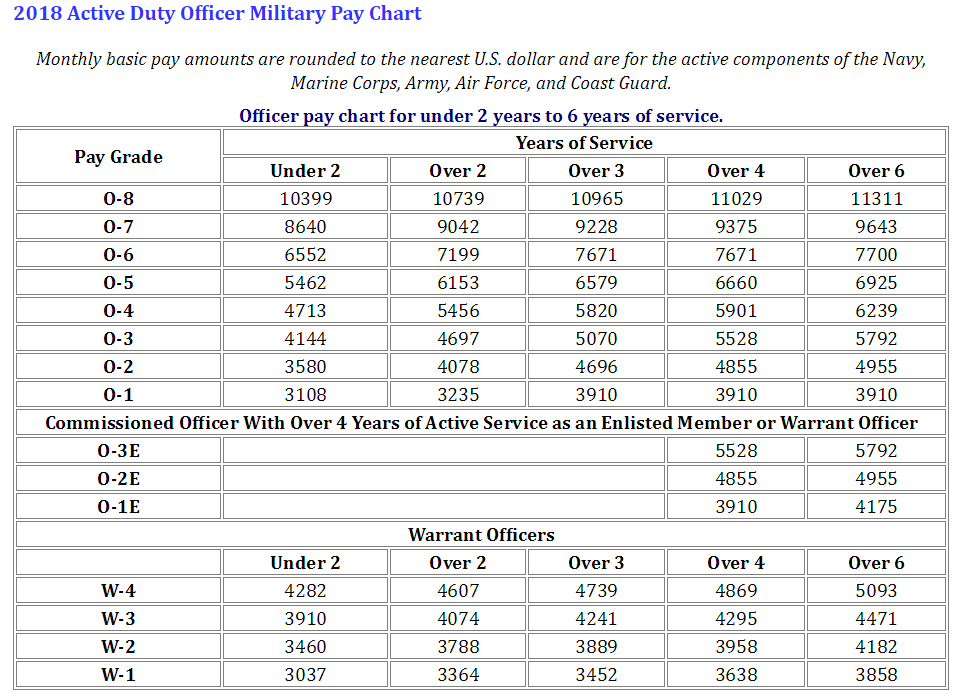

Military Pay Charts 1949 To 2022 Plus Estimated To 2050

Military Pay Charts 1949 To 2022 Plus Estimated To 2050

Army National Guard Pay Chart 2019 Va Air

2023 Fed Pay Raise 2023

Dod Pay Chart 2021 Best Picture Of Chart Anyimage Org

Do Active Duty Military Pay Taxes On Vehicles - No 95 Feb 16 1966 concluding that non resident military personnel stationed in Missouri may obtain a certificate of no tax due often called a waiver from the collector and license their