Do Child Tax Credits Phase Out The child tax credit plateaus at 2 000 per child the maximum amount available per child under current law Phase out This is the point after the plateau when the credit

If you are filing for a single return your child tax credit phases out if your annual income exceeds 75 000 On the other hand if you are filing a joint return the phasing out For 2024 taxes for returns filed in 2025 the IRS Child Tax Credit is worth up to 2 000 for each qualifying dependent child You can claim this

Do Child Tax Credits Phase Out

Do Child Tax Credits Phase Out

https://www.the-sun.com/wp-content/uploads/sites/6/2022/10/child-tax-credit-written-paper-754134886.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

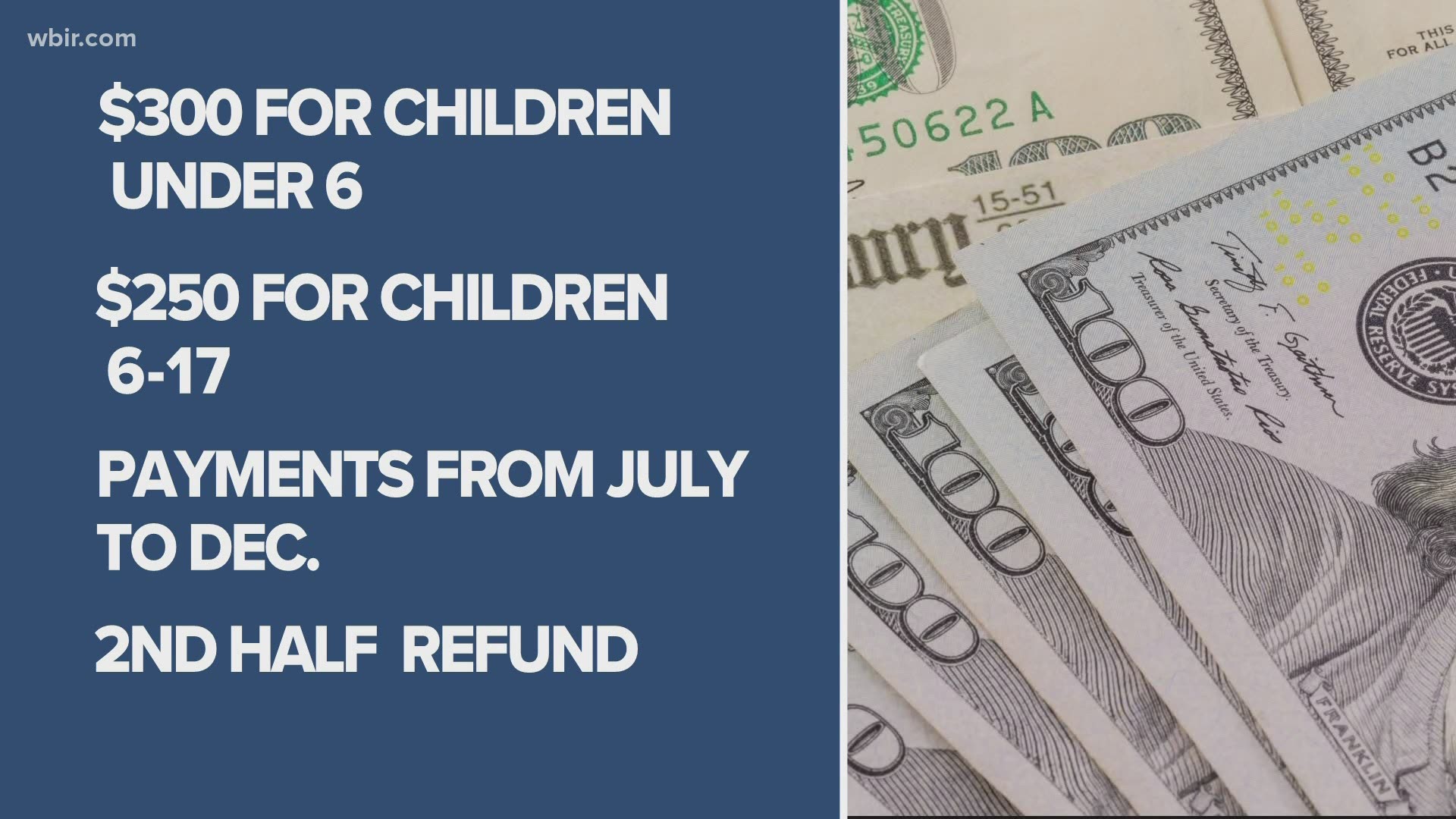

Child Tax Credit Changes Coming Soon Update From The IRS

https://goqbo.com/app/uploads/2021/06/Child-Tax-Credits-1024x683.png

Some Households May Have To REPAY Child Tax Credit Here s How It Will

https://www.the-sun.com/wp-content/uploads/sites/6/2021/06/OFFPLAT-RD-STIMULUS-1.jpg?w=1240

Learn everything about the Child Tax Credit 2025 including eligibility income limits refundable vs non refundable credits and how U S expats can maximize their benefits The Child Tax Credit CTC has returned to normal levels and can only be claimed when filing your tax return versus advance fully refundable payments provided during the pandemic

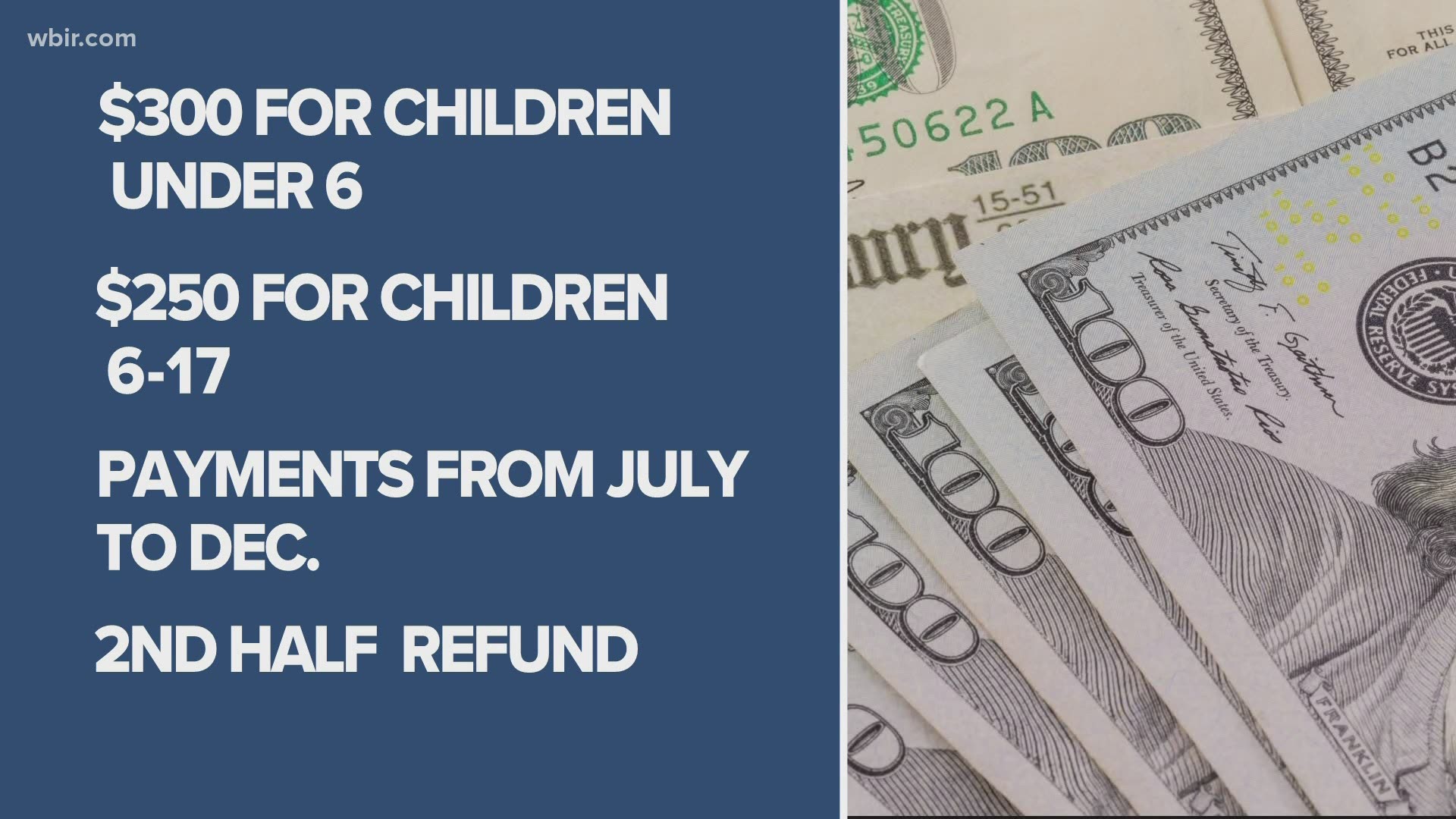

For 2025 the maximum credit per qualifying child under age 17 remains 2 000 Up to 1 600 of the credit is refundable meaning eligible families can receive it even if they For 2021 prior to ARPA the child tax credit would allow eligible taxpayers to reduce their federal income tax liability by up to 2 000 per qualifying child A qualifying child

Download Do Child Tax Credits Phase Out

More picture related to Do Child Tax Credits Phase Out

5 Smart Uses For Your Monthly Child Tax Credit Payments Finance Say

https://www.financesay.com/wp-content/uploads/2021/07/child_tax_credits.jpg

Families With Newborns Qualify For 3 600 Child Tax Credit As Next

https://www.the-sun.com/wp-content/uploads/sites/6/2021/07/NINTCHDBPICT000665941857.jpg?strip=all&quality=100&w=1200&h=800&crop=1

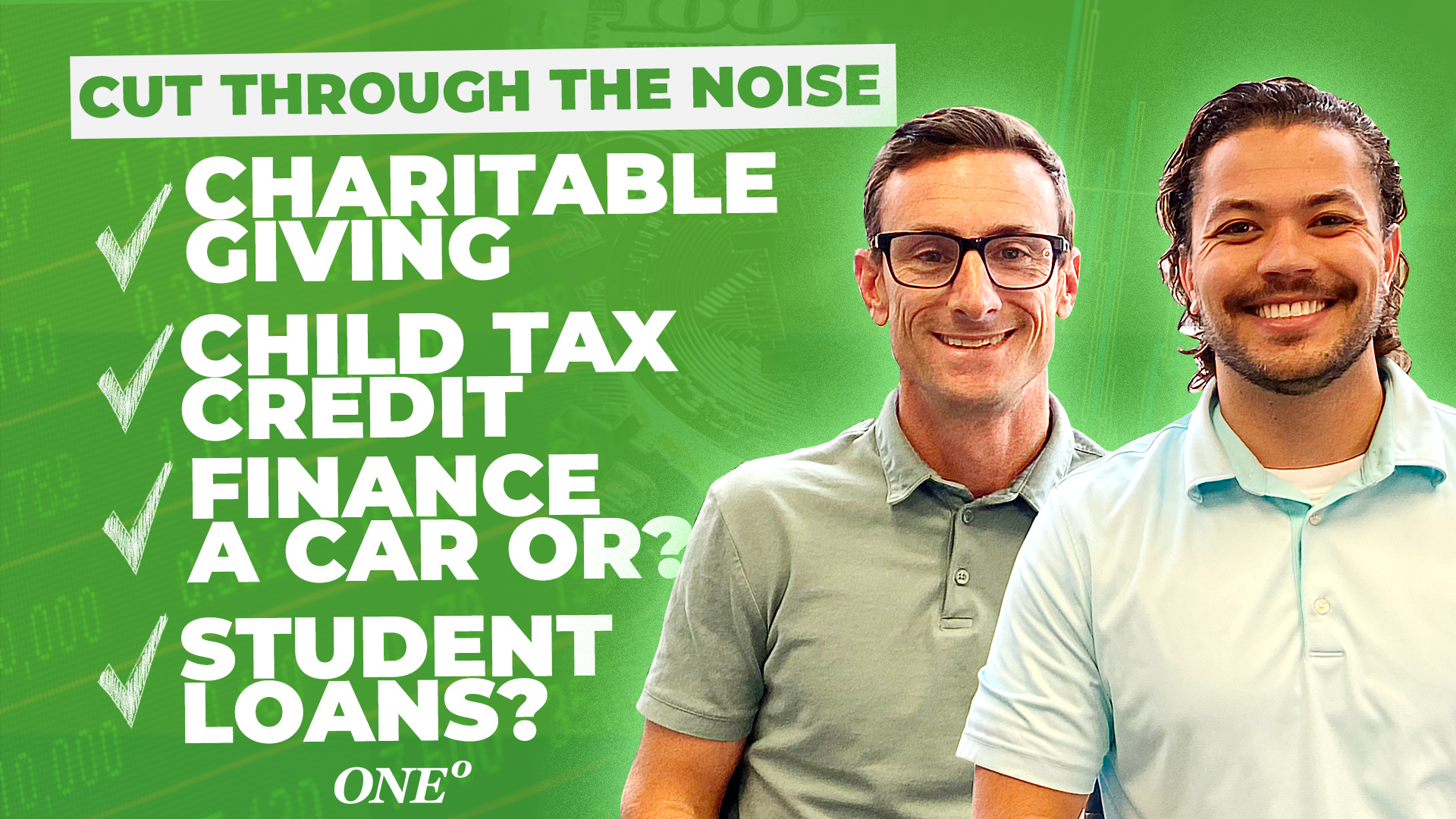

Child Tax Credits Student Loan Forgiveness More Cut Through The

https://onedegreeadvisors.com/wp-content/uploads/2021/08/YT-thumb.jpg

In 2025 the Child Tax Credit CTC provides 2 000 per qualifying child under 17 with income phase out thresholds starting at 400 000 for married couples filing jointly and 200 000 for single filers heads of household and The Child Tax Credit phases out in two different steps based on your modified adjusted gross income AGI in 2021 The first phaseout can reduce the Child Tax Credit to

The Child Tax Credit begins to phase out when your Income exceeds 200 000 if you re a single filer Income exceeds 400 000 if you re married filing jointly The credit phased out in two steps First the credit began to decrease at 112 500 of income for single parents 150 000 for married couples declining in value at a rate of 5 percent of

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

https://www.the-sun.com/wp-content/uploads/sites/6/2021/11/KB_COMP_child-tax-credit-ctc-2.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Maximizing The Child Tax Credit even Without Earned Income Go Curry

https://www.gocurrycracker.com/wp-content/uploads/2020/10/child-tax-credit-phase-out.png

https://taxpolicycenter.org › fiscal-facts › child-tax...

The child tax credit plateaus at 2 000 per child the maximum amount available per child under current law Phase out This is the point after the plateau when the credit

https://www.omnicalculator.com › finance › child-tax-credit

If you are filing for a single return your child tax credit phases out if your annual income exceeds 75 000 On the other hand if you are filing a joint return the phasing out

Monthly Child Tax Credit Checks Worth 300 could Be Extended Until

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

Expanded Child Tax Credit Gains Popularity Kiplinger

Does Maryland Have A Child Tax Credit Have An Amazing Blogosphere

New Transformative Monthly Child Tax Credits Are Starting To Go Out

Child Tax Credit You Can Opt out Of Monthly Payment Soon Fox61

Child Tax Credit You Can Opt out Of Monthly Payment Soon Fox61

New Child Tax Credit Tool Launched To Help Families Claim Up To 3 600

Child Tax Credits Way Better Than Those Stimulus Checks The

Child Tax Credit After Tax Reform 2017 Refund Schedule 2022

Do Child Tax Credits Phase Out - The Child Tax Credit is subject to income phase out rules which reduce the credit for individuals and families whose income exceeds certain thresholds For the 2024 tax year