Do Contractors Charge Sales Tax On Labor In Washington State Sales tax is collected and due on the total contract price Contractor pays sales use tax on all materials consumed by him tools sandpaper etc Does not pay sales tax on materials which become a permanent part of the building

Must also collect and remit retail sales tax on their total charges unless a specific exemption applies This taxable amount includes charges for permits and other fees labor profit materials charges for subcontractors Sales tax rates vary around the state Contractors performing retail services must collect sales tax The taxable amount includes charges for permits and other fees labor profit materials and charges for subcontractors Sales tax rates vary around the state Contractors performing retail services must collect sales tax based on the tax rate of the jurisdiction where they perform their services

Do Contractors Charge Sales Tax On Labor In Washington State

Do Contractors Charge Sales Tax On Labor In Washington State

https://lytaxadvisors.com/wp-content/uploads/2023/12/do-contractors-charge-sales-tax-on-materials-1.png

How Much Do Contractors Charge Per Hour 2024

https://media.angi.com/s3fs-public/general-contractor.jpeg

What States Charge Tax On Beauty Services

https://nutritionless.com/images/do-you-charge-sales-tax-on-labor.jpg

Speculative builders generally pay sales tax on materials and subcontractors but do not pay sales tax on their own employees wages Custom Contractors Custom contractors can generally be defined as contractors that construct buildings or other improvements on real property owned by another person for an Construction Businesses must understand Washington s business tax system and general application of Business and Occupation B O tax classifications retail sales tax and use tax to properly report tax This publication is a guide to help those engaged in construction activities determine their state tax liability

The five states that don t tax construction contractors when they purchase supplies and materials Arizona Hawaii Mississippi New Mexico and Washington often provide an exemption for sub contractors Payment of sales tax on goods delivered to job site Custom contractors that have supplies delivered to the job site pay sales tax on such orders based on the job site location Custom contractors do not typically need to pay sales tax on construction materials that are incorporated into the real estate improvements

Download Do Contractors Charge Sales Tax On Labor In Washington State

More picture related to Do Contractors Charge Sales Tax On Labor In Washington State

Do Construction Companies Charge Sales Tax Kyinbridges

https://kyimages.kyinbridges.com/do-construction-companies-charge-sales-tax-.jpg

Do Contractors Charge Sales Tax On Labor News Week Me

https://ik.imagekit.io/e8n0zowbu/wp-content/uploads/2023/12/do-contractors-charge-sales-tax-on-labor-800x385.jpg

Chicago Sales Tax Clearance Discounts Save 44 Jlcatj gob mx

https://cdn.shopify.com/s/files/1/0070/7032/files/How_to_charge_sales_tax.jpg?v=1656354490

Accordingly the government contractor does not collect sales tax on charges for such work Activities such as the mere sale of tangible personal property or providing professional services to the federal government are not reported under this classification Government contractor is the consumer Yes Washington law has always required developers to pay retail sales tax or use tax on charges by staffing companies for providing temporary construction labor Due to confusion within the staffing industry the department has only recently begun to enforce the requirement for staffing companies to collect sales tax on charges for retail labor

Are services subject to sales tax in Washington Washington often does collect sales taxes on services performed For instance if the services provided have to do with construction services the state of Washington will most likely see them as being taxable Washington requires general contractors to collect retail sales tax on the total contract price when performing work for others at retail Retail sales tax also applies to a subcontractor s total charges contract price to a general contractor unless the general contractor gives the subcontractor a reseller permit

Sales Tax Basics For Interior Designers Capella Kincheloe

https://images.squarespace-cdn.com/content/v1/58406b84b3db2b7f14465fb8/1494268422868-5B16T0ZTDMV7TRE9N0ZN/sales-tax-basics-for-interior-designers-capella-kincheloe.png

Georgia Sales Tax On Fixture Installation And Labor Ansari Law Firm

https://ansaritax.com/wp-content/uploads/2019/01/ansaritax-georgia-sales-tax.jpg

https://dor.wa.gov/.../construction-tax-matrix

Sales tax is collected and due on the total contract price Contractor pays sales use tax on all materials consumed by him tools sandpaper etc Does not pay sales tax on materials which become a permanent part of the building

http://taxpedia.dor.wa.gov/documents/historical industry...

Must also collect and remit retail sales tax on their total charges unless a specific exemption applies This taxable amount includes charges for permits and other fees labor profit materials charges for subcontractors Sales tax rates vary around the state Contractors performing retail services must collect sales tax

Bill Would Cut Washington Sales Tax On Labor Day Weekend 2022 King5

Sales Tax Basics For Interior Designers Capella Kincheloe

Do Construction Companies Need Sales And Use Tax License Kyinbridges

Do Contractors Charge Sales Tax On Labor News Week Me

Do Home Improvement Contractors Charge Sales Tax In Maryland

Assessment Of Sales Tax On Labor In The State Of CT Sapling

Assessment Of Sales Tax On Labor In The State Of CT Sapling

Is Labor Subject To Sales Tax In Florida

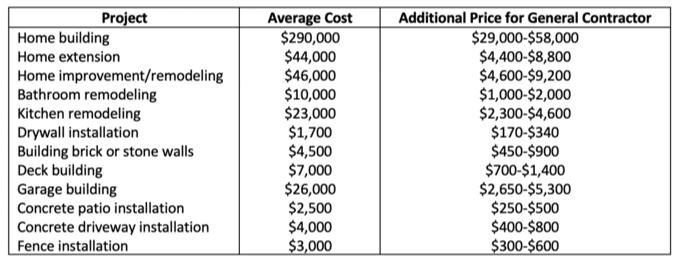

How Much Do Contractors Charge Per Hour ReliaBills

Contractor Hourly Rate Calculator RashumYohana

Do Contractors Charge Sales Tax On Labor In Washington State - WAC 458 20 171 MRSC has prepared a table Public Works Tax Matrix which attempts to summarize WAC regulations regarding sales and use tax applicability to public works contracts For almost all local government public works contracts the sales and use tax issue boils down to this