Do Disabled Pay Property Taxes In Texas New Texas law gives elderly and disabled property tax break AUSTIN Texas The new year is bringing with it new laws For the first time in Texas history a new bill is giving property tax breaks to

Tax Code Section 11 131 entitles a disabled veteran who receives 100 percent disability compensation due to a service connected disability and a rating of 100 percent disabled or of individual unemployability to a total Homeowners over 65 disabled homeowners and disabled veterans may choose to defer property taxes under Section 33 06 of the Texas Tax Code In this case property taxes are postponed until the

Do Disabled Pay Property Taxes In Texas

Do Disabled Pay Property Taxes In Texas

https://blog.paxfinancialgroup.com/hubfs/property taxes and retiring in Texas www.paxfinancialgroup.com.jpeg

MI Disabled Veterans Do NOT Pay Property Taxes YouTube

https://i.ytimg.com/vi/AKl9wlGVGSc/maxresdefault.jpg

Top 15 States For 100 Disabled Veteran Benefits CCK Law

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

Texas provides for a disabled veteran exemption if the property and property owner meet the qualifications A disabled veteran exemption can exempt a portion or the total Do Veterans Pay Property Taxes in Texas Tax exemption options vary from state to state depending on a variety of factors and not all states in the U S offer full tax benefits to disabled vets However

If you are elderly or disabled you qualify for an additional 10 000 school tax exemption Some areas have even higher local exemptions for the elderly and disabled HOUSTON Texans who are age 65 or older or who are disabled as defined by law may postpone paying current and delinquent property taxes on their homes by signing a tax deferral

Download Do Disabled Pay Property Taxes In Texas

More picture related to Do Disabled Pay Property Taxes In Texas

How To Successfully Protest Your Property Tax Appraisal In Harris

https://res.cloudinary.com/agiliti/image/upload/v1664713064/dilapidated-house-assessed-value.webp

CA Parent Child Transfer California Property Tax NewsCalifornia

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/10/California-Property-Taxes-scaled.jpg?resize=2048%2C1192&ssl=1

Hecht Group Outstanding Property Taxes

https://img.hechtgroup.com/1662573424967.jpeg

Disabled veterans owning property other than a residence homestead may qualify for a different exemption under Tax Code Section 11 22 which can be applied to any No While a driver s license or personal identification certificate is required to apply for some exemptions these forms of identification are not satisfactory proof of disability rating for

If you qualify for the Age 65 or Older or Disability exemptions you may defer or postpone paying property taxes on your home for as long as you live in it This deferral does not cancel your taxes Your property taxes accrue five percent interest annually until the deferral is removed The disabled veteran must be a Texas resident and must choose one property to receive the exemption In Texas veterans with a disability rating of 100 are exempt from all

Tax Relief For People With Disability Their Dependents

https://blog.saginfotech.com/wp-content/uploads/2021/12/relief-taxes-people-disability-dependents.jpg

How The Disabled Veterans Property Tax Benefit Works YouTube

https://i.ytimg.com/vi/O8LAZJyQYbo/maxresdefault.jpg

https://cbsaustin.com/news/local/new-te…

New Texas law gives elderly and disabled property tax break AUSTIN Texas The new year is bringing with it new laws For the first time in Texas history a new bill is giving property tax breaks to

https://texvet.org/propertytax

Tax Code Section 11 131 entitles a disabled veteran who receives 100 percent disability compensation due to a service connected disability and a rating of 100 percent disabled or of individual unemployability to a total

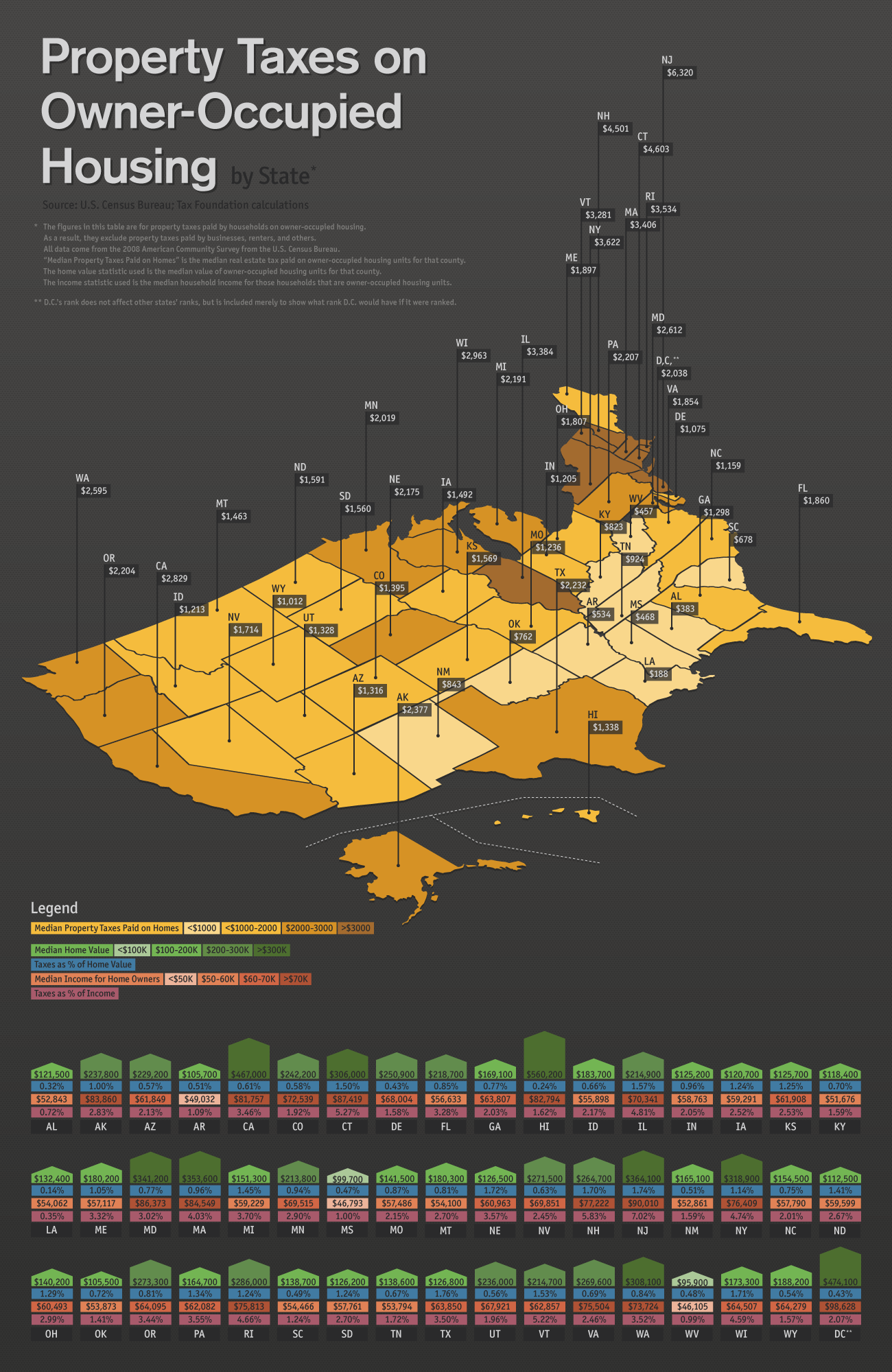

Property Taxes In America The Big Picture

Tax Relief For People With Disability Their Dependents

Hecht Group How To Pay Your Property Taxes In Tarrant County

What Happens If You Don t Pay Property Taxes In Massachusetts Pavel

Circuit Breaker Tax Exemption Archives California Property Tax

Are Property Taxes Included In The Mortgage Coole Home

Are Property Taxes Included In The Mortgage Coole Home

Do Disabled Veterans Pay Sales Tax On Vehicles In Florida Everything

What Happens If You Can t Pay Your Property Taxes Can I Sell My

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

Do Disabled Pay Property Taxes In Texas - Texas Homestead Tax Exemption for 100 Disabled or Unemployable Veterans Property tax in Texas is a locally assessed and locally administered tax by local Appraisal Districts