Do Disabled Veterans Pay Property Taxes All 50 states and the District of Columbia offer property tax benefits for disabled veterans on their primary residence Basic eligibility and the exemption amount depend on your current VA disability rating and property type

While all 50 states offer some sort of property tax exemptions for disabled veterans our new research and analysis uncovered 20 states with no property tax for disabled veterans meaning eligible veterans are completely exempt from paying ANY property tax on their primary residence Veterans with service connected disabilities are eligible for tax breaks and discounts in many states In most cases the tax breaks reduce taxes by lowering the property s assessed value Veterans and their spouses may be able to save thousands of dollars at tax time

Do Disabled Veterans Pay Property Taxes

Do Disabled Veterans Pay Property Taxes

https://img.hechtgroup.com/1664073777943.jpg

Do Disabled Veterans Pay Property Taxes In Ohio STAETI

https://images.radio.com/aiu-media/ohio-7145ce7b-0310-4046-be1a-8be9b1239abb.jpg

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

https://assets.site-static.com/userFiles/3705/image/dis-vet-tax-do.jpg

Disabled veterans may receive a property tax exemption of up to 1 100 on their primary residence if the Veteran is formerly a Prisoner of War and has a 100 percent disability rating A maximum credit of 750 is available to disabled veterans who are renters Property Tax Exemptions for Veterans Some states may only give exemptions to veterans who are 100 permanently disabled or who receive Total Disability Individual Unemployability TDIU Check the rules for your state to be sure

Property tax exemptions for disabled veterans are a small token of appreciation from many states aiming to make homeownership more affordable By staying informed and making the most of these benefits veterans can enjoy the comforts of home without unnecessary financial burdens Property tax exemptions Many states don t require disabled veterans to pay property taxes Often the exemption is only available for veterans who have a 100 permanent and total VA disability rating but some states provide exemptions for veterans who have lower levels of disability

Download Do Disabled Veterans Pay Property Taxes

More picture related to Do Disabled Veterans Pay Property Taxes

Do Disabled Veterans Pay Property Taxes In Ohio STAETI

https://milvetsrc.org/wp-content/uploads/2019/03/2019-Tax-Flyer-1.jpg

Do Disabled Veterans Have To Pay Property Taxes In Arizona YouTube

https://i.ytimg.com/vi/xKxfx2o9dbA/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGCogRyh_MA8=&rs=AOn4CLBVS_6mDk8U214q1yDmFYOqpftgFQ

Disabled Veteran Property Tax Exemption In Every State

https://blog.veteransloans.com/wp-content/uploads/2022/08/Blog-Cover-Disabled-Veteran-Property-Tax-Exemption.jpg

Veterans who have a 100 percent disability rating or are deemed unemployable may qualify for a full property tax exemption on their primary residence Veterans with a lower disability rating can exempt 5 000 to 12 000 of the appraised value on their home depending on the rating Circumstances also come into play a property tax exemption for disabled veterans would be for those who own a home and would normally have to pay property taxes How that exemption works depends on the state you live in See below for more on property tax exemptions for disabled veterans

[desc-10] [desc-11]

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

https://assets.site-static.com/userFiles/3705/image/dis-vet-tax-header.png

Va Disability Calculator Chart

https://cck-law.com/wp-content/uploads/2019/06/VA-pay-chart-infographic-2019-1200px-1.jpg

https://vaclaimsinsider.com/disabled-veteran...

All 50 states and the District of Columbia offer property tax benefits for disabled veterans on their primary residence Basic eligibility and the exemption amount depend on your current VA disability rating and property type

https://vaclaimsinsider.com/property-tax-exemption...

While all 50 states offer some sort of property tax exemptions for disabled veterans our new research and analysis uncovered 20 states with no property tax for disabled veterans meaning eligible veterans are completely exempt from paying ANY property tax on their primary residence

Disabled Veterans Property Tax Exemptions By State Tax Exemption

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

Top 15 States For 100 Disabled Veteran Benefits CCK Law

Disabled Veterans Should Never Have To Pay Property Taxes Editorial

18 States With Full Property Tax Exemption For 100 Disabled Veterans

DAV Oklahoma 100 Disabled American Veterans Pay No Property Tax ad

DAV Oklahoma 100 Disabled American Veterans Pay No Property Tax ad

VA Disability Payment Increase VA Disability Rates 2021

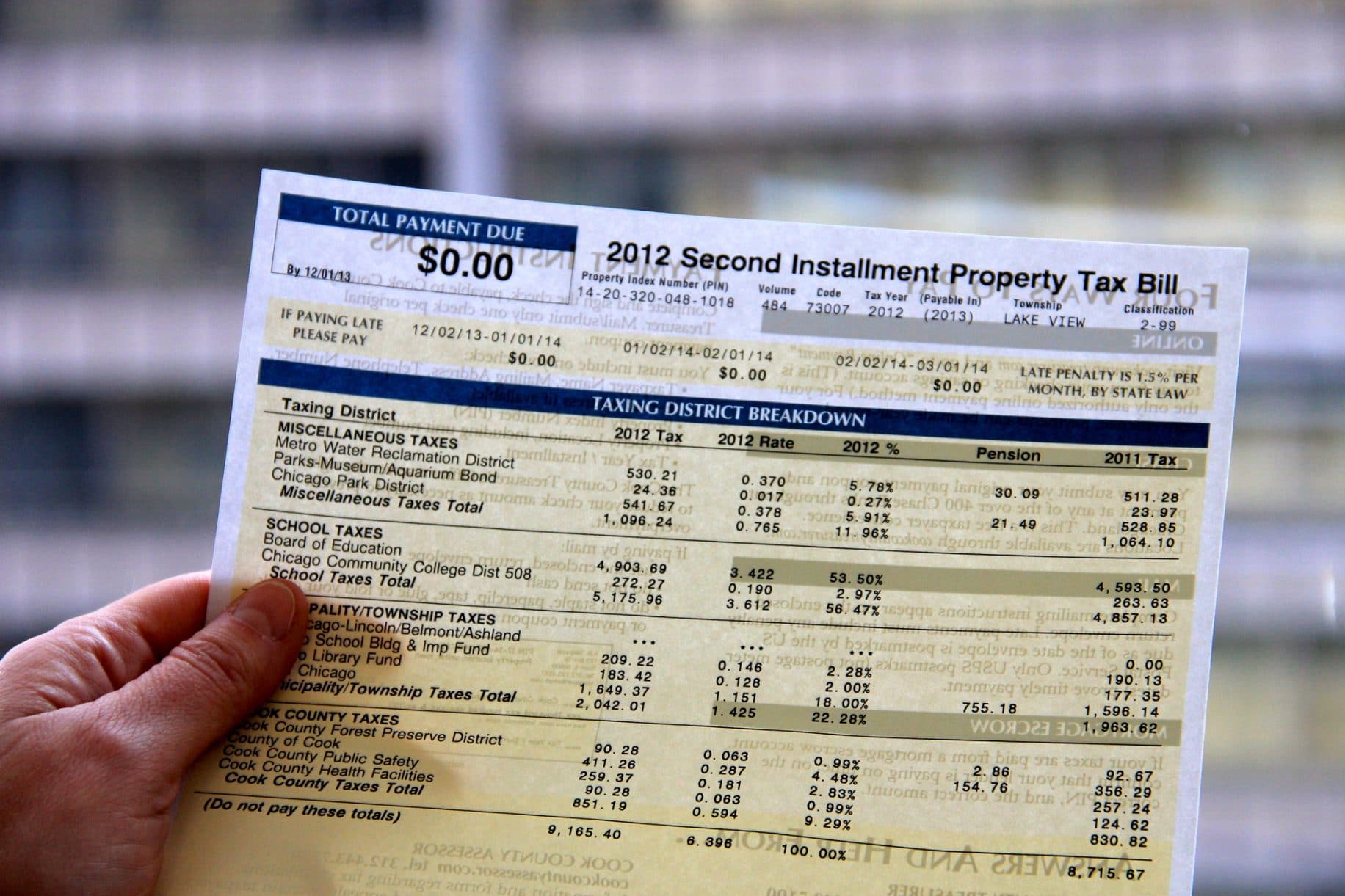

Disabled Veteran To Be Evicted Over Late 236 Property Tax Bill

Does Veterans Pay Property Taxes Va Kreeg

Do Disabled Veterans Pay Property Taxes - [desc-12]