Do Employer Super Contributions Count As Taxable Income James is 35 earns 120 000 p a and has 112 000 in super In 2023 24 his total concessional super contribution was 22 000 That s 13 200 in employer

Key points Money going into your super is generally taxed at a lower rate than your regular income Concessional contributions can be before tax contributions and are Concessional contributions Concessional contributions include employer contributions such as employer super guarantee contributions and any

Do Employer Super Contributions Count As Taxable Income

Do Employer Super Contributions Count As Taxable Income

https://superguy.com.au/wp-content/uploads/2021/08/employer-super-contributions.jpg

Employer Super Contributions How To Pay Super Nationwide Super

https://www.nationwidesuper.com.au/wp-content/uploads/2019/11/NW-header-nov19.jpg

Do Student Loans Count As Taxable Income

https://leveredge-application-public.s3.amazonaws.com/public/VYiofZWjkORdEo3BqfHPBfXIziHQIRGG8m5D1fQu.jpg

Any super contributions made into an employee s account before tax concessional are taxed at 15 and this includes employer contributions such as Defined benefit fund contributions Employer super contributions to a defined benefit fund for employees with defined benefit interests are not reportable This is because

From figuring out what income you ll be taxed on to claiming work deductions tax returns can sometimes feel a bit daunting Here are some tips on how income tax Generally if you earn less than 250 000 per year as of the 2024 25 financial year before tax super contributions are taxed at 15 This tax rate generally applies up to

Download Do Employer Super Contributions Count As Taxable Income

More picture related to Do Employer Super Contributions Count As Taxable Income

How Do Reportable Employer Super Contributions RESC Work

https://www.superguide.com.au/wp-content/uploads/2020/11/writing-c.jpg

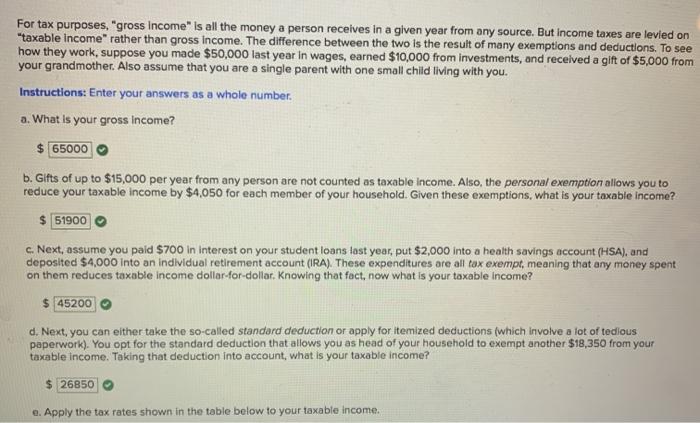

Solved E Apply The Tax Rates Shown In The Table Below To Chegg

https://media.cheggcdn.com/study/ff0/ff01d6ed-b06c-472c-9507-0ae6a6d4109a/image

Does Carer s Payment Count As Taxable Income The Accounting Group

https://images.squarespace-cdn.com/content/v1/6039ed18dca90b29a89eff0c/1617022640173-RKBFFWU09RQL5IDJDLDG/newtaglogofulltransparentbg3.png?format=1500w

Adjusted taxable income may include different types of income taxable income foreign income tax exempt foreign income total net investment losses If you boil it right down the benefit of super is the superannuation tax concessions I mean yes it s a home for compulsory employer super contributions too but the whole system wouldn t be nearly as effective

How super investment earnings are taxed Earnings on investments within your super fund are taxed at 15 This includes interest and dividends less any tax deductions or 1 Salary sacrifice You can ask your employer to pay some of your salary into your super This salary sacrifice is usually on top of the superannuation guarantee minimum

Excess Contributions Tax Are Excess Super Contributions Taxable

https://superguy.com.au/wp-content/uploads/2023/04/excess-contributions-tax.jpg

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

https://www.australiansuper.com/superannuation/how-your-super-is-taxed

James is 35 earns 120 000 p a and has 112 000 in super In 2023 24 his total concessional super contribution was 22 000 That s 13 200 in employer

https://aware.com.au/member/super/understand-super-basics/how-supe…

Key points Money going into your super is generally taxed at a lower rate than your regular income Concessional contributions can be before tax contributions and are

National Insurance contribution rates%2C 2021–22.png?itok=iGs8c8Ix)

National Insurance Contributions Explained IFS Taxlab

Excess Contributions Tax Are Excess Super Contributions Taxable

Voluntary Super Contributions Why You Should Start Yesterday

Do RRSP Contributions Reduce Taxable Income

Here s The Latest 401k IRA And Other Contribution Limits For 2023

Social Security Cost Of Living Adjustments 2023

Social Security Cost Of Living Adjustments 2023

Do Corporate Loans Count As Taxable Income FBC

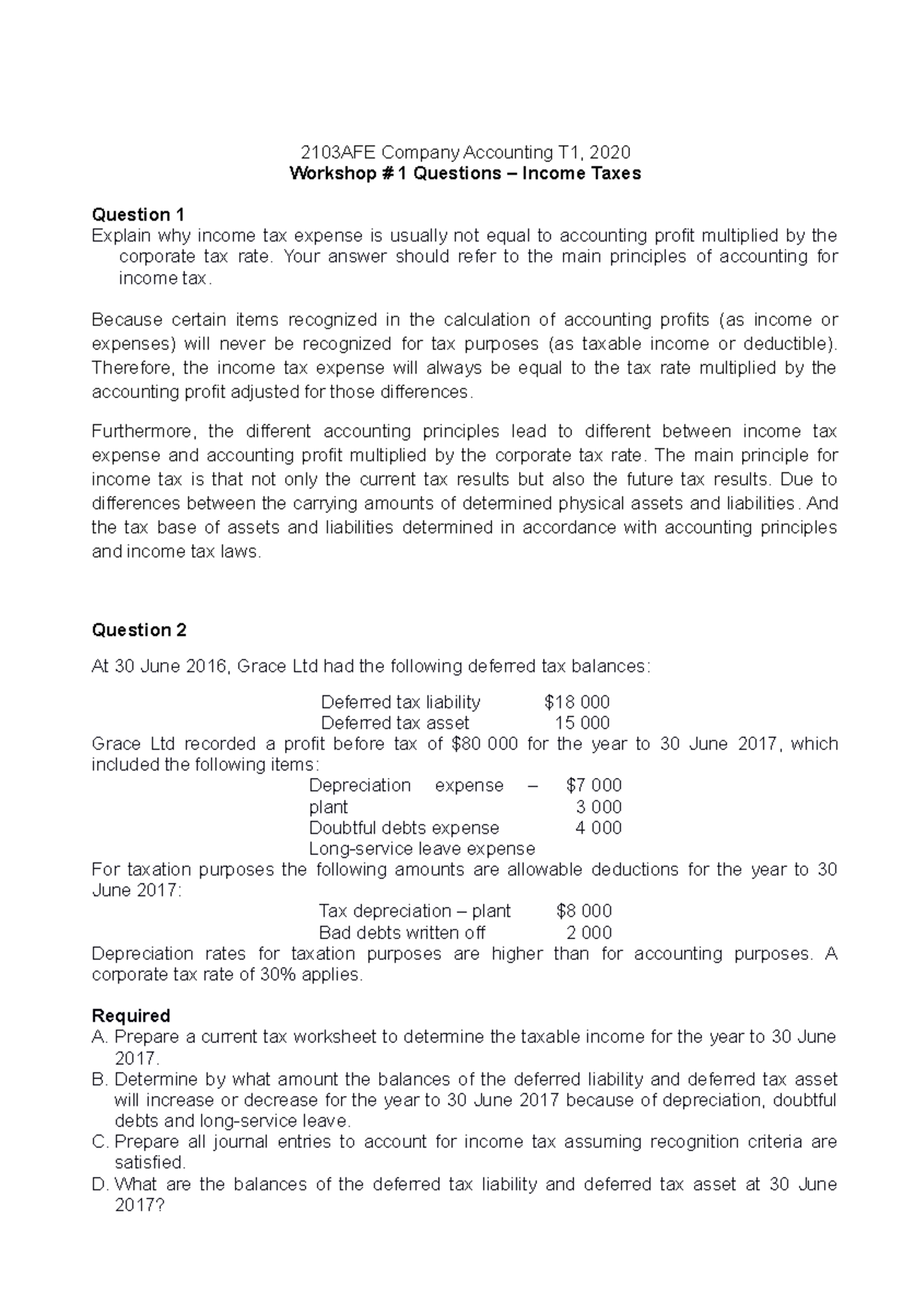

AA 2103AFE 2103AFE Company Accounting T1 2020 Workshop 1

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Do Employer Super Contributions Count As Taxable Income - The concessional contributions cap determines the amount of concessional contributions you can make into super each year Concessional contributions are