Do Employers Pay Tax On Redundancy Payments Web Any redundancy pay over 163 30 000 When you get it your employer will usually have deducted the tax but it s likely they won t have taken off the right amount So you

Web An employer will be required to pay NICs on any part of a termination payment that exceeds the 163 30 000 threshold It is anticipated that this will be collected in real time as Web 12 Apr 2023 nbsp 0183 32 You ll receive your redundancy pay as a lump sum and up to 163 30 000 is generally tax free so you wouldn t owe any income tax or National Insurance contributions NICs It s mandatory for companies to

Do Employers Pay Tax On Redundancy Payments

Do Employers Pay Tax On Redundancy Payments

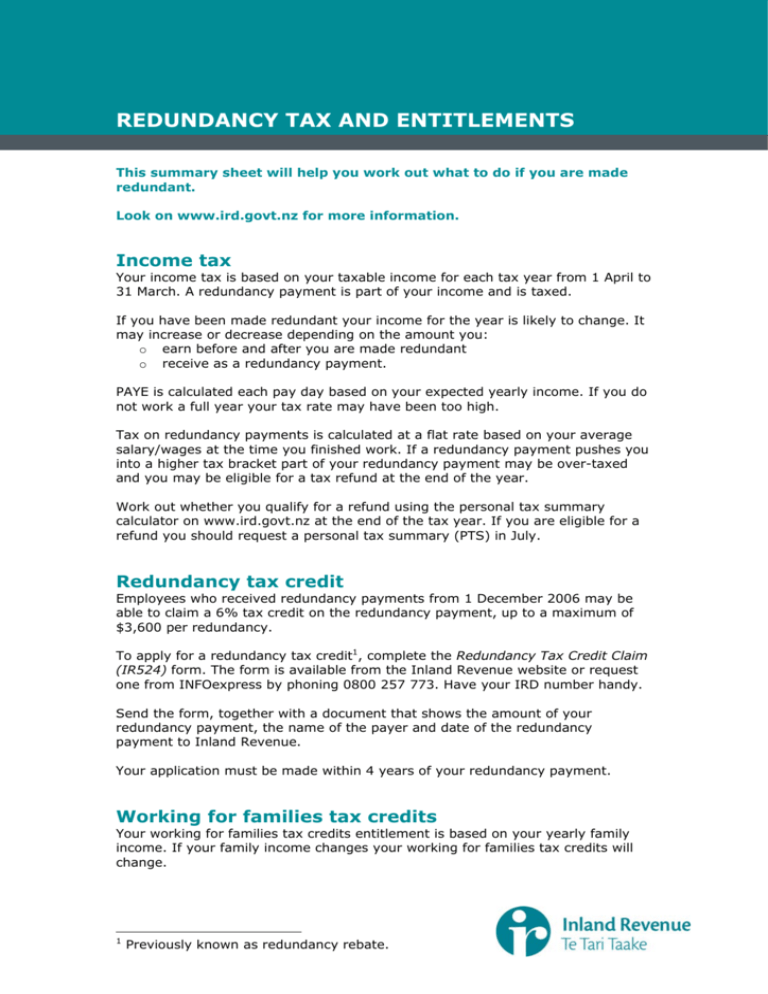

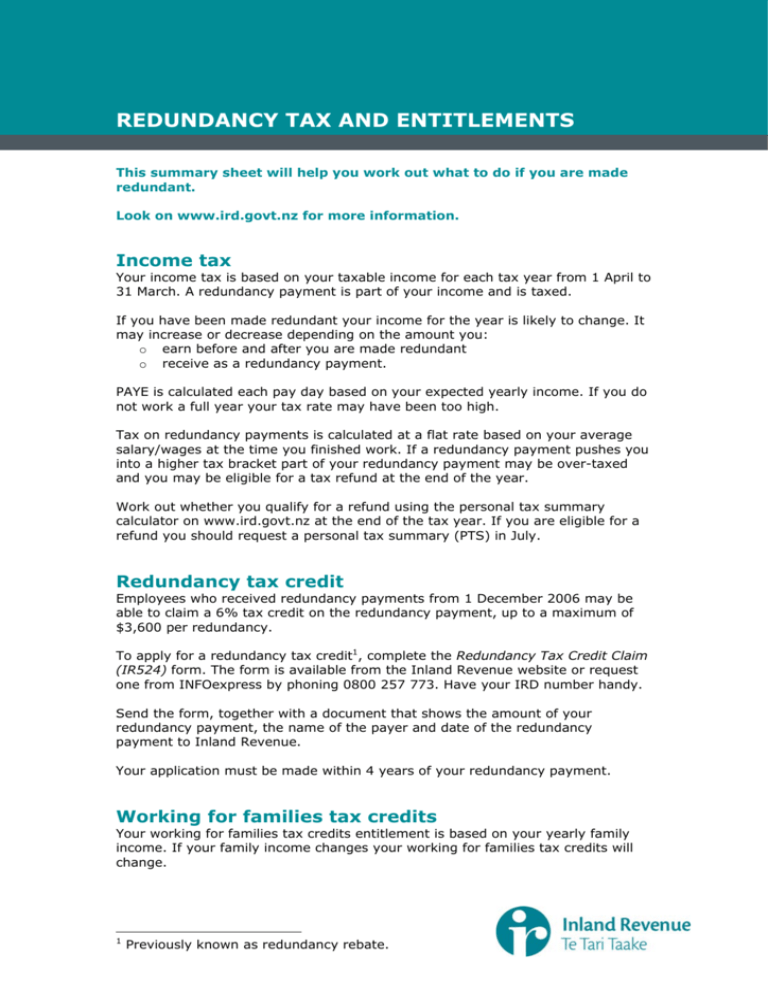

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

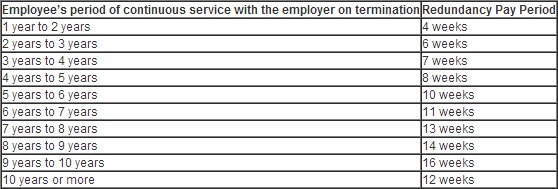

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Suspension Of Employer s Obligation On Redundancy Payments Lifted

https://www.crowe.com/ie/-/media/Crowe/Firms/Europe/ie/Crowe-Ireland/Images/Posts/Redundancy-payments.jpg?h=521&w=750&la=en-GB&modified=20211005083413&hash=549BAB541337142C297F7FD1003D1A24CC78C7A6

Web 17 Jan 2018 nbsp 0183 32 Redundancies qualify for special treatment under tax law you can receive up to 163 30 000 in redundancy pay without having to pay any tax on it There s a legal Web 4 Dez 2023 nbsp 0183 32 Tax treatment of redundancy payments Redundancy pay is compensation for your job loss As such up to 163 30k of it is tax free This applies to a statutory or non statutory where the employer has paid

Web Employees you make redundant might be entitled to redundancy pay this is called a statutory redundancy payment To be eligible an individual must be an employee Web From 6 April 2020 all termination payments that are chargeable to income tax will be subject to employer s Class 1A national insurance contributions at 13 8 to the extent

Download Do Employers Pay Tax On Redundancy Payments

More picture related to Do Employers Pay Tax On Redundancy Payments

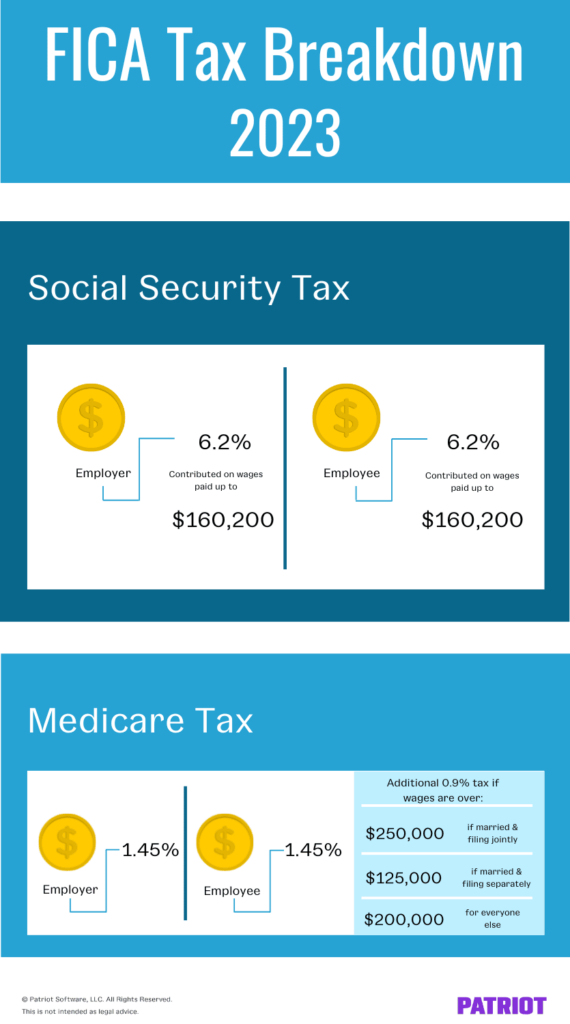

Payroll Tax Estimator GeorgeAnmoal

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Termination Pay Redundancy CooperAitken Chartered Accountants

http://www.cooperaitken.co.nz/wp-content/webpc-passthru.php?src=https://www.cooperaitken.co.nz/wp-content/uploads/2020/08/Redundancy.png&nocache=1

Tax On Redundancy Payments Davis Grant

https://www.davisgrant.co.uk/wp-content/uploads/2020/06/redundancies-blog-featured-image-880x360.jpg

Web 11 Juni 2009 nbsp 0183 32 Redundancy payments are normally taxed as quot compensation quot rather than earnings The first 163 30 000 of compensation can normally be paid tax free and no NICs Web 5 Nov 2020 nbsp 0183 32 On general principles redundancy payments will be allowable as deductions provided that they are paid wholly and exclusively for trade purposes and do not result in the trader acquiring assets or

Web 4 Okt 2022 nbsp 0183 32 Your employer must pay you your redundancy pay even if they didn t know about your redundancy This includes cases where you did not tell your employer that Web 17 Juli 2023 nbsp 0183 32 If the redundancy figure is below 163 30000 you only enter the redundancy figure in the box Compensation and lump sums payments up to the 163 30 000

Payroll Tax Vs Income Tax What s The Difference

https://m.foolcdn.com/media/affiliates/images/Payroll_vs_Income_Taxes_-_01_-_Gusto_6L7kKsQ.width-750.png

How Much Do Employers Pay For Health Insurance PeopleKeep

https://lh3.googleusercontent.com/ydcoycUdJB-irccUwYfuQL2YHNW9Cuf53XVuUPCO9MNNkpj0VyytX6GmAEGZgIcoY9RrJClCO1agQpczS80CdbIfy3Ko-qTHNvzU0zN1S05kS_wtf-vFmhWqUgRAFVqg8aZAKU1O

https://www.moneyhelper.org.uk/en/work/losing-your-job/do-you-hav…

Web Any redundancy pay over 163 30 000 When you get it your employer will usually have deducted the tax but it s likely they won t have taken off the right amount So you

https://www.gov.uk/government/publications/income-tax-and-national...

Web An employer will be required to pay NICs on any part of a termination payment that exceeds the 163 30 000 threshold It is anticipated that this will be collected in real time as

Complete Guide To Calculating Redundancy Pay Essential Tools Tips

Payroll Tax Vs Income Tax What s The Difference

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From

Tax On Redundancy Payments

What Tax Do I Pay On Redundancy Payments CruseBurke

How Much Does An Employer Pay In Payroll Taxes Tax Rate

How Much Does An Employer Pay In Payroll Taxes Tax Rate

Should I Move To Low Rate Accounts To Avoid Paying Savings Tax

Redundancy Pay Redundancy Entitlements Mini Guide Owen Hodge Lawyers

Who Pays Payroll Taxes Employer Employee Or Both Cheatsheet

Do Employers Pay Tax On Redundancy Payments - Web 4 Dez 2023 nbsp 0183 32 Tax treatment of redundancy payments Redundancy pay is compensation for your job loss As such up to 163 30k of it is tax free This applies to a statutory or non statutory where the employer has paid