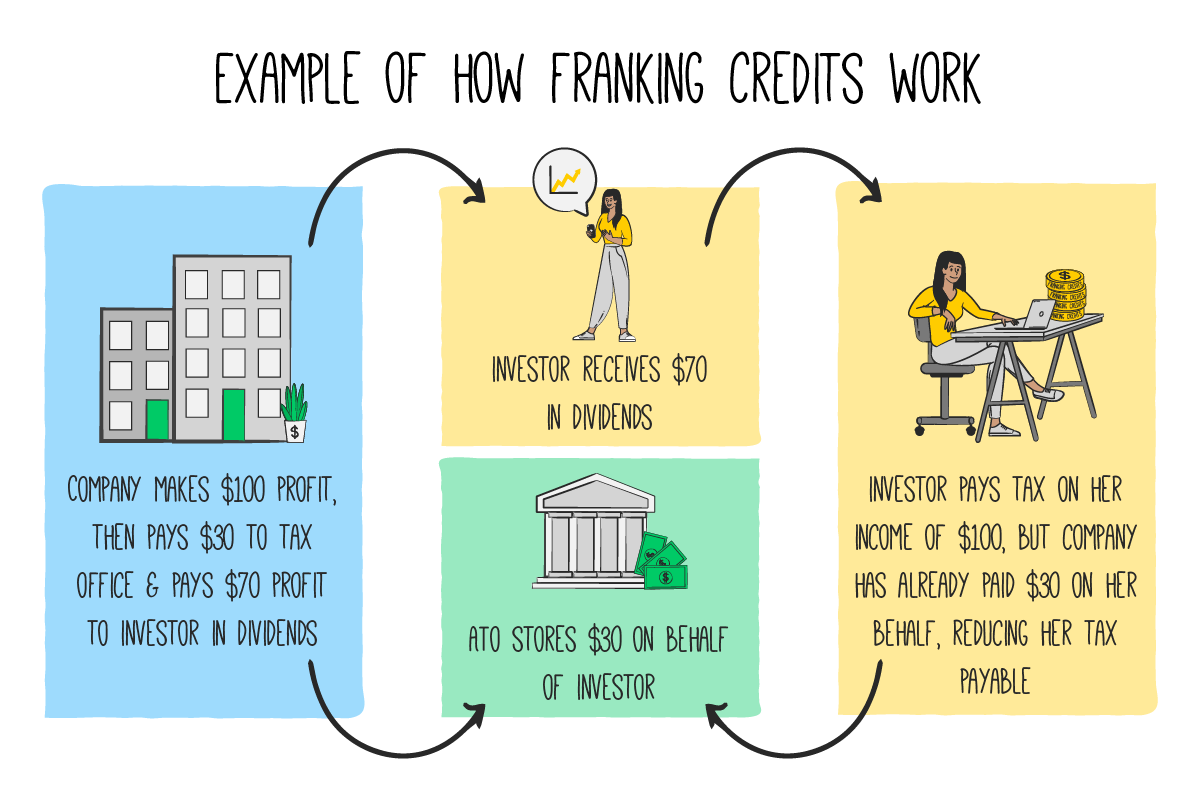

Do Franking Credits Reduce Taxable Income Because the company has already paid tax on the dividend the accompanying franking credit reduces tax payable by the individual on their total taxable income When the individual

In this tax aware environment franking credits are very attractive since they can reduce your tax bill and raise the after tax return on your investment However recent research undertaken by Colonial First State Global Asset Management has some interesting results with regard to the tax effectiveness of loading up a portfolio with Franking credits are essentially a tax rebate paid to investors with shares in Australian companies As the company you have invested in has already paid tax on its profits the idea is that

Do Franking Credits Reduce Taxable Income

Do Franking Credits Reduce Taxable Income

https://plato.com.au/wp-content/uploads/Screen-Shot-2022-06-02-at-3.23.45-pm.png

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

Reduce The Assets Test Taper Rate National Seniors Australia

https://nationalseniors.com.au/generated/1920w-2-1/franking-credits-campaign-image-jpg.jpg?1571981513

Lower taxes Franking credits are a tax offset so naturally they reduce the amount of income tax one has to pay As a result you may receive an overall tax bill or an increased refund So you as a taxpayer get to keep more of your income which is another reason for their popularity Franking credits act as a tax credit that shareholders can offset against tax on their dividend income If your marginal tax rate is less than the 30 company tax rate you may be entitled to a tax refund as a result of franking credits

The after profit tax is transferred to investors using imputation or franking credits hence reducing their tax liability However investors need to consider their marginal tax rate to determine if they are eligible for the tax credits The franking credits are credited towards the tax payable by the investor preventing the dividend income from being taxed twice This creates a level playing field for dividend income with other types of investment income like interest earnings paid on term deposits which are only taxed once Why do we have franking credits in Australia

Download Do Franking Credits Reduce Taxable Income

More picture related to Do Franking Credits Reduce Taxable Income

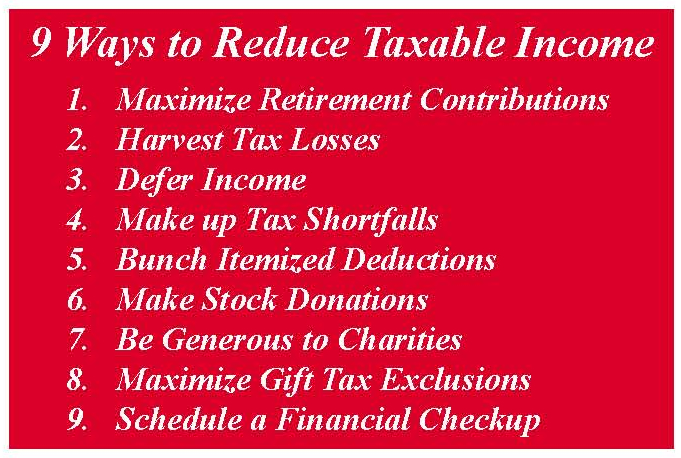

How To Reduce Your Taxable Income

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxableincome-1.jpg

Franking Credit Refund 2023 Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2021/11/franking-credit-calculators.jpg

How Do Franking Credits Work Melior Accounting

https://www.melior.com.au/wp-content/uploads/2016/09/money-1012622__1801-1024x596.jpg

The franking tax offset can be used to reduce your tax liability from all forms of income not just dividends and from your taxable net capital gain Example 4 shows you how this works Any excess franking tax offset amount is refunded to eligible resident individuals after any income tax and Medicare levy liabilities have been met Franking credits effectively boost the return you receive from your Australian shares If you received 1 000 income from your investment property or interest on a term deposit then you will need to pay your full rate of tax on this income

You receive a tax credit for the value of the franking credit which can be offset against other income Remember the company tax rate is 30 If your personal tax rate is 30 dividends are pretty much tax free as you get credit A franking credit is created when an Australian company pays Australian company tax Illustration Simon Letch Because of the way the system works the shareholder is entitled to use that credit to put towards their own tax or receive a refund if no tax is payable

Franking Credits

https://www.australianshareholders.com.au/images/imagelibrary/InvestorJourneyimages/Franking.jpg

9 Ways To Reduce Taxable Income This Year Smedley Financial Blog

https://smedleyfinancial.com/wp/wp-content/uploads/2014/12/9-ways-to-reduce.jpg

https://www.theguardian.com/global/2019/feb/08/...

Because the company has already paid tax on the dividend the accompanying franking credit reduces tax payable by the individual on their total taxable income When the individual

https://www.moneymanagement.com.au/features/...

In this tax aware environment franking credits are very attractive since they can reduce your tax bill and raise the after tax return on your investment However recent research undertaken by Colonial First State Global Asset Management has some interesting results with regard to the tax effectiveness of loading up a portfolio with

How Do Franking Credits Work For Dividends YouTube

Franking Credits

Franking Credits In Australia What Are They And How Do They Work

The A Z Guide Of Tax Saving Tips Australia

What Are Franking Credits How Do They Work

How Do Franking Credits Work Stimulate Accounting

How Do Franking Credits Work Stimulate Accounting

Tax Credits Vs Tax Deductions Making The Most Of Your Tax Benefits

Why The Government Doesn t Want You To Understand How Franking Credits

How Do Franking Credits Work For Dividends Shopping For Shares

Do Franking Credits Reduce Taxable Income - A franking credit also known as an imputation credit is a type of tax credit that allows the company s income tax to flow through to its shareholders It is a system in place to avoid or eliminate doubling taxing dividends Double taxing is when tax is paid twice on the same income or profit