Do Health Insurance Premiums Count As Income Health insurance is not taxable income even if your employer pays for it Under the Affordable Care Act the amount your employer spends on your premiums appears on your W 2s but it

If an employer pays the cost of an accident or health insurance plan for his her employees including an employee s spouse and dependents then the employer s payments are not wages and are not subject to social security Medicare and FUTA taxes or federal income tax withholding You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI

Do Health Insurance Premiums Count As Income

Do Health Insurance Premiums Count As Income

https://www.trustedunion.com/wp-content/uploads/2019/01/shutterstock_premium-increases-part-2-875x410.jpg

Affordable Health Insurance Everything You Need To Know Insurance

https://cdn-res.keymedia.com/cms/images/us/003/0308_638061038182977462.jpg

Opinion Here s Why Your Health Insurance Premiums Are Going Up

https://media.bizj.us/view/img/12296562/gettyimages-858422796*1200xx2070-1164-0-143.jpg

Health insurance premiums can count as a tax deductible medical expense along with other out of pocket medical expenses if you itemize your deductions You can only deduct medical expenses Health insurance premiums can generally be paid with pre tax dollars For most people this means that their employer sponsored health insurance is deducted from their paycheck pre tax and nothing further has to be done on their tax return

This is an adjustment to income rather than an itemized deduction for premiums you paid on a health insurance policy covering medical care including a qualified long term care insurance policy for yourself your spouse and dependents Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few taxpayers qualify for the deduction

Download Do Health Insurance Premiums Count As Income

More picture related to Do Health Insurance Premiums Count As Income

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png)

Medical Insurance Costs

https://www.investopedia.com/thmb/ciSCbyApugxy0iwczQjlV9usj_E=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png

What Does Health Insurance Do HealthCompare Insurance Services Inc

https://healthcompare.com/wp-content/uploads/2021/09/iStock-1049284376-scaled.jpg

How Much Is Health Insurance For A Family Of 3 HealthInsuranceDigest

https://www.healthinsurancedigest.com/wp-content/uploads/ehbs-2015-section-one-cost-of-health-insurance-8775-kff-1024x768.png

If you paid the premiums for a policy you obtained yourself your health insurance premium is deductible when they are out of pocket costs If your insurance is through your employer you can only deduct these Amounts you paid with after tax funds Employer paid premiums for health insurance are exempt from federal income and payroll taxes Additionally the portion of premiums employees pay is typically excluded from taxable income The exclusion of premiums lowers most workers tax bills and thus reduces their after tax cost of coverage

The following coverage meets the Affordable Care Act minimum requirement for health insurance Employer sponsored coverage Employee group health insurance COBRA Retiree coverage Individual health coverage Private plan purchased from a health insurance company Kaiser Aetna Blue Cross etc The health insurance premium deduction can t exceed the earned income you collect from your business If you have a business and you pay health insurance premiums for your employees these amounts are deductible as employee benefit program expenses

Full time Jobs Usually Offer Health Insurance List Foundation

https://lsitlcnd.listfoundation.org/1666070020128.png

Average Health Insurance Premiums Fell After Obamacare Took Effect

https://image.cnbcfm.com/api/v1/image/103818672-GettyImages-467546163-2.jpg?v=1612569835&w=1920&h=1080

https://finance.zacks.com/health-insurance...

Health insurance is not taxable income even if your employer pays for it Under the Affordable Care Act the amount your employer spends on your premiums appears on your W 2s but it

https://www.irs.gov/businesses/small-businesses...

If an employer pays the cost of an accident or health insurance plan for his her employees including an employee s spouse and dependents then the employer s payments are not wages and are not subject to social security Medicare and FUTA taxes or federal income tax withholding

How Can I Reduce Premium Of Medical Insurance Cover Mint

Full time Jobs Usually Offer Health Insurance List Foundation

IRDAI Allows Payment Of Health Insurance Premium In Monthly Installments

Health Insurance Premiums Are A Problem Unhealthy Healthcare

Why Do My Health Insurance Premiums Keep Going Up Each Year Part 3

01 November 2017 Minnesota Prairie Roots

01 November 2017 Minnesota Prairie Roots

Do Medicare Premiums Count As Health Insurance

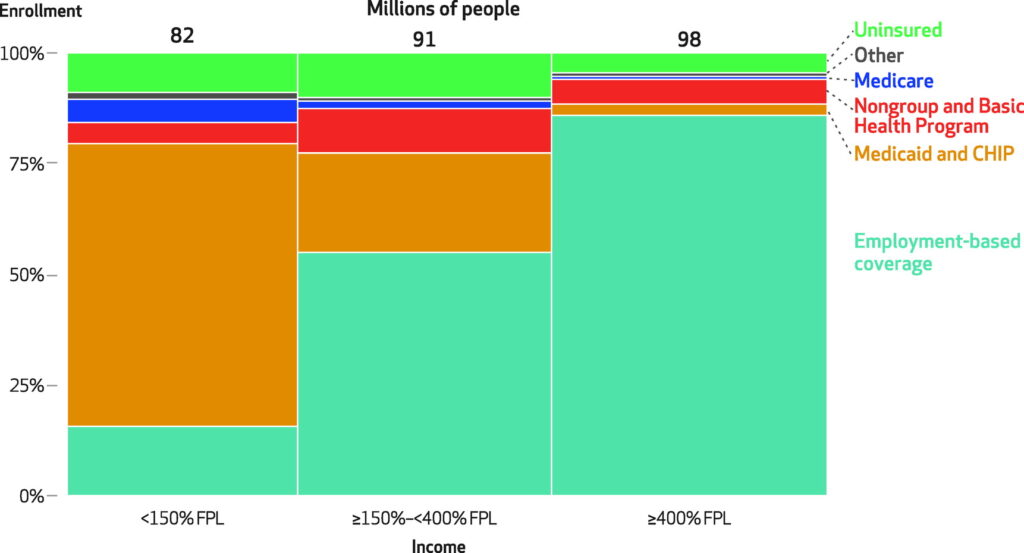

CBO Projections Of US Health Insurance Coverage 2023 2033 Healthcare

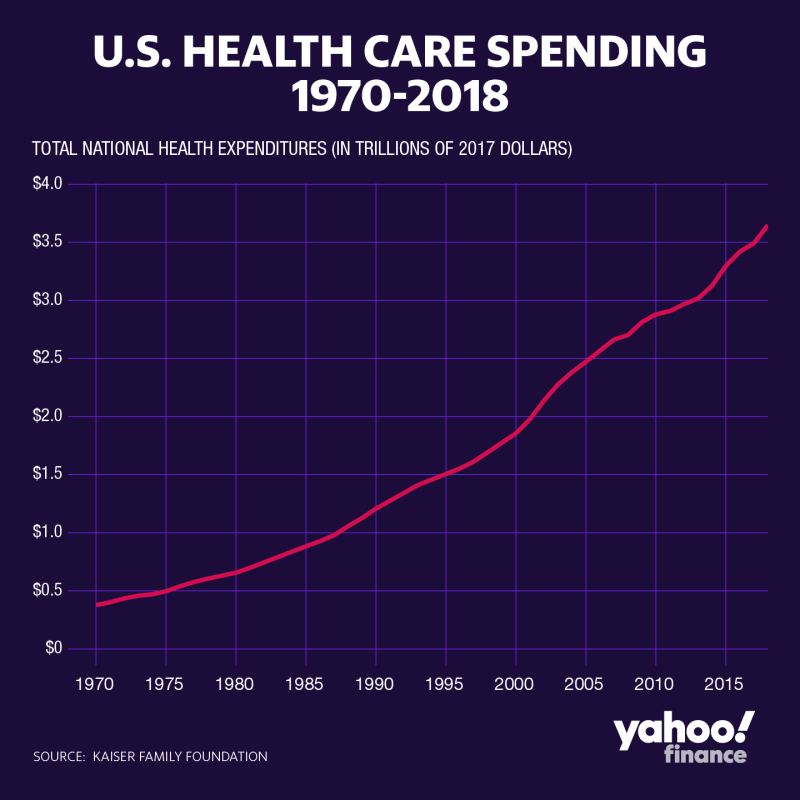

Health Insurance Premiums Are Headed Way Higher

Do Health Insurance Premiums Count As Income - Self Employment Eligibility There are also some rules to follow concerning your own eligibility for this deduction To qualify for deducting health insurance premiums you must have reported net profit income as a sole proprietor on Schedule C or as a farmer on Schedule F