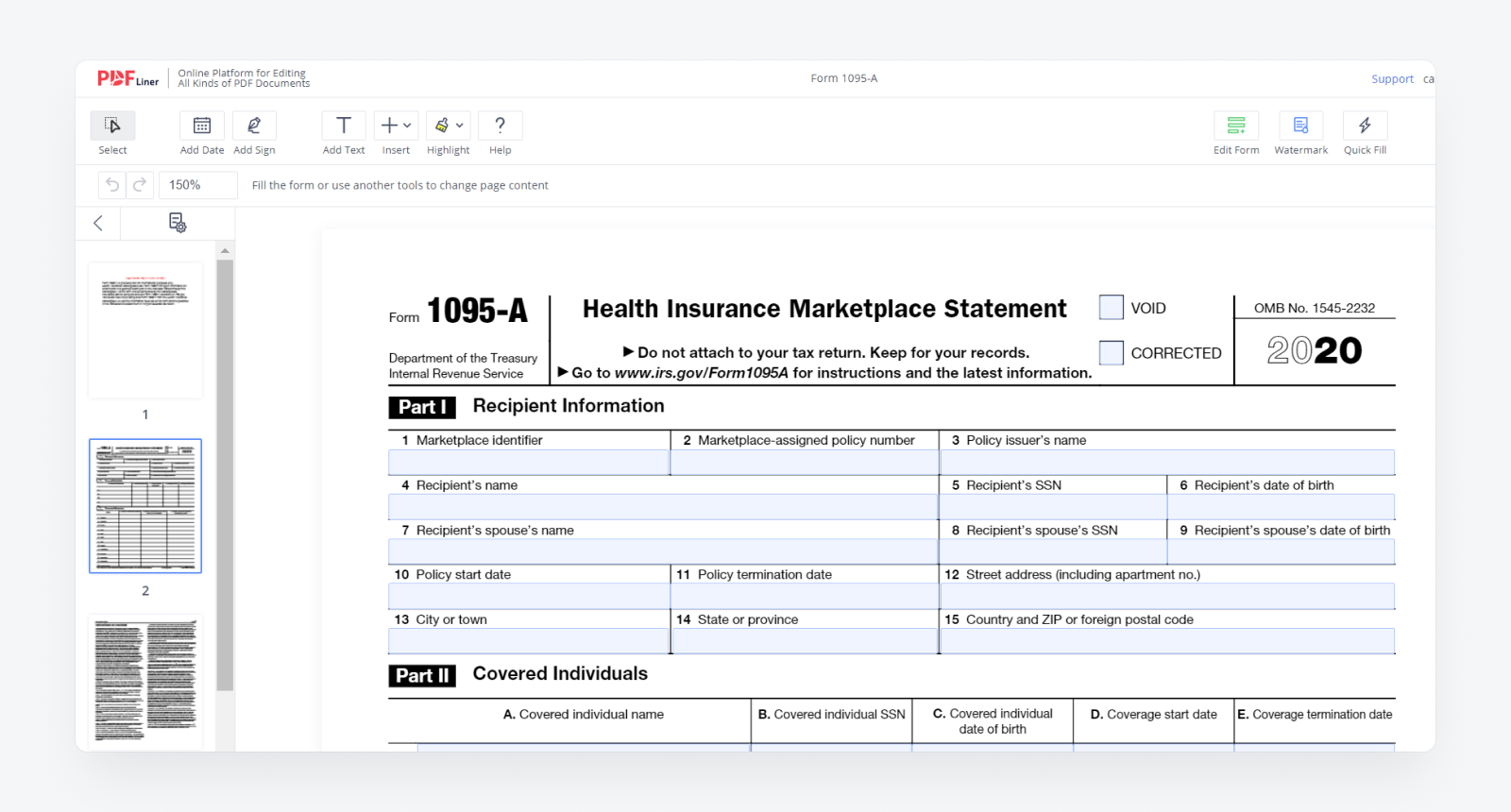

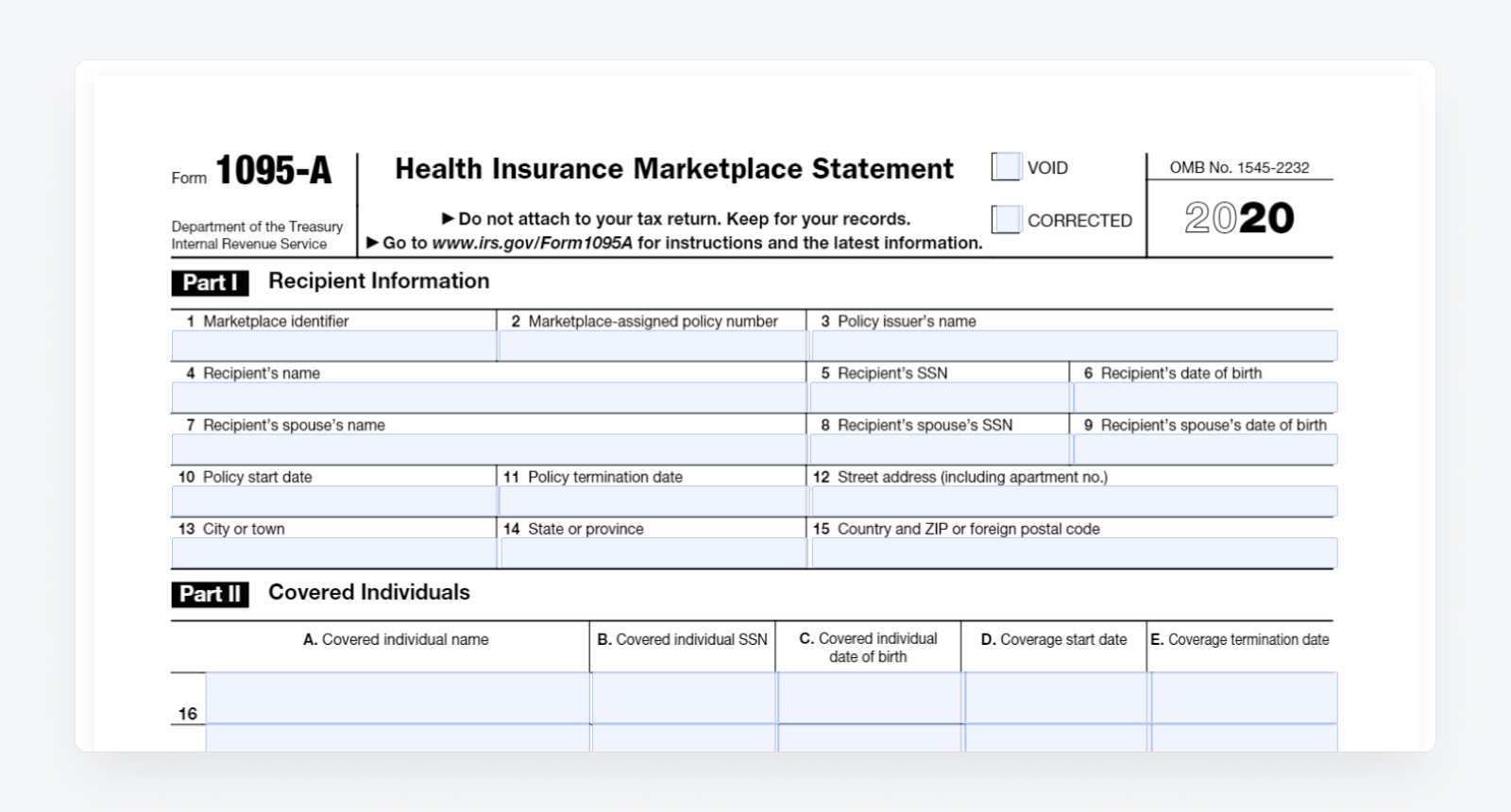

Do I Get A 1095 A From My Employer Information about Form 1095 A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace

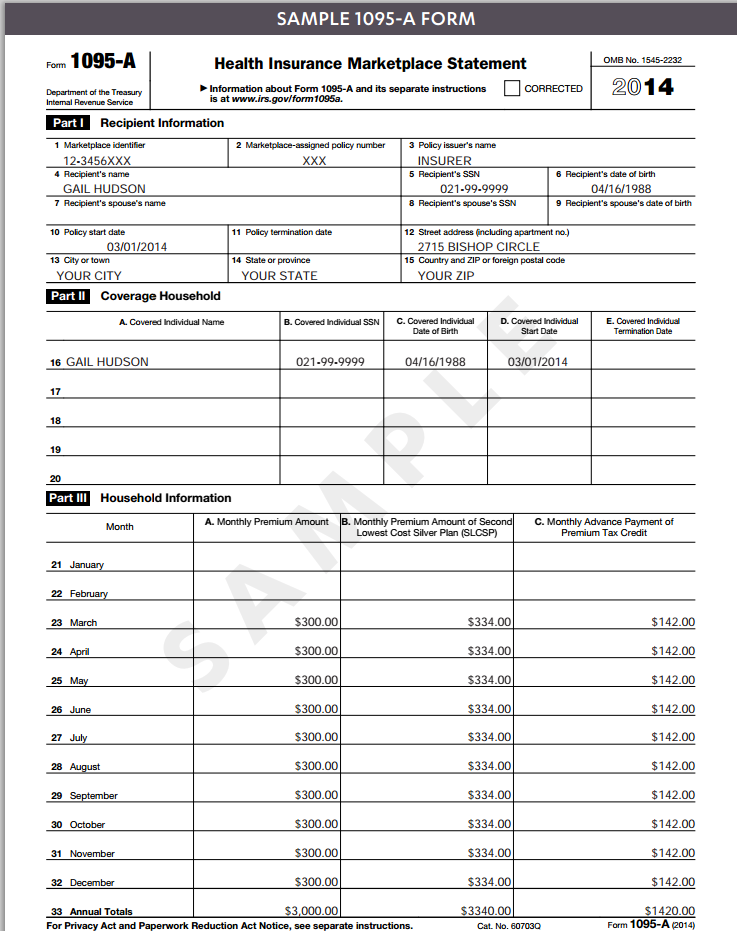

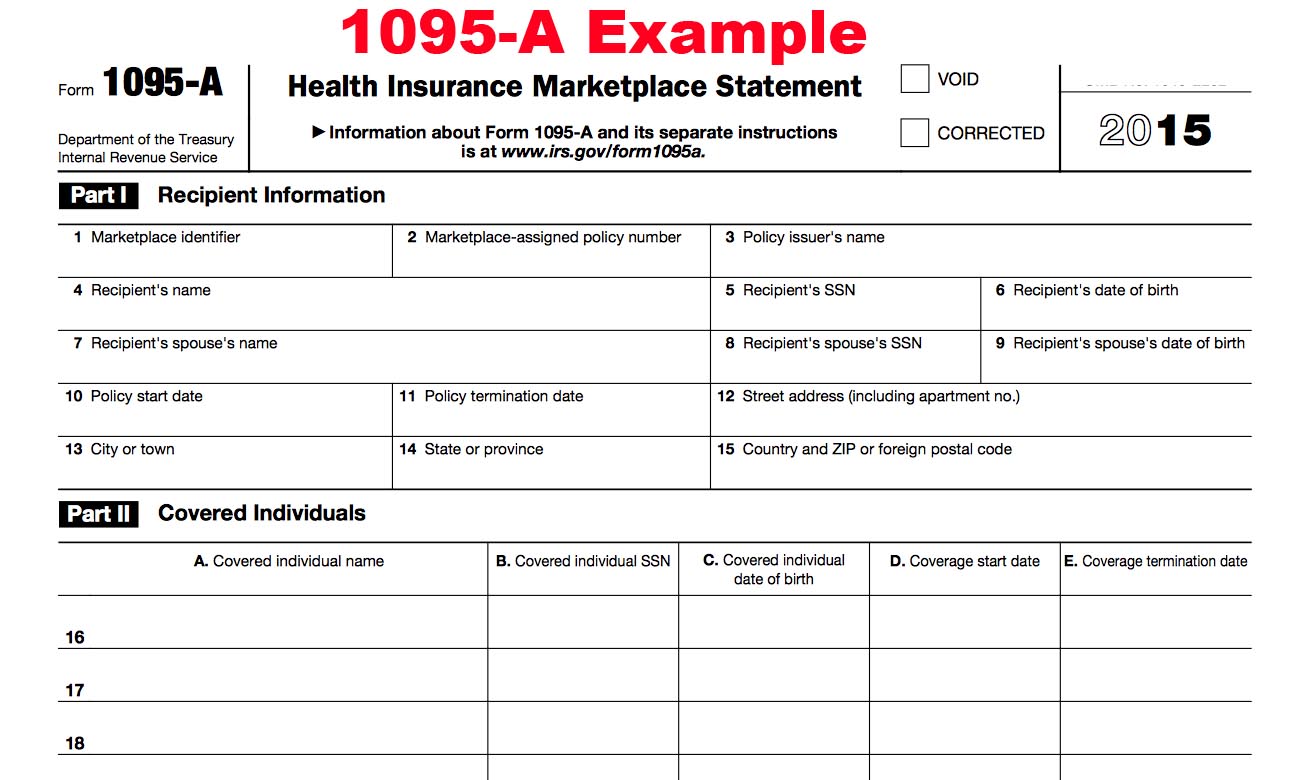

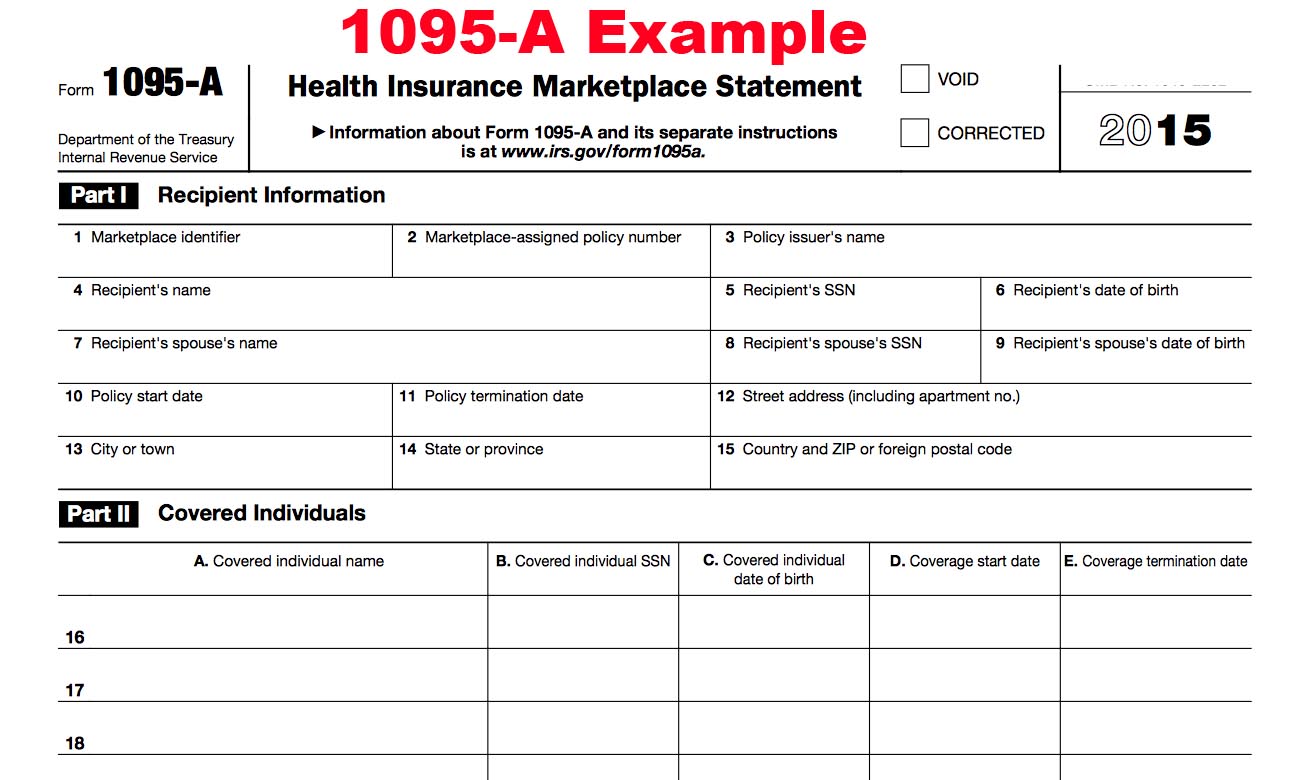

Form 1095 A is your proof that you had Marketplace exchange health insurance coverage during the year and it s also used to reconcile your premium subsidy on your tax return using Form 8962 details below This form includes information about the cost of your Marketplace plan If you or anyone in your household enrolled in a health plan through the Health Insurance Marketplace you ll get Form 1095 A Health Insurance Marketplace Statement You will get this form from the Marketplace not the IRS You will use the information from the Form 1095 A to calculate the amount of your premium tax credit

Do I Get A 1095 A From My Employer

Do I Get A 1095 A From My Employer

https://images.ctfassets.net/4f3rgqwzdznj/46ckWbfAAZyalFkPAXpWll/8968dbf56ff5bbaec5ac6134af90b7f4/taking_envelope_out_of-mailbox480197395.jpg

1095 A Tax Form H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2015/01/1095-banner-featured-825x510.jpg

Instructions For Form 1095 A And How To Fill Out It PDFliner

https://blog.pdfliner.com/howTo/img/tild6536-3761-4039-a239-346663353333__how-to-fill-out-form.png

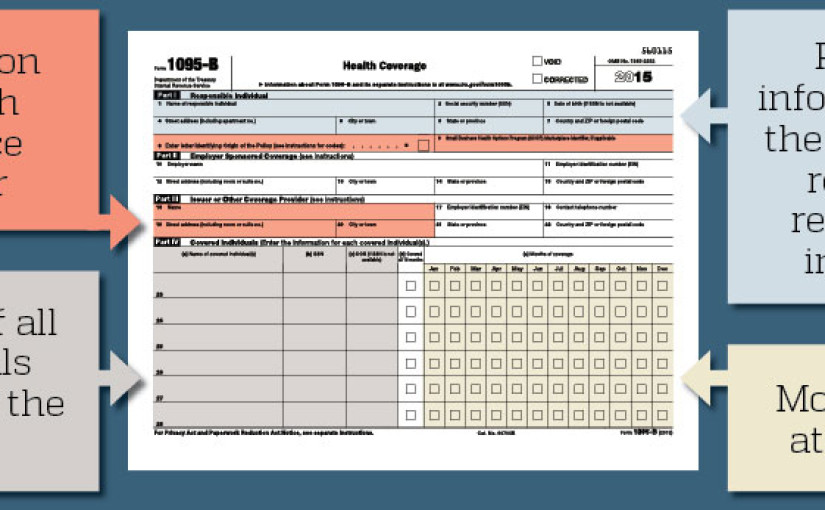

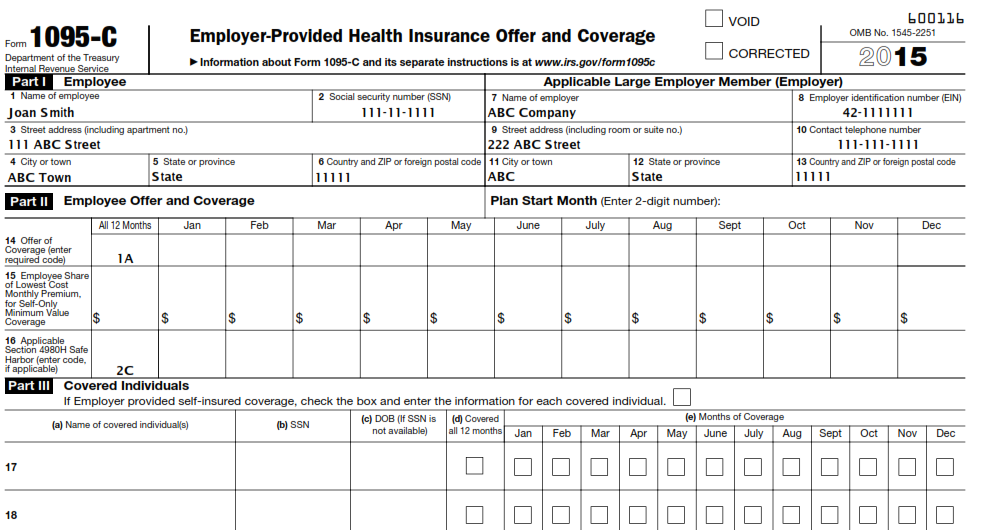

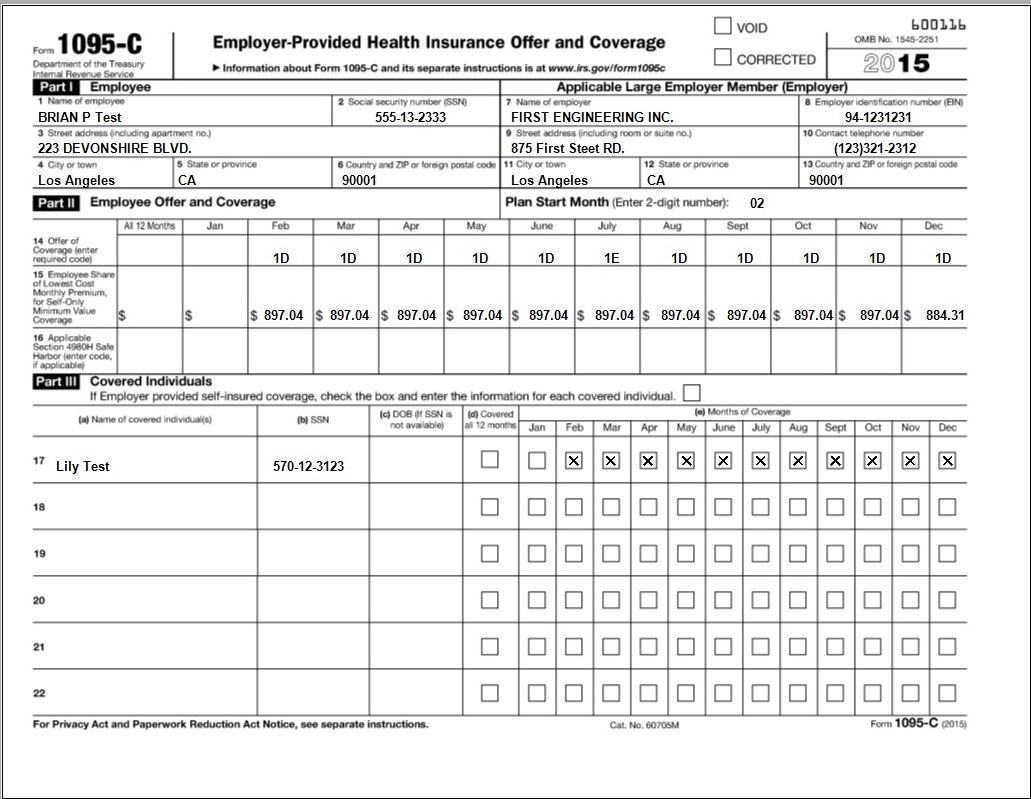

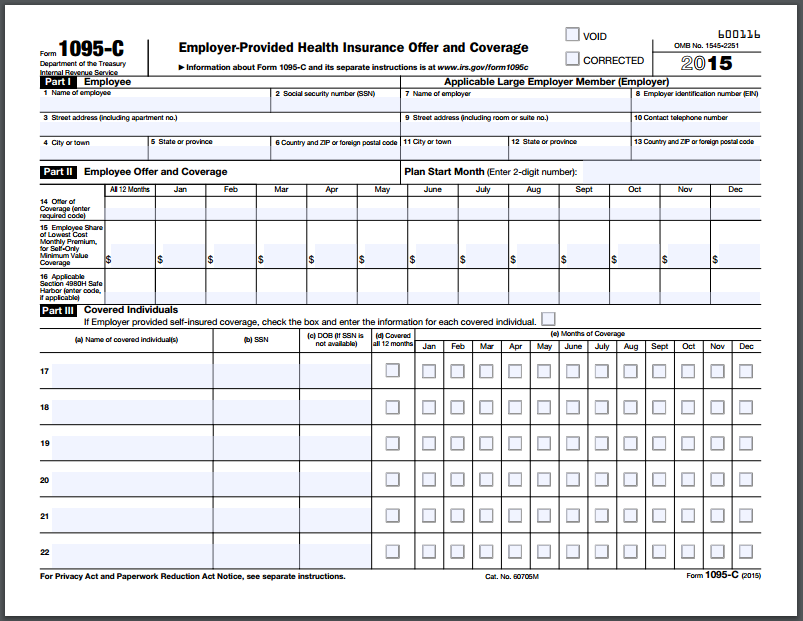

File IRS form 1095 A to get highest federal tax return Learn what to do how to file why you got form what to do if no 1095 A In addition if you work for a company with 50 or more employees and the coverage provided by that employer is purchased through an insurance company you will then receive 1095 B from the insurance company as well as 1095 C from your employer Where do I enter information from IRS Form 1095 A 1095 B or 1095 C on my tax return

Form 1095 A is broken down into three sections The first section lists the marketplace information and the name and Social Security number of the recipient the person expected to file the tax return and claim the credit and spouse It also shows the policy start and end date and the recipient s address The second section lists the name If you bought health insurance through a Health Care Exchange or Marketplace you should get Form 1095 A the Health Insurance Marketplace Statement A Form 1040 return with limited credits is one that s filed using IRS Form 1040 only with the exception of the specific covered situations described below Roughly 37 of taxpayers

Download Do I Get A 1095 A From My Employer

More picture related to Do I Get A 1095 A From My Employer

WHAT TO DO WITH FORM 1095 A Insurance Information

https://i1.wp.com/claimlinx.com/wp-content/uploads/2021/05/1095-A.jpg?fit=2240%2C1260&ssl=1

Instructions For Form 1095 A And How To Fill Out It PDFliner

https://pdfliner.com/howTo/img/tild3830-3336-4662-b234-616236653764__how-to-get-form-1095.png

Form 1095 A Sample Amulette

http://amulettejewelry.com/wp-content/uploads/2018/09/form-1095-a-sample-sample-1095-c-form.jpg

As with most things tax the answer is it depends Here s a quick summary to outline if you need your Form 1095 You don t need your Form 1095 to file your federal return if You had health insurance through your employer a government program or other non marketplace source You get Form 1095 B or Form 1095 C Form 1095 A is a Health Insurance Marketplace Statement that comes in the mail and you ll need it to accurately file your 2023 tax return This form should arrive in your mailbox by mid February 2024 Read on to get answers to seven of the most common questions about Form 1095 A Why do I need Form 1095 A

STEP 1 Log into your Marketplace account STEP 2 Under My Applications Coverage select your 2023 application not your 2024 application STEP 3 Select Tax Forms from the menu on the left How to find your Form 1095 A online 2 STEP 4 Under Your Forms 1095 A for Tax Filing select Download PDF and follow these steps based on your You will receive Form 1095 A if you or a member of your household purchased health insurance through a state or federal healthcare exchange This is also known as the health insurance marketplace You should be on the lookout for Form 1095 A if you received marketplace coverage at any time during the previous year

1095 C Form IRS Half Sheet Format Discount Tax Forms

https://www.discounttaxforms.com/wp-content/uploads/2017/07/1095-C-IRS-Employer-Provided-Health-Offer-and-Coverage-Form-1095CIRS50-FINAL-min.jpg

New Tax Forms In 2015

http://lerablog.org/wp-content/uploads/2015/03/sample-1095.png

https://www.irs.gov/forms-pubs/about-form-1095-a

Information about Form 1095 A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace

https://www.healthinsurance.org/faqs/where

Form 1095 A is your proof that you had Marketplace exchange health insurance coverage during the year and it s also used to reconcile your premium subsidy on your tax return using Form 8962 details below This form includes information about the cost of your Marketplace plan

Form 1095 A Sample Amulette

1095 C Form IRS Half Sheet Format Discount Tax Forms

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them

Form 1095 A Sample Amulette

Form 1095 A Sample Amulette

What Is Form 1095 C And Why Did I Receive It In The Mail From The IRS

IRS Form 1095 A Katz Insurance Group

What Is Form 1095 C And Do You Need It To File Your Taxes

Do I Get A 1095 A From My Employer - If you bought health insurance through a Health Care Exchange or Marketplace you should get Form 1095 A the Health Insurance Marketplace Statement A Form 1040 return with limited credits is one that s filed using IRS Form 1040 only with the exception of the specific covered situations described below Roughly 37 of taxpayers