Do I Have To Claim My Mortgage Interest On My Taxes The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Claiming the mortgage interest deduction requires itemizing

To take the mortgage interest deduction the interest paid must be on a qualified home Your first and second home may be considered qualified homes but there are some exceptions The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe The deduction is only available if you choose to itemize your deductions instead of claiming the standard deduction

Do I Have To Claim My Mortgage Interest On My Taxes

Do I Have To Claim My Mortgage Interest On My Taxes

https://www.tffn.net/wp-content/uploads/2023/01/do-i-have-to-claim-crypto-on-my-taxes.jpg

Understanding The Mortgage Interest Deduction The Official Blog Of

https://www.taxslayer.com/blog/wp-content/uploads/2022/05/Mortgage-Interest-Deduction-8-1594x2048.png

Do I Have To Claim IRA Interest On My Taxes Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/90/63/fotolia_4055154_XS.jpg

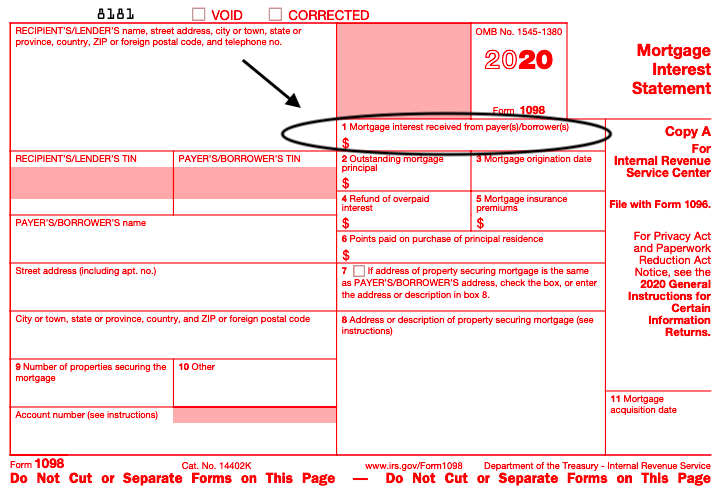

If you re a homeowner you probably qualify for a deduction on your home mortgage interest The tax deduction also applies if you pay interest on a condominium cooperative mobile home boat or recreational vehicle used as a residence Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns Schedule A accompanies Form 1040 or 1040 SR a simplified 1040 for seniors

The IRS lets you deduct your mortgage interest but only if you itemize deductions You can t deduct the principal the borrowed money you re paying back In addition to itemizing these conditions must be met for mortgage interest to be deductible The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use married filing separate status the

Download Do I Have To Claim My Mortgage Interest On My Taxes

More picture related to Do I Have To Claim My Mortgage Interest On My Taxes

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

https://images.squarespace-cdn.com/content/v1/5510bad9e4b0ce924f0445c5/1588021918445-TABXNEL49HY41OAUTBE9/Can+You+Deduct+Your+RV%2C+Travel+Trailer+or+Boat+Mortgage+Interest+on+Your+Taxes%3F+NuventureCPA.com

Can I Deduct Mortgage Interest On My Timeshare Finance Zacks

https://img-aws.ehowcdn.com/600x600p/photos.demandstudios.com/92/132/fotolia_11193772_XS.jpg

SA105 How Do I Show My Mortgage Interest Property Finance Costs

https://support.gosimpletax.com/galleryDocuments/edbsnf7dab4e9aecd119008a6349ad2c7cc140ea5bbdff7c011675dc29a8fa0796ead2fa4923b76e03f5a6ffb5e1639b54692?inline=true

How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest That means forgoing the standard deduction for your filing status You can itemize or you can claim the standard deduction but you can t do both It s true you can deduct the interest you pay each tax year on your individual tax return Learn more about the mortgage interest tax deduction here Who qualifies for the mortgage interest tax deduction If you itemize deductions on Schedule A you can deduct qualified mortgage interest paid on a qualifying residence including your

Here are the two major hurdles you have to jump over in order to take advantage of the mortgage interest deduction Rule 1 You must have secured debt on a qualified home in which you have an ownership interest Rule 2 You must file your federal income taxes using Form 1040 and itemize deductions on Schedule A If your yearly salary is 120 000 you can use the mortgage interest you paid to reduce your taxable income to 100 000 This means you ll only pay taxes on 100 000 of your income not 120 000

Home Mortgage Interest Deduction Limitation Home Sweet Home Modern

https://www.houselogic.com/wp-content/uploads/2016/08/mortgage-points-deduction-retina_retina_5f63bd64598409bb08a3daf8b0e545a9.jpg

Which States Benefit Most From The Home Mortgage Interest Deduction

https://files.taxfoundation.org/20170810130243/HomeMortgIntDed-01.png

https://www.nerdwallet.com/article/taxes/mortgage...

The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Claiming the mortgage interest deduction requires itemizing

https://www.kiplinger.com/taxes/mortgage-interest-deduction

To take the mortgage interest deduction the interest paid must be on a qualified home Your first and second home may be considered qualified homes but there are some exceptions

Is Mortgage Interest Tax Deductible In 2023 Orchard

Home Mortgage Interest Deduction Limitation Home Sweet Home Modern

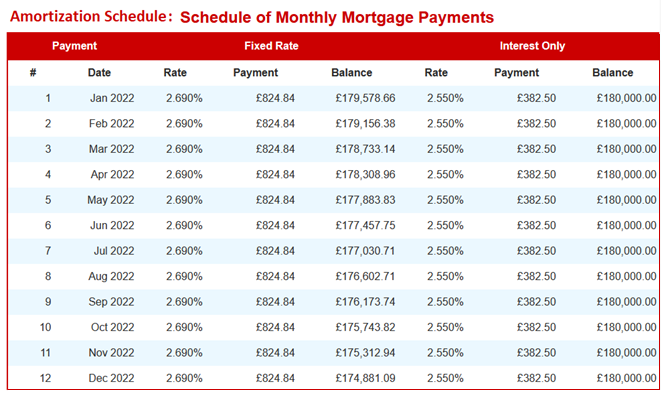

How To Calculate Your Monthly Mortgage Payment Given The Principal

How To Convert Rental Property To A Principal Residence For Capital

Interest Rate Calculator Uk Online Wholesale Save 69 Jlcatj gob mx

How To Claim Mortgage Interest On Your Taxes Home Improvement Loans

How To Claim Mortgage Interest On Your Taxes Home Improvement Loans

Mortgage Interest Rate Deduction Definition How It Works NerdWallet

Should I Lock Or Float My Mortgage Interest Rate Fha Loans Mortgage

How Do I Claim My HELOC Interest On My Taxes Leia Aqui Where Do I

Do I Have To Claim My Mortgage Interest On My Taxes - Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns Schedule A accompanies Form 1040 or 1040 SR a simplified 1040 for seniors